Market Definition

The market involves the use of control systems, sensors, transmitters, and software to monitor and manage industrial processes. It covers functions such as flow measurement, pressure control, temperature regulation, and level monitoring. These systems help standardize operations, improve accuracy, and reduce manual intervention.

The market spans applications across oil and gas, water treatment, chemicals, pharmaceuticals, and food processing. The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks expected to impact market development over the forecast period.

Process Automation and Instrumentation Market Overview

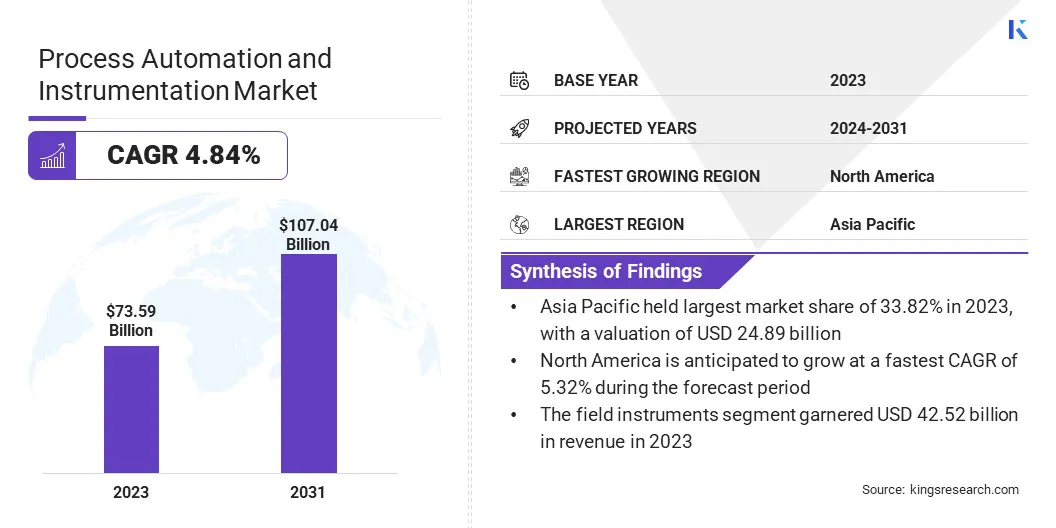

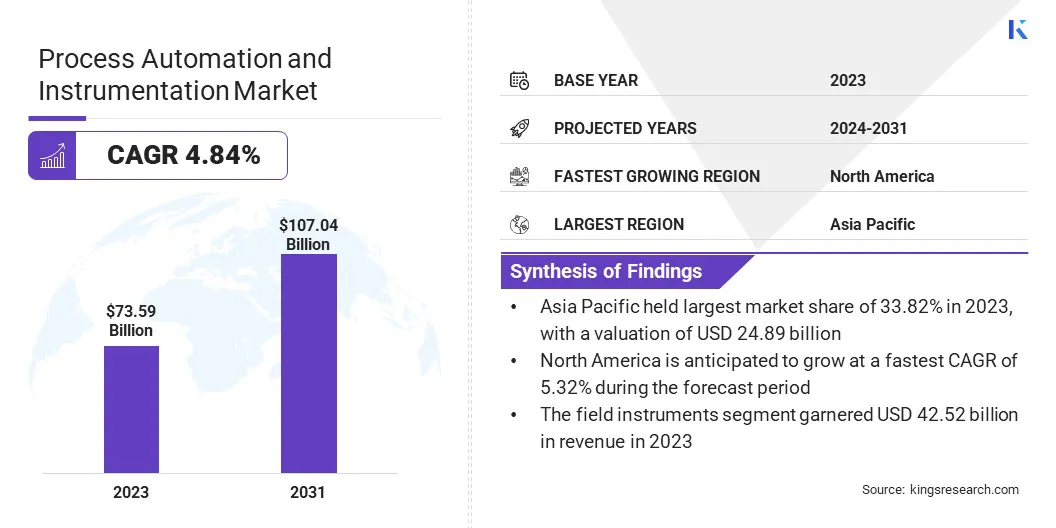

The global process automation and instrumentation market size was valued at USD 73.59 billion in 2023 and is projected to grow from USD 76.89 billion in 2024 to USD 107.04 billion by 2031, exhibiting a CAGR of 4.84% during the forecast period.

Market growth is driven by the rising adoption of the Industrial Internet of Things (IIoT), which enables real-time monitoring and advanced data analytics across industries. Additionally, technological advancements in smart sensors and control systems are improving process efficiency, reliability, and operational safety, accelerating market expansion.

