Market Definition

Printed electronics involves the use of printing technologies like inkjet, screen, and roll‑to‑roll methods to create electronic circuits and components on flexible substrates such as paper, plastic, textiles, and glass. These systems enable lightweight, cost‑efficient manufacturing with lower energy use and environmental impact compared to traditional silicon-based processes.

Its applications span flexible displays, RFID tags, wearable sensors, smart packaging, solar cells, and thin-film transistors across consumer electronics, healthcare, automotive, aerospace, and logistics sectors.

Printed Electronics Market Overview

The global printed electronics market size was valued at USD 17.16 billion in 2024 and is projected to grow from USD 20.88 billion in 2025 to USD 94.78 billion by 2032, exhibiting a CAGR of 24.13% during the forecast period.

The market is growing steadily, driven by the surging adoption of printed electronics in healthcare and smart packaging, where flexible sensors and smart labels enable real-time monitoring and tracking. Additionally, expanding applications flexible hybrid electronics through flexible hybrid electronics are supporting the development of lightweight, adaptable components across consumer electronics, automotive, and industrial sectors.

Major companies operating in the printed electronics industry are E INK HOLDINGS INC., SAMSUNG, LG Electronics, DuPont, BASF, Agfa-Gevaert Group, Molex, LLC, NovaCentrix, Nissha Co., Ltd., Optomec Inc., Vorbeck Materials Corp., Ynvisible Interactive Inc., Applied Materials, Inc., CERADROP, and Kayaku AM.

Increasing demand for flexible and lightweight electronics is driving the widespread adoption of printed electronics across multiple industries. Printed electronics technology allows for the development of thin, bendable, and lightweight components that can be integrated into wearables, smart packaging, and consumer gadgets.

Manufacturers use printed sensors, circuits, and displays to create compact, energy-efficient devices with new design possibilities. The ability to produce electronics on flexible substrates such as plastic or fabric is enabling innovation in Internet of Things (IoT) applications and healthcare monitoring devices. Lower material usage and roll-to-roll manufacturing processes are also contributing to reduced production costs and faster scalability.

- In July 2024, researchers at Yokohama National University unveiled a roll-to-roll process for stretchable electronics. This continuous production method fabricates multilayered elastic substrates with liquid-metal wiring, maintaining functionality even when stretched to 70 %. This enables scalable manufacturing of printed sensors, microLEDs, and wearable devices.

Key Highlights

- The printed electronics industry size was valued at USD 17.16 billion in 2024.

- The market is projected to grow at a CAGR of 24.13% from 2025 to 2032.

