Market Definition

The market involves the global production, distribution, and application of synthetic amorphous silica across industries including automotive, personal care, food, and agriculture. Rising demand for eco-friendly and high-performance materials used in green tires and oral care has led to a focus on innovation, regulatory compliance, and strategic collaborations.

The market continues to evolve with advancements in sustainable manufacturing and increasing emphasis on product efficiency and environmental impact. The report outlines the primary drivers of the market, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market trajectory.

Precipitated Silica Market Overview

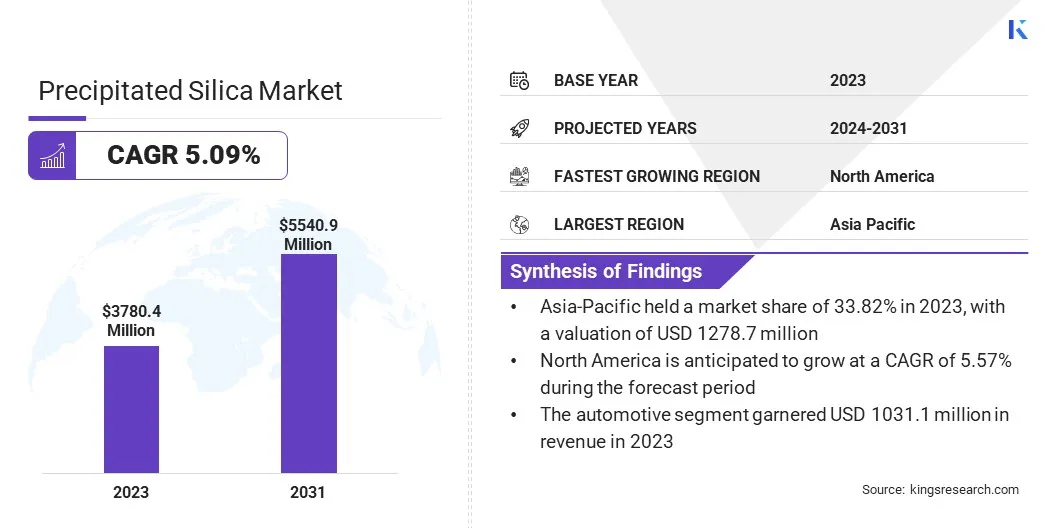

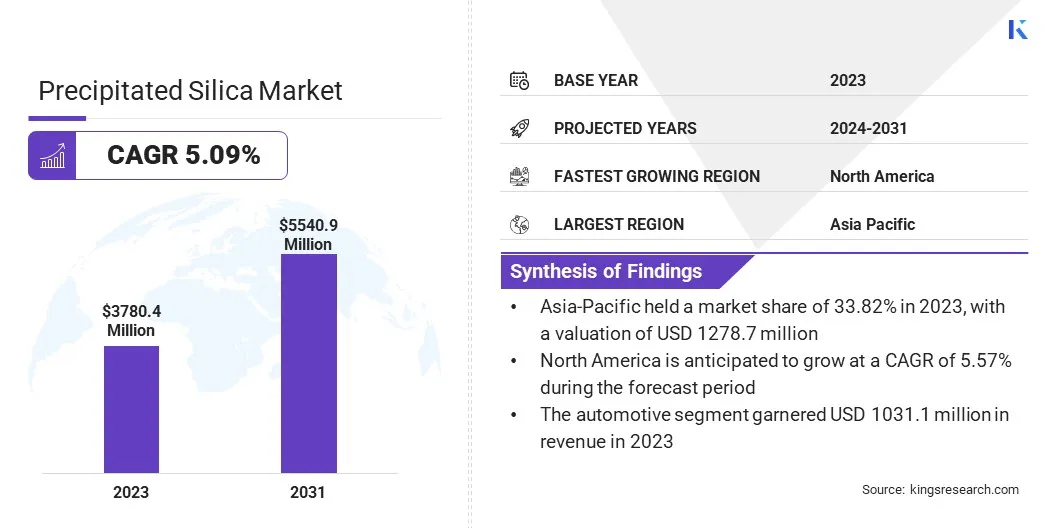

The global precipitated silica market size was valued at USD 3780.4 million in 2023, which is estimated to be USD 3915.4 million in 2024 and reach USD 5540.9 million by 2031, growing at a CAGR of 5.09% from 2024 to 2031.

