Reactive Diluents Market Size

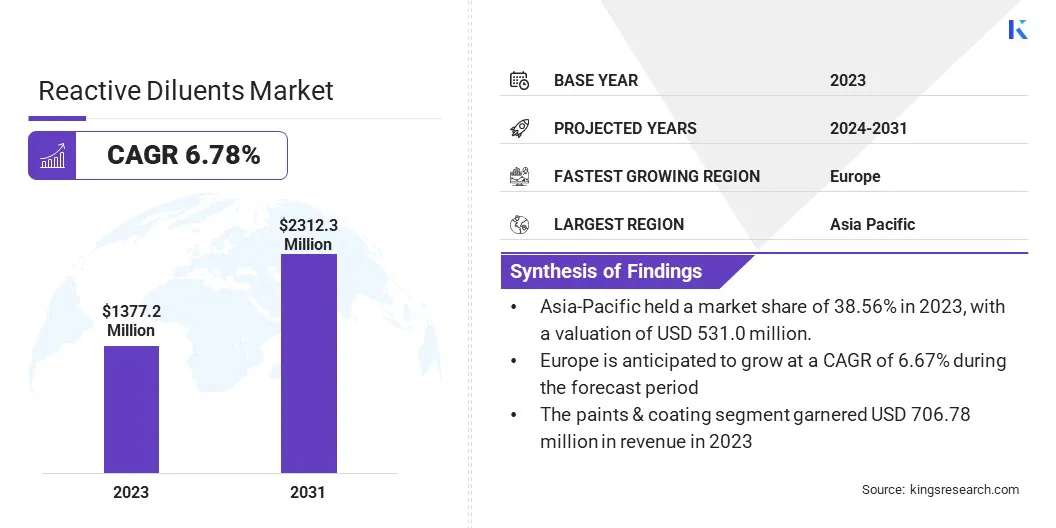

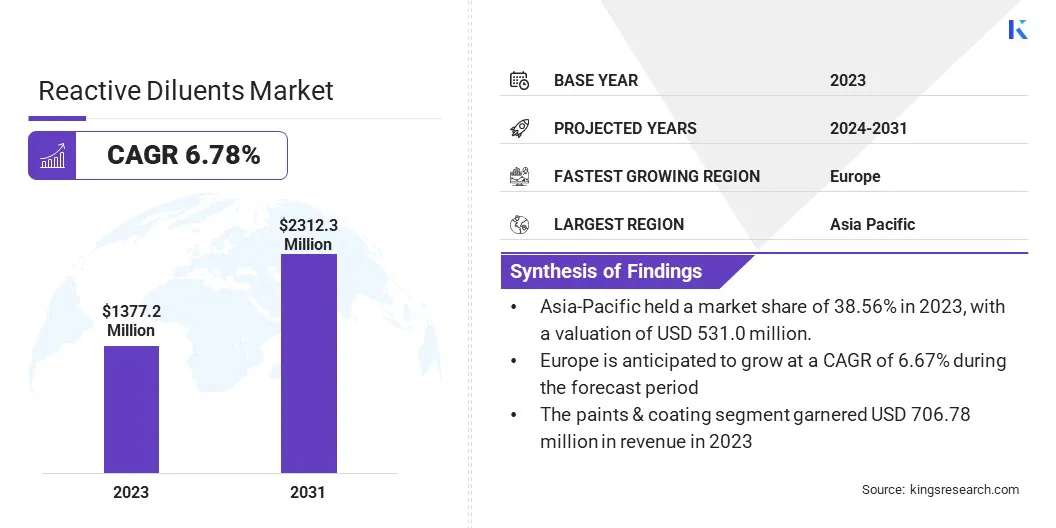

The global Reactive Diluents Market size was valued at USD 1,377.2 million in 2023 and is projected to grow from USD 1,461.1 million in 2024 to USD 2,312.3 million by 2031, exhibiting a CAGR of 6.78% during the forecast period. In the scope of work, the report includes solutions offered by companies such as Arkema, Cardolite Corporation, Aditya Birla Chemicals (Thailand) Pvt. Ltd, Evonik Industries AG, Huntsman International LLC, King Industries, Inc., KUKDO CHEMICAL CO., LTD., Olin Corporation, BASF, SACHEM, INC, and others.

The market is growing due to the surging need for cost-effective resin formulations, longing advancements in smart coatings, and the increasing use of advanced composites in electronics and aerospace. Additionally, the rising demand for improved heat resistance and chemical stability in materials, along with a shift toward waterborne and solvent-free formulations, is boosting its adoption across various high-performance applications.

