Market Definition

The market covers industrial activities involved in the production and supply of pulp and paper products. This market includes operations across raw material sourcing, processing, and end-use applications. It is segmented by raw material types such as wood-based fibers, agro-based sources, and recycled fiber based inputs.

Key processes such as pulping and bleaching, which are essential stages in transforming raw materials into usable paper products. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Pulp and Paper Market Overview

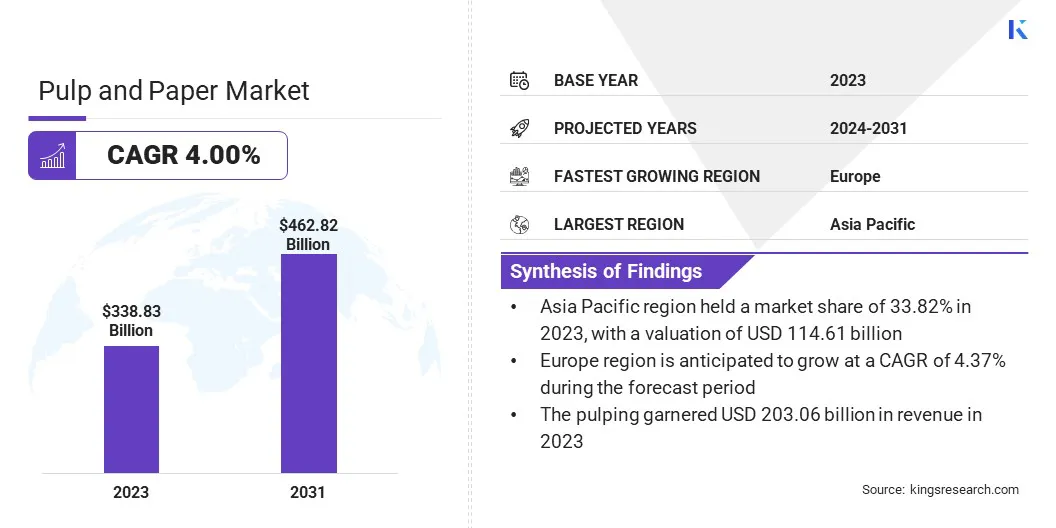

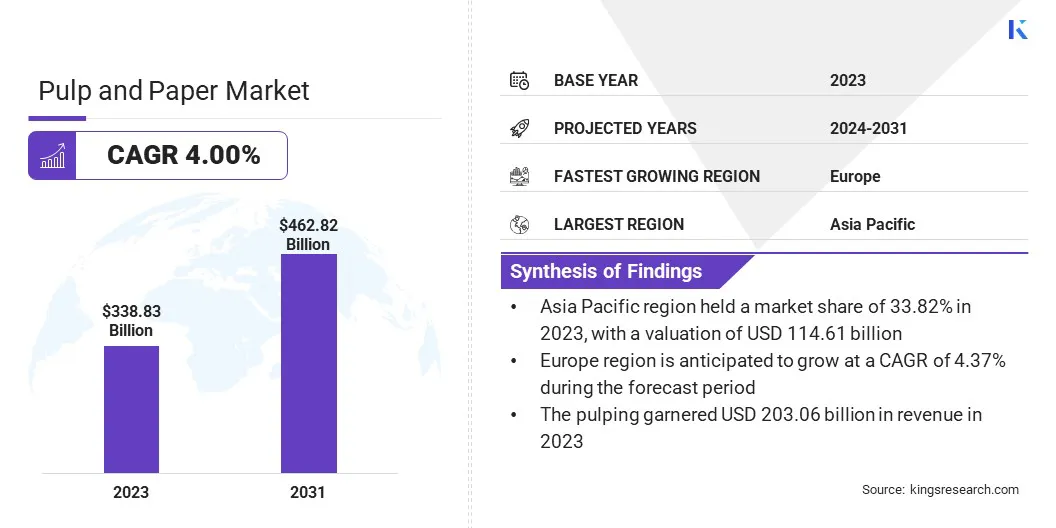

The global pulp and paper market size was valued at USD 338.83 billion in 2023 and is projected to grow from USD 351.71 billion in 2024 to USD 462.82 billion by 2031, exhibiting a CAGR of 4.00% during the forecast period.