The market is growing, due to strategic portfolio realignments, rising demand for green tires, and ongoing technological advancements. These factors enhance silica’s performance, support sustainability goals, and drive its adoption across automotive, personal care, and industrial applications.

Major companies operating in the precipitated silica industry are Evonik, QEMETICA, Solvay, Madhu Silica Pvt. Ltd, Oriental Silicas Corporation, W. R. Grace & Co.-Conn, Tosoh Silica Corporation, Tata Chemicals Ltd., Antenchem, PQ Corporation, IQE Group, Supersil Chemicals (I) Pvt. Ltd, MLA Group of Industries, SUNSHINE INDUSTRIES, and Regoj Chemical Industries.

Strategic focus on core competencies by companies is leading to increased specialization and portfolio expansion, thereby driving the global market. Key players in the market acquire silica product businesses and gain access to high-performance materials that can be leveraged across various industries, such as automotive, personal care, and coatings.

This shift enables companies to strengthen their market positions, fostering innovation, increasing competition, and driving demand for specialized silica applications, ultimately contributing to market growth.

- In August 2024, PPG Industries announced the sale of its silica products business, including precipitated silica, to QEMETICA. This strategic decision allows PPG to concentrate on core operations, while enabling QEMETICA to broaden its high-performance materials portfolio. The acquisition supports QEMETICA’s expansion in the silica market and enhances application potential across multiple industries, benefiting both companies.

Key Highlights:

- The precipitated silica industry size was valued at USD 3780.4 million in 2023.

- The market is projected to grow at a CAGR of 5.09% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 1278.7 million.

- The automotive segment garnered USD 1 million in revenue in 2023.

- The market in North America is anticipated to grow at a CAGR of 5.57% during the forecast period.

Market Driver

"Rising demand for green tires"

The precipitated silica market is significantly driven by the growing demand for green tires, which prioritize fuel efficiency and reduced environmental impact. Precipitated silica plays a crucial role in enhancing tire performance by improving rolling resistance and fuel efficiency.

This makes it essential in the production of green tires. The market is fueled by the increasing consumer demand for sustainable products, stricter carbon emission regulations, and continuous advancements in tire technology. As a result, manufacturers are making strategic investments in high-performance silica to meet the evolving needs of the automotive industry.

- In January 2024, Evonik announced a mid-double-digit million Euro investment to expand its precipitated silica production in Charleston, U.S. The new line, set to begin construction in mid-2024 and become operational by early 2026, aims to meet the growing demand, particularly in the tire, oral care, and coatings sectors in North America. This strategic move enhances local supply chain resilience and supports sustainability goals.

Market Challenge

"Fluctuating prices of sodium silicate and sulfuric acid"

Fluctuating prices of raw materials, such as sodium silicate and sulfuric acid, pose a persistent challenge for manufacturers in the precipitated silica market. These cost variations hinder accurate budgeting and inventory planning, ultimately affecting profit margins and operational performance.

Price volatility often stems from supply chain disruptions, geopolitical instability, and shifting global demand. Companies increasingly rely on strategic sourcing, diversified supplier networks, and advanced data analytics for real-time cost monitoring.

Enhanced supply chain resilience and improved procurement strategies help mitigate financial risks and support stable pricing in a competitive market landscape.

Market Trend

"Technological Advancements"

The precipitated silica market is being transformed by technological advancements that improve efficiency, performance, and cost-effectiveness in production. Innovations in manufacturing processes, such as the development of proprietary reactors and more efficient extraction methods, allow for the production of higher-quality silica with reduced energy consumption and waste.

These advancements enhance the material's properties while lowering operational costs, making it more accessible across various industries. These technological improvements play a key role in meeting market needs and supporting environmental objectives as the demand for sustainable and high-performance products rises.

- In December 2024, HPQ Silicon Inc. announced progress on HPQ Silica Polvere Inc.'s (HSPI) commercial validation of its proprietary Fumed Silica Reactor (FSR) process. PyroGenesis Inc., a key technology partner, successfully completed extended refractory conditioning on the pilot system, enhancing the consistent flow of fumed silica to downstream recovery equipment, ensuring improved production efficiency.

Precipitated Silica Market Report Snapshot

|

Segmentation

|

Details

|

|

By End-User

|

Agriculture, Cosmetics, Automotive, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America : Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By End User (Agriculture, Cosmetics, Automotive, Electronics, Others): The automotive segment earned USD 1031.1 million in 2023, due to the rising demand for fuel-efficient tires and increased use of precipitated silica as a reinforcing agent in automotive applications.

