Market Definition

The market involves the use of advanced agricultural technologies to improve the efficiency and accuracy of crop harvesting. It includes GPS-guided harvesters, autonomous machinery, sensors, drones, AI-driven analytics, and IoT-enabled systems that optimize yield, reduce waste, and lower operational costs.

This market covers hardware, software, and services that support data-driven decision-making in agriculture. This report highlights the primary market drivers of the global market, alongside significant trends, regulatory frameworks, and the competitive landscape, shaping the market in the coming years.

Precision Harvesting Market Overview

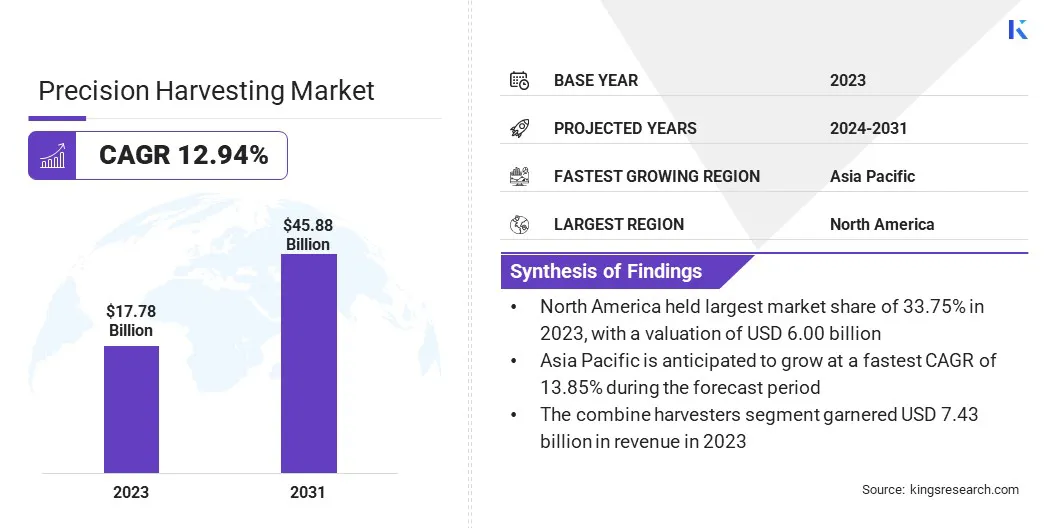

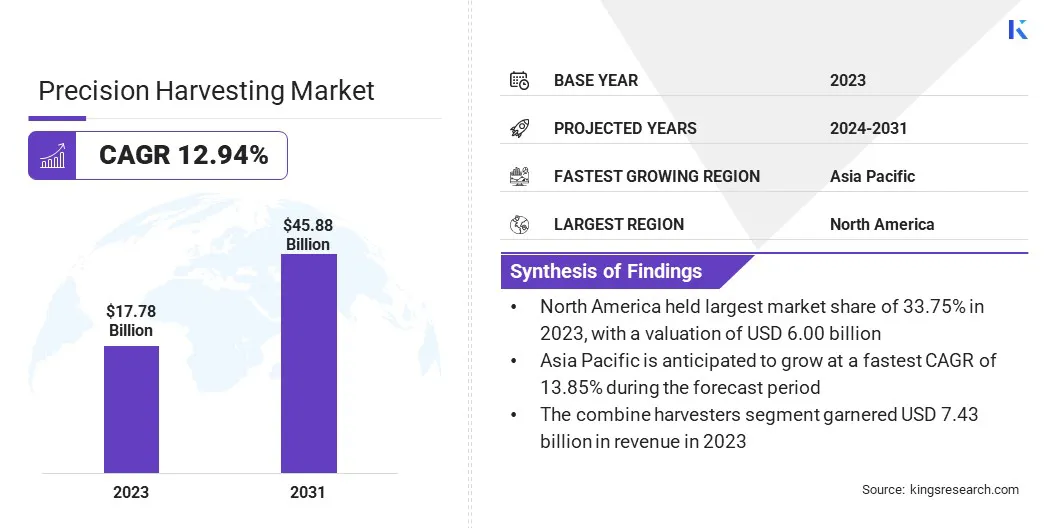

The global precision harvesting market size was valued at USD 17.78 billion in 2023 and is projected to grow from USD 19.58 billion in 2024 to USD 45.88 billion by 2031, exhibiting a CAGR of 12.94% during the forecast period. This market is witnessing rapid growth due to the increasing adoption of automated machinery, GPS-based guidance systems, and AI-powered analytics in agriculture.

