Market Definition

The market focuses on the research and development of treatments for rare conditions, involving clinical trials that assess the safety and efficacy of novel therapies. Due to small patient populations, these trials utilize innovative methodologies such as adaptive designs and real-world evidence.

Key stakeholders include pharmaceutical companies, contract research organizations (CROs), regulatory agencies, and patient advocacy groups, with government incentives supporting increased investment and fostering innovation.

Rare Disease Clinical Trials Market Overview

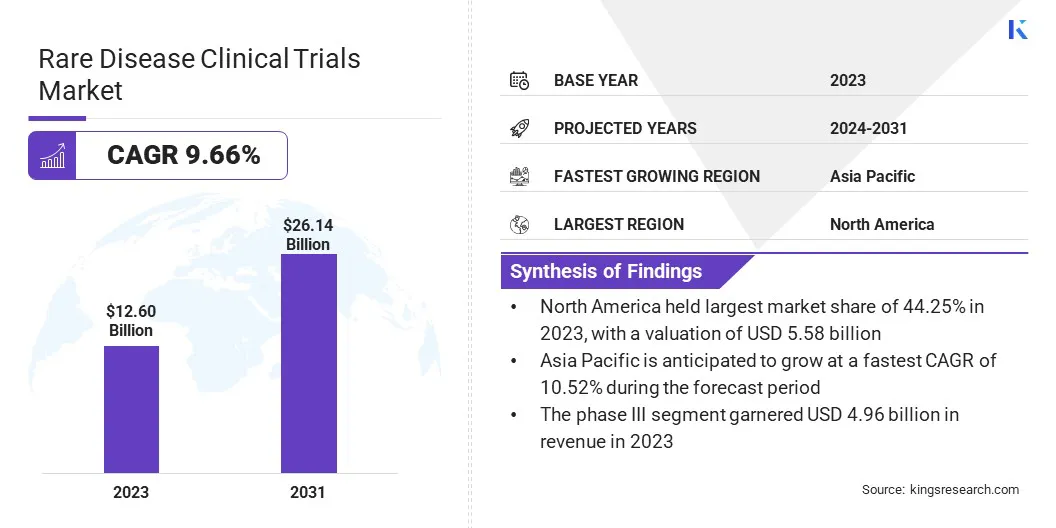

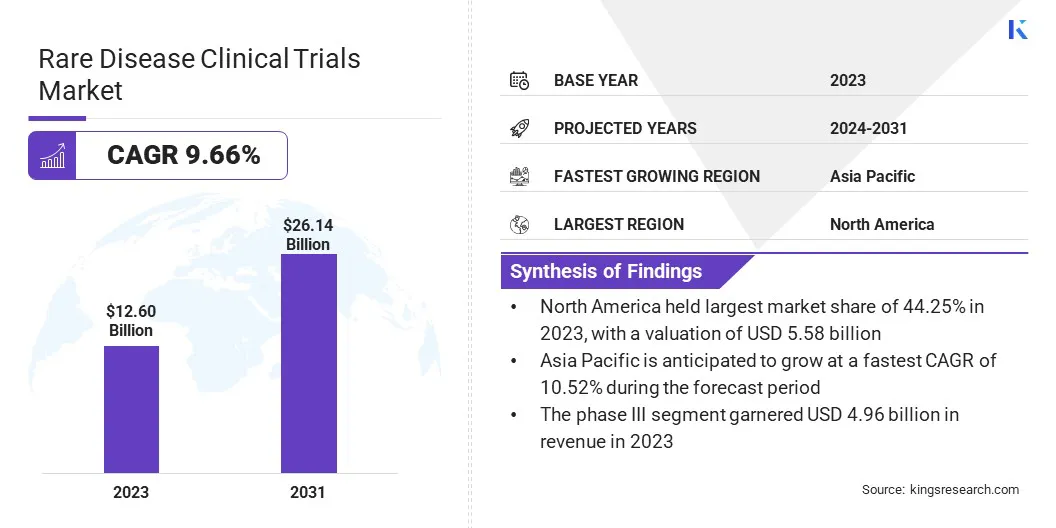

The global rare disease clinical trials market size was valued at USD 12.60 billion in 2023 and is projected to grow from USD 13.71 billion in 2024 to USD 26.14 billion by 2031, exhibiting a CAGR of 9.66% during the forecast period.

