Market Definition

The market encompasses instruments designed for precise measurement, analysis, and evaluation of electrical parameters in power electronics. These tools assess voltage, current, power efficiency, and harmonic distortion in semiconductor devices, converters, inverters, and other power components.

Power device analyzers facilitate the optimization of circuit designs, ensuring compliance with regulatory standards and improving system performance.

Power Device Analyzer Market Overview

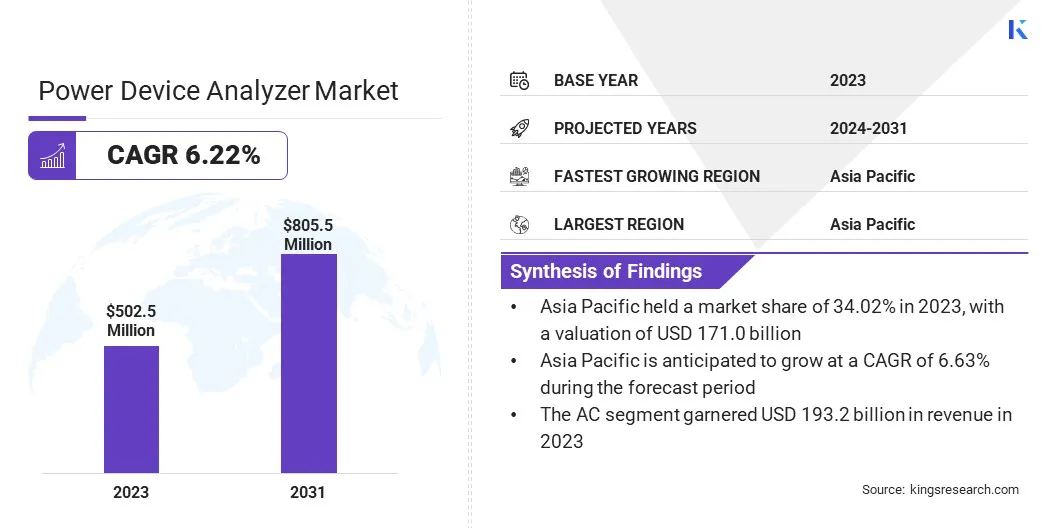

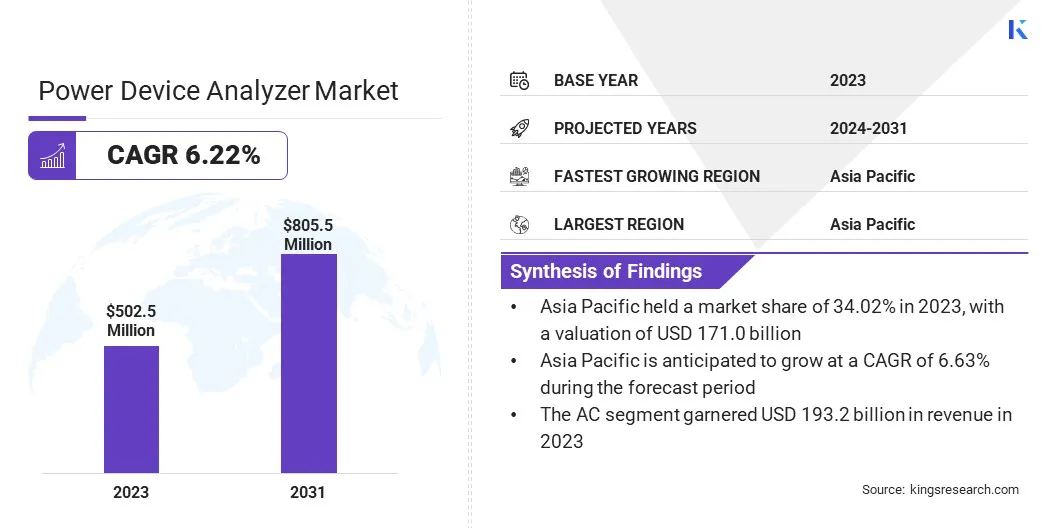

The global power device analyzer market size was valued at USD 502.5 million in 2023 and is projected to grow from USD 528.1 million in 2024 to USD 805.5 million by 2031, exhibiting a CAGR of 6.22% during the forecast period.

The transition toward electric vehicles (EVs) is accelerating the need for advanced power testing solutions, ensuring energy efficiency and regulatory compliance, thereby driving the growth of the market.

The expansion of semiconductor industries is further driving the market, as precise power analysis is essential in chip manufacturing and testing. Additionally, the rise of high-performance computing and data centers is fueling the adoption of power measurement solutions, contributing to market expansion.

