Market Definition

The market involves the manufacturing and assembly of building components in controlled factory settings. It includes a range of structural and non-structural elements, such as walls, floors, roofs, and complete modules, used in residential, commercial, and industrial projects.

Prefabricated offers benefits such as reduced construction time, improved quality control, cost efficiency, and lower environmental impact. The report examines key drivers, technological innovations, and regulatory developments influencing the growth and adoption of prefabricated building solutions across the global construction industry.

Prefabricated Construction Market Overview

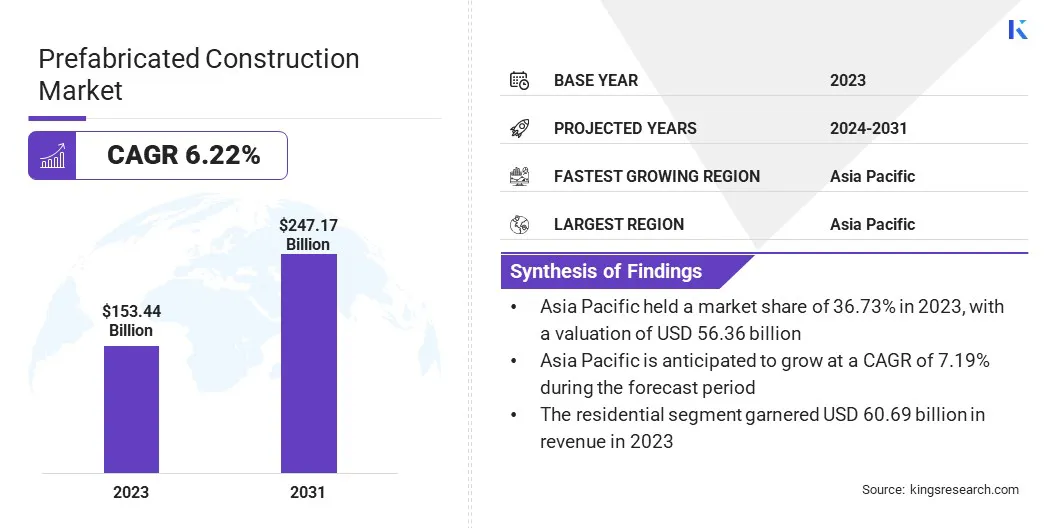

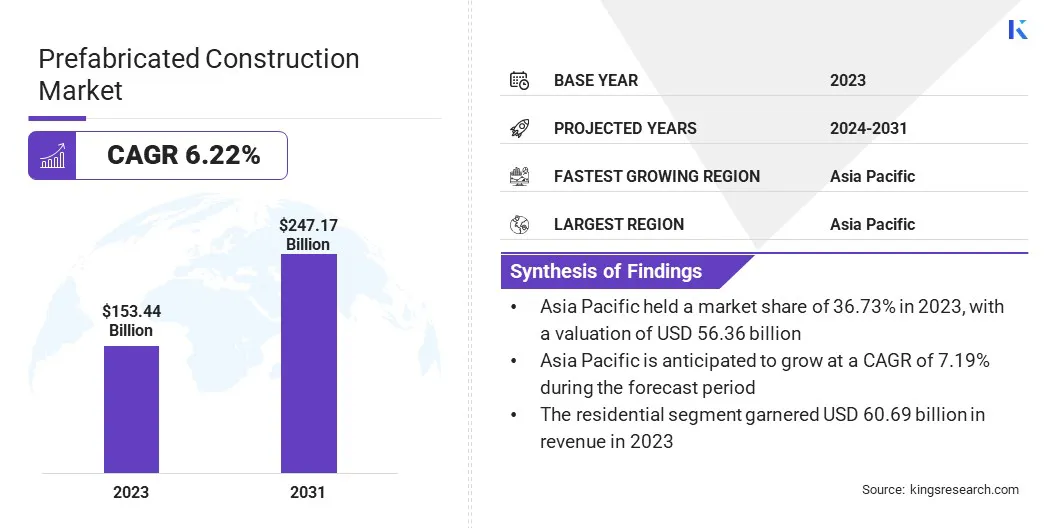

The global prefabricated construction market size was valued at USD 153.44 billion in 2023 and is projected to grow from USD 161.99 billion in 2024 to USD 247.17 billion by 2031, exhibiting a CAGR of 6.22% during the forecast period.

Market growth is driven by the increasing demand for faster project delivery, cost control, and reduced on-site labor. Rapid urbanization and housing shortages are further boosting adoption of prefabricated construction across residential, commercial, and industrial sectors.