This expansion is fueled by innovations in drug development, increased funding, and strategic industry partnerships. Growing awareness of rare diseases, coupled with advancements in genetic research and biomarker identification, is enabling more targeted and effective therapeutic approaches.

Governments and regulatory agencies worldwide are supporting groth through favorable policies such as orphan drug incentives and expedited approval. Additionally, technologies such as AI-driven data analysis, wearable health monitoring devices, and decentralized trial models are enhancing efficiency, patient participation, and data accuracy.

Major companies operating in the rare disease clinical trials industry are Sanofi, Takeda Pharmaceutical Company Limited, F. Hoffmann-La Roche Ltd, Pfizer Inc., AstraZeneca, Syneos Health, Allucent, ICON plc, Parexel, Veristat LLC., Thermo Fisher Scientific Inc., Regeneron Pharmaceuticals Inc., Novotech, Worldwide Clinical Trials, and Apellis Pharmaceuticals.

Additionally, cross-sector collaborations between pharmaceutical companies, research institutions, and patient advocacy organizations are fostering innovation, ensuring a continuous pipeline of novel therapies to address unmet medical needs in rare diseases.

- In February 2025, Biogen Inc. and Stoke Therapeutics, Inc. collaborated to develop and commercialize zorevunersen, a potential disease-modifying medicine for Dravet syndrome. The partnership focuses on advancing a Phase 3 clinical trial and addressing the significant unmet needs in rare genetic epilepsies.

Key Highlights

- The rare disease clinical trials industry size was valued at USD 12.60 billion in 2023.

- The market is projected to grow at a CAGR of 9.66% from 2024 to 2031.

- North America held a share of 44.25% in 2023, valued at USD 5.58 billion.

- The phase III segment garnered USD 4.96 billion in revenue in 2023.

- The oncology segment is expected to reach USD 8.21 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.52% over the forecast period.

Market Driver

Regulatory Support and Advancements in Gene and Cell Therapies

The market is experiencing substantial growth, driven by strong regulatory support that accelerates treatment development. Agencies such as the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency) offer incentives such as orphan drug designations, which grants benefits such as extended market exclusivity, reduced fees, and tax credits.

Additionally, fast-track approvals expedite the review process, enabling earlier patient access to new therapies. Additionally, grants and funding programs further mitigate financial risks associated with high R&D costs and limited market potential.

These incentives are essential for overcoming barriers and fostering pharmaceutical investment in rare disease research, leading to the development of essential therapies for underserved conditions.

- In March 2025, the FDA launched the START Pilot Program to accelerate rare disease drug development through enhanced regulatory guidance. The program supports gene, cell, and neurodegenerative therapies, offering selected sponsors assistance in clinical study design, patient selection, and product characterization to streamline the approval of life-saving treatments.

Advancements in gene and cell therapies are fostering innovation in the market. Technologies such as CRISPR gene editing, antisense oligonucleotides and cell-based therapies are transforming treatment approaches. CRISPR allows for precise gene editing to correct genetic defects, while antisense oligonucleotides modify RNA to address gene expression issues.

Additionally, cell-based therapies, including gene t gene modifications, offer promising solutions for genetic disorders. These innovations enable targeted, effective, and personalized treatments, addressing the limitations of traditional therapies for rare diseases.

Market Challenge

Challenges in Patient Recruitment

Patient recruitment remains a major challenge in rare disease clinical trials market due to the limited and heterogeneous patient population. The low prevalence of these diseases makes it difficult to enroll a sufficient number of participants, leading to extended recruitment timelines, trial delays, and increased costs.

Additionally, the variability in symptoms and disease progression complicates the selection of a homogenous study group, posing challenges in trial design, outcome analysis, and data interpretation.

Geographic dispersion and limited access to specialized care hinder patient participation in clinical trials. Decentralized trial models and real-world evidence integration address this challenge.