Major companies operating in the power device analyzer industry are Keysight Technologies, TEKTRONIX, INC., Yokogawa Electric Corporation, Fluke Corporation, HIOKI E.E. CORPORATION, Chroma ATE Inc., Rohde & Schwarz, OMICRON, Schneider Electric, KIKUSUI ELECTRONICS CORP, Siemens AG, Megger Group Limited, Yokogawa Test & Measurement Corporation, Thermo Fisher Scientific, and PCE Instruments India Private Ltd.

The transition toward electric vehicles (EVs) has increased the demand for advanced power electronics, strengthening the growth of the market.

- The International Energy Agency's 2024 report highlights that around 14 million new electric cars were registered globally in 2023, increasing the total number of EVs on the road to 40 million. Sales in 2023 exceeded the previous year by 3.5 million units, reflecting a 35% annual growth rate. Electric vehicles accounted for approximately 18% of total vehicle sales in 2023, up from 14% in 2022, reflecting steady growth over the past five years.

Automakers and battery manufacturers rely on precise testing equipment to evaluate efficiency, switching characteristics, and thermal performance in power semiconductor devices. Additionally, the growing investments in EV infrastructure and fast-charging solutions are driving the need for high-performance testing systems.

Key Highlights:

- The power device analyzer industry size was recorded at USD 502.5 million in 2023.

- The market is projected to grow at a CAGR of 6.22% from 2024 to 2031.

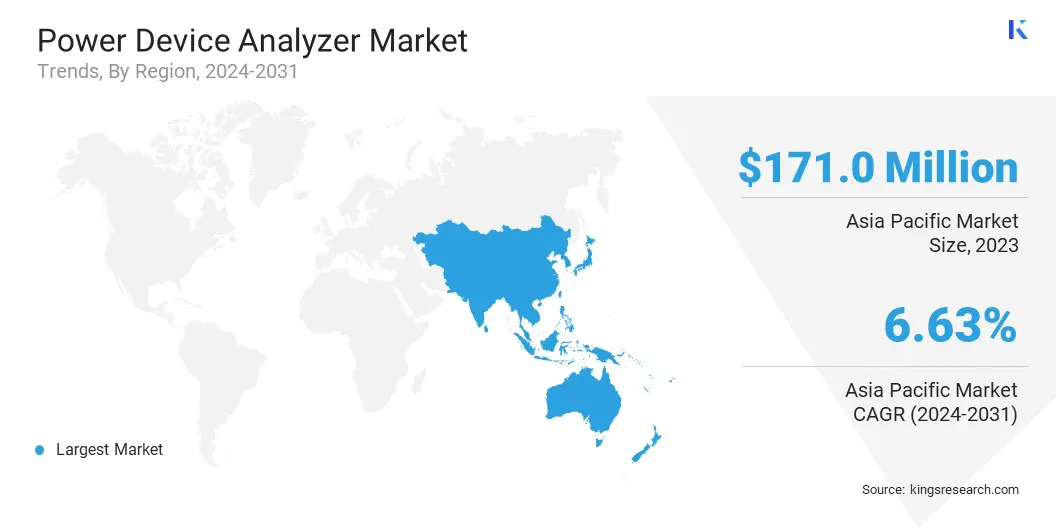

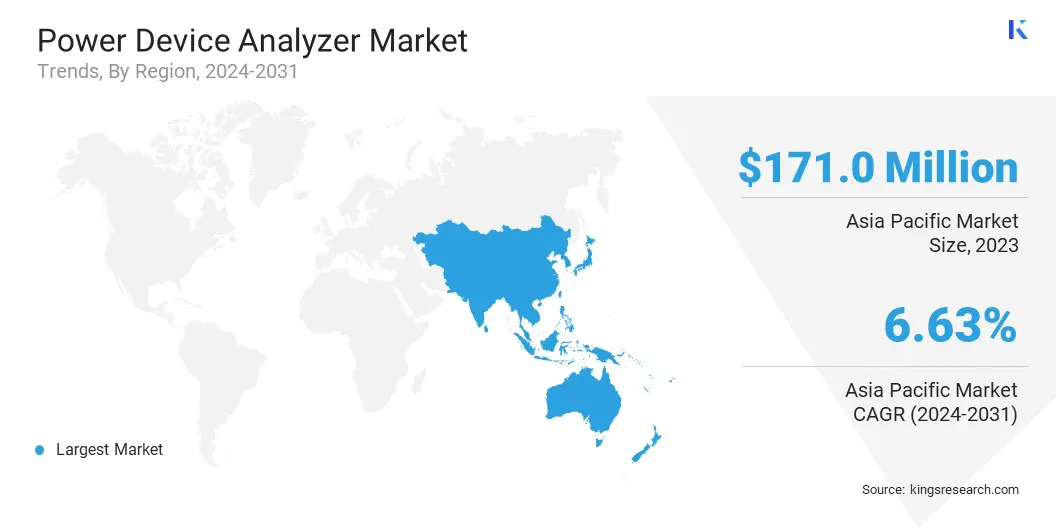

- Asia Pacific held a market share of 34.02% in 2023, with a valuation of USD 171.0 million.

