Market Definition

The market involves the production, distribution, and application of various chemical additives used to enhance the performance, processing, and durability of polyvinyl chloride (PVC) materials. These additives include plasticizers, stabilizers, lubricants, impact modifiers, and flame retardants, among others.

The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period

PVC Additives Market Overview

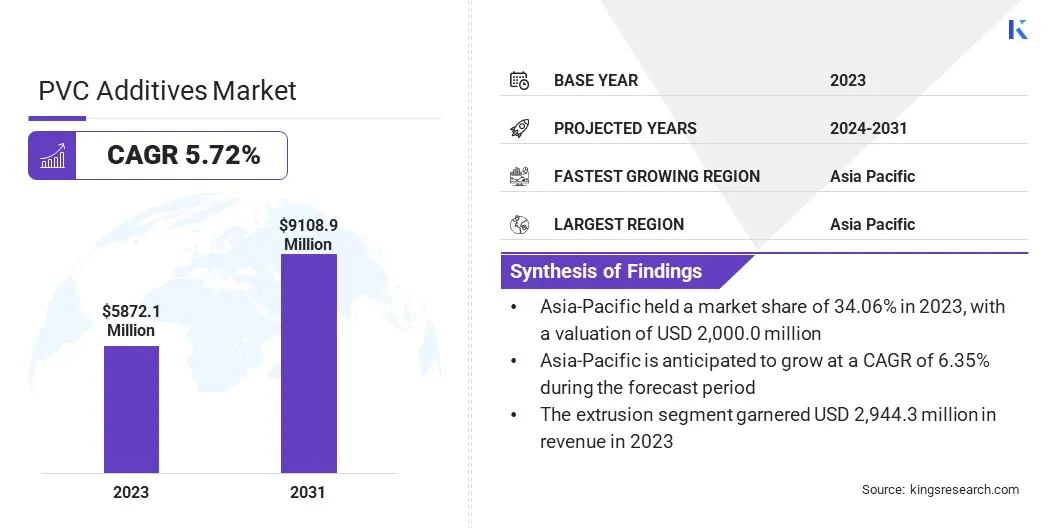

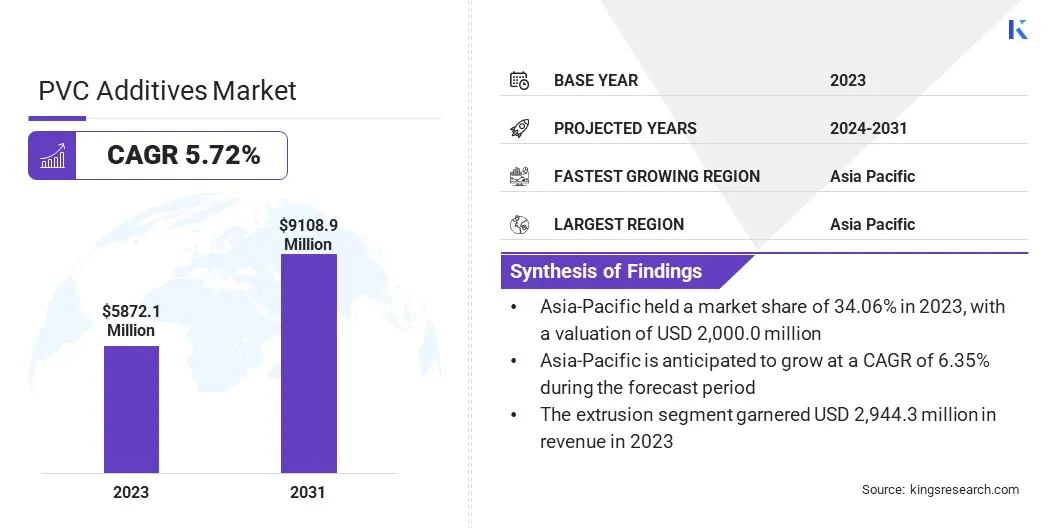

The global PVC additives market size was valued at USD 5,872.1 million in 2023 and is projected to grow from USD 6,171.5 million in 2024 to USD 9,108.9 million by 2031, exhibiting a CAGR of 5.72% during the forecast period.

Market growth is attributed to the increasing demand for PVC-based products across construction, automotive, electrical, and packaging sectors, where additives are essential for enhancing material properties such as durability, flexibility, and weather resistance.

The expanding infrastructure development and urbanization in emerging economies are further driving the consumption of PVC, highlighting the need for performance-enhancing additives.

Major companies operating in the PVC additives industry are Dow, Clariant, Evonik Industries AG, LANXESS, ADEKA CORPORATION, SONGWON, Exxon Mobil Corporation, Nouryon, Emery Oleochemicals, Baerlocher GmbH, DIC CORPORATION, Finolex Industries Ltd., LG Chem, Avient Corporation, and Solvay.