Virtual trials and remote monitoring technologies expand geographic reach, reducing travel burdens. Additionally, partnerships with patient advocacy groups andregistries enhance recruitment efficiency, ensuring timely trial completion with robust data.

Market Trend

Virtual Trials and Collaborative Approaches

The market is evolving with key trends that that enhance efficiency, patient-centricity, and collaboration in clinical research. Decentralized and adaptive trial designs are transforming trial execution, while virtual trials expand patient participation by overcoming geographical barriers and reducing logistical challenges.

Digital tools and telemedicine improve accessibility, particularly for remote patients. Integrating real-world evidence strengthens trial designs by incorporating clinical practice data, offering deeper insights into patient outcomes and disease progression.

Adaptive study designs further optimize efficiency by allowing protocol modifications based on interim results, accelerating trial completion and resource utilization.

Increased collaboration and data sharing are accelerating rare disease therapy development. Partnerships among pharmaceutical companies, biotech firms, patient advocacy groups, and regulatory bodies foster a collaborative ecosystem that enhances trial recruitment and outcomes.

By pooling resources and expertise, these collaborations address challenges posed by limited patient populations. Moreover, data sharing improves understanding of disease mechanisms, treatment responses, and patient needs, leading to better decision-making and morestudy success.

- In November 2024, Healx partnered with Sanofi to identify new rare disease indications for a Sanofi compound using its AI-driven drug discovery platform, Healnet. This collaboration aims to accelerate rare disease drug discovery by leveraging AI to generate therapeutic rationale and address unmet medical needs.

Rare Disease Clinical Trials Market Report Snapshot

|

Segmentation

|

Details

|

|

By Phase

|

Phase I, Phase II, Phase III, Phase IV, Sub1_Seg5

|

|

By Therapeutic Area

|

Oncology, Cardiovascular Disorders, Neurological Disorders, Infectious Disease, Genetic Disorders, Autoimmune and Inflammation, Hematologic Disorders, Musculoskeletal Disorders, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Phase (Phase I, Phase II, Phase III, and Phase IV): The phase III segment earned USD 4.96 billion in 2023 due to the increasing demand for advanced clinical trials to evaluate the efficacy and safety of drugs in larger patient populations.

- By Therapeutic Area (Oncology, Cardiovascular Disorders, Neurological Disorders, Infectious Disease, Genetic Disorders, Autoimmune and Inflammation, Hematologic Disorders, Musculoskeletal Disorders, and Others): The oncology segment held a share of 28.75% in 2023, largely attributed to the high prevalence of cancer and continuous advancements in novel therapies.

Rare Disease Clinical Trials Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America rare disease clinical trials market accounted for a substantial share of 44.25% in 2023, valued at USD 5.58 billion. This dominance is reinforced by the region's robust healthcare system and extensive regulatory support.

The U.S. Food and Drug Administration (FDA) has been pivotal in advancing rare disease therapies through programs such as orphan drug designation, fast-track approvals, and market exclusivity, fostering a supportive development environment.

The country's advanced research infrastructure, focus on personalized medicine, and adoption of technologies such as gene therapy and CRISPR further strengthen its leading position.

Additionally, renowned research centers, expertise in genomic medicine, and robust intellectual property protection enhance its position in rare disease clinical trials. Moreover, public and private funding initiatives, including government-private collaborations, fuel innovation and provide critical financial support for clinical trials.

Asia Pacific rare disease clinical trials industry is expected to register the fastest CAGR of 10.52% over the forecast period. This growth is primarily attributed to the increasing prevalence of rare diseases and the growing need for innovative treatment.

The region's large and diverse patient populations offers significant opportunities for clinical trials targeting rare diseases, enabling broader research insights and the inclusion of underrepresented groups. Governments are strenghthening clinical trial infrastructure and streamlining regulatory processes.

Additionally, the rise of personalized medicine and gene therapies is fostering innovation, with pharmaceutical companies are increasingly partnering with local biotech firms to advance research and improve patient access.

- In February 2025, Cure Rare Disease (CRD) secured a USD 5.69 million grant from the California Institute for Regenerative Medicine (CIRM) to advance its antisense oligonucleotide (ASO) therapy for Spinocerebellar Ataxia Type 3 (SCA3), a rare neurodegenerative disorder lacking approved treatment. The program, initiated in 2021, has shown promising results in in vivo studies and received regulatory guidance from the FDA.

