Radiopharmaceuticals Market Snapshot

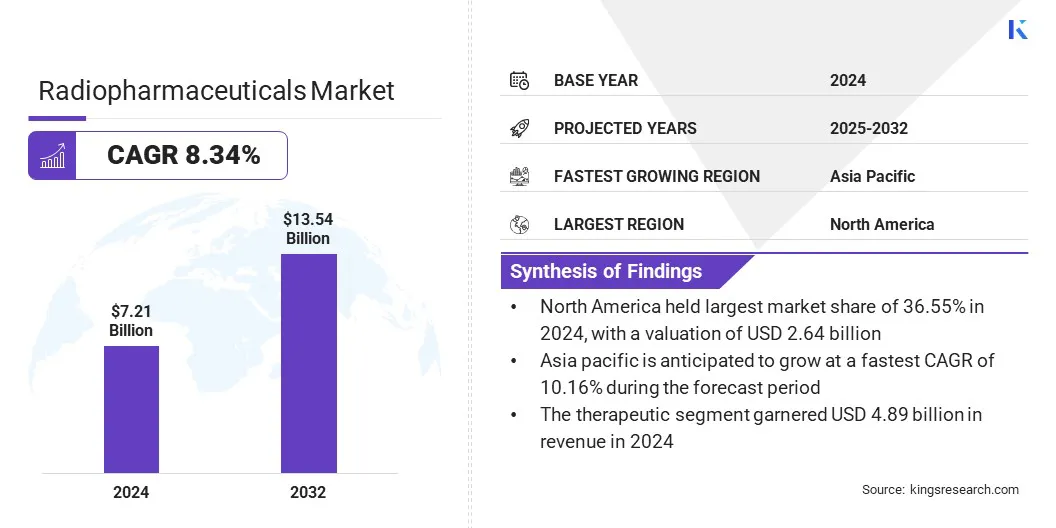

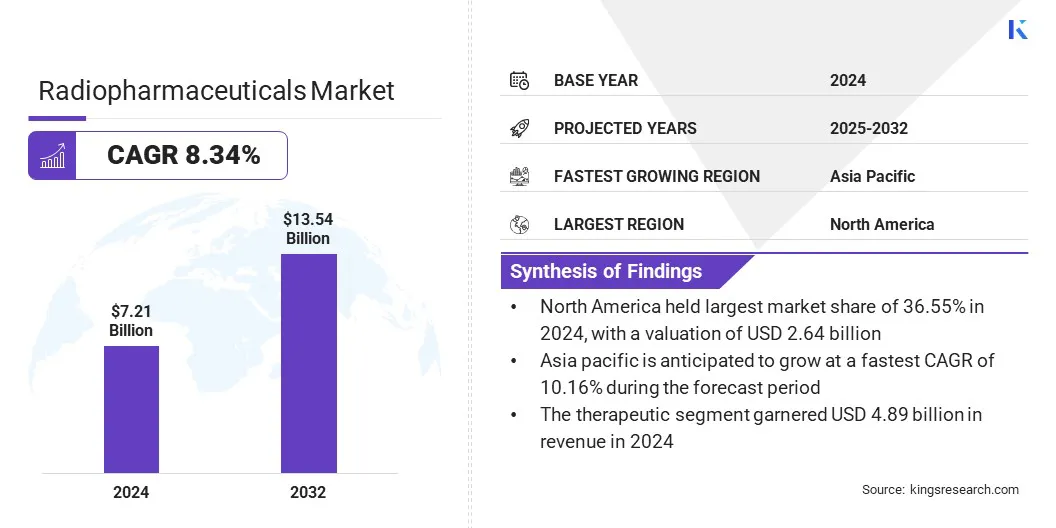

The global radiopharmaceuticals market size was valued at USD 7.21 billion in 2024 and is projected to grow from USD 7.73 billion in 2025 to USD 13.54 billion by 2032, exhibiting a CAGR of 8.34% during the forecast period. This market is growing due to the increasing momentum in theranostics and personalized medicine, which enable targeted diagnosis and therapy.

