Market Definition

The reactive hot melt adhesives market focuses on advanced adhesive formulations that undergo chemical curing after cooling, enhancing bond strength and durability. These adhesives typically contain polyurethane or silane-modified polymers, offering superior resistance to moisture, heat, and chemicals. Applied in molten form, they solidify upon cooling and then react with ambient moisture or a catalyst to achieve structural integrity.

Widely used in automotive, electronics, packaging, and woodworking applications, they provide high-performance bonding for materials such as plastics, metals, and composites. Their ability to form strong, flexible, and long-lasting bonds makes them essential for demanding industrial and manufacturing processes.

Reactive Hot Melt Adhesives Market Overview

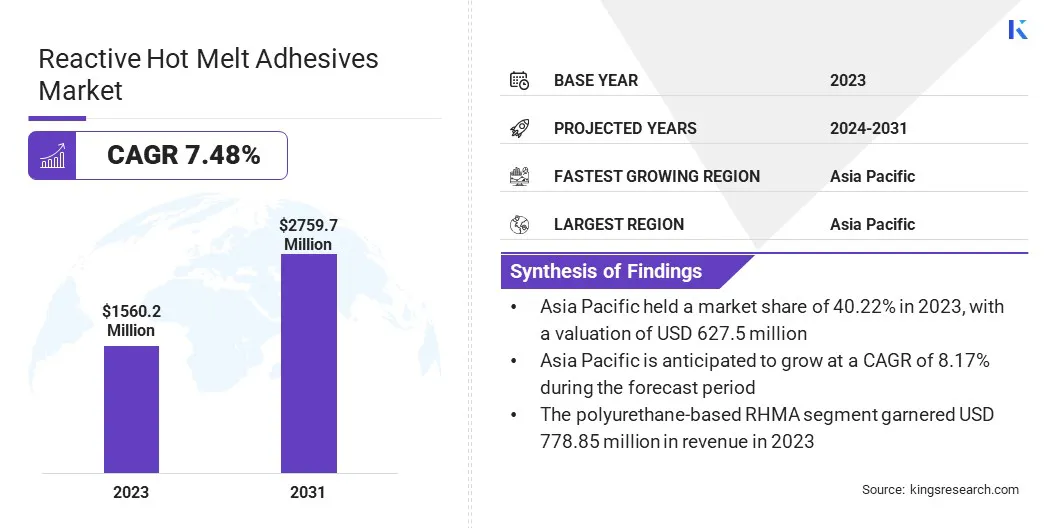

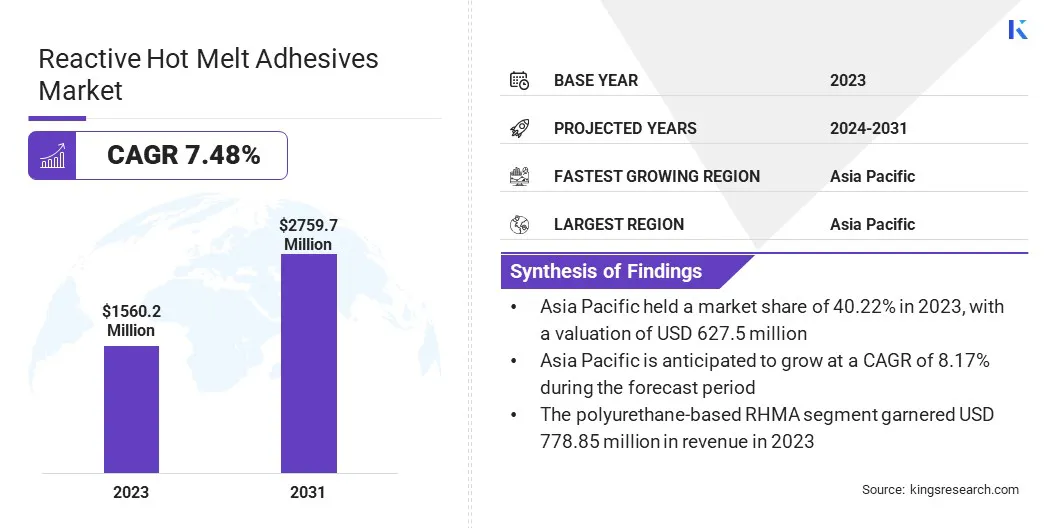

The global reactive hot melt adhesives market size was valued at USD 1,560.2 million in 2023 and is projected to grow from USD 1,665.3 million in 2024 to USD 2,759.7 million by 2031, exhibiting a CAGR of 7.48% during the forecast period.