Moreover, the rising adoption of non-toxic and sustainable additives, coupled with ongoing innovations in additive formulations to meet regulatory standards and performance expectations, is expected to support market expansion through the forecast period.

- In August 2023, LANXESS announced the launch of a more sustainable version of its Mesamoll plasticizer, effective from October 1, 2023. Containing over 30% renewable raw materials, the new formulation reduces the product’s carbon footprint by around 20% without compromising performance. Mesamoll remains a phthalate-free, versatile plasticizer for PVC, PUR, and rubber applications.

Key Highlights

Key Highlights

- The PVC additives industry size was valued at USD 5,872.1 million in 2023.

- The market is projected to grow at a CAGR of 5.72% from 2024 to 2031.

- Asia-Pacific held a market share of 34.06% in 2023, with a valuation of USD 2,000.0 million.

- The UV stabilizers & others segment garnered USD 1,866.2 million in revenue in 2023.

- The extrusion segment is expected to reach USD 4,354.5 million by 2031.

- The pipes & fittings segment is anticipated to witness the fastest CAGR of 6.46% over the forecast period

- Europe is anticipated to grow at a CAGR of 5.84% through the projection period.

Market Driver

"Growing Demand in the Construction Sector"

Growing demand in the construction sector is significantly contributing to the expansion of the PVC additives market, as PVC continues to be a preferred material for a wide range of building and infrastructure applications, including pipes, window profiles, flooring, and roofing membranes.

These construction applications require tailored additive formulations to enhance properties such as durability, weather resistance, impact strength, and thermal stability, enabling PVC to perform reliably under varying environmental and structural conditions.

The increasing scale of global infrastructure development, particularly in emerging economies, combined with the need for long-lasting and cost-effective materials, is accelerating the demand for high-performance PVC additives that meet both technical and regulatory requirements.

Market Challenge

"Technical Challenges in Product Formulation"

Technical challenges in product formulation are impeding the progress of the PVC additives market. The specialized additives, essential for properties such as flexibility, durability, and chemical resistance, often require premium materials and complex manufacturing processes.

This increases production costs and makes it difficult for manufacturers to deliver cost-effective solutions, particularly in price-sensitive markets. While these advanced additives offer enhanced performance and compliance with strict environmental standards, their high cost can limit adoption, particularly in regions with budget constraints or among smaller manufacturers.

To overcome this challenge, manufacturers can focus on R&D to create cost-effective, high-performance additives by exploring alternative materials. Additionally, optimizing additive formulations for specific applications and implementing automated production technologies can reduce costs without sacrificing product quality.

Collaboration between additive suppliers and end-users can also lead to more tailored and cost-efficient solutions, while economies of scale in larger production runs can lower per-unit costs, enhancing the affordability of advanced PVC additives.

Market Trend

"Sustainable and Eco-Friendly Additives"

The growing emphasis on sustainable and eco-friendly additives is propelling the expansion of the PVC additives market. As environmental regulations tighten and consumer awareness increases, manufacturers are shifting away from hazardous compounds such as lead-based stabilizers and phthalate plasticizers toward non-toxic alternatives such as calcium-zinc stabilizers and bio-based plasticizers.

These sustainable additives are designed to reduce health and environmental risks while maintaining the mechanical and thermal properties required for PVC applications.

Additionally, advancements in green chemistry are enabling the development of high-performance, renewable additives that align with global sustainability goals. Moreover, the shift toward eco-friendly formulations support regulatory compliance and enhance brand credibility, particularly in environmentally conscious markets.

This trend is shaping innovation in the industry, as companies prioritize sustainable solutions to meet both market demand and evolving environmental standards.

- In February 2025, BASF launched sustainable versions of its Palatinol plasticizers in North America, featuring biomass-balanced (BMB) and Ccycled grades. Produced at its sites in Texas and Ontario, the products are ISCC PLUS certified, supporting BASF’s commitment to carbon reduction and circular economy initiatives.

PVC Additives Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Heat Stabilizers, Plasticizers, Impact Modifiers, Lubricants, UV Stabilizers & Others

|

|

By Fabrication Process

|

Extrusion, Injection Molding, Others

|

|

By Application

|

Pipes & Fittings, Profiles & Tubing, Wires & Cables, Flooring & Roofing

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Heat Stabilizers, Plasticizers, Impact Modifiers, Lubricants, UV Stabilizers & Others ): The UV stabilizers & others segment earned USD 1,866.2 million in 2023 due to rising demand for weather-resistant and durable PVC products across outdoor construction and automotive applications.