- The AC segment garnered USD 193.2 million in revenue in 2023.

- The below 1000A segment is expected to reach USD 465.6 million by 2031.

- The medical segment is poised for a robust CAGR of 6.52% through the forecast period.

- The maket in Europe is anticipated to grow at a CAGR of 6.23% during the forecast period.

Market Driver

"Expansion of Semiconductor Industries"

The increasing demand for advanced semiconductors in automotive, consumer electronics, telecommunications, and industrial applications is fueling the growth of the power device analyzer market.

Leading semiconductor manufacturers are expanding production capacities to meet the rising need for power-efficient chips, due to the growth of electric vehicles, renewable energy systems, and high-performance computing.

The development of next-generation power semiconductors, including silicon carbide (SiC) and gallium nitride (GaN) devices, requires precise testing, driving the adoption of power device analyzers. Governments and private enterprises worldwide are investing in semiconductor fabrication facilities to enhance supply chain resilience, further accelerating market expansion.

- According to the Semiconductor Industry Association's 2024 report, global semiconductor sales reached USD 627.6 billion in 2024, reflecting a 19.1% increase from the 2023 total of USD 526.8 billion. The semiconductor industry recorded its highest-ever annual sales in 2024, surpassing USD 600 billion.

Market Challenge

"High Cost of Advanced Power Analyzers"

The high cost of advanced power analyzers presents a significant challenge, limiting adoption across small and mid-sized enterprises. Precision measurement tools with enhanced functionalities require substantial investment, making affordability a concern for cost-sensitive industries.

To address this, companies are focusing on modular designs, enabling users to customize features and reduce initial costs. Additionally, manufacturers are offering flexible pricing models, including leasing and subscription-based services, to improve accessibility.

Investments in research and development are also driving technological advancements to optimize cost-efficiency while maintaining performance, supporting wider adoption.

Market Trend

"Expansion of High-Performance Computing and Data Centers"

The rising demand for high-performance computing (HPC) and cloud-based data centers is driving the growth of the power device analyzer market. The International Energy Agency's 2024 report underscores a sharp rise in investments in new data centers over the past two years, fueled by growing digitalization and the swift adoption of artificial intelligence (AI), a trend projected to gain further momentum.

Power-intensive servers, storage devices, and networking infrastructure require efficient power management to reduce energy consumption and operational costs. To enhance efficiency and comply with global energy standards,data center operators are implementing power optimization strategies .

As a result, the demand for precise power measurement in power supply units (PSUs) and voltage regulators is rising, driving the adoption of power device analyzers in the IT sector.

Power Device Analyzer Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Both AC and DC, AC, DC

|

|

By Current

|

Below 1000A, Above 1000A

|

|

By End User

|

Automotive, Energy, Telecommunication, Consumer Electronics & Appliances, Medical, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Both AC and DC, AC, and DC): The AC segment earned USD 193.2 million in 2023 due to the increasing demand for precise power analysis in industrial automation, renewable energy systems, and electric vehicle testing, where AC power measurements are essential for ensuring efficiency, performance optimization, and regulatory compliance.

- By Current (Below 1000A and Above 1000A): The below 1000A segment held 57.87% of the market in 2023, due to its widespread adoption across industries for evaluating low-to-medium power electronic devices, offering precise measurements essential for applications in consumer electronics, automotive components, and industrial equipment testing.

- By End User (Automotive, Energy, Telecommunication, Consumer Electronics & Appliances, Medical, and Others): The medical segment is poised for significant growth at a CAGR of 6.52% through the forecast period, attributed to the increasing demand for precise power analysis in advanced medical equipment to ensure compliance with stringent regulatory standards and optimize energy efficiency in critical healthcare applications.

Power Device Analyzer Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific power device analyzer market share stood around 34.02% in 2023 in the global market, with a valuation of USD 171.0 million. The increasing production of energy-efficient consumer electronics and industrial automation equipment in countries such as China, Japan, and South Korea is fueling the market.

The rising demand for compact, high-efficiency power supplies in smartphones, home appliances, and automation systems is further incrasing the need for precise power analysis.

- The National Bureau of Statistics reports that China's home appliance industry generated approximately USD 255 billion in revenue in 2023, reflecting a 7% increase from the previous year. Profits rose to around USD 21.7 billion, registering a 12.1% year-over-year growth.

Additionally, Asia Pacific is leading investments in 5G networks and high-performance computing (HPC) infrastructure, particularly in China, South Korea, and Japan. The deployment of 5G base stations and data centers requires efficient power management solutions to optimize energy consumption, strengthening the growth of the market.

Europe power device analyzer industry is poised for significant growth at a robust CAGR of 6.23% over the forecast period. The expansion of cloud computing, artificial intelligence, and data center facilities across Europe is driving demand for efficient power management solutions.

