Market Definition

The market refers to the specialized segment of the telecommunications industry that provides reliable, high-speed, and secure broadband communication solutions for public safety agencies, including police, fire departments, emergency medical services, and disaster response teams.

Designed for mission-critical use, these networks offer enhanced coverage, low latency, and prioritization features. They operate on dedicated or shared spectrum, enabling seamless agency interoperability. The report outlines major factors driving the market, along with key drivers, regional analysis, and regulatory frameworks that are set to influence the growth trajectory over the forecast period.

Public Safety LTE Market Overview

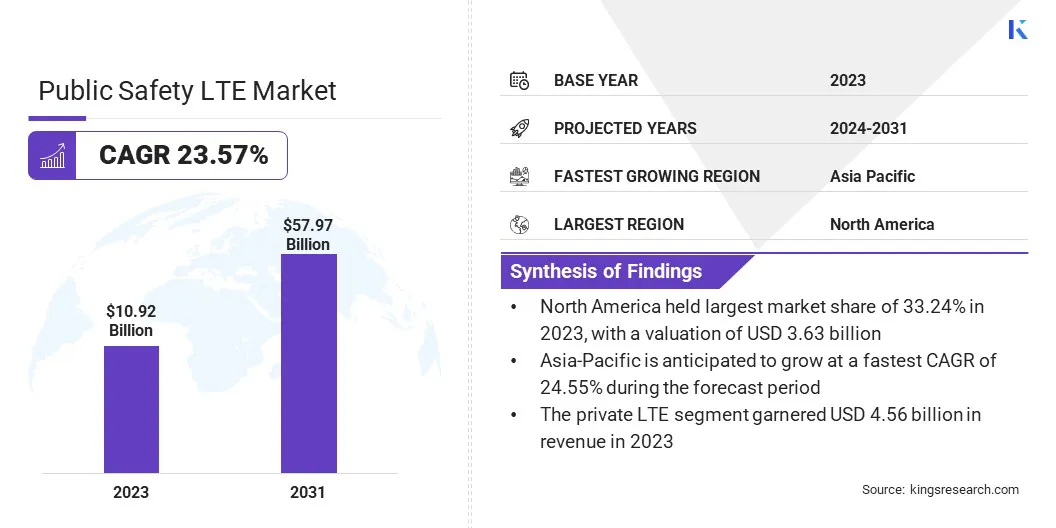

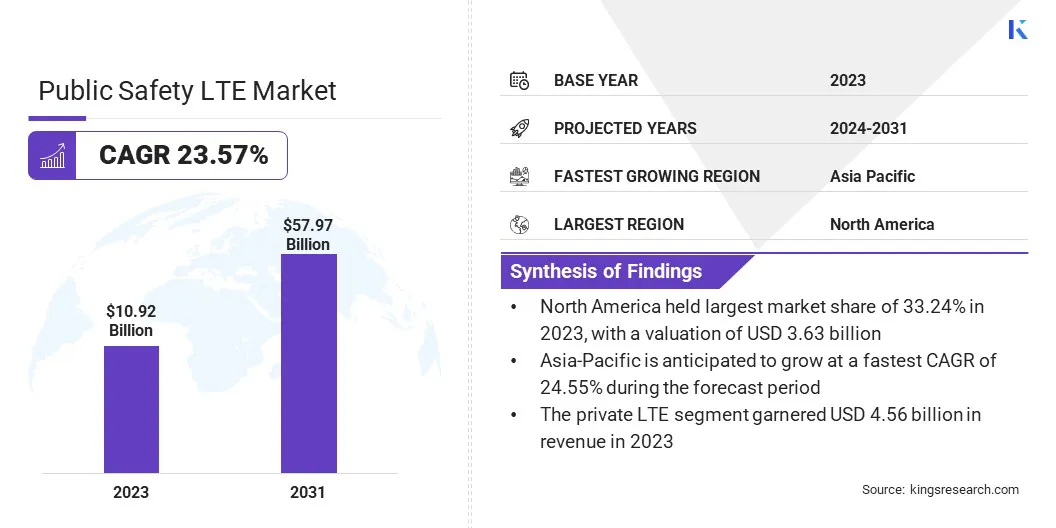

The global public safety LTE market size was valued at USD 10.92 billion in 2023 and is projected to grow from USD 13.18 billion in 2024 to USD 57.97 billion by 2031, exhibiting a CAGR of 23.57% during the forecast period.