The growing demand for high-performance bonding solutions in automotive and electronics manufacturing is driving the market. Industries are increasingly adopting these adhesives for their superior durability, flexibility, and resistance to moisture and chemicals.

Additionally, rising investments in sustainable adhesive solutions, including bio-based and recyclable formulations, are fostering market growth as companies seek environmentally friendly alternatives to traditional bonding technologies.

Major companies operating in the global reactive hot melt adhesives industry are Henkel AG & Co. KGaA, H.B. Fuller Company, Jowat SE, 3M, Arkema, Dow, Exxon Mobil, Avery Dennison Corporation, Franklin International, Wacker Chemie AG, Ashland, TEX YEAR INDUSTRIES INC., Evans Adhesive Corporation, Huntsman Corporation, and RPM International Inc.

The increasing complexity of consumer electronics, medical devices, and industrial components has driven the demand for reactive hot melt adhesives that offer superior electrical insulation, thermal conductivity, and shock resistance.

These adhesives are widely used in printed circuit boards, component encapsulation, and wearable devices, ensuring product reliability and longevity. The rapid expansion of miniaturized electronics and IoT-enabled devices has further intensified market demand, as manufacturers seek high-precision bonding solutions that enhance structural integrity without adding weight.

The shift toward automated electronics manufacturing has also played a crucial role in supporting market expansion through improved efficiency and reduced material waste.

Key Highlights:

- The global reactive hot melt adhesives market size was valued at USD 1,560.2 million in 2023.

- The market is projected to grow at a CAGR of 7.48% from 2024 to 2031.