Market growth is driven by the rising demand for sustainable packaging solutions, as industries shift away from plastic in favor of recyclable, biodegradable alternatives. The expansion of the e-commerce sector has further fueled the need for efficient and eco-friendly packaging materials, particularly corrugated paper products.

Major companies operating in the pulp and paper industry are NIPPON PAPER INDUSTRIES CO., LTD., Mondi, Stora Enso, Smurfit Kappa, Sappi Ltd, DS Smith, International Paper, Domtar Corporation, WestRock Company, UPM Global, CMPC, Suzano S/A, APP Group, Oji Holdings Corporation, and Nine Dragons Paper Limited.

Additionally, innovations in specialty papers are contributing to the growth of the market. These advancements include the development of high-performance paper products for applications in industries such as electronics, healthcare, and food packaging. The rise of functional papers, such as water-repellent, antimicrobial, and barrier-coated papers, is creating new growth opportunities.

- In January 2025, International Paper and DS Smith announced their merger to form a global leader in sustainable packaging. The combined entity seeks to enhance customer experience by integrating the strengths of both businesses, ensuring more responsive and efficient service. With a strong focus on innovation, the company will maintain strong focus on innovation, continuing to advance sustainable packaging solutions.

Key Highlights:

- The pulp and paper industry size was recorded at USD 338.83 billion in 2023.

- The market is projected to grow at a CAGR of 4.00% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 114.61 billion.

- The wood-based segment garnered USD 142.88 billion in revenue in 2023.

- The pulping segment is expected to reach USD 272.78 billion by 2031.

- The packaging segment is estimated to generate a revenue of USD 112.42 billion by 2031.

- Europe is anticipated to grow at a CAGR of 4.37% over the forecast period.

Market Driver

"Demand for Sustainable Packaging"

The growth of the global pulp and paper market is driven by the growing demand for sustainable packaging. As environmental concerns rise globally, industries such as e-commerce, food, and retail are increasingly adopting eco-friendly, recyclable, and biodegradable packaging solutions.

This shift is supported by regulations targeting plastic waste, such as bans on single-use plastics, along with rising consumer awareness of environmental issues. The shift away from plastic packaging is prompting businesses to invest in sustainable and recyclable paper-based alternatives.

Paper packaging offers a viable solution that aligns with sustainability goals, meets regulatory requirements, and meets consumer demand for eco-conscious products. Manufacturers are focusing on the development of innovative, sustainable products to cater to this growing demand.

- In March 2025, ANDRITZ and HolyPoly entered an exclusive agreement to provide a comprehensive recycling solution for used paper machine clothing (PMC) to paper producers across Europe. The partnership enables mills to recycle all forming fabrics and felts at the end of their service life, promoting circular economy initiatives.

Market Challenge

"Increasing Cost of Raw Materials"

A major challenge hampering the expansion of the pulp and paper market is the increasing cost of raw materials, particularly wood and recycled fibers. Fluctuations in price and supply, fueled by deforestation regulations, supply chain disruptions, and cross-industry competition significantly affect production costs.

To address this challenge, companies are investing in alternative fiber sources such as agro-based and recycled materials. Additionally, innovations in fiber recycling technologies and the development of more efficient pulp processing techniques can help mitigate the impact of raw material shortages and reduce dependency on traditional sources.

Market Trend

"Focus on Unbleached Water Repellent Paper"

In the pulp and paper market, unbleached water-repellent paper is emerging as a key trend. This trend reflects the growing preference for natural, untreated paper products with enhanced durability. Unbleached papers retain the raw fiber qualities, making them a more environmentally friendly alternative to bleached options.

The incorporation of water-repellent features increases their utility, particularly in moisture-sensitive applications. This shift toward unbleached, water-resistant paper aligns with industry efforts to develop functional and sustainable materials without relying on harmful chemicals.

- In October 2024, Lintec launched an unbleached and uncolored kraft paper with high water repellency, designed for applications such as carrier bags and envelopes in the logistics sector. The product offers natural pulp color tones and achieves a water repellency rating of R7 without surface coating, maintaining compatibility with various printing methods and standard processing adhesives.

