Market Definition

The market refers to the global industry focused on the development, production, and distribution of treatments for prostate cancer. It includes various therapies such as hormone therapy, chemotherapy, immunotherapy, targeted therapy, and radiotherapy.

The market is driven by factors like increasing prevalence of prostate cancer, advancements in drug development, and growing awareness about early diagnosis. Key market players include pharmaceutical companies, biotechnology firms, and healthcare providers working to enhance treatment efficacy and patient outcomes.

Prostate Cancer Therapeutics Market Overview

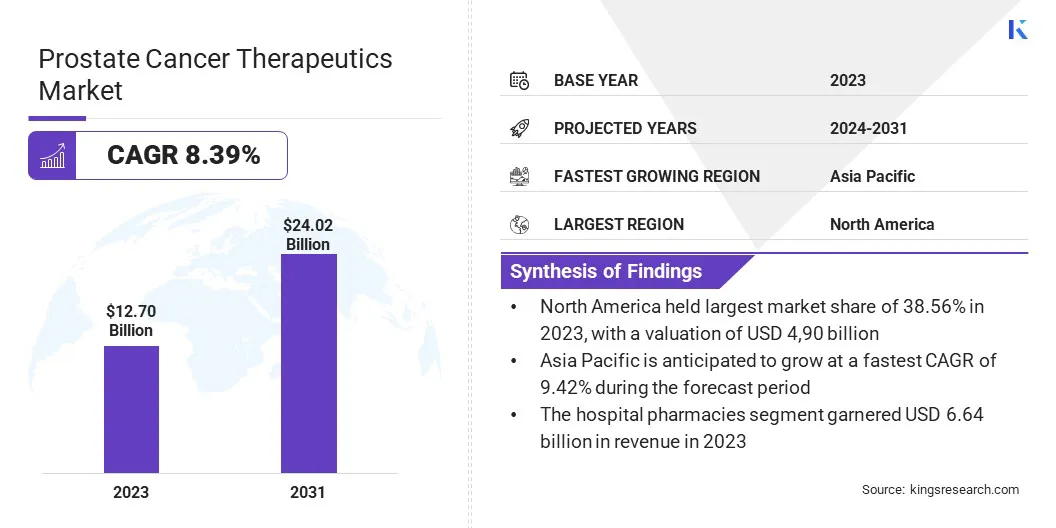

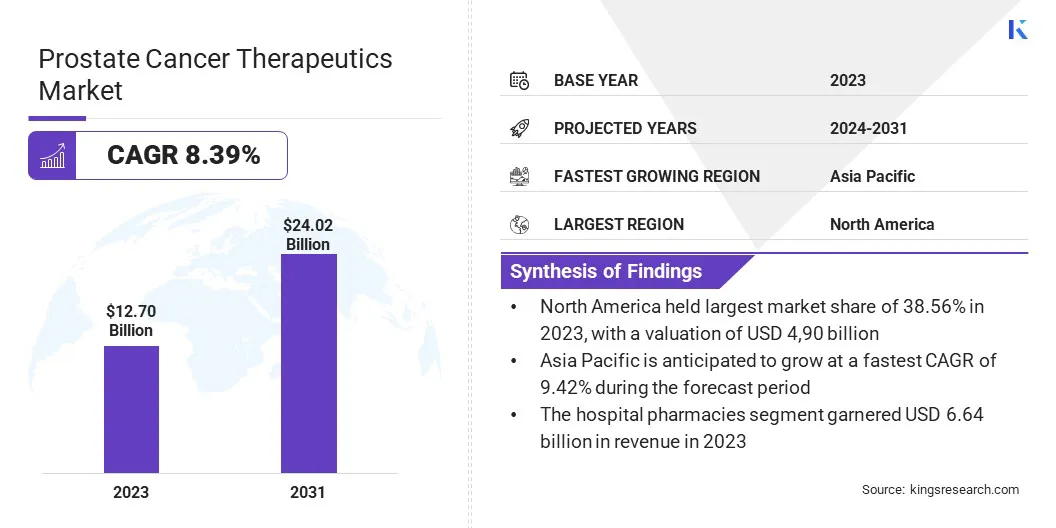

The global prostate cancer therapeutics market size was valued at USD 12.70 billion in 2023 and is projected to grow from USD 13.67 billion in 2024 to USD 24.02 billion by 2031, exhibiting a CAGR of 8.39% during the forecast period.

This market is expanding rapidly, due to the rising incidence of prostate cancer, advancements in treatment options, and increasing awareness about early detection. The adoption of targeted therapies, immunotherapies, and precision medicine is significantly improving patient outcomes.