Farmers are leveraging multi-spectral imaging, LiDAR sensors, and IoT-connected devices to monitor crop health and optimize harvesting schedules. In addition, the rising popularity of robotic harvesters and self-driving combines (referring to autonomous agricultural vehicles such as tractors and harvesters) is revolutionizing large-scale farming, ensuring faster and more precise harvesting with minimal human intervention.

Moreover, the expansion of cloud computing and edge AI is enabling real-time data processing regarding crop conditions, machinery performance, and environmental factors, allowing farmers to make quicker and more informed decisions.

Major companies operating in the precision harvesting industry are Deere & Company, Trimble Inc., AGCO Corporation, Raven Industries, Inc., Precision Ag Solutions, Topcon, Taranis, AgEagle Aerial Systems Inc., Hexagon AB, Bayer AG, CropX Inc., BASF SE, Spraying Systems Co., Farmers Edge Inc., and KUBOTA Corporation.

The market is also benefiting from the rise of vertical and indoor farming, where precision harvesting technologies play a crucial role in maintaining controlled environments. Additionally, collaborations between agriculture technology companies and research institutions are driving innovation in precision harvesting technologies, leading to more efficient and cost-effective solutions.

With increasing concerns about food security and climate change, precision harvesting is becoming a key factor in enhancing agricultural resilience, ensuring optimal resource utilization, and boosting overall farm profitability.

Key Highlights

- The precision harvesting industry size was valued at USD 17.78 billion in 2023.

- The market is projected to grow at a CAGR of 12.94% from 2024 to 2031.

- North America held a market share of 33.75% in 2023, with a valuation of USD 6.00 billion.

- The hardware segment garnered USD 6.83 billion in revenue in 2023.

- The combine harvesters segment is expected to reach USD 18.97 billion by 2031.

- The guidance systems segment is expected to reach USD 13.12 billion by 2031.

- The yield monitoring segment is expected to reach USD 13.74 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.85% during the forecast period.

Market Driver

Advancing Agricultural Efficiency through Automation and Smart Technologies

The market is expanding rapidly, driven by advancements in farm automation and the increasing need for high-yield farming to meet global food demand. Farmers are increasingly adopting robotic harvesters, autonomous machinery, and AI-powered decision-making systems to improve efficiency and reduce labor dependency.

These technologies enable real-time crop monitoring, precision cutting, and automated sorting, leading to higher productivity and reduced crop loss. Autonomous harvesting systems, guided by GPS, Light Detection and Ranging (LiDAR), and machine learning algorithms, allow for precise harvesting without human intervention.

Additionally, Precision harvesting technologies optimize resource allocation, minimize post-harvest waste, and enhance per-acre yields. By utilizing predictive modeling, advanced sensors, and data analytics, precision harvesting technologies allows farmers to make informed decisions about crop health, soil conditions, and harvest timing.

- In February 2025, TTA-ISO launched its fully automated tomato harvesting robot at FRUIT LOGISTICA 2025 in Berlin. This AI-powered robot features advanced ripeness detection, 3D-guided smart navigation, and seamless integration with standard heating rails. With an operational speed of up to 450 vines per hour, the system enhances efficiency, reduces labor dependency, and improves food safety through automated disinfection. The robot also collects real-time data, enabling growers to optimize harvesting strategies and productivity in commercial greenhouse operations.

Market Challenge

High Initial Investment and Cost Constraints

One of the major challenges in the precision harvesting market is the high initial cost of acquiring advanced technologies. Precision harvesting relies on robotic harvesters, AI-powered decision-making systems, GPS-guided autonomous machinery, drones, and IoT-enabled sensors, which require significant capital investment.

The cost of purchasing, installing, and maintaining these systems is often prohibitive for small and medium-sized farms, limiting widespread adoption. Additionally, software upgrades, data management platforms, and training skilled labor to operate high-tech machinery add to the overall expense. In developing regions, where farmers have limited access to financial resources, the adoption rate remains low due to the difficulty in achieving immediate return on investment.

Farmers often hesitate to invest in these technologies unless there is a clear and rapid improvement in productivity and profitability. To address this challenge, governments, financial institutions, and agri-tech companies are introducing subsidies, grants, and low-interest loans to help farmers integrate precision harvesting technologies.

