Market Definition

Powder handling equipment comprises machinery and systems engineered to transport, process, and store powdered and granular materials safely and efficiently. These solutions utilize technologies such as vibratory feeders, pneumatic conveyors, bulk bag dischargers, and flexible screw conveyors to enable accurate dosing, contamination control, and streamlined operations.

The market scope spans industries, including pharmaceuticals, food and beverage, chemicals, cement, and plastics, where precise material flow and hygiene are critical. This equipment supports tasks such as filling, mixing, packaging, and bulk transfer, while meeting regulatory standards and improving productivity across production environments.

Powder Handling Equipment Market Overview

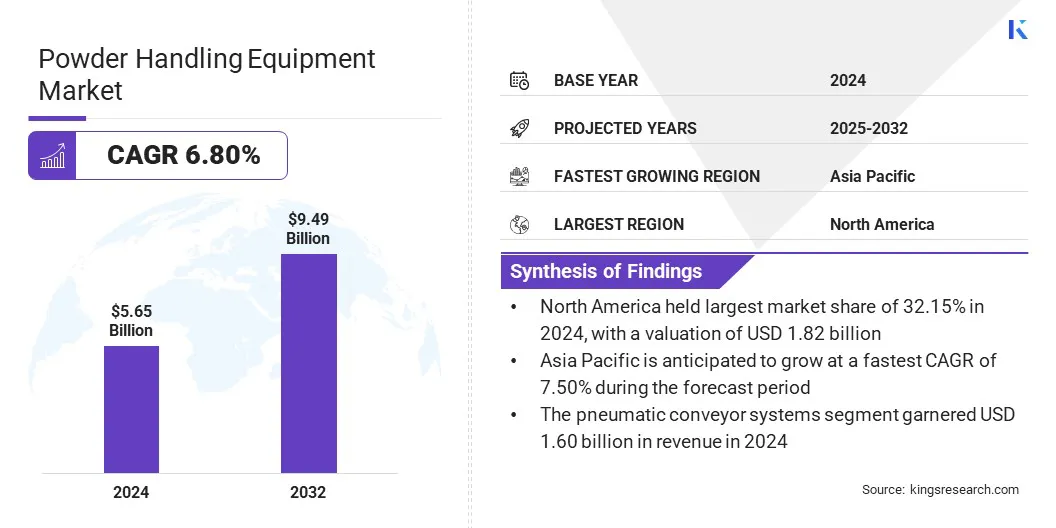

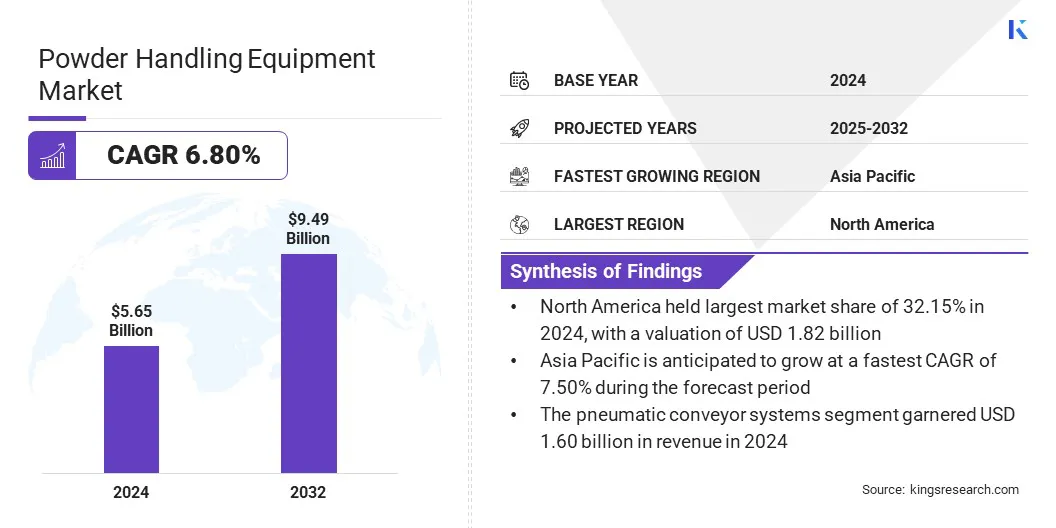

The global powder handling equipment market size was valued at USD 5.65 billion in 2024 and is projected to grow from USD 5.99 billion in 2025 to USD 9.49 billion by 2032, exhibiting a CAGR of 6.80% during the forecast period.

The growth of the market is driven by rising automation and efficiency requirements across industries such as food, pharmaceuticals, and chemicals. Companies are also integrating Internet of Things technologies and predictive analytics into equipment to improve real-time monitoring, reduce downtime, and ensure higher accuracy in bulk material processing.

Key Highlights

- The powder handling equipment industry size was USD 5.65 billion in 2024.

- The market is projected to grow at a CAGR of 6.80% from 2025 to 2032.

- North America held a share of 32.15% in 2024, valued at USD 1.82 billion.

- The pneumatic conveying systems segment garnered USD 1.60 billion in revenue in 2024.

- The automatic systems segment is expected to reach USD 2.64 billion by 2032.

- The food & beverage segment secured the largest revenue share of 26.74% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 7.50% over the forecast period.

Major companies operating in the powder handling equipment market are Hosokawa Micron Corporation, Baker Perkins Limited, Syntegon Technology GmbH, Hänsel Processing GmbH, Sollich UK Ltd., Dongsun Powder Processing Equipment Co. Ltd., Sanovo Technology Group, Powder Process-Solutions, Bepex International LLC, ProChem, Inc., Matcon IBC, PALAMATIC PROCESS INC., Gericke AG, Tetra Pak, and ILC Dover.