Major companies operating in the process automation and instrumentation industry are Emerson Electric Co., Siemens, ABB, Honeywell International Inc., Schneider Electric, Rockwell Automation, Inc., Yokogawa Electric Corporation, Mitsubishi Electric Corporation, Endress+Hauser Group Services AG, General Electric, Omron, FANUC, Danaher Corporation, Brooks Instrument, LLC, and SMC Corporation.

Growing concerns about energy consumption and operational costs are prompting industries to adopt automated systems. The market is expanding as companies seek to improve efficiency through real-time data monitoring and automated control systems.

Automation technologies help optimize resource usage, which significantly reduces energy wastage. The growth of the market is influenced by the rising focus on sustainable and cost-effective production practices across energy-intensive sectors.

- In August 2024, Yokogawa Electric Corporation introduced the OpreX Open Automation SI Kit and the OpreX OPC UA Management Package. These tools are pivotal for implementing Open Process Automation (OPA) systems, allowing for greater interoperability and security in industrial process control. By adhering to the Open Process Automation Standard (O-PAS), these products enable end-users to integrate best-in-class components from multiple supplier.

Key Highlights:

- The process automation and instrumentation market size was valued at USD 73.59 billion in 2023.

- The market is projected to grow at a CAGR of 4.84% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 24.89 billion.

- The field instrument segment garnered USD 42.52 billion in revenue in 2023.

- The programmable logic controller (PLC) segment is expected to reach USD 38.05 billion by 2031.

- The water & wastewater treatment segment secured the largest revenue share of 24.20% in 2023.

- North America is anticipated to grow at a CAGR of 5.32% over the forecast period.

Market Driver

Growing Adoption of Industrial Internet of Things (IIoT)

The integration of IIoT is reshaping industrial operations by connecting machines, devices, and control systems through data networks, propelling the growth of the market.

Companies are deploying smart sensors, cloud computing, and analytics to enhance process control. IIoT-based automation improves predictive maintenance, reduces downtime, and enhances asset utilization, making industrial processes more agile and adaptable to evolving production requirements.

- In April 2024, ABB co-launched the "Margo" interoperability initiative, hosted by the Linux Foundation. This open standard aims to address key challenges in digital transformation by enhancing interoperability within Industrial IoT ecosystems. By facilitating seamless integration of plant data into AI-powered insights, Margo seeks to drive efficiency and sustainability in industrial operations.

Market Challenge

High Initial Investment

A significant challenge impacting the growth of the process automation and instrumentation market is the high initial investment required for advanced systems. Several industries, particularly small and medium enterprises, find it difficult to allocate large budgets for new automation technologies.

To address this, key players are introducing modular and scalable automation solutions that allow gradual upgrades. Some manufacturers are offering flexible financing options and subscription-based models to lower upfront costs.

Additionally, training and technical support services are being expanded to help businesses maximize the value of their investments, making automation more accessible and appealing across different industry sectors.

Market Trend

Technological Advancements in Smart Sensors and Control Systems

The integration of smart sensors, wireless technologies, and advanced control platforms is accelerating the growth of the market. Smart devices offer real-time diagnostics, predictive maintenance, and seamless communication between equipment.

These advancements help industries gain deeper operational insights and faster decision-making capabilities. The increasing adoption of Internet of Things (IoT) technologies is further enhancing automation capabilities across diverse industrial sectors.

- In June 2024, the National Institute of Standards and Technology (NIST) presented new interoperability testing methods for smart sensors at the 2024 Sensor Converge event. These methods aim to ensure seamless communication between devices in IoT and Industrial IoT applications, facilitating improved integration and performance of smart sensors in various industrial settings.

Process Automation and Instrumentation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Instrument

|

Field Instrument, Process Analyzers

|

|

By Technology

|

Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition (SCADA), Manufacturing Execution System (MES)

|

|

By End User

|

Water & Wastewater Treatment, Energy & Utilities, Pulp & Paper, Oil & Gas, Chemicals, Metals & Mining, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Instrument (Field Instrument and Process Analyzers): The field instrument segment earned USD 42.52 billion in 2023 due to its critical role in ensuring accurate real-time measurement and control of key process parameters.

- By Technology (Programmable Logic Controller (PLC), Distributed Control System (DCS), Supervisory Control and Data Acquisition (SCADA), and Manufacturing Execution System (MES)): The programmable logic controller (PLC) segment held a share 35.65% in 2023, attributed to its ability to offer flexible, reliable, and cost-effective control solutions across a wide range of industrial applications.