- By Fabrication (Process Extrusion, Injection Molding, and Others): The extrusion segment held a share of 50.14% in 2023, fueled by its widespread use in manufacturing PVC pipes, profiles, and sheets for construction and infrastructure applications.

- By Application (Pipes & Fittings, Profiles & Tubing, Wires & Cables, and Flooring & Roofing): The pipes & fittings segment is projected to reach USD 3,283.0 million by 2031, propelled by rising infrastructure development and rising demand for durable, cost-effective piping solutions.

PVC Additives Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific PVC additives market share stood at around 34.06% in 2023, with a valuation of USD 2,000.0 million. The dominance is reinforced by the region’s robust manufacturing capabilities, expanding construction sector, and increasing demand for PVC-based products in infrastructure, automotive, and electrical applications.

Asia Pacific PVC additives market share stood at around 34.06% in 2023, with a valuation of USD 2,000.0 million. The dominance is reinforced by the region’s robust manufacturing capabilities, expanding construction sector, and increasing demand for PVC-based products in infrastructure, automotive, and electrical applications.

The increasing use of PVC in applications such as pipes, profiles, and cables is creating a strong demand for specialized additives. Moreover, supportive government policies, availability of cost-effective labor and raw materials, and growing foreign investments in industrial development further strengthen the region’s market position.

The Europe PVC additives industry is set to grow at a CAGR of 5.84% over the forecast period. This growth is fostered by the rising demand for sustainable construction materials and stringent regulations that promote the use of non-toxic and eco-friendly additives.

Additionally, there is a growing focus on recycling and circular economy practices. The regional market benefits from advanced research and development capabilities and a strong presence of leading chemical manufacturers, fostering innovation in high-performance additive solutions.

The increasing use of PVC in automotive light weighting, electrical systems, and green building applications is expected to further accelerate regional market growth.

Regulatory Frameworks

- In the United States, the Hazard Communication Standard (HCS) (29 CFR 1910.1200) ensures that chemical hazards are communicated to workers through labels, safety data sheets, and training. The regulation aligns with the Global Harmonization System (GHS) to standardize hazard information.

- In the United States, the Toxic Substances Control Act (TSCA) regulates the manufacture, use, and disposal of chemicals to ensure they do not pose risks to human health or the environment. The EPA is responsible for assessing and controlling chemicals, including restricting or banning those deemed hazardous.

- In the European Union, REACH regulates chemicals used in PVC additives to ensure they do not harm human health or the environment. It mandates that all chemicals, including additives, be registered with the European Chemicals Agency (ECHA) for safety assessment.

- In Japan, the Chemical Substances Control Law (CSCL) regulates the manufacture, import, and use of chemical substances to prevent environmental pollution and protect human health, flora, and fauna

Competitive Landscape

The PVC additives industry is highly competitive with key players focusing on innovation, sustainability, and meeting evolving industry demands. Manufacturers are increasingly prioritizing the development of eco-friendly and non-toxic additives to comply with stringent environmental regulations and satisfy consumer demand for sustainable solutions.

Companies are expanding their manufacturing capabilities, investing in cutting-edge technologies, and forming strategic partnerships. They are also leveraging sustainability practices, such as utilizing renewable resources and promoting recycling initiatives, to align with global efforts to reduce plastic waste.

List of Key Companies in PVC Additives Market:

- Dow

- Clariant

- Evonik Industries AG

- LANXESS

- ADEKA CORPORATION

- SONGWON

- Exxon Mobil Corporation

- Nouryon

- Emery Oleochemicals

- Baerlocher GmbH

- DIC CORPORATION

- Finolex Industries Ltd.

- LG Chem

- Avient Corporation

- Solvay

Recent Developments (Expansion)

- In October 2024, Evonik Oxeno announced an expansion of its production capacities for ELATUR CH (DINCH) and ELATUR DINCD plasticizers at its Marl site in Germany. This expansion aims to meet rising demand and ensure a reliable supply for the European market, utilizing biobased and circular raw materials as part of Evonik’s sustainability efforts.

Key Highlights

Key Highlights Asia Pacific PVC additives market share stood at around 34.06% in 2023, with a valuation of USD 2,000.0 million. The dominance is reinforced by the region’s robust manufacturing capabilities, expanding construction sector, and increasing demand for PVC-based products in infrastructure, automotive, and electrical applications.

Asia Pacific PVC additives market share stood at around 34.06% in 2023, with a valuation of USD 2,000.0 million. The dominance is reinforced by the region’s robust manufacturing capabilities, expanding construction sector, and increasing demand for PVC-based products in infrastructure, automotive, and electrical applications.