Rising demand for packaged and processed food is fueling market growth. Manufacturers are increasingly relying on automated systems to handle bulk ingredients such as flour, sugar, and milk powder efficiently and safely.

Maintaining product consistency and hygiene during processing promots the adoption of specialized conveying, blending, and storage equipment. Additionally, the need to reduce labor costs and improve operational efficiency is supporting the integration of automated powder handling solutions. Expanding production capacities in the food and beverage sector are further boosting demand for scalable and flexible equipment.

- In December 2024, Automated Flexible Conveyor (AFC) launched its Spiralfeeder flexible screw conveyor. Designed for fine, non-free-flowing powders such as powdered sugar and starch, it transfers material from hopper to discharge in a controlled first-in, first-out sequence. Its enclosed design minimizes dust emissions, enhancing safety and hygiene in processing environments.

Market Driver

Rising Automation and Efficiency Requirements

The growth of the powder handling equipment market is boosted by the rising adoption of automated powder handling systems to reduce manual labor and improve safety. Automation enables precise control over material flow and minimizes spillage and contamination during processing.

Companies are integrating conveyors, mixers, and dosing systems to enhance operational productivity and maintain consistent product quality. The use of automated solutions is also reducing downtime and improving overall process efficiency. Growing emphasis on worker safety and regulatory compliance is further promoting the adoption of advanced handling technologies.

- In August 2024, Automated Flexible Conveyor (AFC) launched its Spiralfeeder flexible screw conveyor. The Spiralfeeder automatically transfers fine, non-free-flowing powders such as powdered sugar and starch on a first-in, first-out basis. This enclosed design prevents dust escape, improving safety, hygiene, and precise material handling.

Market Challenge

High Capital Investment

A key challenge impeding the progress of the powder handling equipment market is the substantial upfront cost of advanced systems, including conveyors, mixers, and storage solutions. These high expenses create barriers for smaller enterprises with limited budgets. Additionally, specialized installation and integration requirements add to the financial and operational burden.

