Automated Material Handling Equipment Market Size

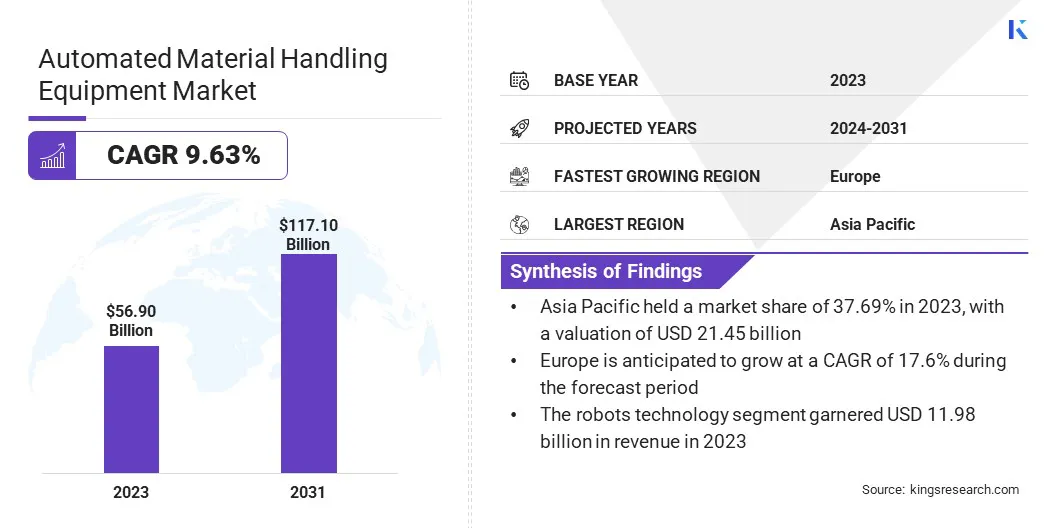

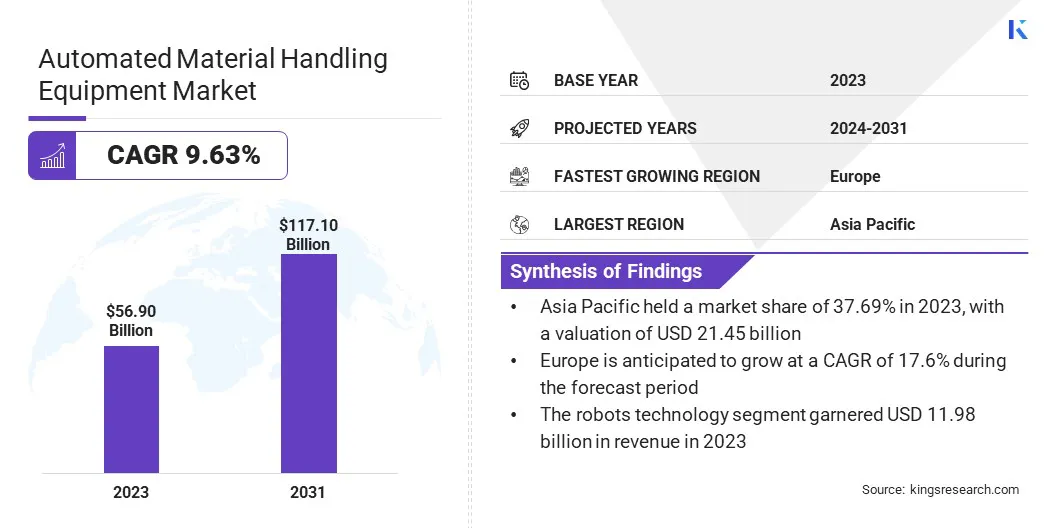

The global Automated Material Handling Equipment Market size was valued at USD 56.90 billion in 2023 and is projected to grow from USD 61.53 billion in 2024 to USD 117.10 billion by 2031, exhibiting a CAGR of 9.63% during the forecast period.

In the scope of work, the report includes solutions offered by companies such as Daifuku Co., Ltd., KION GROUP AG, Schaefer Systems International, Inc., Honeywell International Inc., Toyota Material Handling International, Hyster-Yale Materials Handling, Inc., Jungheinrich AG, Hanwha Corporation¸KUKA AG and Flex-Line Automation and others.

The expansion of the automated material handling equipment market is driven by technological advancements such as AI and IoT, rising demand for efficiency in logistics, increasing industrial automation, strategic mergers and acquisitions, and supportive government policies.

The advent of Industry 4.0 and the shift towards smart manufacturing. Companies are increasingly integrating advanced automation technologies such as robotics, artificial intelligence (AI), and Internet of Things (IoT), enhancing operational efficiency and reducing labor costs.

Key factors supporting the growth of the market include the integration of AI, machine learning, and IoT, thereby enhancing the efficiency and precision of automated material handling systems. Industries such as manufacturing, automotive, e-commerce, and retail are adopting these technologies to boost productivity and meet fast-paced delivery demands.

Significant M&A activities are expanding technological capabilities and market reach. Government support through initiatives such as foreign direct investments and safety standards are likely to foster market growth.

- According to IBEF, India's e-commerce platforms reached a significant milestone, achieving a GMV of USD 60 billion in fiscal year 2023, reflecting a 22% increase from the previous year.