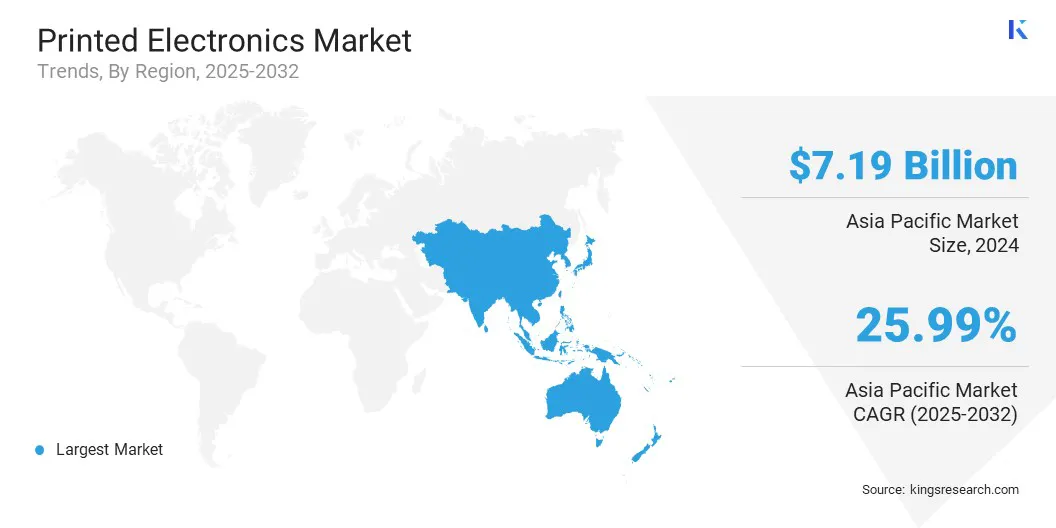

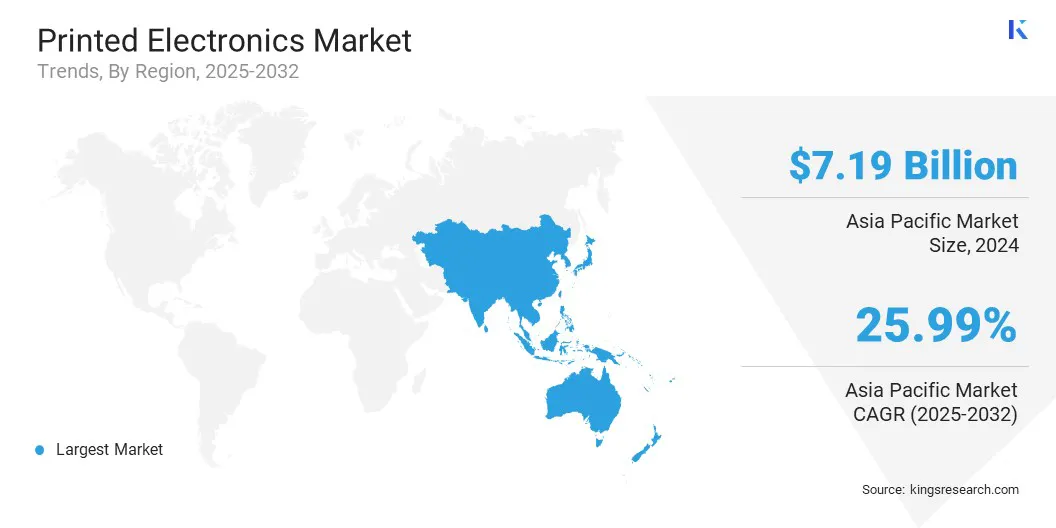

- Asia Pacific held a market share of 41.90% in 2024, with a valuation of USD 7.19 billion.

- The inkjet printing segment garnered USD 5.92 billion in revenue in 2024.

- The inks segment is expected to reach USD 53.63 billion by 2032.

- The displays segment secured the largest revenue share of 33.00% in 2024.

- The market in Europe is anticipated to grow at a CAGR of 25.99% during the forecast period.

Market Driver

Surging Adoption in Healthcare and Smart Packaging

The surging adoption of printed electronics in healthcare and smart packaging is driving the market, due to the rising demand for intelligent and flexible solutions. Printed biosensors are used in medical patches for continuous health monitoring, enabling real-time tracking of vital signs and patient conditions.

Smart labels with printed electronics are supporting inventory management, temperature tracking, and product authentication across pharmaceutical and food supply chains. Flexible hybrid electronics allow for seamless integration of sensors and circuits into wearable medical devices and packaging materials. These innovations are improving patient care, enhancing safety, and increasing efficiency in logistics and supply monitoring.

- In November 2024, Henkel and Linxens unveiled a proof-of-concept self-regulating heating skin patch enabled by printed electronics at MEDICA in Germany. This medical wearable integrates printed heating elements and conductive inks on flexible foil, offering comfort-enhancing solutions for pain relief or temperature-controlled drug delivery. The venture highlights the real-world applications of printed biosensors and circuits in patient care.

Market Challenge

Durability and Longevity Limitations Restricting High-stress Applications

A key challenge in the printed electronics market is the tendency of printed devices to degrade when exposed to mechanical stress, temperature fluctuations, or repeated flexing. These limitations are especially critical in demanding environments such as automotive and industrial settings, where consistent performance and long service life are essential. Performance instability over time is reducing confidence in adopting printed electronics for mission-critical applications.