- By End User (Water & Wastewater Treatment, Energy & Utilities, Pulp & Paper, Oil & Gas, Chemicals, Metals & Mining, and Others): The water & wastewater treatment segment is projected to reach USD 26.00billion by 2031, propelled by the rising need for efficient resource management, stricter environmental regulations, and increasing investments in modernizing aging infrastructure to ensure reliable and compliant operations.

Process Automation and Instrumentation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific process automation and instrumentation market share stood at around 33.82% in 2023, with a valuation of USD 24.89 billion. The rapid adoption of cutting-edge technologies such as artificial intelligence (AI), machine learning, and big data analytics in industrial processes is fueling this growth.

These advancements allow for enhanced process control, predictive maintenance, and real-time decision-making, improving productivity and minimizing downtime. The region's strong emphasis on embracing the latest technology trends is a key leading to the increased demand for automation solutions.

- In April 2025, Databricks announced a significant investment of over USD 250 million in India to expand its artificial intelligence (AI) and big data analytics capabilities. The company plans to increase its Indian workforce by more than 50%, establishing a new research and development center in Bengaluru and launching a Data + AI Academy aimed at training 500,000 partners and customers over the next three years.

North America process automation and instrumentation industry is poised to grow at a robust CAGR of 5.32% over the forecast period. The development of smart grid systems in is contributing to this growth. Smart grids rely on automation for monitoring, controlling, and optimizing energy distribution.

By using sensors, data analytics, and real-time feedback, these systems help utilities improve energy efficiency, reduce costs, and ensure grid stability. The growing investment in smart grid infrastructure is increasing the demand for automation and instrumentation solutions in the energy sector.

- In November 2025, the U.S. Department of Energy (DOE) announced a USD 30 million investment in the Artificial Intelligence for Interconnection (AI4IX) program. This initiative aims to expedite the connection of renewable energy projects, such as solar and wind farms, to the power grid by utilizing AI technologies. The program seeks to streamline the interconnection process, which has historically been lengthy, thereby enhancing the integration of clean energy sources into the grid.

Regulatory Frameworks

- The U.S. enforces several key regulations, including OSHA 29 CFR 1910.119, which focuses on Process Safety Management for hazardous chemicals, and NFPA 79, which provides standards for industrial machinery electrical safety. ISA standards such as ISA-95 and ISA-84 ensure integration and functional safety in automation systems.

- The EU’s Machinery Regulation (EU) 2023/1230 outlines health and safety requirements for industrial machinery. The NIS2 Directive improves cybersecurity across industries, particularly in automation systems. Meanwhile, EN ISO 13849 ensures that safety-related control systems for machinery adhere to strict risk-reduction standards.

- Japan relies on JIS certification to ensure industrial automation equipment meets rigorous quality and safety standards. It also adheres to IEC 61508 for functional safety of automation systems in critical industries, ensuring high standards in process automation across sectors such as manufacturing and energy.

- South Korea’s Korean Industrial Standards (KS) set technical requirements for industrial automation systems. The Industrial Standardization Act promotes quality assurance for automation equipment, particularly in public procurement and safety-critical applications. These regulations support innovation while ensuring safe practices across industries.

Competitive Landscape

Leading players in the process automation and instrumentation industry are increasingly expanding their product lines to meet the evolving demands of various sectors. By introducing advanced features and capabilities, such as enhanced integration and support for modern networks, companies are improving the overall performance of their systems.

These product innovations are key in attracting a broader customer base and fostering customer loyalty. The focus on integrating systems with existing technologies allows for smoother transitions and more flexible solutions, thereby propelling market growth .

- In July 2024, Emerson released DeltaV Version 15 Feature Pack 2, enhancing its distributed control system (DCS) with improved integration capabilities and simplified state-based control implementations. This update facilitates smoother transitions from third-party systems and better support for data-rich Ethernet device networks.

List of Key Companies in Process Automation and Instrumentation Market:

- Emerson Electric Co.

- Siemens

- ABB

- Honeywell International Inc.

- Schneider Electric

- Rockwell Automation, Inc.

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Endress+Hauser Group Services AG

- General Electric

- Omron

- FANUC

- Danaher Corporation

- Brooks Instrument, LLC

- SMC Corporation

Recent Developments (Product Launch)

- In April 2025, ABB unveiled its new Ability System 800xA, an advanced process control system that features enhanced connectivity and AI-driven analytics. This system enables businesses to optimize asset performance, reduce downtime, and ensure high levels of safety and productivity across industrial sectors.