Growing investments in pharmaceutical research and development, along with government initiatives and favorable regulatory approvals, are driving innovation in the market. The increasing use of minimally invasive procedures, radiopharmaceuticals, and biomarker-based therapies is enhancing treatment efficacy.

Major companies operating in the prostate cancer therapeutics industry are Johnson & Johnson Services, Inc., Eli Lilly and Company, Astellas Pharma Inc., Sanofi, Ipsen Pharma, Bayer AG, AstraZeneca, RefleXion Medical, Lantheus Holdings, Inc., Merck KGaA, Pfizer Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Orion Corporation, and Essa Pharma.

Additionally, the integration of Artificial Intelligence (AI) and big data analytics in oncology research is streamlining drug discovery and clinical decision-making.

The expansion of healthcare infrastructure, along with rising healthcare expenditure and supportive reimbursement policies, is further fueling the market. Strategic collaborations between pharmaceutical companies and research institutions are accelerating the development of novel therapies.

- In March 2024, AstraZeneca announced the acquisition of Fusion Pharmaceuticals Inc. through a definitive agreement to advance the development of next-generation radioconjugates (RCs) for cancer treatment. The acquisition includes Fusion’s pipeline of radioconjugates, R&D and manufacturing facilities, and expertise in actinium-based RCs. A clinical-stage radioconjugate targeting prostate-specific membrane antigen is being developed as a potential treatment for metastatic castration-resistant prostate cancer.

Key Highlights:

- The prostate cancer therapeutics industry size was valued at USD 12.70 billion in 2023.

- The market is projected to grow at a CAGR of 8.39% from 2024 to 2031.

- North America held a market share of 38.56% in 2023, with a valuation of USD 4.90 billion.

- The hormonal therapy segment garnered USD 7.21 billion in revenue in 2023.

- The hospital pharmacies segment is expected to reach USD 12.50 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.42% during the forecast period.

Market Driver

Advancements in Targeted Therapies and Rising Disease Prevalence

The market is driven by continuous advancements in treatment modalities and the rising incidence of prostate cancer globally. One of the key drivers of the market is the development of radioligand therapy (RLT), a highly targeted approach that uses radiolabeled molecules to deliver radiation directly to cancer cells.

Unlike conventional radiotherapy, which can affect both cancerous and healthy tissues, RLT specifically binds to prostate cancer biomarkers such as prostate-specific membrane antigen (PSMA), ensuring precise tumor targeting. This reduces collateral damage, enhances therapeutic efficacy, and offers a viable treatment option for patients with advanced or treatment-resistant prostate cancer.

The increasing adoption of this therapy reflects a shift toward more personalized and effective treatment strategies. Additionally, the rising prevalence of metastatic castration-resistant prostate cancer has created a strong demand for next-generation therapies.

Metastatic castration-resistant prostate cancer is an aggressive form of prostate cancer that continues to progress despite androgen deprivation therapy, necessitating the development of novel therapeutics such as radioconjugates, targeted inhibitors, and combination treatments.

Several patients require advanced treatment options, hence, pharmaceutical companies are investing heavily in research and innovation to improve survival rates and enhance the quality of life for those affected. The need for more effective treatments has also accelerated regulatory approvals and clinical trials, further propelling the market growth.

- In July 2024, Blue Earth Therapeutics announced clinical research collaboration with University College London to develop an innovative alpha-labelled radioligand therapy for prostate cancer. The partnership focuses on a Phase 1/2 trial evaluating the safety, tolerability, radiation dosimetry, and anti-tumor activity of 225Ac-rhPSMA-10.1, a next-generation therapeutic radiopharmaceutical for metastatic castrate-resistant prostate cancer.

Market Challenge

Treatment Resistance

A major challenge in the prostate cancer therapeutics market is the development of resistance to existing treatments, particularly in patients with metastatic castration-resistant prostate cancer. Initially, most prostate cancer patients respond well to androgen deprivation therapy, which reduces androgen levels to slow tumor growth.

However, cancer cells can adapt over time by activating alternative survival pathways, mutating androgen receptors, or producing their own androgens, leading to treatment resistance and disease progression. This resistance significantly limits the effectiveness of current therapeutic options, making it difficult to achieve long-term disease control.

Additionally, resistance can develop against newer targeted treatments such as androgen receptor inhibitors and radioligand therapies, further complicating disease management. Researchers and pharmaceutical companies are focusing on next-generation combination therapies and alternative treatment strategies.

