Market Definition

Prepreg refers to a composite material made by pre-impregnating reinforcing fibers such as carbon, glass, or aramid with a resin system, typically epoxy. The material is ready for lay-up and curing without additional resin application.

The market encompasses thermoset and thermoplastic prepregs used across aerospace, automotive, wind energy, sporting goods, and industrial applications. The market covers raw material suppliers, manufacturers, and end users involved in producing lightweight, high-performance components requiring strength, durability, and thermal resistance.

Prepreg Market Overview

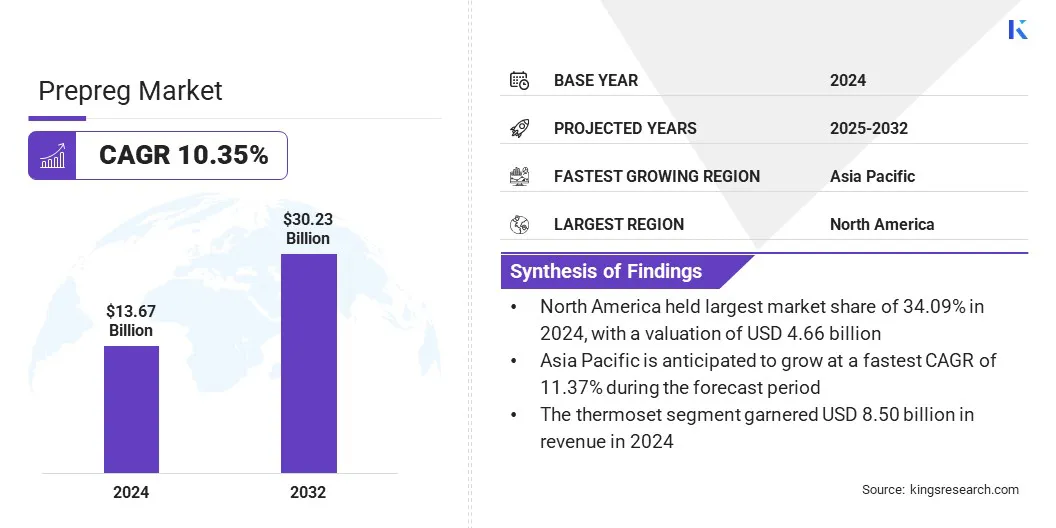

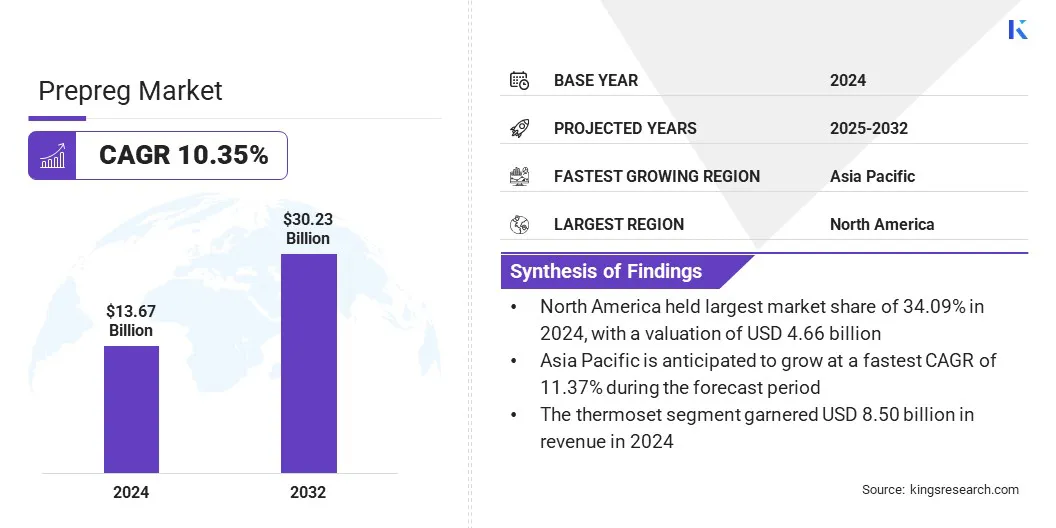

The global prepreg market size was valued at USD 13.67 billion in 2024 and is projected to grow from USD 15.03 billion in 2025 to USD 30.23 billion by 2032, exhibiting a CAGR of 10.35% during the forecast period.

The market is growing steadily due to the rising demand for lightweight construction, higher energy efficiency, and performance-optimized components across aerospace, automotive, and renewable energy sectors, as they require materials to reduce weight while maintaining structural integrity.

Key Market Highlights:

- The prepreg industry size was valued at USD 13.67 billion in 2024.

- The market is projected to grow at a CAGR of 10.35% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 4.66 billion.