Additionally, the rise of precision harvesting-as-a-service models enables farmers to access advanced equipment on a rental or pay-per-use basis, reducing upfront costs. Scalable and modular automation solutions are also being developed, allowing farmers to gradually upgrade their harvesting systems without making a full-scale investment at once.

Market Trend

The Rise of Smart Sensors and UAV-Based Solutions

The market is evolving with the integration of smart sensors, cloud-based analytics, and unmanned aerial vehicles (UAVs) to enhance efficiency and productivity. Farmers are leveraging IoT-enabled sensors, real-time data analytics, and AI-powered monitoring systems to gain deeper insights into crop health, moisture levels, and soil conditions.

These systems facilitate automated yield predictions and optimized harvesting schedules, ensuring maximum efficiency and minimal resource wastage. Cloud-based analytics further allow farmers to store, process, and analyze large agricultural datasets, improving decision-making for precision farming and sustainable resource management.

Additionally, drones and UAVs are transforming harvesting operations by providing high-resolution aerial imaging, real-time crop scouting, and automated yield assessment. Equipped with multispectral and thermal sensors, these technologies help detect disease outbreaks, nutrient deficiencies, and moisture variations across vast farmland areas.

UAVs are also being integrated with robotic arms and harvesting mechanisms to enable automated fruit picking and targeted crop collection, reducing reliance on manual labor. These data-driven and automation-based advancements are making precision harvesting more scalable, cost-effective, and efficient, revolutionizing modern agricultural practices.

- In March 2025, AirForestry, a Swedish company specializing in drone-based tree harvesting technology, secured USD 11 million in seed funding. The round was led by Northzone and included participation from investors such as Sveaskog, Kiko VC, CapitalT, Walerud Ventures, SEB Greentech VC, and Cloudbreak VC. This funding aims to advance AirForestry's development of fully electric drones designed for aerial tree harvesting, offering an environmentally friendly alternative to traditional ground-based forestry machinery. By utilizing drones, AirForestry aims to minimize terrain disruption, protect biodiversity, and reduce carbon emissions associated with conventional logging practices.

Precision Harvesting Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Product

|

Combine Harvesters, Harvesting Robots, Forage Harvesters

|

|

By Technology

|

Guidance Systems, Remote Sensing, Variable-Rate Technology, Drones, UAVs

|

|

By Application

|

Yield Monitoring, Variable Rate Application, Field Mapping, Soil Monitoring, Crop Scouting, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, Services): The hardware segment earned USD 6.83 billion in 2023 due to the widespread adoption of GPS-enabled harvesters, advanced sensors, and automation technologies in modern farming.

- By Product (Combine Harvesters, Harvesting Robots, and Forage Harvesters): The combine harvesters segment held 41.79% of the market in 2023, due to increasing demand for high-efficiency harvesting machines with AI-driven precision and automation features.

- By Technology (Guidance Systems, Remote Sensing, Variable-Rate Technology, Drones, and UAVs): The guidance systems segment is projected to reach USD 13.12 billion by 2031, owing to the growing need for real-time navigation, enhanced accuracy, and reduced operational costs in large-scale farming.

- By Application (Yield Monitoring, Variable Rate Application, Field Mapping, Soil Monitoring, Crop Scouting, Others): The yield monitoring segment is projected to reach USD 13.74 billion by 2031, owing to the increasing integration of AI-driven analytics and IoT-based sensors for real-time yield optimization.

Precision Harvesting Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 33.75% share of the precision harvesting market in 2023, with a valuation of USD 6.00 billion. This dominance is attributed to the widespread adoption of advanced agricultural technologies, strong financial support for innovation, and the presence of industry-leading companies.

The region's well-developed agriculture sector, large-scale commercial farming operations, and access to cutting-edge research and development in agri-tech drives the growth of the market. Additionally, the increasing labor shortage in the agricultural sector has driven demand for autonomous and robotic harvesting solutions.

The market in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 13.85% over the forecast period. This growth is driven by the increasing demand for agricultural production, rapid urbanization, and advancements in smart farming technologies.

