Market Definition

Radiofrequency ablation devices are medical instruments used to treat various conditions by delivering heat to tissues through radiofrequency energy. The heat causes controlled tissue destruction or coagulation. This process is commonly used to treat tumors, chronic pain, heart arrhythmias, and certain other conditions.

Radiofrequency Ablation Devices Market Overview

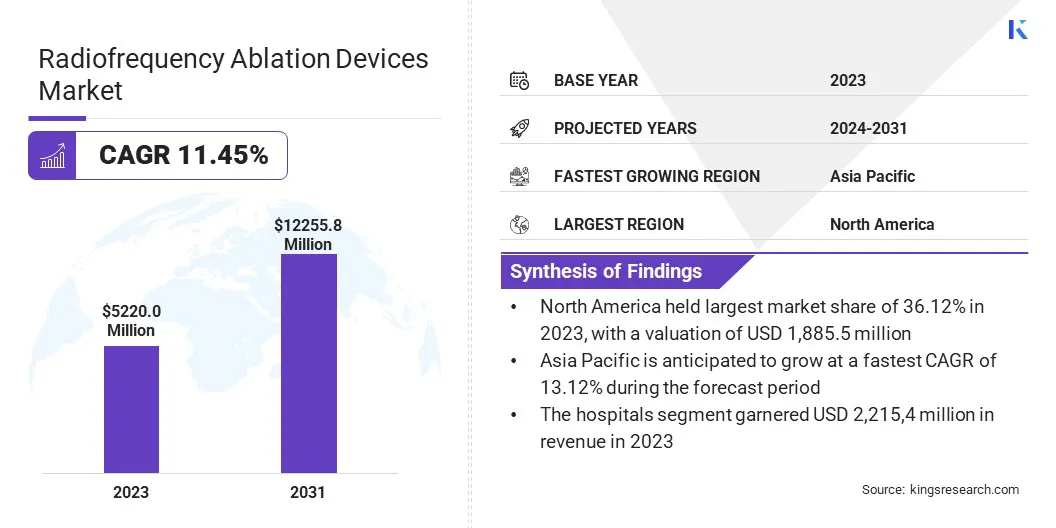

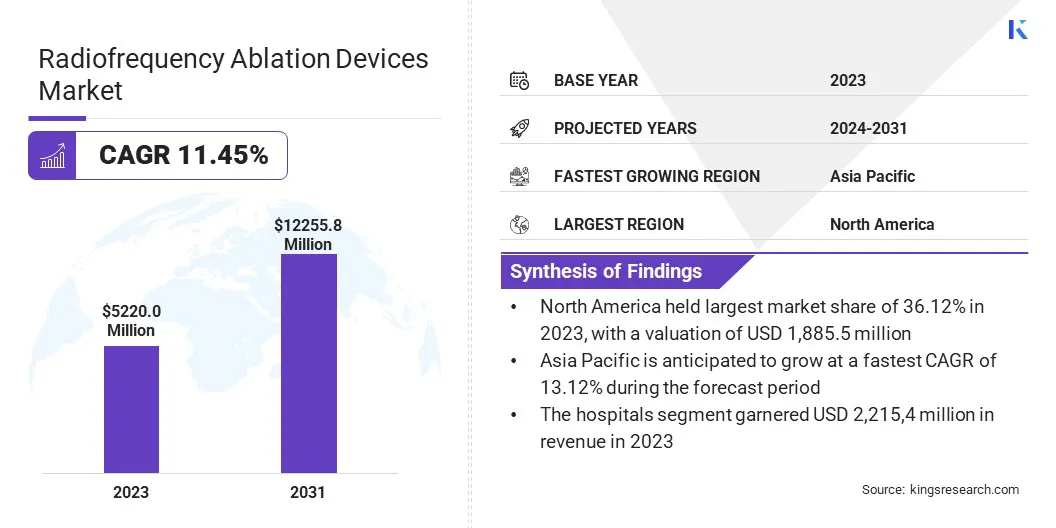

The global radiofrequency ablation (RFA) devices market size was valued at USD 5,220.0 million in 2023 and is projected to grow from USD 5,739.5 million in 2024 to USD 12,255.8 million by 2031, exhibiting a CAGR of 11.45% during the forecast period.

The market for radiofrequency ablation devices is registering steady growth, driven by technological advancements and the increasing adoption of minimally invasive procedures. This growth is primarily fueled by the rising prevalence of conditions such as cancer, chronic pain, and heart arrhythmias, all of which are commonly treated with RFA.

Major companies operating in the radiofrequency ablation devices industry are Medtronic Inc., Boston Scientific Corporation, Abbott Laboratories, Stryker Corporation, Hologic, Inc., AngioDynamics, Inc., Koninklijke Philips N.V., Smith+Nephew, Becton, Dickinson and Company, Olympus Corporation, Biotronik, Arthrex, Inc., Avanos Medical, Inc., Merit Medical Systems., and BVM MEDICAL LTD.