To address this challenge, market players are offering modular and scalable equipment, providing leasing or rental options, and designing energy-efficient systems to reduce total ownership costs. These initiatives are helping smaller enterprises access advanced powder handling solutions while managing financial constraints.

Market Trend

Integration of IoT & Predictive Analytics

The powder handling equipment market is witnessing a notable trend toward the adoption of IoT-enabled sensors and monitoring systems to enhance process reliability and efficiency. These smart technologies track parameters such as flow rate, pressure, and particle behavior in real time, enabling early detection of blockages or irregularities.

Predictive analytics further analyze collected data to anticipate equipment failures and schedule timely maintenance, minimizing unplanned downtime. This approach improves operational continuity, reduces maintenance costs, and supports safer handling of powders across industries such as food, pharmaceuticals, and chemicals. The integration of IoT and analytics is supporting the shift toward more intelligent and automated powder handling solutions.

- In June 2024, the SSRG International Journal of Electrical and Electronics Engineering published a peer-reviewed study on a predictive maintenance system for conveyor belts. The system leveraged IoT devices, cloud infrastructure, and machine learning, collecting real-time data from sensors such as accelerometers, temperature sensors, and current sensors installed on the belts.

Powder Handling Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Pneumatic Conveying Systems, Mechanical Conveying Systems, Bulk Bag Dischargers, Hoppers and Silos, Mixers and Blenders, Dust Collection Systems, Others

|

|

By Operation

|

Automatic Systems, Semi-automatic Systems, Manual Systems

|

|

By Application

|

Pharmaceuticals , Food & Beverage, Chemicals & Petrochemicals, Construction Materials, Metals & Mining, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Pneumatic Conveying Systems, Mechanical Conveying Systems, Bulk Bag Dischargers, Hoppers and Silos, Mixers and Blenders, Dust Collection Systems, and Others): The pneumatic conveying systems segment earned USD 1.60 billion in 2024, mainly due to its ability to handle large volumes of powders efficiently while minimizing contamination and ensuring flexibility across industries such as food, chemicals, and pharmaceuticals.

- By Operation (Automatic Systems, Semi-automatic Systems, and Manual Systems): The automatic systems segment held a share of 46.70% in 2024, fueled by increasing demand for high efficiency, reduced labor dependency, and consistent material handling performance across large-scale industrial operations.

- By Application (Pharmaceuticals, Food & Beverage, Chemicals & Petrochemicals, Construction Materials, Metals & Mining, and Others): The food & beverage segment is projected to reach USD 2.61 billion by 2032, propelled by the rising demand for efficient processing, packaging, and handling of powdered ingredients such as dairy products, nutritional mixes, and bakery formulations.

Powder Handling Equipment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America powder handling equipment market share stood at 32.15% in 2024, valued at USD 1.82 billion. This dominance is reinforced by the region's high concentration of pharmaceutical and food processing industries that require advanced powder handling systems.

The pharmaceutical sector, in particular, demands precise dosing, contamination control, and compliance with FDA and cGMP standards, which increases the need for specialized handling equipment. Stricter hygiene and safety rules in the region compel manufacturers to adopt automated and enclosed equipment. Increasing emphasis on traceability and product quality further supports regional market growth.

- In March 2025, Pneuconveyor launched its Pharma Powder Transfer System, designed to comply with cGMP, FDA, and EU GMP standards. This enclosed powder transfer system automates the conveying of bulk pharmaceuticals, minimizing contamination by preventing powder escape. The design maintains strict hygiene and regulatory compliance required in pharmaceutical manufacturing environments.

The Asia-Pacific powder handling equipment industry is estimated to grow at a CAGR of 7.50% over the forecast period. This growth is propelled by the rapid expansion of large-scale manufacturing and process industries. Rising demand for processed foods, packaged dairy powders, and nutritional products is creating the need for efficient powder conveying and packaging systems.