The region’s large and growing population has intensified the need for efficient harvesting solutions to boost productivity and ensure food security. Countries such as China, India, and Japan are leading the transformation toward precision harvesting. China’s Smart Agriculture Initiative and India’s Digital Agriculture Mission are major policy drivers promoting the adoption of IoT-enabled farming, AI-powered harvesting robots, and data-driven decision-making tools.

Government subsidies for modern farming equipment are helping small and mid-sized farmers transition to adopt these solutions. Additionally, foreign investments and partnerships with global agri-tech firms are driving innovation in the Asia Pacific market. Companies are expanding their presence in the region to capitalize on the rising demand for smart farming solutions, further accelerating growth.

Regulatory Frameworks

- In the U.S., harvesting regulations are governed by the United States Department of Agriculture (USDA) and the Environmental Protection Agency (EPA). The Farm Bill sets policies for sustainable agricultural practices, while the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) regulate pesticide use in harvesting to ensure food safety. Additionally, the Occupational Safety and Health Administration (OSHA) enforces labor safety standards for farmworkers involved in harvesting operations.

- In the European Union, harvesting is regulated under the Common Agricultural Policy (CAP), which promotes sustainable farming practices and environmental protection. The EU Regulation on plant protection products ensures that pesticides used during harvesting are safe for human consumption and the environment.

- In China, harvesting regulations are overseen by the Ministry of Agriculture and Rural Affairs (MARA) and the National Food Safety Standard, which establish limits on pesticide residues and ensure the safe use of fertilizers. The Land Administration Law regulates land use to prevent overharvesting and soil degradation.

- In Japan, harvesting falls under the Agricultural Land Act and the Food Sanitation Act, which regulate pesticide use and land management. The Ministry of Agriculture, and Forestry and Fisheries (MAFF) oversees policies promoting sustainable harvesting techniques and food safety.

Competitive Landscape

The precision harvesting market is characterized by rapid technological advancements, strategic collaborations, and continuous investment in automation and AI-driven solutions. Key players in the industry are focusing on developing innovative harvesting equipment, integrating IoT and data analytics, and enhancing autonomous capabilities to improve efficiency and productivity.

To strengthen their market position, leading companies are expanding their R&D efforts, investing in machine learning algorithms, GPS-guided harvesting, and cloud-based farm management systems.

Additionally, key players are partnering with agri-tech startups to incorporate cutting-edge technologies such as drone-assisted harvesting, LiDAR-based crop analysis, and real-time yield monitoring. Strategic mergers and acquisitions are playing a crucial role in market consolidation, enabling companies to broaden their product portfolios and enter new markets.

Manufacturers are also focusing on sustainability by developing eco-friendly harvesting equipment that reduces fuel consumption and minimizes environmental impact. The adoption of predictive maintenance solutions and AI-powered automation software is further helping companies enhance operational efficiency and reduce downtime in harvesting operations.

- In August 2024, Yanmar Holdings Co., Ltd. acquired CLAAS India through its group company Yanmar Coromandel Agrisolutions. The acquisition aims to expand Yanmar’s agribusiness in India by integrating CLAAS India’s expertise in manufacturing high-quality and durable combine harvesters, strengthening Yanmar’s market presence and offering a wider range of harvesting solutions.

List of Key Companies in Precision Harvesting Market:

- Deere & Company

- Trimble Inc.

- AGCO Corporation

- Raven Industries, Inc.

- Precision Ag Solutions

- Topcon

- Taranis

- AgEagle Aerial Systems Inc

- Hexagon AB

- Bayer AG

- CropX Inc.

- BASF SE

- Spraying Systems Co.

- Farmers Edge Inc.

- KUBOTA Corporation

Recent Developments (Collaboration/New Company Launch)

- In March 2025, Yamaha Motor Co., Ltd. launched Yamaha Agriculture, Inc., a new company dedicated to advancing automation and digital crop management solutions for specialty crops. Through the acquisitions of Robotics Plus and The Yield, Yamaha Agriculture aims to integrate autonomous equipment for spraying and weeding with AI-powered analytics, enabling precision farming and data-driven decision-making.

- In February 2025, Topcon Agriculture and Bonsai Robotics collaborated to advance agricultural automation for permanent crops through autonomous navigation and smart implement controls. The partnership integrates Bonsai Robotics’ vision-based autonomous driving solutions with Topcon Agriculture’s precision sensors, autosteering, and smart implement technologies to enhance efficiency, sustainability, and high-precision harvesting in orchard farming.