The market is driven by the increasing demand for reliable and secure communication networks for emergency services, advancements in LTE technology, and rising government investments in public safety infrastructure. The adoption of mission-critical LTE solutions by law enforcement, fire departments, and emergency medical services is further fueling the market.

Major companies operating in the public safety LTE industry are Motorola Solutions, Inc., L3Harris Technologies, Inc., SAMSUNG, Nokia, Cobham Satcom, Hytera Communications Corporation Limited., KT Corp, ZTE Corporation, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Sonim Technologies Inc, Bittium, AT&T, General Dynamics Mission Systems, Inc., and Airbus.

The integration of emerging technologies such as 5G, IoT, and AI into public safety networks is enhancing operational efficiency and real-time decision-making. North America and Europe currently lead the market, due to established public safety infrastructure, while the market in Asia Pacific is expected to register significant growth driven by increasing urbanization and disaster management initiatives.

- In November 2023, Verizon and Axon successfully demonstrated 5G network slicing to enhance public safety communications. Using Axon's Fleet 3 and Axon Respond, the technology improved live streaming and location tracking for law enforcement, ensuring reliable performance even under network congestion.

f

f

Key Highlights:

- The global public safety LTE industry size was valued at USD 10.92 billion in 2023.

- The market is projected to grow at a CAGR of 23.57% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 3.63 billion.

- The private LTE segment garnered USD 4.56 billion in revenue in 2023.

- The emergency medical services segment is expected to reach USD 16.58 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 24.55% during the forecast period.

Market Driver

Rising Demand for Mission-critical Communication

The rising demand for mission-critical communication is contributing significantly to the market, as emergency response agencies require fast, reliable, and secure communication networks to ensure effective coordination during crises.

Traditional LMR (land mobile radio) systems lack the capacity for real-time data sharing, while LTE enables high-speed broadband for video, GPS, and emergency alerts. Amid increasing threats, disasters, and interoperability demands, the need for advanced communication infrastructure capable of seamless interoperability between multiple agencies has become more urgent.

This growing demand is pushing governments and public safety organizations to invest in LTE-based solutions that enhance response times, improve decision-making, and ultimately save lives.

- In April 2023, Southern Linc announced the integration of L3Harris Technologies' XL series radios, enabling seamless LTE-to-P25 LMR interoperability for public safety agencies. This solution allows users to communicate across both networks using a single device, improving interoperability and efficiency. Each XL series radio is custom-configured by Southern Linc to meet specific Mission-Critical Push-To-Talk (MCPTT) needs.

Market Challenge

Interoperability with Legacy Systems

A critical challenge in the public safety LTE market is interoperability with legacy systems. Many emergency response agencies continue to rely on traditional LMR networks, which lack seamless integration with modern LTE infrastructure.

This incompatibility hinders real-time data exchange and coordinated emergency responses across agencies. Ensuring effective interoperability requires substantial investments in infrastructure upgrades, technical expertise, and adherence to standardized protocols

Addressing interoperability challenges in public safety LTE requires a strategic blend of technology, standardization, and phased implementation. Hybrid solutions, such as interoperable gateways and mission-critical push-to-talk (MCPTT), enable seamless integration with legacy LMR systems.

A phased transition using dual-mode devices ensures operational continuity while minimizing disruptions. Governments must invest in infrastructure upgrades and cybersecurity to enhance network reliability. Collaboration with telecom providers and adherence to global standards further streamline integration, ensuring a secure, efficient, and future-ready public safety communication system.

Market Trend

Adoption of 5G Technology

The integration of 5G technology is emerging as a significant trend in the market. Public safety agencies are leveraging the ultra-low latency, high-speed data transmission, and enhanced network capacity of 5G to improve real-time situational awareness, video streaming, and AI-driven analytics as 5G deployment expands.

This transition enables faster emergency response, better resource allocation, and improved interoperability between agencies. Additionally, the adoption of private 5G networks is growing, providing dedicated, secure communication channels for first responders and ensuring uninterrupted service during crises.

- In February 2025, Ericsson and the Lower Colorado River Authority (LCRA) entered a multi-year partnership to implement a private LTE network across 68 Texas counties. Designed to enhance grid modernization, security, and critical communications, the network will support utilities, electric cooperatives, and government agencies. Leveraging Ericsson’s 5G-ready core, RAN solutions, and network management, it will facilitate mission-critical applications such as MCPTT and SCADA.

Public Safety LTE Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Private LTE, Commercial LTE, Hybrid LTE

|

|

By Application

|

Emergency Medical Services, Law Enforcement, Border Control, Firefighting Services, Disaster Management

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (Private LTE, Commercial LTE, Hybrid LTE): The private LTE segment earned USD 4.56 billion in 2023, due to its enhanced security, reliability, and dedicated communication capabilities for mission-critical public safety operations.