Combination regimens, such as pairing androgen receptor inhibitors with radiopharmaceuticals or immunotherapies, are being developed to target multiple resistance mechanisms simultaneously.

Market Trend

AI-driven Precision Medicine and Combination Therapies

The market is registering significant trends that are shaping the future of treatment approaches. One major trend is the advancement of AI-driven precision medicine, which is revolutionizing how prostate cancer is diagnosed and treated.

AI-powered prognostic and predictive tools are being integrated into clinical decision-making, allowing for more accurate risk stratification and personalized treatment plans.

AI can predict treatment responses, optimize therapeutic strategies, and reduce unnecessary interventions by analyzing vast datasets of patient information. This technological shift is improving patient outcomes and driving the adoption of AI-based solutions in prostate cancer care.

- In March 2025, Artera and Tempus announced their collaboration to expand access to the ArteraAI Prostate Test, an AI-enabled prognostic and predictive test for localized prostate cancer. Through this exclusive partnership, Tempus will commercialize Artera’s risk stratification test, leveraging its network that connects with over 50% of oncologists in the U.S. The ArteraAI Prostate Test provides predictive insights on short-term androgen deprivation therapy and helps personalize prostate cancer treatment.

Another key trend is the increasing focus on next-generation combination therapies, which aim to enhance treatment efficacy by targeting multiple pathways simultaneously.

Instead of relying on single-agent therapies, researchers and pharmaceutical companies are exploring combinations of androgen receptor inhibitors, targeted radiopharmaceuticals, and immunotherapies to combat resistance mechanisms in advanced prostate cancer.

These combination regimens not only improve survival rates but also provide a more comprehensive approach to disease management. Clinical trials are undertaken to validate their effectiveness, making combination therapies crucial in the treatment of prostate cancer.

Prostate Cancer Therapeutics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Drug Class

|

Hormonal Therapy, Chemotherapy, Immunotherapy, Targeted Therapy, Others

|

|

By Distribution Channel

|

Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Pharmacies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Drug Class (Hormonal Therapy, Chemotherapy, Immunotherapy, Targeted Therapy, and Others): The hormonal therapy segment earned USD 3.84 billion in 2023, due to its widespread use in treating hormone-sensitive cancers and endocrine disorders, coupled with advancements in inhalable formulations enhancing patient adherence.

- By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies): The hospital pharmacies segment held 52.26% share of the market in 2023, due to the high availability of specialized biologics, strong healthcare infrastructure, and the preference for hospital-based dispensing of complex inhalable therapies.

Prostate Cancer Therapeutics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 38.56% share of the prostate cancer therapeutics market in 2023, with a valuation of USD 4.90 billion. The region’s stronghold in the market is primarily attributed to high disease prevalence, advanced healthcare infrastructure, and strong R&D investments in oncology therapeutics.

The increasing incidence of prostate cancer cases, particularly in the U.S., has driven the demand for innovative treatment options, including radioligand therapies, immunotherapies, and combination treatments. Moreover, favorable reimbursement policies and the presence of key pharmaceutical players have fueled the market.

Regulatory bodies like the FDA have expedited approvals for novel therapies, ensuring rapid access to advanced treatment solutions. Additionally, high awareness levels, routine prostate cancer screenings, and early diagnosis rates contribute to North America’s leadership position in the market.

Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 9.42% over the forecast period. The rapid expansion is driven by rising cancer incidence, increasing healthcare expenditures, and improving access to advanced treatments in countries such as China, Japan, and India.

Government initiatives aimed at enhancing cancer care infrastructure, coupled with growing investments in pharmaceutical R&D, are significantly boosting the market. Additionally, the increasing adoption of precision medicine, expanding clinical trials, and rising awareness about prostate cancer screenings are accelerating the demand for innovative therapeutics.

The region also benefits from a large aging population and a growing burden of lifestyle-related risk factors, further emphasizing the need for advanced treatment solutions. Expanding access to radioligand therapies, targeted inhibitors, and immunotherapies in Asia Pacific makes it a key market for prostate cancer therapeutics in the coming years.

Regulatory Frameworks:

- In the U.S., prostate cancer therapeutics are regulated by the U.S. Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act (FDCA). Drugs and biologics must undergo clinical trials following Investigational New Drug (IND) regulations before obtaining New Drug Application (NDA) or Biologics License Application (BLA) approval.

- In the European Union (EU), prostate cancer therapeutics are regulated by the European Medicines Agency (EMA) under the Medicines for Human Use Directive. The Committee for Medicinal Products for Human Use (CHMP) evaluates new therapies, and approval is granted under the Centralized Procedure, ensuring market authorization across all EU member states.