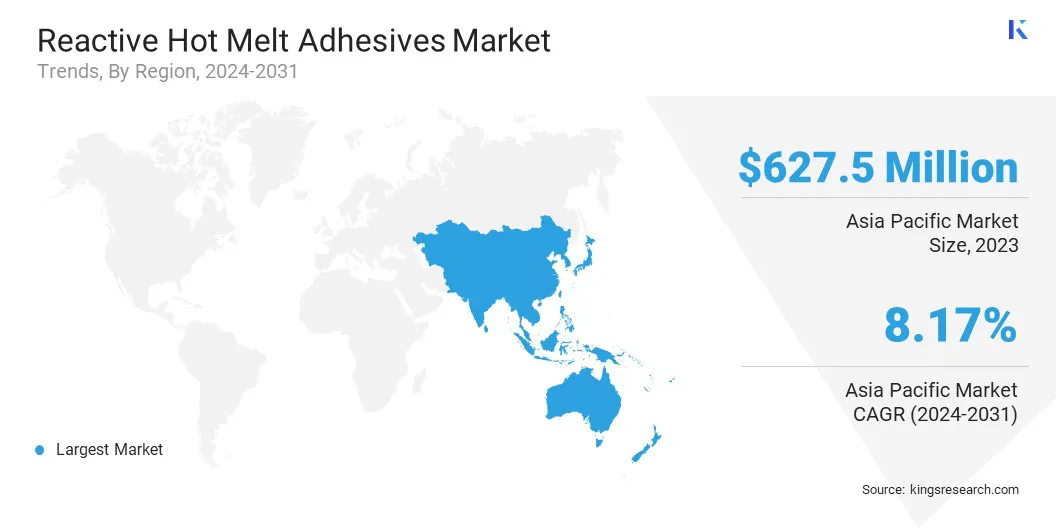

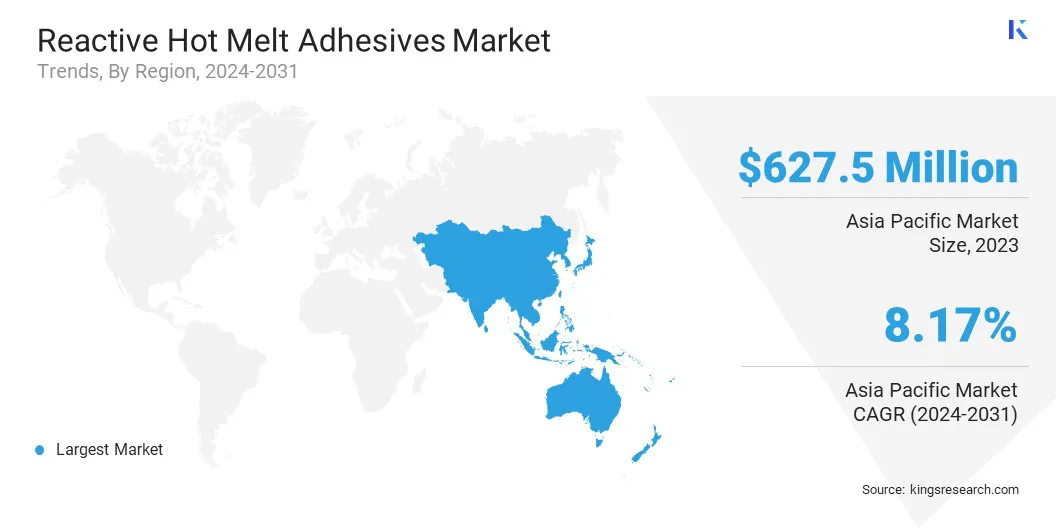

- Asia Pacific held a market share of 40.22% in 2023, with a valuation of USD 627.5 million.

- The polyurethane-based RHMA segment garnered USD 778.85 million in revenue in 2023.

- The electronics & electrical segment is poised for a robust CAGR of 9.51% through the forecast period.

- The market in North America is anticipated to grow at a CAGR of 7.40% during the forecast period.

Market Driver

"Increasing Infrastructure Development and Construction Activities"

The growth of the reactive hot melt adhesives market is supported by rising infrastructure projects, including residential, commercial, and industrial construction. These adhesives are widely used in flooring, insulation panels, and façade applications, providing superior adhesion, thermal resistance, and structural integrity.

The rapid expansion of smart cities and green building initiatives has increased the demand for energy-efficient and durable construction materials, driving the market. Mega infrastructure projects such as NEOM in Saudi Arabia and HS2 in the UK are accelerating the demand for advanced construction materials and technologies, contributing to market growth.

NEOM, a futuristic smart city spanning 10,000 square miles, is a key component of Saudi Arabia’s Vision 2030, aiming to diversify the economy and integrate sustainable urban development.

Projects like The Line and OXAGON emphasize green building practices, incorporating low-carbon concrete and recycled materials. Similarly, HS2, a high-speed rail network connecting London with key regions, is driving infrastructure expansion in the UK. These developments are reinforcing the demand for sustainable materials, innovative adhesives, and advanced engineering solutions.

Manufacturers are developing high-performance adhesives tailored for composite materials, fire-resistant applications, and prefabricated structures, reinforcing their role in modern construction. The expansion of urban infrastructure projects continues to contribute to the widespread adoption of these advanced adhesive solutions.

Market Challenge

"Complex Production and High Processing Costs"

The reactive hot melt adhesives market faces challenges, due to complex manufacturing processes and high processing costs, which can hinder large-scale adoption. The need for specialized equipment and controlled curing conditions adds to production expenses, limiting accessibility for smaller manufacturers.

Investments in advanced automation and process optimization are enhancing efficiency and reducing costs. Research into alternative raw materials and sustainable formulations is driving innovation in cost-effective adhesive solutions.

Strategic collaborations with end users are refining product performance while ensuring economic feasibility, supporting the broader adoption of reactive hot melt adhesives across industries.

Market Trend

"Technological Advancements in Adhesive Formulations"

Continuous research and development efforts have introduced high-performance polyurethane (PUR) and polyolefin-based reactive hot melt adhesives with enhanced thermal stability, adhesion properties, and curing efficiency.