Additionally, the integration of AI and automation in radiopharmaceutical research and imaging is enhancing precision, accelerating development timelines, and improving diagnostic accuracy, driving broader clinical adoption and market expansion.

Key Market Highlights:

- The global market size was valued at USD 7.21 billion in 2024.

- The market is projected to grow at a CAGR of 8.34% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 2.64 billion.

- The therapeutic segment garnered USD 4.89 billion in revenue in 2024.

- The technetium 99m segment is expected to reach USD 4.39 billion by 2032.

- The oncology segment secured the largest revenue share of 42.12% in 2024.

- The diagnostic centers segment is poised for a robust CAGR of 9.21% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.16% during the forecast period.

Major companies operating in the radiopharmaceuticals industry are Novartis AG, Bayer, AstraZeneca, Lilly, Bristol-Myers Squibb Company, Curium, Cardinal Health, General Electric, Siemens, Bracco, Lantheus, Jubilant Radiopharma, Telix Pharmaceuticals Limited, Radiopharma Solutions, and Eckert & Ziegler.

Radiopharmaceuticals Market Overview

The rising prevalence of chronic diseases, such as cancer, neurological disorders, and cardiovascular conditions, is driving the demand for radiopharmaceuticals. Increasing global burden of these complex conditions is prompting the use of advanced diagnostic and therapeutic tools.

Radiopharmaceuticals are enabling precise imaging and targeted treatment, allowing for earlier detection and more effective disease management. Healthcare providers are adopting nuclear medicine solutions to improve patient outcomes and support personalized treatment strategies.

This growing awareness and clinical acceptance of radiopharmaceuticals are further expanding their use across oncology, cardiology, and neurology.

- According to a 2024 report by the World Heart Association, cardiovascular disease (CVD) was identified as the underlying cause of 931,578 deaths in the U.S. in 2021. Between 2017 and 2020, approximately 127.9 million U.S. adults, representing 48.6% of the adult population, were living with some form of CVD.

Market Driver

Momentum in Theranostics & Personalized Medicine

Rising demand for theranostics and personalized medicine is driving the adoption of radiopharmaceuticals across advanced clinical settings. The integration of targeted diagnostic and therapeutic functions is enabling more precise disease detection and tailored treatment approaches.

Agents such as Prostate-Specific Membrane Antigen (PSMA)-targeted compounds, Lutetium-177, and Actinium-225 are improving outcomes in conditions like prostate cancer through the highly specific delivery of radiation to diseased cells.

This dual capability reduces side effects and increases therapeutic effectiveness compared to conventional treatments. Healthcare providers are embracing these innovations to support individualized care and improve clinical decision-making.

- In October 2024, Blue Earth completed patient enrollment for its Phase 1 study of Lutetium‑177‑rhPSMA‑1, which is a PSMA-targeting agent for prostate cancer. Early data shows favorable safety and tumor-targeting dosimetry, prompting Phase 2 initiation across the U.S. and European sites.

Market Challenge

Limited Supply of Short-Lived Isotopes Delaying Market Expansion

A key challenge in the radiopharmaceuticals market is the constrained availability of short-lived isotopes, such as Actinium-225, which are critical for targeted therapies.

These isotopes have brief half-lives and require tightly coordinated supply chains, making production and distribution highly complex. Supply shortages are slowing the clinical trial progress and restricting the broader adoption of advanced radiotherapeutics.

To address this challenge, market players are investing in domestic isotope production facilities, partnering with nuclear reactors, and developing alternative production methods to improve availability.

Market Trend

Integrating AI and Automation in Radiopharmaceuticals Research and Imaging

A key trend in the market is the use of artificial intelligence and automation to enhance research, development, and imaging processes. AI tools are being applied to design more targeted radiotracers and optimize production workflows for improved consistency and output.