- In China, the National Medical Products Administration (NMPA), under the Drug Administration Law, regulates prostate cancer therapeutics. The Center for Drug Evaluation (CDE) oversees clinical trials and approval processes, requiring compliance with Good Clinical Practice (GCP) standards.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) regulate prostate cancer drugs under the Pharmaceuticals and Medical Devices Act (PMD Act). Approval follows a rigorous clinical evaluation process, with post-market surveillance requirements.

- In India, the Central Drugs Standard Control Organization (CDSCO) oversees prostate cancer therapeutics under the Drugs and Cosmetics Act, 1940. The Drug Controller General of India (DCGI) reviews clinical trial data before granting approval, and the Indian Council of Medical Research (ICMR) provides ethical guidelines for oncology research.

Competitive Landscape

The prostate cancer therapeutics industry is characterized by continuous innovation, strategic partnerships, and product development as key players strengthen their market presence. Companies are heavily investing in research and development to introduce novel therapies, including targeted treatments, immunotherapies, and radiopharmaceuticals, to enhance efficacy and minimize side effects.

Mergers and acquisitions remain a crucial strategy, allowing firms to expand their portfolios, acquire advanced technologies, and strengthen their pipelines. Collaborations with research institutions, biotechnology firms, and academic centers are accelerating drug discovery, clinical trials, and regulatory approvals.

Additionally, strategic licensing agreements and joint ventures are helping companies expand their reach and diversify their offerings. Many firms are leveraging digital health solutions, such as AI-driven drug discovery, biomarker-based treatment approaches, and real-world data analytics, to enhance precision medicine.

Competitive pricing strategies, expanded reimbursement support, patient assistance programs, and strong marketing efforts further drive brand positioning and market penetration.

- In October 2024, Johnson & Johnson announced results from a real-world, head-to-head study demonstrating that ERLEADA (apalutamide) significantly improved overall survival compared to enzalutamide in patients with metastatic castration-sensitive prostate cancer. The study, presented at the 6th European Congress of Oncology Pharmacy, showed that ERLEADA reduced the risk of death by 23% at 24 months.

List of Key Companies in Prostate Cancer Therapeutics Market:

- Johnson & Johnson Services, Inc.

- Eli Lilly and Company

- Astellas Pharma Inc.

- Sanofi

- Ipsen Pharma

- Bayer AG

- AstraZeneca

- RefleXion Medical

- Lantheus Holdings, Inc.

- Merck KGaA

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Orion Corporation

- Essa Pharma

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In February 2025, Pfizer Inc. announced that its TALZENNA (talazoparib) + XTANDI (enzalutamide) combination significantly improved overall survival in metastatic castration-resistant prostate cancer patients in the Phase 3 TALAPRO-2 trial, with data presented at American Society of Clinical Oncology Genitourinary 2025 and submitted for global regulatory review.

- In November 2024, AstraZeneca announced positive results from the CAPItello-281 Phase III trial, demonstrating that Truqap (capivasertib) in combination with abiraterone and androgen deprivation therapy significantly improved radiographic progression-free survival in patients with PTEN-deficient metastatic hormone-sensitive prostate cancer. This marks the first AKT inhibitor combination to show clinical benefit in this specific prostate cancer subtype.

- In September 2024, Lantheus Holdings, Inc. presented positive Phase 3 SPLASH trial results at European Society of Medical Oncology Congress 2024, showing that 177Lu-PNT2002 Radioligand Therapy significantly improved radiographic progression-free survival, overall response rate, and quality of life in patients with metastatic castration-resistant prostate cancer after androgen receptor pathway inhibitor therapy, with a favorable safety profile and ongoing overall survival analysis.

- In July 2024, Bayer announced positive topline results from the Phase III ARANOTE trial evaluating NUBEQA (darolutamide) plus Androgen Deprivation Therapy (ADT) in patients with metastatic hormone-sensitive prostate cancer. The trial met its primary endpoint, demonstrating a statistically significant improvement in radiological progression-free survival compared to placebo plus ADT.

- In April 2024, Astellas Pharma Inc. announced that the European Commission approved the use of XTANDITM (enzalutamide) in monotherapy or in combination with ADT for the treatment of adult men with high-risk biochemical recurrent non-metastatic hormone-sensitive prostate cancer who are unsuitable for salvage radiotherapy. The approval was based on results from the Phase 3 EMBARK trial, which demonstrated a significant reduction in the risk of metastasis or death.