The demand for non-invasive treatment options has surged as cancer rates continue to rise globally, particularly for tumors in organs such as the liver, lungs, and kidneys. Similarly, RFA’s role in chronic pain management, particularly for back pain, osteoarthritis, and neck pain, is contributing to its expanding use.

The aging population further supports the need for these kinds of treatments, as more people seek alternatives to traditional surgical methods.

- In April 2024, Medtronic received FDA clearance for the OsteoCool 2.0 bone tumor ablation system. The upgraded system features four internally cooled probes, allowing for more efficient and flexible treatments, including multi-level spine tumor ablations. OsteoCool 2.0 is the only system with cooled probes, ensuring predictable ablations and effective pain relief.

Key Highlights:

- The radiofrequency ablation devices market size was valued at USD 5,220 million in 2023.

- The market is projected to grow at a CAGR of 11.45% from 2024 to 2031.

- North America held a market share of 36.12% in 2023, with a valuation of USD 1,885.5 million.

- The disposable equipment segment garnered USD 2215.4 million in revenue in 2023.

- The cardiac ablation segment is expected to reach USD 5,798.0 million by 2031.

- The hospitals segment is expected to reach USD 5703.2 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.12% during the forecast period.

Market Driver

"Technological Advancements in RFA Devices and Growing Shift toward Minimally Invasive Procedures"

The increasing prevalence of chronic conditions such as cardiovascular diseases and cancer is fueling the demand for advanced and effective treatment options, thereby boosting market adoption.

Additionally, continuous technological advancements in RFA devices, including enhanced precision, integration of mapping and ablation systems, and improved ease of use, are optimizing clinical outcomes and reducing procedure times, making them more attractive to healthcare professionals.

- In October 2024, Medtronic received FDA approval for the Affera Mapping and Ablation System with the Sphere-9 Catheter, an all-in-one solution for treating persistent atrial fibrillation (AFib) and atrial flutter. The system combines pulsed field and radiofrequency ablation, offering improved efficiency and a shorter learning curve for physicians.

Moreover, the growing shift toward minimally invasive procedures, which offer benefits such as faster recovery times and reduced complication risks, is further driving the market across multiple medical specialties, including cardiology, oncology, and pain management. These drivers are collectively contributing to the market's accelerated growth trajectory.

Market Challenge

"Competition from Alternative Therapy"

The radiofrequency ablation devices market faces several challenges that may impact its growth trajectory. The increasing shift toward alternative technologies, such as pulsed field ablation (PFA), which offers advantages like reduced tissue damage and shorter procedure times, is eroding RFA's market share, particularly in the treatment of AFib.

- In 2024, Citi survey predicted that PFA will surpass radiofrequency ablation in treating atrial fibrillation by 2025. PFA is expected to account for 49% of procedures, up from 39%, while RFA's share will decrease to 33%. This shift is driven by PFA's advantages, such as reduced tissue damage and shorter procedure times.

Additionally, the high capital expenditure required for advanced RFA systems, coupled with ongoing maintenance costs, presents a barrier to adoption, especially in cost-sensitive markets.

Furthermore, concerns around procedural risks, such as complications and the potential for incomplete ablation leading to recurrence, may affect clinician confidence and hinder broader market acceptance.

Market Trend

"Integration of Robotics and Mapping Technology"

The integration of robotics and advanced navigation systems is significantly enhancing the precision and safety of RFA procedures, driving the adoption of more sophisticated, automated devices.

- In December 2024, Stereotaxis and MicroPort EP announced that the Magbot Magnetic Navigation Ablation Catheter, a radiofrequency ablation catheter, received regulatory approval from China’s NMPA. Developed by MicroPort EP in collaboration with Stereotaxis, the catheter works with robotic systems like Genesis RMN and Columbus 3D EP Mapping System. It enables precise, safe navigation for treating arrhythmias and will be commercially launched in China by MicroPort EP.

Additionally, there is a growing shift toward personalized and targeted treatments, with RFA being increasingly utilized in combination with imaging and mapping technologies to enhance precision and treatment outcomes.

Furthermore, the rising healthcare investments in emerging markets, along with expanding healthcare access and improved reimbursement policies, are driving the adoption of RFA technologies and spurring market growth in regions such as Asia Pacific.

Radiofrequency Ablation Devices Market Report Snapshot

| Segmentation |

Details |

| By Component |

Disposable Equipment, Capital Equipment, Reusable Equipment |

| By Application |

Cardiac Ablation, Oncology, Pain Management, Others |

| By End User |

Hospitals, Ambulatory Surgical Centers (ASCs), Research Laboratories |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Disposable Equipment, Capital Equipment, and Reusable Equipment): The disposable equipment segment earned USD 2,215.4 million in 2023, due to the increasing demand for cost-effective, hygienic, and single-use solutions that reduce the risk of cross-contamination and align with infection control protocols in medical procedures.

- By Application (Cardiac Ablation, Oncology, Pain Management, and Others): The cardiac ablation segment held 46.44% share of the market in 2023, due to the rising prevalence of arrhythmias, particularly AFib, and the growing preference for minimally invasive procedures that offer quicker recovery times and reduced complication risks.