Pulp and Paper Market Report Snapshot

|

Segmentation

|

Details

|

|

By Raw Material

|

Wood-based, Agro-based, Recycled Fiber Based

|

|

By Process

|

Pulping, Bleaching

|

|

By End Use Industry

|

Packaging, Printing, Construction, Consumer Goods, Transportation, Energy, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Raw Material (Wood-based, Agro-based, and Recycled Fiber Based): The wood-based segment earned USD 142.88 billion in 2023 due to its widespread availability, high fiber quality, and established processing infrastructure.

- By Process (Pulping and Bleaching): The pulping segment held a share of 59.93% in 2023, attributed to its central role in fiber extraction and cost-effective production methods.

- By End Use Industry (Packaging, Printing, Construction, and Consumer Goods): The packaging segment is projected to reach USD 112.42 billion by 2031, fueled by the rising demand for sustainable and recyclable packaging across e-commerce and FMCG sectors.

Pulp and Paper Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific pulp and paper market share stood at around 33.82% in 2023, valued at USD 114.61 billion. The dominance is supported by strong demand from the packaging, printing, and hygiene sectors.

Countries such as China, India, Indonesia, and Vietnam have witnessed rapid industrialization and urbanization, leading to higher consumption of paper products. The expansion of e-commerce and retail industries has increased the need for corrugated packaging and labeling. Additionally, abundant availability of raw materials, low labor costs, and favorable government policies have made the region a major hub for pulp and paper production.

The Europe pulp and paper industry is poised to grow at a CAGR of 4.37% over the forecast period. This growth is fostered by its strong focus on sustainability, recycling, and technological innovation. Europe has the highest paper recycling rates globally, which supports the shift toward circular economy practices.

Rising demand for eco-friendly and biodegradable packaging from sectors such as food, cosmetics, and e-commerce is further propelling regional market expansion. Countries such as Germany, Finland, and Sweden are leading the regional market with well-established production facilities and research-driven developments in sustainable fiber processing.

- In May 2024, Starkraft, under the HEINZEL GROUP, successfully commenced operations of its PM6 paper machine at the Steyrermühl paper mill in Austria. The expansion boosts the company’s kraft paper production capacity to 350,000 tons annually, supporting global growth and reinforcing its commitment to innovation, quality, and sustainability in flexible packaging solutions.

Regulatory Frameworks

- In the U.S, the pulp and paper industry is regulated by the Environmental Protection Agency (EPA) under frameworks such as the Clean Air Act (CAA) and the Clean Water Act (CWA), which set limits on air emissions and wastewater discharge from mills.

- In India, the Central Pollution Control Board (CPCB) oversees compliance with the Water (Prevention and Control of Pollution) Act, 1974, and the Environment (Protection) Act, 1986, mandating zero liquid discharge and promoting cleaner production technologies in paper mills.

Competitive Landscape

Key players in the pulp and paper industry are focusing on strategic investments in advanced processing technologies to improve operational efficiency and reduce environmental impact. Companies are expanding their production capacities in high-growth regions through joint ventures and facility upgrades to meet rising demand.

Mergers and acquisitions are being used to strengthen product portfolios and enter new geographic markets. Many players are shifting toward integrated production models to streamline supply chains and reduce dependency on external suppliers. There is a strong emphasis on developing sustainable and recyclable paper products to align with regulatory standards and changing consumer preferences.

- In April 2025, ANDRITZ signed an agreement to acquire A.Celli Paper, expanding its capabilities in winding and rewinding technologies and strengthening its position as a full-line supplier in the tissue and paper industry. The acquisition enhances ANDRITZ’s service offerings and supports its strategy to deliver innovative, end-to-end solutions from fiber processing to packaged paper rolls.

List of Key Companies in Pulp and Paper Market:

- NIPPON PAPER INDUSTRIES CO., LTD.

- Mondi

- Stora Enso

- Smurfit Kappa

- Sappi Ltd

- DS Smith

- International Paper

- Domtar Corporation

- WestRock Company

- UPM Global

- CMPC

- Suzano S/A

- APP Group

- Oji Holdings Corporation

- Nine Dragons Paper Limited

Recent Developments (M&A)

- In March 2025, ITC Limited signed a business transfer agreement to acquire the Century Pulp & Paper Undertaking (CPP) from Aditya Birla Real Estate Limited. The acquisition adds 480,000 MT of annual capacity to ITC’s Paperboards & Specialty Papers Business and offers strategic benefits in scale, operational resilience, and locational advantage, while aligning with ITC’s growth strategy and sustainability objectives.