Major companies operating in the prefabricated construction industry are Daiwa House Industry Co., Ltd., Berkshire Hathaway, Cedar Homes Europe, EPACK PREFAB, Merit Holdings Private Limited, Fading West Development, Sekisui House, Skanska AB, GUERDON MODULAR BUILDINGS, Bouygues Construction, Palomar Modular Buildings LLC, ATCO ENERGY SOLUTIONS, Fluor Corporation, Larsen & Toubro Limited, and Balfour Beatty PLC.

Increasing government support for modular construction of public infrastructure due to its scalability and reduced environmental footprint is propelling market growth. Additionally, integration of digital tools such as BIM and automated manufacturing is improving efficiency and customization in prefabricated construction.

- In August 2024, Garden Reach Shipbuilders and Engineers Ltd. (GRSE) signed a Memorandum of Understanding (MoU) with the Indian National Highways & Infrastructure Development Corporation Ltd. (NHIDCL) to supply and install double-lane modular steel bridges across India’s border regions.

Key Highlights

- The prefabricated construction industry size was recorded at USD 153.44 billion in 2023.

- The market is projected to grow at a CAGR of 6.22% from 2024 to 2031.

- Asia Pacific held a market share of 36.73% in 2023, valued at USD 56.36 billion.

- The panelized buildings segment garnered USD 90.19 billion in revenue in 2023.

- The residential segment is expected to reach USD 99.62 billion by 2031.

- The developers segment secured the largest revenue share of 41.43% in 2023.

- North America is anticipated to grow at a CAGR of 5.79% over the forecast period.

Market Driver

"Rising Demand for Faster and Cost-Efficient Construction"

The need to reduce construction time, labor costs, and project delays is propelling the growth of the prefabricated construction market. Rapid urbanization, housing shortages, and increasing infrastructure needs are pressuring the construction sector to deliver projects faster and at lower costs.

Traditional methods often face delays due to labor constraints, unpredictable weather, and on-site inefficiencies. To overcome these challenges, developers are turning to prefabricated construction, which allows components to be manufactured off-site and assembled on-site.

This approach shortens build time, reduces labor dependency, helps lowers costs, and improves overall project efficiency, making it a viable solution for both public and private construction demands.

- In 2023, Larsen & Toubro (L&T) completed a seven-story flight control system integration facility for the Indian Defence Research and Development Organisation (DRDO) in just 45 days using integrated hybrid modular construction technology.

Market Challenge

"Skilled Labor Shortage and On-Site Integration Constraints"

The prefabricated construction market faces a significant challenge due to the shortage of skilled labor for on-site assembly and integration of prefabricated components.

While off-site manufacturing reduces labor requirements during production, the final on-site assembly still demands precision, coordination, and technical expertise. In many regions, the workforce lacks sufficient training to handle modular integration, which can lead to construction delays, quality issues, and higher operational costs.

This labor gap, combined with varying on-site conditions and design complexities, hinders the seamless execution of prefabricated projects and slows broader market adoption.

Market Trend

"Integration of BIM and Digital Twin Technologies"

The prefabricated construction market is witnessing a growing trend toward the integration of building information modeling (BIM) and digital twin technologies. These tools enhance design accuracy, streamline project coordination, and improve communication among stakeholders by creating real-time digital replicas of construction projects.

The use of BIM allows for better visualization and clash detection before on-site assembly, while digital twins enable continuous monitoring and predictive maintenance post-construction.

This digital shift is improving efficiency, reducing errors, and supporting faster project delivery, leading to the increased adoption of prefabrication across the construction sector.

- In January 2025, the European Commission launched the HORIZON-CL5-2024-D4-02-03 initiative under the Built4People Partnership to advance the integration of building information modeling (BIM) and digital twin solutions across the building lifecycle. The program focuses on enhancing energy efficiency, sustainability, and circularity in construction, including prefabricated methods.

Prefabricated Construction Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Modular Buildings, Panelized Buildings

|

|

By Application

|

Residential, Commercial, Industrial, Institutional

|

|

By End User

|

Developers, Contractors, Government Agencies, Private Owners

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Modular Buildings and Panelized Buildings): The panelized buildings segment earned USD 90.19 billion in 2023 due to its ability to significantly reduce on-site labor and construction time while offering greater design flexibility and structural precision.

- By Application (Residential, Commercial, Industrial, and Institutional): The residential segment held a share of 39.55% in 2023, fueled by the growing demand for affordable housing and rapid urbanization.