- By End User (Hospitals, Ambulatory Surgical Centers (ASCs), and Research Laboratories): The hospitals segment is projected to reach USD 5703.2 million by 2031, owing to the increasing number of patients requiring advanced treatments and the growing adoption of minimally invasive procedures.

Radiofrequency Ablation Devices Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial radiofrequency ablation devices market share of 36.12% and was valued at USD 1,885.5 million in 2023.

This dominance is primarily driven by the region's advanced healthcare infrastructure, high adoption of innovative medical technologies, and increasing prevalence of chronic diseases such as cardiovascular conditions, cancer, and chronic pain, all of which drive the demand for RFA treatments.

The market is further supported by the presence of leading medical device manufacturers and the growing trend of minimally invasive procedures, which offer patients faster recovery and fewer complications.

Additionally, the region’s favourable reimbursement policies and ongoing investments in healthcare innovation are contributing to the market’s robust growth. North America is expected to maintain a strong foothold in the global market as the demand for diagnostic and therapeutic RFA procedures continues to rise.

Asia Pacific is expected to register the fastest growth in the global market, with a projected CAGR of 13.12%. This rapid growth can be attributed to several factors, including the rising prevalence of chronic diseases such as AFib, cancer, and osteoarthritis in the region.

Additionally, the growing adoption of minimally invasive procedures, which offer shorter recovery times and lower complication rates, is boosting the demand for RFA treatments. The increasing healthcare investments, improvements in medical infrastructure, and the rising availability of advanced RFA devices are further contributing to the market’s expansion.

Moreover, favourable government initiatives, along with the growing middle-class population and healthcare access in emerging economies like China and India, are expected to drivethe market in Asia Pacific over the coming years.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- The U.S. follows FDA guidelines that regulate radiofrequency ablation devices through rigorous clinical trials and approval processes, ensuring that devices meet safety and efficacy standards before they reach the market. The Centers for Medicare & Medicaid Services (CMS) also plays a role in determining reimbursement policies for RFA procedures based on clinical evidence.

- The EMA oversees the approval and regulation of medical devices in the EU, ensuring that RFA devices meet the required safety and performance standards under the Medical Device Regulation (MDR). The regulation also includes post-market surveillance and vigilance to monitor the safety of RFA devices after they are commercially available.

- In APAC, countries like China regulate radiofrequency ablation devices through the National Medical Products Administration (NMPA), which ensures that devices undergo rigorous testing and approval before being sold. The NMPA also monitors the quality and safety of devices throughout their lifecycle, requiring regular inspections and compliance with national standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates RFA devices under the Pharmaceutical and Medical Device Act (PMD Act), ensuring their safety and effectiveness through pre-market approval and post-market surveillance. The PMDA also works to ensure that RFA procedures comply with the ethical standards of medical practice.

- On the international stage, the World Health Organization (WHO) provides guidelines and recommendations for the regulation of medical devices like RFA equipment, focusing on harmonizing standards across regions while addressing patient safety and ethical concerns. The WHO encourages global cooperation to maintain high standards of practice and innovation in the medical device sector.

Competitive Landscape:

The radiofrequency ablation devices market is characterized by a large number of participants, including both established corporations and rising organizations. Large, well-established companies typically lead the market with a broad range of products, advanced technologies, and robust distribution channels.

These players are focusing on continuous innovation, product enhancements, and strategic collaborations to strengthen their market positions. At the same time, emerging organizations are introducing new, specialized RFA devices, often leveraging cutting-edge technologies such as robotic-assisted navigation systems and advanced mapping tools.

The market is also registering a growing number of partnerships and joint ventures, particularly in emerging markets, aimed at expanding regional footprints and increasing access to RFA treatments.

Competition within the market is intensifying as the demand for minimally invasive procedures rises, with companies differentiating themselves based on product performance, pricing, and customer support services.

List of Key Companies in Radiofrequency Ablation Devices Market:

- Medtronic Inc.

- Boston Scientific Corporation

- Abbott Laboratories

- Stryker Corporation

- Hologic, Inc.

- AngioDynamics, Inc.

- Koninklijke Philips N.V.

- Smith+Nephew

- Becton, Dickinson and Company

- Olympus Corporation

- Biotronik

- Arthrex, Inc.

- Avanos Medical, Inc.

- Merit Medical Systems.

- BVM MEDICAL LTD

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, NeuroOne and Zimmer Biomet expanded their agreement, giving Zimmer Biomet exclusive rights to distribute NeuroOne’s FDA-cleared OneRF radiofrequency ablation system for brain use. The OneRF system, used successfully in brain ablation cases, aims to reduce hospital stays and surgeries. The partnership will leverage Zimmer Biomet's robotic technology and distribution network to expand the system's reach.

- In October 2024, Hologic, Inc. announced its acquisition of Gynesonics, Inc. for $350 million. Gynesonics, Inc. develops the Sonata System, a minimally invasive technology for treating uterine fibroids using real-time ultrasound and radiofrequency ablation. This acquisition expands Hologic’s women’s health offerings and treatment options for GYN surgeons, pending regulatory approvals.