- The carbon segment garnered USD 5.26 billion in revenue in 2024.

- The thermoset segment is expected to reach USD 18.61 billion by 2032.

- The hot-melt segment is expected to reach USD 17.21 billion by 2032.

- The aerospace & defense segment is expected to reach USD 9.05 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 11.37% during the forecast period.

Major companies operating in the global prepreg market are TORAY INDUSTRIES, INC., Hexcel Corporation, Solvay, TEIJIN LIMITED, Mitsubishi Chemical Group Corporation, SGL Carbon, Gurit Services AG, Axiom Materials, Park Aerospace Corp., Plastic Reinforcement Fabrics Ltd, Avient Corporation, Barrday Inc., CHOMARAT Group, 3A Associate Incorporated, and SHD Composite Materials Ltd.

The growth of the prepreg market is driven by capacity expansion, advanced product development, and increased industry focus on industrial and specialty applications. Manufacturers are investing in higher production capacity to ensure faster delivery timelines and meet large-scale demand across sectors.

Advancements in material technology are improving product performance and expanding the range of applications. At the same time, end-users across oil and gas, sports equipment, and infrastructure are adopting prepregs for their strength-to-weight advantages and durability. This sectoral diversification is creating new revenue streams and reinforcing the market’s long-term growth potential.

- In November 2024, Toray Advanced Composites expanded its continuous fiber reinforced thermoplastic composite portfolio by acquiring Gordon Plastics’ assets, technology, and IP. The acquisition includes a 47,000 sq. ft. production facility in Colorado and enhances Toray’s capacity to produce unidirectional tapes using high-temperature polymer systems for industrial and specialty applications.

Market Driver

Increased Adoption of Prepregs in Aircraft Structures

The global market is growing due to the aerospace industry's increased use of advanced composite materials. Aircraft manufacturers use prepregs to produce lightweight and high-strength structural parts to improve fuel efficiency and support emission reduction goals.

Prepregs offer consistent quality and strong mechanical properties making them suitable for key applications such as fuselage panels, wings, and interior sections. The aerospace sector is increasingly focusing on performance, reliability, and compliance with regulatory standards, which is driving the demand for certified and durable prepreg materials. This rising dependence on prepreg across the commercial and defense aviation sectors is driving the expansion of the market.

- In June 2025, Toray Industries showcased its thermoset and thermoplastic composites at the Paris Air Show, including the T1100/3960 carbon fiber prepreg. This material was selected for the Future Long Range Assault Aircraft (FLRAA) program. The company also announced expanded manufacturing operations in France to meet growing demand across the aviation, space, and defense sectors..

Market Challenge

Limited Recycling Options for Thermoset Prepregs

A major challenge in the prepreg market is the lack of standardized recycling processes for thermoset prepregs. These materials form permanent cross-linked structures after curing, which makes them difficult to break down or reuse.

This leads to waste management concerns, especially in the aerospace and automotive sectors, where large volumes are used. The absence of efficient recycling methods restricts material circularity and increases environmental impact. Companies are addressing this issue by recovering secondary structural components from retired aircraft.

They are implementing closed-loop recycling systems and repurposing composite parts for other applications. These efforts aim to reduce composite waste and improve the sustainability of operations across the prepreg value chain.

- In June 2025, Toray Advanced Composites, Daher, and TARMAC Aerosave launched a joint End-of-Life Aerospace Recycling Program for thermoplastic composites. The initiative is supported by Airbus and focuses on recovering and reusing secondary structural components from retired A380 aircraft to develop closed-loop recycling systems and advance sustainable practices in aerospace manufacturing.

Market Trend

Growth in Demand for Bio-Based and Sustainable Composite Solutions

The global market is witnessing a growing shift toward sustainable and bio-based composite materials. Manufacturers are adopting plant-derived resins and recyclable systems to reduce environmental impact and meet evolving regulatory requirements.

This shift supports emissions reduction, resource conservation, and life cycle sustainability, particularly in sectors such as automotive, mobility, and industrial applications. Bio-based prepregs offer comparable mechanical performance to conventional alternatives while aligning with industry-wide sustainability targets.

Companies are integrating mass balance approaches and certification frameworks to validate material sourcing and environmental compliance. Rising demand for eco-friendly materials is driving the adoption of sustainable and bio-based prepregs, which play a key role in shaping future product development and market growth.

- In November 2024, Mitsubishi Chemical Group received ISCC PLUS certification for its prepreg products made with plant-derived resin at its Tokai Plant, reinforcing its commitment to sustainable materials.

Prepreg Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fiber

|

Carbon, Glass, Aramid

|

|

By Resin

|

Thermoset, Thermoplastic

|

|

By Manufacturing Process

|

Hot-melt, Solvent dip

|

|

By Application

|

Aerospace & Defense, Automotive, Wind Energy, Sports, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fiber (Carbon, Glass, and Aramid): The carbon segment earned USD 5.26 billion in 2024 due to its high strength-to-weight ratio and widespread use in aerospace and automotive applications.