To address this challenge, market players are developing advanced conductive inks, protective coatings, and substrate materials that enhance mechanical and thermal resilience. Companies are also investing in rigorous testing protocols and material innovations to extend the durability and reliability of printed electronic components.

Market Trend

Development of Flexible Hybrid Electronics

A key trend in the printed electronics market is the development of Flexible Hybrid Electronics (FHE) that integrate printed and conventional components. This approach is enabling the production of electronic systems in bendable, stretchable formats suitable for a wide range of applications. Wearables, smart textiles, automotive interior panels, and intelligent packaging are adopting FHE to enhance functionality and design flexibility.

Combining printed sensors and circuits with silicon-based chips supports both lightweight construction and reliable performance. Manufacturers are focusing on scalable production methods to meet the growing demand for FHE across consumer and industrial sectors.

- In June 2024, NovaCentrix partnered with PulseForge to demonstrate an FHE circuit at the ICEP 2024 conference in Toyama. They used photonic curing and soldering technologies to attach conventional micro-components onto printed conductive ink traces on PET film. This prototype achieved significantly higher electrical conductivity and mechanical shear strength compared to traditional oven-cured methods.

Printed Electronics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Inkjet Printing, Screen Printing, Flexographic Printing, Gravure Printing, Others

|

|

By Material

|

Inks, Substrates, Others

|

|

By Application

|

Displays, RFID, Photovoltaics, Sensors, Batteries, Lighting (OLED), Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Inkjet Printing, Screen Printing, Flexographic Printing, Gravure Printing, and Others): The inkjet printing segment earned USD 5.92 billion in 2024, due to its high precision, material efficiency, and suitability for rapid prototyping and scalable production.

- By Material (Inks, Substrates, and Others): The inks segment held 51.20% share of the market in 2024, due to its critical role in enabling high-resolution, low-cost, and scalable printing of conductive, dielectric, and semiconductive layers essential for device functionality across various applications.

- By Application (Displays, RFID, Photovoltaics, Sensors, Batteries, Lighting (OLED), and Others): The displays segment is projected to reach USD 27.39 billion by 2032, owing to the high demand for lightweight, flexible, and cost-effective display technologies in consumer electronics, retail signage, and e-readers, driving large-scale adoption and commercial viability.

Printed Electronics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific printed electronics market share stood at around 41.90% in 2024, with a valuation of USD 7.19 billion. This dominant position is largely attributed to Asia Pacific’s established role as a global manufacturing hub for consumer electronics. The presence of leading producers in the region, particularly in smartphones, displays, and wearable devices, has generated consistent demand for advanced, lightweight, and flexible electronic components.

- In January 2024, Samsung Display unveiled a versatile lineup of foldable and rollable OLED panels at the Consumer Electronics Show (CES) 2024. These panels feature 360° folding, rollable “Rollable Flex” displays, and hybrid fold–slide designs, all built on thin, lightweight substrates.

Printed electronics effectively address these requirements for flexibility, lightweight construction, and advanced form factors with scalable and cost-efficient solutions, facilitating their growing adoption in next-generation consumer products.

The printed electronics industry in Europe is poised for significant growth at a CAGR of 24.99% over the forecast period. This growth is largely attributed to Europe’s well-established automotive sector, which is actively adopting printed electronics.

Manufacturers are integrating flexible circuits, printed sensors, and in-mold electronics into components such as vehicle interiors, lighting systems, and battery management units. Presently, the region is focusing on Electric Vehicles (EVs) and smart mobility. Hence, printed electronics are valued in Europe for enabling lightweight, compact designs that enhance energy efficiency and performance.