A research team from ACS Publications, a division of the American Chemical Society, has highlighted the exceptional adhesive properties of hydroxyl-functionalized propylene-based copolymers, demonstrating their effectiveness in bonding both polar and nonpolar surfaces.

Developing multiple functionalized polyolefin grades with varying hydroxyl content poses challenges for industrial-scale production. Researchers explored an alternative approach of blending functionalized propylene copolymers with nonfunctionalized counterparts to fine-tune adhesive performance.

The study confirmed that adhesive strength correlates linearly with hydroxyl functionality, enabling precise control over adhesion levels for applications such as bonding aluminum or steel surfaces.

These advancements have strengthened the reactive hot melt adhesives market, allowing manufacturers to meet performance demands in industries such as automotive, construction, and consumer electronics.

The development of moisture-curing adhesives has further expanded application possibilities by delivering superior bond strength, resistance to harsh environmental conditions, and extended durability. Ongoing investments in nanotechnology and bio-based adhesive formulations are expected to drive further innovation, supporting the long-term growth of the market.

Reactive Hot Melt Adhesives Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Polyurethane-based RHMA, EVA-based RHMA, Polyamide-based RHMA, Others

|

|

By Application

|

Automotive & Transportation, Packaging Industry, Construction & Building, Electronics & Electrical, Consumer Goods & Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Polyurethane-based RHMA, EVA-based RHMA, Polyamide-based RHMA, and Others): The polyurethane-based RHMA segment earned USD 778.85 million in 2023, due to its superior bonding strength, flexibility, and resistance to moisture, heat, and chemicals, making it highly suitable for applications in automotive, electronics, packaging, and woodworking industries.

- By Application (Automotive & Transportation, Packaging Industry, Construction & Building, Electronics & Electrical, Consumer Goods & Retail, and Others): The automotive & transportation segment held 32.09% share of the market in 2023, due to the increasing demand for high-performance bonding solutions that enhance structural durability, reduce vehicle weight, and improve resistance to heat, chemicals, and vibrations, supporting advanced manufacturing processes and lightweight vehicle designs.

Reactive Hot Melt Adhesives Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a reactive hot melt adhesives market share of around 40.22% in 2023, with a valuation of USD 627.5 million. India’s booming electronics manufacturing sector is playing a crucial role in expanding the reactive hot melt adhesive market, particularly in applications such as PCB assembly, display bonding, and semiconductor packaging.

According to the India Brand Equity Foundation (IBEF) report (2024), India is the second-largest manufacturer of mobile phones globally and is set to become the fifth-largest consumer of electronic products by 2025.

- The country’s electronic goods exports surged by 23% in FY24, reaching USD 29.11 billion, with ambitious targets of USD 300 billion in electronics manufacturing and US$ 120 billion in exports by 2025-26. Additionally, the government’s USD 1.06 billion investment under the Production-Linked Incentive (PLI) scheme is strengthening the domestic semiconductor and electronic component ecosystem, further driving the demand for high-performance adhesives in advanced assembly processes.

Additionally, Asia Pacific is registering unprecedented urbanization, with large-scale residential, commercial, and industrial construction projects driving the demand for advanced adhesive solutions.

Countries such as China, India, Indonesia, and Vietnam are investing heavily in high-rise buildings, smart cities, and sustainable infrastructure, fueling the need for durable, weather-resistant adhesives in flooring, paneling, insulation, and structural bonding.

The adoption of modular construction and green building practices, including the use of low-emission adhesives for energy-efficient buildings, further supports the market expansion.

The reactive hot melt adhesives industry in North America is poised for significant growth at a robust CAGR of 7.40% over the forecast period. The North American construction industry is undergoing modernization, with increasing adoption of smart building materials and energy-efficient solutions.

The rise in sustainable and modular construction projects across the U.S. and Canada has fueled the demand for high-performance adhesives in flooring, insulation, panel bonding, and prefabricated structures.

- Government initiatives, such as the U.S. Infrastructure Investment and Jobs Act (IIJA), which allocates USD 1.2 trillion for infrastructure development, are driving the use of advanced adhesives in transportation, commercial buildings, and residential projects.