- By Application (Emergency Medical Services, Law Enforcement, Border Control, Firefighting Services, Disaster Management): The emergency medical services segment held 28.47% share of the market in 2023, due to the growing demand for real-time patient data transmission, telemedicine support, and seamless communication for emergency response coordination.

Public Safety LTE Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 33.24% share of the public safety LTE market in 2023, with a valuation of USD 3.63 billion. This large market share of the region can be attributed to the strong government initiatives, high adoption of advanced communication technologies, and significant investments in public safety infrastructure in the region.

The presence of key industry players, along with the deployment of private LTE and 5G networks for emergency response agencies, further strengthens the market growth. Increasing incidents of natural disasters and security threats have accelerated the demand for reliable, high-speed communication solutions across law enforcement, firefighting, and emergency medical services.

- In February 2025, T-Mobile secured a landmark deal with New York City, becoming its primary carrier for public safety operations. The partnership provides first responders with 5G standalone (SA) network access, network slicing, and T-Priority security, while city employees and families receive discounted plans with added perks.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 24.55% over the forecast period. The market is registering rapid expansion, due to the rising demand for mission-critical communication, expanding urbanization, and technological advancements in public safety infrastructure.

Governments across the region are heavily investing in dedicated LTE networks to enhance emergency response efficiency, particularly in disaster-prone areas such as Japan, Indonesia, and the Philippines. Strategic partnerships between telecom providers and law enforcement agencies are also driving network deployments, with China and South Korea leading in 5G-powered emergency communication systems.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates radio spectrum allocation for public safety communications, ensuring reliable and interference-free networks for emergency responders through spectrum management, policy enforcement, and technical standards.

- In Europe, the European Telecommunications Standards Institute (ETSI) develops technical standards for public safety communications, ensuring interoperability, reliability, and efficiency through regulatory frameworks, mission-critical LTE advancements, and emergency alert systems.

- In Asia Pacific, the Asia-Pacific Telecommunity (APT) develops policies and regulations for public safety communications, ensuring effective and coordinated emergency response through spectrum harmonization, technical standards, and capacity-building initiatives.

- The International Telecommunication Union (ITU) establishes policies and standards for public safety communications globally, ensuring seamless interoperability, spectrum management, and emergency response coordination through regulatory frameworks, technical guidelines, and international cooperation.

Competitive Landscape

The public safety LTE industry is characterized by the presence of major telecom providers, network infrastructure companies, and specialized solution vendors competing to offer reliable, high-speed, and secure communication networks for emergency services.

Companies are focusing on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance technological capabilities. R&D investments in 5G integration, AI-driven analytics, and cloud-based public safety solutions are intensifying competition.

Government contracts and regulatory approvals play a crucial role in market positioning, with firms striving to comply with strict security and interoperability standards to secure large-scale deployments.

- In June 2023, Nokia and DXC Technology launched DXC Signal Private LTE and 5G, a managed wireless solution for industries like manufacturing, energy, and healthcare. Combining Nokia DAC, MXIE, and DXC Platform X, it delivers high-bandwidth, low-latency connectivity to enhance automation and operations.

List of Key Companies in Public Safety LTE Market:

- Motorola Solutions, Inc.

- L3Harris Technologies, Inc.

- SAMSUNG

- Nokia

- Cobham Satcom

- Hytera Communications Corporation Limited.

- KT Corp

- ZTE Corporation

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Sonim Technologies Inc

- Bittium

- AT&T

- General Dynamics Mission Systems, Inc.

- Airbus

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In February 2025, ST Engineering iDirect, Inc. showcased the role of its satellite communication technology in enhancing public safety solutions through its partnership with Verizon Frontline at an exclusive event for public safety officials ahead of Super Bowl LIX in New Orleans.

- In December 2024, Nokia and Motorola Solutions announced an AI-powered drone solution integrating Nokia Drone Networks with Motorola’s CAPE software. The system enables remote deployment, real-time situational awareness, and BVLOS operations over 4G/LTE and 5G, enhancing safety, efficiency, and sustainability for public safety and critical industries.

- In November 2024, Verizon partnered with Knightscope to enhance public safety using K5 autonomous security robots and K1 emergency communication devices. Powered by Verizon’s 4G LTE (with future 5G integration), these solutions provide real-time monitoring, automated patrolling, and emergency communication to secure public spaces.