Automation is supporting precise dosimetry calculations, reducing manual errors and improving safety in clinical settings. In imaging, advanced algorithms are improving the quality and interpretation of PET and SPECT scans, aiding in more accurate diagnosis and treatment planning.

These technologies are increasing operational efficiency and enabling faster decision-making across the radiopharmaceutical value chain.

- In May 2024, Blue Earth Diagnostics (a Bracco company) agreed with Siemens Healthineers to support AI-based algorithm development for its PET imaging agent POSLUMA (flotufolastat F‑18). The agreement provides anonymized clinical PET/CT data from the Phase 3 LIGHTHOUSE trial to enhance Siemens Healthineers’ AI tools for better prostate cancer image quantification and interpretation.

Radiopharmaceuticals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Therapeutic, Diagnostic

|

|

By Radioisotope

|

Iodine I, Gallium 68, Technetium 99m, Fluorine 18, Others

|

|

By Application

|

Oncology, Cardiology, Neurology, Others

|

|

By End-User

|

Hospitals and Clinics, Diagnostic Centers, Cancer Research Institutes, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Therapeutic and Diagnostic): The therapeutic segment earned USD 4.89 billion in 2024, due to the rising adoption of targeted radioligand therapies in oncology, offering higher treatment precision and improved patient outcomes.

- By Radioisotope (Iodine I, Gallium 68, Technetium 99m, Fluorine 18, and Others): The technetium 99m segment held 23% of the market in 2024, attributed to its widespread use in diagnostic imaging, favorable physical properties, an established supply chain.

- By Application (Oncology, Cardiology, Neurology, and Others): The oncology segment is projected to reach USD 6.08 billion by 2032, owing to the high demand for targeted diagnostic imaging and radioligand therapies in cancer care.

- By End-User (Hospitals and Clinics, Diagnostic Centers, Cancer Research Institutes, Ambulatory Surgical Centers, and Others): The diagnostic centers segment is poised for significant growth at a CAGR of 9.21% through the forecast period, driven by the high volume of advanced imaging procedures such as PET and SPECT scans performed in these specialized facilities.

Radiopharmaceuticals Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America radiopharmaceuticals market share stood at 36.55% in 2024, with a valuation of USD 2.64 billion. This dominance is attributed to the region’s well-established healthcare system, widespread availability of advanced diagnostic, and presence of therapeutic nuclear medicine departments across major hospitals and specialty clinics.

This infrastructure enables the routine use of radiopharmaceuticals for cancer imaging, cardiac diagnostics, and neuroimaging. The growing demand for precision diagnostics and minimally invasive treatments is supporting the expansion of radiopharmaceutical usage.

Furthermore, the region benefits from a relatively supportive regulatory framework and reimbursement policies, with expedited approvals for radiopharmaceuticals, particularly for oncology applications.

- In March 2025, the U.S. Centers for Medicare & Medicaid Services (CMS) updated reimbursement policies to expand coverage for radiopharmaceuticals used in oncology and cardiology. The policy covers advanced imaging agents like PSMA PET scans and therapeutic radioligands, increasing access across hospitals and specialty clinics nationwide. This update supports the broader adoption of nuclear medicine procedures in precision diagnostics and minimally invasive therapies.

Asia Pacific is poised for significant growth at a CAGR of 10.16% over the forecast period, owing to the rise in cancer screening programs and the proliferation of oncology centers, particularly in urban areas.

With this expansion, there is greater clinical reliance on molecular imaging for early cancer detection, staging, and treatment planning. Radiopharmaceuticals like fluorodeoxyglucose (FDG) and newer tracers for prostate and neuroendocrine tumors are being increasingly used as part of routine cancer diagnosis, driving market growth.

Regulatory Frameworks

- In the U.S., radiopharmaceuticals are regulated by the Food and Drug Administration (FDA) under 21 CFR Part 212, which sets Current Good Manufacturing Practice (cGMP) requirements for Positron Emission Tomography (PET) drugs. The Nuclear Regulatory Commission (NRC) oversees radioactive material licensing and safety under 10 CFR Part 35.