Reactive diluents are becoming increasingly vital in the formulation of high-performance coatings, adhesives, and sealants, particularly in industries such as automotive, construction, and aerospace. These sectors require products that offer superior durability, weather resistance, and chemical resistance to withstand harsh environmental conditions and rigorous operational requirements.

- According to the Climate Change Committee, it was estimated that around 27,000 to 50,000 new homes would be built in the United Kingdom by 2022. This construction boom increased the demand for reactive diluents, as these materials are essential for ensuring the durability and performance of coatings, adhesives, and sealants used in the new homes.

Furthermore, reactive diluents enhance the performance of these products by improving their mechanical properties and ensuring a more robust and resilient final material. As these industries increasingly seek advanced materials that meet higher performance and durability standards, the reliance on reactive diluents is growing, thereby aiding the reactive diluents market expansion.

Reactive diluents are low-viscosity compounds added to resins or polymers to reduce their viscosity while maintaining the integrity of their properties. Unlike traditional solvents, reactive diluents chemically integrate into the polymer matrix during the curing process, This integration enhances the final material's mechanical properties, including flexibility, toughness, and adhesion.

They are commonly used in coatings, adhesives, and sealants to improve workability, facilitate application, and reduce volatile organic compound (VOC) emissions. By participating in the polymerization reaction, reactive diluents help achieve an optimal balance between fluidity and performance in various industrial applications.

Analyst’s Review

Innovations in epoxy-based reactive diluents are gaining prominence, largely due to their superior performance in industrial applications. These advancements are focused on enhancing properties such as flexibility, toughness, and chemical resistance, making them more suitable for demanding applications across diverse sectors such as automotive, aerospace, and electronics.

- In February 2023, Huntsman showcased a range of new products at the European Coatings Show. Among the highlights was the POLYRESYST IC6005 polyurethane system, designed for intumescent coatings in construction, which offers improved chemical resistance, quick curing, and low VOCs. Additionally, the company introduced a new bio-based coating system and the JEFFAMINE® M-3085 amine, a higher molecular weight amine aimed at improving pigment dispersants and reactive surfactants. These advancements reflect Huntsman’s commitment to enhanced performance and sustainability in their chemical solutions.

Key players are driving market growth by launching innovative products that focus on advanced, sustainable coatings and chemical systems. These new solutions meet the growing demand for high-performance, eco-friendly options in industries like construction and coatings. By addressing this rising need, companies are strengthening their market position and expanding their customer base.

Reactive Diluents Market Growth Factors

The widespread adoption of reactive diluents in response to stringent environmental regulations and rising consumer demand for sustainable products is fueling market growth. As manufacturers increasingly prioritize the development of low-VOC coatings and adhesives, reactive diluents are becoming essential for achieving these objectives.

Their ability to reduce VOC emissions while maintaining product performance allows companies to comply with regulatory standards and meet rising demand for eco-friendly solutions. This growing reliance on reactive diluents for the development of sustainable products is fueling their demand across various industries. This is bolstering market expansion and solidifying their position as a critical component in the global coatings and adhesives markets.

A major challenge hampering the development of the market is the volatility in raw material prices, which can significantly impact production costs. Additionally, stringent environmental regulations related to the use of certain chemicals in reactive diluents pose compliance challenges for manufacturers.

Key players in the reactive diluents market are mitigating these challenges by investing in sustainable sourcing and developing eco-friendly alternatives that comply with environmental regulations. They are further adopting advanced manufacturing processes to optimize production efficiency and reduce dependence on volatile raw materials.

Moreover, industry participants are focusing on strategic collaborations and long-term supply agreements to ensure stable access to essential raw materials, thereby minimizing cost fluctuations and maintaining market competitiveness.

Reactive Diluents Market Trends

The widespread adoption of bio-based reactive diluents is augmenting market growth by offering a sustainable alternative to petroleum-based options. As industries increasingly focus on reducing environmental impact, these renewable diluents are becoming more attractive due to their alignment with global sustainability goals and the principles of the circular economy.

Their ability to reduce reliance on fossil fuels and lower carbon footprints meets both regulatory requirements and the growing consumer demand for eco-friendly products.

- For instance, in November 2023, Arkema launched a new line of Elium resins that incorporate recycled materials to enhance the sustainability of composite parts. This development represents a significant advancement in the market, as the company launched a first-generation Elium resin containing at least 18% recycled material and tested a formulation with up to 92% recycled content. This initiative showcased the industry’s commitment to reducing environmental impact while also addressing the growing demand for eco-friendly materials in high-performance applications.

This shift is prompting more manufacturers to integrate bio-based reactive diluents into their formulations, thereby fueling market expansion.