- In August 2024, the Asian Development Bank reported that Asia’s annual food product demand could reach USD 8.4 trillion by 2030, more than double 2020 levels. This surge is fueled by rapid urbanization and rising middle-class consumption.

Equipment suppliers benefit from large-scale industrial projects that require integrated systems for storage, mixing, and transfer of powders. Continuous investment in production facilities across the region highlights the requirement for automated and high-capacity powder handling equipment, thereby boosting domestic market expansion.

Regulatory Frameworks

- In the U.S., powder handling safety is governed by the Occupational Safety and Health Administration (OSHA) requirements. The Combustible Dust National Emphasis Program directs facilities to identify and mitigate explosion hazards, while the Process Safety Management standard governs operations with hazardous chemicals. The U.S. Environmental Protection Agency (EPA) enforces the Risk Management Program, which requires process hazard analyses and emergency planning.

- In Europe, powder handling equipment is regulated by harmonized directives. The ATEX Equipment Directive 2014/34/EU oversees the design, testing, and certification of machinery used in explosive atmospheres, requiring CE marking. The ATEX Workplace Directive 1999/92/EC mandates employers to perform risk assessments and classify hazardous zones. The Machinery Directive and the Pressure Equipment Directive apply to mixers, silos, and vessels.

- In China, powder handling is monitored by the Regulations on the Safety Management of Hazardous Chemicals, supervised by the Ministry of Emergency Management. Equipment used in explosive dust environments must comply with the GB 3836 national standard, which sets technical requirements for both electrical and non-electrical devices. Companies handling powders must register hazardous processes, conduct risk assessments, and use certified equipment.

- In Japan, powder handling rules are enforced by the Industrial Safety and Health Act, requiring hazard identification, worker training, and technical controls for dust explosions. The Fire Service Act governs combustible solids, with enforcement by local fire departments. Equipment used in hazardous areas must comply with Japanese Industrial Standards (JIS), which define explosion-protection requirements.

Competitive Landscape

Major players in the powder handling equipment industry are adopting strategies such as acquisitions, partnerships, and product innovation to maintain competitiveness. Companies are strengthening their portfolios by integrating advanced loading and conveying technologies that improve efficiency and meet stricter safety and environmental standards.

Partnerships with regional distributors expand service networks and enable faster customer support. Additionally, technological advancements in automation and real-time monitoring are being integrated to support higher productivity and compliance with regulatory requirements. These strategies reflect the industry’s focus on efficiency, reliability, and long-term customer value.

- In September 2024, Vortex Global acquired SolidEx, a rail-car loading systems provider featuring spin-loader technology. The acquisition combines SolidEx’s innovative system that boosts rail-car fill rates up to 99 percent with Vortex’s robust dry-bulk flow control portfolio. This strengthens Vortex’s capabilities for efficient, cleaner loading operations and enhances its offerings across plastics and other bulk-material industries.

Key Companies in Powder Handling Equipment Market:

- Hosokawa Micron Corporation

- Baker Perkins Limited

- Syntegon Technology GmbH

- Hänsel Processing GmbH

- Sollich UK Ltd.

- Dongsun Powder Processing Equipment Co. Ltd.

- Sanovo Technology Group

- Powder Process-Solutions

- Bepex International LLC

- ProChem, Inc.

- Matcon IBC

- PALAMATIC PROCESS INC.

- Gericke AG

- Tetra Pak

- ILC Dover

Recent Developments (Expansions)

- In June 2025, Vortex Global expanded its Pneuvay Engineering partnership by appointing Pneuvay as its official representative in New Zealand, following years of successful collaboration in Australia. This expansion ensures localized support and access to Vortex’s modular and customizable powder‐handling equipment for customers in New Zealand.

- In July 2024, Beumer Group announced a USD 24 million expansion with a new manufacturing facility in India’s Reliance MET City industrial zone. The 10-acre plant, set to open in September 2025, is expected to support Beumer India’s expanding portfolio, including airport baggage systems and bulk conveyors.