- The European radiopharmaceutical framework is governed by Directive 2001/83/EC and Directive 2003/94/EC, which regulate manufacturing and marketing authorization. The European Medicines Agency (EMA) enforces these rules across member states, while EU GMP Annex 3 addresses radiopharmaceutical manufacturing. Clinical trials are regulated under centralized or mutual recognition procedures.

- The National Medical Products Administration (NMPA) oversees radiopharmaceutical regulation in China under the country’s Drug Administration Law. Product approval, safety testing, and clinical trials must comply with NMPA standards and align with Good Manufacturing Practice (GMP). China has also introduced guidance for using Real-World Evidence (RWE) in radiopharmaceutical development.

- Japan’s radiopharmaceuticals are regulated by the Pharmaceuticals and Medical Devices Agency (PMDA) under the authority of the Ministry of Health, Labour and Welfare (MHLW). The approval process follows ICH (International Council for Harmonisation) guidelines and includes expedited pathways for orphan or pediatric radiopharmaceuticals. Manufacturing standards are aligned with ICH E6 GCP and Japanese GMP.

Competitive Landscape

Major players in the radiopharmaceuticals market are expanding their manufacturing infrastructure, investing in research and development, and forming strategic partnerships to strengthen their position. These efforts are being made to increase production capacity, enhance the reliability of supply chains, and support the rising demand for targeted cancer therapies.

Companies are also focusing on technological advancements in radioligand therapies to improve treatment outcomes, which is contributing significantly to the overall growth of the market.

- In September 2024, Novartis began the construction of two radioligand therapy manufacturing facilities in Indiana and California. The new sites are designed to increase production capacity for Pluvicto and Lutathera. This development reflects Novartis’ commitment to building infrastructure that supports the growing application of radioligand therapies in cancer treatment.

Key Companies in Radiopharmaceuticals Market:

- Novartis AG

- Bayer

- AstraZeneca

- Lilly

- Bristol-Myers Squibb Company

- Curium

- Cardinal Health

- General Electric

- Siemens

- Bracco

- Lantheus

- Jubilant Radiopharma

- Telix Pharmaceuticals Limited

- Radiopharma Solutions

- Eckert & Ziegler

Recent Developments (M&A/Partnerships/Agreements/Expansion)

- In December 2024, Radiopharm Theranostics partnered with Lantheus for the co-development of a Phase I imaging trial for a novel oncology radiopharmaceutical. Lantheus will fund all trial costs and Radiopharm will lead the clinical programme under payments up to USD 2 million.

- In May 2024, Novartis acquired Mariana Oncology, a preclinical-stage biotech company specializing in innovative radioligand therapies (RLTs) for cancers with significant unmet medical needs. The acquisition also integrates Mariana’s research capabilities into Novartis’s broader radiopharmaceutical development portfolio.

- In June 2024, AstraZeneca acquired Fusion Pharmaceuticals for USD 2.4 billion. Fusion’s pipeline includes FPI‑2265, an actinium‑225 PSMA-targeting radioconjugate in Phase II trials for metastatic castration-resistant prostate cancer. The acquisition also brought Fusion’s research and manufacturing infrastructure into AstraZeneca’s radiopharmaceutical business.

- In March 2024, Ariceum Therapeutics opened a new 200 m² radiopharmaceutical R&D laboratory in Berlin. The facility includes cold biology and radioactive labs and supports PET/SPECT imaging and alpha/beta therapeutic isotope work. It enables in‑house development and non‑clinical testing of next‑generation radiopharmaceutical candidates.

- In February 2024, Bristol‑Myers Squibb acquired RayzeBio for USD 4.1 billion which included RayzeBio’s actinium‑225 radiopharmaceutical RYZ101, currently in Phase III for small‑cell lung and neuroendocrine tumors. The deal added RayzeBio’s Indianapolis manufacturing facility to BMS’s capabilities.