- By Resin (Thermoset, Thermoplastic): The thermoset segment held 62.15% of the market in 2024, due to its superior mechanical properties and long-established use in structural applications.

- By Manufacturing Process (Hot-melt, Solvent dip): The hot-melt segment is projected to reach USD 17.21 billion by 2032, owing to its cleaner processing, faster curing, and compatibility with automated production.

- By Application (Aerospace & Defense, Automotive, Wind Energy, Sports, Electronics, and Others): The aerospace & defense segment is estimated to reach USD 9.05 billion by 2032, owing to the increased aircraft production and rising demand for lightweight, high-performance composite components.

Prepreg Market Regional Analysis

Based on region, the prepreg market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for a substantial market share of 34.09% in 2024 in the global market, with a valuation of USD 4.66 billion. he region’s leadership is driven by a well-established aerospace and defense industry, robust R&D capabilities, and a mature manufacturing ecosystem.

Continued investments in next-generation aircraft and space programs sustain demand for advanced composite materials. In addition, regulatory focus on fuel efficiency and material performance supports the use of lightweight and fire-retardant prepregs in defense and commercial aviation.

While sustainability remains a growing concern, leading manufacturers are initiating partnerships with recycling firms to explore viable reuse strategies for prepreg waste.

These early-stage efforts reflect the region’s long-term alignment with circular economy goals, without significantly disrupting current market growth. The presence of key prepreg producers further supports innovation and reliable supply across end-use industries.

- In July 2024, Toray Composite Materials America signed a three-year memorandum of understanding with Elevated Materials to repurpose scrap carbon fiber prepreg from its Tacoma facility. The agreement supports sustainability by converting waste into press-cured carbon fiber products, aligning with Toray’s goal of achieving net-zero emissions by 2050.

The market in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 11.37% over the forecast period. The region’s expansion is driven by rising demand from the aerospace, automotive, and wind energy sectors.

Countries like China, Japan, and India are actively investing in commercial aviation, defense programs, and electric vehicles, which rely on lightweight and high-performance composite materials. Local governments are supporting domestic manufacturing through subsidies and production-linked incentives, further accelerating the adoption of prepreg.

In parallel, growing localization of prepreg production and the emergence of low-cost manufacturing hubs are creating cost advantages. OEMs in the region are also prioritizing fuel efficiency and emission reduction, further boosting demand for advanced prepreg solutions across a range of applications.

Regulatory Frameworks

- In the U.S., the regulatory authorities overseeing advanced composite materials are the FAA (Federal Aviation Administration) for aerospace applications, and the Department of Defense (DoD) for military applications.

Competitive Landscape

The global prepreg market is characterized by the strategic focus of manufacturers on long-term partnerships and targeted investments. Companies are entering multi-year agreements with aerospace and defense firms to supply advanced composite materials.

Companies are investing in the development of sustainable and high-performance prepregs to meet evolving industry standards. They are expanding manufacturing capacity to support large-scale commercialization and improve operational efficiency.

Collaborative efforts coupled with capital investment are enabling companies to strengthen their market position and improve their capability to deliver lightweight, durable, and application-specific composite materials.

- In June 2025, Kongsberg Defence & Aerospace AS and Hexcel Corporation signed a five-year partnership agreement at the Paris Air Show for the supply of HexWeb engineered honeycombs and HexPly prepregs. This aims to support KONGSBERG’s strategic production programs in the defense and aerospace sectors.

Key Companies in Prepreg Market:

- TORAY INDUSTRIES, INC.

- Hexcel Corporation

- Solvay

- TEIJIN LIMITED

- Mitsubishi Chemical Group Corporation

- SGL Carbon

- Gurit Services AG

- Axiom Materials

- Park Aerospace Corp.

- Plastic Reinforcement Fabrics Ltd

- Avient Corporation

- Barrday Inc.

- CHOMARAT Group

- 3A Associate Incorporated

- SHD Composite Materials Ltd

Recent Developments (Product Launches)

- In July 2025, SHD Group launched MTE500, a cost-effective, hot-melt, solvent-free epoxy component system designed for improved handling, with a 60-day outlife at 20°C and a 24-month freezer life. The system offers enhanced processing versatility, visual quality, and sustainability, making it suitable for both low- and high-volume composite component manufacturing.

- In June 2024, PRF Composite Materials launched RP570 FR REEPREG at RECOMP 2024. The fire retardant eXpress cure prepreg, made with recycled carbon fibre nonwoven mat, is designed for aircraft interior components, offering fast processing, improved circularity, and suitability for high-volume manufacturing.