Precipitated Silica Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific precipitated silica market share stood at around 33.82% in 2023, with a valuation of USD 1278.7 million. Asia Pacific dominates the market, due to several key factors.

The rapidly growing automotive industry, particularly in China and India, drives the demand for high-performance tires that use silica. Additionally, the expanding manufacturing sector including rubber, plastics, and personal care boosts silica consumption.

Cost-effective labor and raw materials make production more economical, attracting global players. Rising urbanization and disposable incomes fuel the demand for consumer goods.

Moreover, government initiatives supporting industrial development and foreign investment strengthen the region's position as a global hub for precipitated silica production and application.

The precipitated silica industry in North America is poised to register the fastest growth at a robust CAGR of 5.57% over the forecast period. This is attributed to the increasing demand for green and fuel-efficient tires.

Tire producers are shifting toward advanced materials that enhance performance and reduce environmental impact as automotive manufacturers and consumers prioritize sustainability and regulatory compliance.

Precipitated silica plays a critical role in improving tire rolling resistance, grip, and durability. This trend is further supported by growing investments in the regional automotive sector, encouraging the adoption of innovative materials to meet evolving performance and environmental standards across the industry.

- In January 2025, Evonik announced the closure of its fumed silica facility in Waterford, NY, and precipitated silica site in Havre de Grace, MD, as part of a strategic asset network optimization to improve efficiency. A global leader in silica production, Evonik continues operations at six North American and 26 global sites, supporting diverse end markets.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees the regulation of precipitated silica across sectors such as food, household products, and pesticides. It exempts certain inert forms, like fumed silica, from tolerance requirements due to their low ingestion risk and safety profile.

- In India, the Central Pollution Control Board (CPCB), under the Ministry of Environment, Forest and Climate Change, serves as the key regulatory authority overseeing environmental compliance in precipitated silica production, including emissions control, waste management, and sustainable manufacturing practices.

- In Europe, precipitated silica is regulated by the European Chemicals Agency (ECHA) under the reach regulation for chemical substances, while the European Food Safety Authority (EFSA) assesses its safety as a food additive. These agencies ensure compliance with environmental and health standards across industrial and food applications.

Competitive Landscape

The precipitated silica industry is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the market are actively implementing strategic initiatives such as mergers and acquisitions, product launches, and portfolio diversification to drive growth and enhance market competitiveness.

These approaches are aimed at expanding geographical reach, strengthening production capabilities, and meeting evolving customer demands across various industries.

Market players are positioning themselves to capitalize on emerging opportunities and reinforce their presence in both established and developing markets by leveraging innovation and operational synergies.

- In November 2024, Qemetica acquired PPG’s precipitated silica business for USD 310 million, marking one of the largest U.S. industrial acquisitions by a Polish firm. The deal aligns with Qemetica’s 2024–2029 strategy, boosting global expansion, innovation, and sustainability while strengthening its presence in North America and diversifying its portfolio across key industrial applications.

List of Key Companies in Precipitated Silica Market:

- Evonik

- QEMETICA

- Solvay

- Madhu Silica Pvt. Ltd.

- Oriental Silicas Corporation

- R. Grace & Co.-Conn

- Tosoh Silica Corporation.

- Tata Chemicals Ltd.

- Antenchem

- PQ Corporation

- IQE Group

- Supersil Chemicals (I) Pvt. Ltd

- MLA Group of Industries

- SUNSHINE INDUSTRIES

- Regoj Chemical Industries

Recent Developments

- In January 2025, PQ acquired the specialty silicate business from the Sibelco Group, based at the Lödöse plant in Sweden. This strategic acquisition strengthens PQ’s footprint in the Nordic region, enabling the company to expand its customer base and deliver its silicate products and services to new markets, supporting its broader growth and regional expansion strategy.

- In October 2024, Evonik Industries announced a major expansion of its Charleston site in Berkeley County, South Carolina. The project will increase precipitated silica production capacity by 50%, addressing the rising demand for environmentally friendly green tires from the U.S. tire industry. This move reinforces Evonik’s strategic focus on sustainable mobility, strengthening its North American footprint.

- In January 2023, Solvay announced the launch of its first circular highly dispersible silica (HDS) unit in Livorno, Italy, using bio-based sodium silicate from rice husk ash. Supported by global tire manufacturers, this innovation enables a 50% CO2 reduction per ton, enhances sustainability, and will replace the Zeosil portfolio, targeting multiple industries such as tire, personal care, and food.