Regulatory Frameworks

- In Europe, the regulatory framework for rare disease clinical trials, including orphan drug designation and development, is guided by the EU Orphan Drug Regulation and the European Medicines Agency (EMA), with individual member states responsible for clinical trial authorization and oversight.

- In China, the National Medical Products Administration (NMPA) oversees the regulatory framework for rare disease clinical trials, with its Center for Drug Evaluation (CDE) responsible for evaluating drug clinical trial applications. The government supports rare disease research through tax incentives, expedited reviews, and market exclusivity.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) under the Ministry of Health, Labour, and Welfare (MHLW), regulates clinical trials, offering with incentives through the Orphan Drug Designation system.

- In India, the Central Drugs Standard Control Organization (CDSCO) oversees clinical trials, guided by the National Policy for Treatment of Rare Diseases (NPRD). The New Drugs and Clinical Trial Rules 2019 regulate orphan drug development and trial approvals.

Competitive Landscape

Companies operating in the rare disease clinical trials industry are adopting adaptive trial designs and decentralized clinical trials to improve patient recruitment and streamline operations. Collaborations with research institutions, contract research organizations (CROs), and patient advocacy groups are expanding patient access and leveraging specialized expertise.

Companies are leveraging artificial intelligence, machine learning, and big data analytics to optimize trial design, patient identification, and real-time data monitoring. They are also expanding globally through research collaborations to ensure diverse patient representation and regulatory compliance.

Mergers, acquisitions, and exclusive licensing agreements with biotech firms and academic institutions enhance clinical research capabilities and drive innovation in rare disease treatment development.

- In January 2025, the Innovative Health Initiative (IHI) launched the USD 18 million RealiseD project to enhance clinical trials for rare and ultra-rare diseases. In collaboration with nearly 40 public and private partners, the initiative seeks to optimize trial processes, enhance patient access to treatments, and advance rare disease research.

List of Key Companies in Rare Disease Clinical Trials Market:

- Sanofi

- Takeda Pharmaceutical Company Limited

- F. Hoffmann-La Roche Ltd

- Pfizer Inc.

- AstraZeneca

- Syneos Health

- Allucent

- ICON plc

- Parexel

- Veristat LLC.

- Thermo Fisher Scientific Inc.

- Regeneron Pharmaceuticals Inc.

- Novotech

- Worldwide Clinical Trials

- Apellis Pharmaceuticals

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Alexion and MSD reported positive results from the KOMET Phase III trial evaluating Koselugo for neurofibromatosis type 1 with inoperable plexiform neurofibromas in adults. The trial met its primary endpoint, showing a statistically significant and clinically meaningful objective response rate compared to placebo. As the largest global placebo-controlled Phase III trial for adults, it underscores Koselugo’s potential for expanded treatment beyond pediatric patients.

- In December 2024, Novartis announced that its Phase III STEER study for intrathecal onasemnogene abeparvovec (OAV101 IT) in SMA Type 2 patients met its primary endpoint, improving motor function. The treatment demonstrated a favorable safety profile, with adverse events comparable to the control group. Novartis plans to seek regulatory approval in 2025 to expand patient access.

- In September 2024, the European Rare Diseases Research Alliance (ERDERA) was launched with a USD 411 million budget to advance rare disease research. Led by INSERM (France) and supported by Horizon Europe, the initiative unites over 170 organizations to enhance clinical trials, diagnostics, and treatment development. ERDERA will support research projects, advanced therapies, and global collaborations.

- In June 2024, Amgen's Phase 3 MITIGATE trial for UPLIZNA (inebilizumab-cdon) in IgG4-related disease (IgG4-RD) achieved an 87% reduction in disease flares, meeting all key endpoints. Conducted across 80 sites in 22 countries, it is the first placebo-controlled trial providing Class 1 evidence for treating this rare immune-mediated disease. Amgen plans to seek regulatory approval to establish UPLIZNA as the first approved therapy for IgG4-RD.