Nanotechnology is emerging as a significant trend in the development of the reactive diluents market, offering enhanced properties such as improved adhesion, scratch resistance, and UV stability. This trend is fostering innovation in coatings and adhesives, as industries increasingly seek to leverage the superior performance characteristics provided by nanomaterials.

With applications extending across automotive, aerospace, and electronics, the integration of nanotechnology into reactive diluents is expected to reshape the market landscape. This advancement is expected to foster the development of next-generation products that meet the growing demand for high-performance, durable solutions, thereby supporting market growth.

Segmentation Analysis

The global market has been segmented based on application, type, category, and geography.

By Application

Based on application, the reactive diluents market has been categorized into paints & coating, composites, adhesives & sealants, and others. The paints & coating segment garnered the highest revenue of USD 706.78 million in 2023, mainly bolstered by rising demand in the construction, automotive, and industrial sectors.

Rapid urbanization and infrastructure development, particularly in emerging economies, are boosting the need for protective and decorative coatings. Additionally, advancements in technology, such as the development of eco-friendly and high-performance coatings that offer enhanced durability, corrosion resistance, and aesthetic appeal, are propelling segmental expansion. Regulatory pressure for low-VOC and sustainable solutions is further stimulating product innovation, thereby boosting the expansion of the paints and coatings segment.

By Type

Based on type, the market has been categorized into aliphatic, aromatic, and cycloaliphatic. The aliphatic segment captured the largest reactive diluents market share of 45.67% in 2023, largely due to its superior properties such as UV stability, weather resistance, and low yellowing, making it ideal for applications in coatings, adhesives, and sealants.

The demand is particularly strong in industries like automotive, construction, and aerospace, where long-term durability and aesthetic retention are critical. Additionally, the shift towards eco-friendly formulations and regulatory compliance is driving the adoption of aliphatic compounds, as they offer lower VOC emissions. Continuous innovation and the development of advanced aliphatic products are further boosting the segment's growth.

By Category

Based on category, the market has been categorized into mono functional, di-functional, tri-functional, multi-functional glycidyl-ethers. The di-functional segment is expected to garner the highest revenue of USD 1,337.9 million by 2031. These di-functional compounds are crucial in the production of high-performance coatings, adhesives, and sealants, offering improved mechanical properties and durability.

The increasing demand for advanced materials across diverse industries such as automotive, aerospace, and electronics is fueling the expansion of the segment. Additionally, the focus on developing innovative, high-quality products with specific functional properties is propelling segmental growth.

Reactive Diluents Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific reactive diluents market share stood around 38.56% in 2023 in the global market, with a valuation of USD 531.0 million. This notable growth is largely attributed to a strong demand from major economies such as China, India, and Japan.

- The Indian government's substantial investment of USD 31,650 billion in the development of 100 smart cities, along with an additional USD 28.18 billion for 500 cities over the next five years, is creating considerable opportunities for reactive diluents, particularly in paints and coatings.

This reactive diuents application extends beyond coatings to include adhesives, sealants, and composites, driven by diverse applications in automotive, electrical, and electronics industries. Thus, the expanding infrastructure and industrial sectors in the region are boosting regional market development.

Europe is anticipated to witness significant growth at a CAGR of 6.67% over the forecast period. The rising focus on sustainability and environmental regulations is leading to increased demand for eco-friendly formulations, including low-VOC and bio-based reactive diluents.

The European Union's stringent environmental policies and commitment to a circular economy are fostering the adoption of advanced, sustainable materials across various industries such as automotive, construction, and aerospace. Additionally, the growing emphasis on high-performance coatings and adhesives in infrastructure renovation and technological advancements fuels domestic market expansion.

Competitive Landscape

The global reactive diluents market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Reactive Diluents Market

- Arkema

- Cardolite Corporation

- Aditya Birla Chemicals (Thailand) Pvt. Ltd

- Evonik Industries AG

- Huntsman International LLC

- King Industries, Inc.

- KUKDO CHEMICAL CO., LTD.

- Olin Corporation

- BASF

- SACHEM, INC

Key Industry Development

- April 2023 (Production): Huntsman Corporation announced that its production site in Monthey, Switzerland, had adopted a mass balance concept and achieved REDcert2 certification. The certification pertains to the production of epoxy resin products used across various industrial and consumer markets.

The global reactive diluents market is segmented as:

By Application

- Paints & Coating

- Composites

- Adhesives & Sealants

- Others

By Type

- Aliphatic

- Aromatic

- Cycloaliphatic

By Category

- Mono Functional

- Di-Functional

- Tri-Functional

- Multi-Functional Glycidyl-Ethers

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America