- At LOPEC, the world’s premier event for printed electronics held in February 2025 in Munich, exhibitors demonstrated practical automotive applications, such as ultra-thin printed pressure and temperature sensors for battery management in EVs. Examples included printed armrest heaters with LED lighting and in‑mold electronics integrated into interior surfaces.

Regulatory Frameworks

- Printed electronics in the U.S. are regulated primarily under the Toxic Substances Control Act (TSCA), which oversees chemical use in manufacturing. Additionally, Federal Communications Commission (FCC) regulations apply to printed electronics with wireless functionality, and Underwriters Laboratories (UL) standards ensure fire and safety compliance for electronic components.

- The European Union (EU) strictly regulates printed electronics through the Restriction of Hazardous Substances (RoHS) Directive, which limits the use of ten substances like lead, mercury, and cadmium in electronic products. The Waste Electrical and Electronic Equipment (WEEE) Directive mandates proper collection and recycling of end-of-life devices, while the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation ensures chemical safety.

- China regulates printed electronics through China RoHS I & II under the Administrative Measures for the Restriction of Hazardous Substances in Electrical and Electronic Products (ACPEIP). This law restricts substances like lead and mercury and requires an Environmentally Friendly Use Period (EFUP) label.

- Japan’s regulatory framework includes J-MOSS (Japanese Management of Chemical Substances), a voluntary scheme requiring labeling when restricted substances exceed thresholds in electronics. Additionally, the Home Appliance Recycling Law and Law for the Promotion of Effective Utilization of Resources (LPUR) govern the recycling and resource recovery of electronic products.

Competitive Landscape

Major players in the printed electronics industry are adopting strategies such as focused R&D investments, strategic partnerships with research institutions, and advancements in printing technologies to strengthen their market position. These efforts are aimed at improving material performance, enabling complex applications like flexible and 3D electronics, and accelerating commercialization.

Such initiatives are contributing directly to market growth by expanding the range of practical, scalable solutions across industries like consumer electronics, automotive, and healthcare.

- In May 2024, Komori Corporation entered into a comprehensive collaboration agreement with Yamagata University to advance printed electronics. The partnership focuses on joint research on organic EL electrode printing, conductive wiring for flexible hybrid electronics, and three-dimensional curved electronics. The collaboration leverages Komori’s printing technology and Yamagata University’s materials expertise and includes prototype production & commercialization pathways.

List of Key Companies in Printed Electronics Market:

- E INK HOLDINGS INC.

- SAMSUNG

- LG Electronics

- DuPont

- BASF

- Agfa-Gevaert Group.

- Molex, LLC

- NovaCentrix

- Nissha Co., Ltd.

- Optomec Inc.

- Vorbeck Materials Corp.

- Ynvisible Interactive Inc.

- Applied Materials, Inc.

- CERADROP

- Kayaku AM

Recent Developments (M&A/Product Launches)

- In March 2025, Naxnova Technologies launched India’s first Flexible Hybrid Printed Electronics R&D Centre in Pune. The facility focuses on developing smart sensors, flexible circuits, and intelligent interfaces and includes a Class 10,000 cleanroom and comprehensive in-house testing capabilities. The centre supports end-to-end innovation from materials and mechanical testing to climate resilience validation.

- In September 2024, DuPont launched its Artistri PN1000 series at the PRINTING United Expo 2024. The low-viscosity, water-based pigment inkjet inks deliver high optical density and broad color gamut for commercial printing applications. The inks are engineered to minimize drying time while supporting high-speed digital printing workflows.

- In June 2024, Kyocera launched its flexible transparent printed antenna using carbon nanotube ink. The antenna is printed directly onto thin films to enable lightweight, bendable wireless communication for wearable and IoT devices. The development represents a shift toward integrating printed antennas into next-generation flexible electronics products.

- In January 2024, Neways acquired Sencio, a Netherlands‑based microsystems firm. Sencio specialises in advanced packaging for smart sensing and actuation applications. The acquisition strengthens Neways’s capabilities in microelectronics and printed sensor integration for industrial use.