The emphasis on green construction and LEED-certified buildings is further increasing the adoption of low-emission adhesives, supporting long-term market growth. Furthermore, the North American packaging industry, driven by e-commerce growth and sustainable packaging solutions, is a key contributor to the reactive hot melt adhesive market.

Companies such as Amazon, Walmart, and Target are increasing their use of high-strength adhesives for case and carton sealing, flexible packaging, and labeling applications. Additionally, the push for eco-friendly and recyclable packaging materials has accelerated the adoption of low-VOC, bio-based adhesives, aligning with sustainability commitments by major brands.

The rising demand for food-safe and temperature-resistant adhesives in cold chain logistics and perishable goods packaging further strengthens market expansion

Regulatory Frameworks:

- In the U.S., the Environmental Protection Agency (EPA) enforces the Toxic Substances Control Act (TSCA), which requires manufacturers to report and test chemicals used in adhesives to ensure that they do not pose environmental or health risks. Additionally, the Occupational Safety and Health Administration (OSHA) sets standards for workplace safety concerning chemical exposure.

- In Europe, the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation mandates that companies register chemical substances and assess their safety. The Classification, Labelling, and Packaging (CLP) regulation ensures that chemicals, including those in adhesives, are appropriately labeled with hazard information.

- In China, the Ministry of Ecology and Environment (MEE) regulates chemicals under the Measures for Environmental Management of New Chemical Substances, often referred to as China REACH. This regulation requires the registration and evaluation of chemicals, including those used in adhesives.

- The Ministry of Environment, Forest and Climate Change (MoEFCC) is developing the Chemical (Management and Safety) Rules, aiming to regulate the use of hazardous chemicals. Currently, the Manufacture, Storage, and Import of Hazardous Chemical Rules (MSIHC) provide guidelines for chemical safety.

Competitive Landscape:

The global reactive hot melt adhesives market is characterized by several market players that are implementing strategic initiatives such as collaborations and the development of cutting-edge products to strengthen their market presence and drive growth.

Partnerships between adhesive manufacturers and end-use industries are accelerating innovations in reactive hot melt adhesives, enhancing their performance, sustainability, and application versatility.

Companies are also investing in advanced formulations with improved bonding strength, durability, and environmental compliance to meet evolving industry standards.

Additionally, manufacturers are integrating bio-based and recyclable materials into their adhesives, aligning with global sustainability goals. These strategies are fostering technological advancements, expanding application scope, and supporting the overall expansion of the market.

- In April 2023, Dow and Avery Dennison collaborated to develop a pioneering and sustainable hot melt label adhesive solution, allowing polyolefin filmic labels and polypropylene (PP) or polyethylene (PE) packaging to be mechanically recycled in a single stream. This first-of-its-kind adhesive in the label market has received RecyClass approval for recycling within the HDPE colored stream, achieving Class B certification.

List of Key Companies in Reactive Hot Melt Adhesives Market:

- Henkel AG & Co. KGaA

- B. Fuller Company

- Jowat SE

- 3M

- Arkema

- Dow

- Exxon Mobil

- Avery Dennison Corporation

- Franklin International

- Wacker Chemie AG

- Ashland

- TEX YEAR INDUSTRIES INC.

- Evans Adhesive Corporation

- Huntsman Corporation

- RPM International Inc.

Recent Developments (Partnerships/Product Launch)

- In April 2024, Henkel, Kraton, and Dow formed a partnership to advance sustainability in the North American consumer goods industry. Their collaboration focuses on lowering emissions by incorporating renewable raw materials into adhesive products. This initiative is set to promote the development of eco-friendly and sustainable solutions within the sector, reinforcing their commitment to driving the transition toward sustainable adhesives and packaging.

- In December 2023, Henkel Adhesive Technologies announced plans to showcase two advanced solutions at LogiMAT 2024: automated packaging and palletizing using hot melt adhesives. Through its Technomelt E-COM portfolio for e-commerce packaging, the company aims to provide hot melt adhesive solutions designed for right-sized cartons and envelopes, enhancing packaging efficiency and sustainability.