- By End User (Developers, Contractors, Government Agencies, and Private Owners): The developers segment is projected to reach USD 112.59 billion by 2031, as developers increasingly adopt modular and off-site building solutions to reduce construction time, lower labor costs, and ensure consistent quality across large-scale residential and commercial projects.

Prefabricated Construction Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific prefabricated construction market share stood at around 36.73% in 2023, Valued at USD 56.36 billion. This dominance is attributed to the rapid urbanization, large-scale infrastructure projects, and government-backed housing initiatives across countries such as China, India, Japan, and Australia.

The growing demand for cost-effective, time-efficient construction solutions to meet the rising population and housing shortages in urban areas, is propelling regional market expansion.

- In China, national initiatives such as the "Made in China 2025" plan, and in India, programs such as "Pradhan Mantri Awas Yojana" and Smart Cities Mission are fostering the adoption of prefab and modular technologies to support affordable housing development.

Increasing investments in smart city infrastructure and rising awareness about green building practices are expected to support regional market expansion.

- In April 2024, China's Ministry of Housing and Urban-Rural Development introduced the "14th Five-Year Plan for Prefabricated Buildings," targeting 55% of new constructions to be prefabricated by 2025. This initiative includes policies to enhance industrial systems, advance green urban development, and implement supportive regulatory frameworks.

North America prefabricated construction industry is set to grow at a CAGR of 5.79% over the forecast period. This growth is stimulated by government initiatives, labor shortages, and the increasing demand for affordable housing and commercial spaces.

In the U.S., government-backed programs such as the “Build Back Better” initiative and various state-level green building incentives are promoting the use of prefabricated and modular construction methods.

These programs are designed to reduce carbon emissions and improve energy efficiency, contributing to regional market expansion. Initiatives aimed at addressing housing affordability and reducing construction time are accelerating the adoption of prefabricated solutions.

The ongoing labor shortages in the North American construction industry are creating a strong demand for prefabricated construction. The need for quicker, more efficient construction methods that require less on-site labor is prompting builders to adopt modular solutions.

Regulatory Frameworks

- In the U.S., prefabricated construction is primarily governed by the International Building Code (IBC) and International Residential Code (IRC), adopted at state and local levels. These codes ensure structural safety, fire protection, and energy efficiency. Additional local requirements may apply, particularly for modular and mobile units.

- In the UK, the Building Safety Act 2022 and Construction Products Regulations regulate prefabricated construction, emphasizing product safety, structural integrity, and fire compliance. Government frameworks such as Modern Methods of Construction (MMC1) promote adoption in public projects, particularly in education and housing, aligned with sustainability and efficiency goals.

- China supports prefabricated construction through national policies, including the 2016 State Council directive, which targets 30% prefabrication in new urban buildings. Standards such as GB/T 40399-2021 ensure quality in precast concrete components, while the Construction Law governs safety and contractor qualifications.

- Japan regulates prefabricated construction through the Building Standards Act and Construction Business Act. These laws require licensing for contractors and ensure buildings meet structural safety, fire, and seismic requirements. Modular and steel-framed units are increasingly used in residential and commercial projects, with clear guidelines for design approval and on-site assembly.

- South Korea oversees prefabricated construction via the Building Act and Korean Industrial Standards (KS). These set strict guidelines for materials, structural design, and quality assurance. Modular methods are increasingly used in housing and education, supported by government policies promoting innovation, sustainability, and off-site construction efficiency.

Competitive Landscape

The prefabricated construction industry is highly competitive, with numerous players operating across various regions. The market is shaped by both established companies and new entrants who are focused on leveraging advanced technologies, strategic partnerships, and expansion into emerging markets to stay ahead.

Key players in the industry are innovating through the development of modular and prefab building solutions that cater to diverse applications, including residential, commercial, and industrial sectors.

List of Key Companies in Prefabricated Construction Market:

- Daiwa House Industry Co., Ltd.

- Berkshire Hathaway

- Cedar Homes Europe

- EPACK PREFAB

- Merit Holdings Private Limited

- Fading West Development

- Sekisui House

- Skanska AB

- GUERDON MODULAR BUILDINGS

- Bouygues Construction

- Palomar Modular Buildings LLC

- ATCO ENERGY SOLUTIONS

- Fluor Corporation

- Larsen & Toubro Limited

- Balfour Beatty PLC

Recent Developments (Collaboration)

- In November 2024, EPACK Prefab built a 151,000 sq. ft. factory in 150 hours at APIIC Industrial Park, Andhra Pradesh, utilizing pre-engineered building technology for a multinational electronics manufacturer.