Countries like Ireland, the Netherlands, and Germany are witnessing increased data center investments, requiring advanced power monitoring to optimize energy consumption and ensure sustainable operations.

Moreover, the European Union has mandated a complete shift to zero-emission vehicle sales by 2035, accelerating investments in battery technology, power electronics, and charging infrastructure.

Automakers and charging station developers require precise power analysis to optimize energy efficiency and ensure regulatory compliance, contributing to the market growth in this region.

Regulatory Frameworks

- In the U.S., the Federal Communications Commission (FCC) regulates electromagnetic interference (EMI) from electronic devices to prevent disruptions in communication networks. The Underwriters Laboratories (UL) offers safety certifications ensuring electrical products meet rigorous safety standards. The National Electrical Code (NEC) provides comprehensive guidelines for safe electrical installations. Compliance with these standards is essential for legal distribution in the U.S.

- In Europe, The CE marking is mandatory for electronic products sold within the EU, indicating compliance with health, safety, and environmental protection standards. The Electromagnetic Compatibility (EMC) Directive ensures devices operate without causing or being affected by electromagnetic disturbances. The Low Voltage Directive (LVD) addresses safety requirements for electrical equipment operating within specific voltage ranges. These directives facilitate the free movement of compliant products across EU member states.

- The China Compulsory Certificate (CCC) mark is required for various electronic products, signifying compliance with Chinese safety and quality standards. Additionally, China's Electromagnetic Compatibility (EMC) standards regulate emissions to prevent interference with other electronic devices and communication systems. Manufacturers must undergo testing and certification to obtain the CCC mark before entering the Chinese market.

- Japan mandates the PSE Mark (Product Safety Electrical Appliance & Material) for electrical products, indicating compliance with the Electrical Appliance and Material Safety Law. Devices emitting radio frequencies must adhere to the Radio Law and Telecommunications Business Law, regulating electromagnetic emissions to prevent interference with communication networks.

Competitive Landscape:

The power device analyzer industry is characterized by several market players, that are actively focusing on developing new products and expanding their product portfolios to strengthen their market presence.

By integrating advanced measurement capabilities and compliance features, companies are enhancing their offerings to cater to a wider range of applications. These strategic initiatives improve product performanceand drive technological advancements within the industry.

As companies introduce innovative solutions tailored to industry standards, the market continues to witness steady growth, fueled by the increasing demand for precision testing and compliance evaluation across various sectors.

- In April 2024, Rohde & Schwarz introduced three new power analyzer models, expanding its product portfolio to address diverse measurement needs for voltage, current, power, and total harmonic distortion across both DC and AC sources. The R&S NPA101 power meter offers essential measurement capabilities, while the R&S NPA501 power analyzer integrates advanced measurement functions and graphical analysis. The R&S NPA701 compliance tester includes evaluation features aligned with IEC 62301 and EN 50564 for power consumption assessment, as well as EN 61000-3-2 for EMC harmonic emission testing.

List of Key Companies in Power Device Analyzer Market :

- Keysight Technologies

- TEKTRONIX, INC.

- Yokogawa Electric Corporation

- Fluke Corporation

- HIOKI E.E. CORPORATION

- Chroma ATE Inc.

- Rohde & Schwarz

- OMICRON

- Schneider Electric

- KIKUSUI ELECTRONICS CORP

- Siemens AG

- Megger Group Limited

- Yokogawa Test & Measurement Corporation

- Thermo Fisher Scientific

- PCE Instruments India Private Ltd.

Recent Developments (M&A/Product Launch)

- In March 2025, Keysight Technologies introduced a new series of optically isolated differential probes designed to improve efficiency and performance testing for fast-switching devices, including wide bandgap GaN and SiC semiconductors. This innovation is set to advance efficiency and switching loss analysis in high-voltage applications such as electric vehicles (EVs), solar energy systems, and battery management solutions.

- In March 2025, Hioki announced a major firmware update for its flagship PW8001 power analyzer series, designed to enhance the development of Electric Vehicle (EV) and Photovoltaic (PV) inverters. The update introduces three key features: Power Spectrum Analysis (PSA), IEC standard-compliant power quality measurements, and an optical link interface for multi-unit synchronization. These advancements are integrated to support the evolving requirements of inverter technology, ensuring more precise and efficient power analysis for next-generation energy solutions.

- In April 2024, Tektronix, Inc. acquired EA Elektro-Automatik (EA), a leading provider of high-power electronic test solutions for energy storage, mobility, hydrogen, and renewable energy applications. This acquisition enhances Tektronix’s portfolio by integrating its advanced oscilloscopes and isolated probes with EA’s high-efficiency power supplies and electronic loads, alongside Keithley’s precision source meters and instrumentation.