Automated material handling (AMH) equipment refers to a range of machinery and systems designed to move, store, control, and protect materials and products throughout manufacturing, warehousing, distribution, consumption, and disposal processes.

These systems utilize advanced technologies such as robotics, automation, artificial intelligence (AI), and machine learning (ML) to perform tasks that traditionally require manual labor.

Examples of such systems include automated guided vehicles (AGVs), automated storage and retrieval systems (AS/RS), conveyors, sortation systems, robotic pickers, and palletizers. The primary goals of using automated material handling equipment are to increase efficiency, reduce labor costs, minimize errors, enhance safety, and improve overall productivity across various industrial and commercial applications.

Analyst’s Review

The automated material handling equipment market is experiencing significant growth, propelled by increased merger and acquisition activity, which highlights the industry's rapid transformation. Established companies are strategically acquiring startups to bolster their technological capabilities and enhance their competitive positions.

- For instance, in March 2024, PR Industrial Srl and BlueBotics collaborated to launch their first line of mobile robot solutions under the X-ACT brand. This partnership integrated BlueBotics' ANT navigation technology and fleet management software with PR Industrial Srl's new X-ACT mobile logistics robots, which were marketed under the Lifter Mobile Robotics unit.

Additionally, increased government support, including foreign direct investments in various countries, is fostering investments in the industrial sector.

Automated Material Handling Equipment Market Growth Factors

The exponential growth of e-commerce and the surging need for efficient retail operations are major factors augmenting the growth of the market. E-commerce giants such as Amazon, Alibaba, and other major retailers are investing heavily in automation to handle vast volumes of orders, manage inventory, and ensure timely delivery.

Automated material handling systems, including automated guided vehicles, conveyor systems, and robotic pickers, enhance the efficiency and accuracy of warehouse operations.

The need for faster order fulfillment, reduced labor costs, and improved accuracy is prompting companies to adopt these technologies. Furthermore, the growing trend of same-day or next-day delivery services highlights the need for highly efficient and automated logistics operations, thereby fueling the demand for AMH equipment.

However, the high initial investment and implementation costs are expected to impede the development of the market. Deploying automated systems involves substantial capital expenditure for purchasing equipment such as AGVs, conveyor belts, robotic arms, and warehouse management software.

Additionally, integrating these systems into existing operations requires comprehensive planning, customization, and potentially significant infrastructure modifications.

However, the development of scalable and modular systems allows companies to start with smaller investments and expand their automation gradually as their needs and budgets grow. Additionally, the rise of flexible financing options, such as leasing and subscription-based models, enables businesses to distribute costs over time rather than facing a large upfront expense.

Government incentives and subsidies aimed at promoting industrial automation provide financial relief and encourage widespread adoption. These factors collectively mitigate the financial barriers and facilitate the broader adoption of AMH equipment.

Automated Material Handling Equipment Industry Trends

The growing adoption of the Internet of Things (IoT) and smart technologies is transforming the automated material handling equipment market landscape. IoT-enabled devices and sensors provide real-time data on equipment status, inventory levels, and environmental conditions, thereby enhancing monitoring, control, and management of material handling processes.

This connectivity boosts visibility and traceability across the supply chain, leading to more efficient and responsive operations.

For instance, real-time data from IoT sensors predicts maintenance needs, thus preventing unexpected equipment failures and reducing operational downtime.

Smart technology facilitates seamless communication between different supply chain components, enabling precise inventory management and faster decision-making. By automating operations and optimizing logistics, these advancements significantly reduce operational costs and improve overall efficiency.

- In March 2024, PR Industrial Srl and BlueBotics joined forces to introduce their first line of mobile robot solutions under the X-ACT brand. The partnership involved BlueBotics contributing its ANT navigation technology and fleet management software to power PR Industrial Srl's latest range of X-ACT mobile logistics robots. These robots were marketed under PR Industrial Srl's newly established business unit, known as Lifter Mobile Robotics.

Moreover, the automated material handling industry is set to benefit significantly from the increasing trend toward smart factories. Advancements in motion control have made robots more agile and precise, enabling them to creatively manipulate workpieces or products and perform a diverse range of tasks. This evolution is crucial as it allows for enhanced flexibility and efficiency in manufacturing processes.

In smart factories, integrated automated systems facilitate real-time monitoring of every process, including picking, sorting, and conveying systems. This real-time oversight is essential for improving efficiency, reducing waste, and optimizing overall production workflows. The ability to monitor and adjust processes instantaneously ensures that operations are streamlined and any issues are addressed promptly.

Segmentation Analysis

The global market is segmented based on product, type, vertical, and geography.

By Product

Based on product, the market is categorized into robots, automated storage and retrieval system, conveyor systems, sortation systems, cranes, warehouse management system, collaborative robots, autonomous mobile robots, and automated guide vehicles. The robots segment led the automated material handling equipment market in 2023, reaching a valuation of USD 11.98 billion.

The proliferation of e-commerce and retail demands faster order fulfillment and efficient inventory management, thereby propelling the adoption of robotic systems. Technological advancements in AI, machine learning, and sensors have significantly enhanced the capabilities and cost-effectiveness of robots, making them more accessible across various industries.

Rising labor costs and shortages further incentivize businesses to invest in automation to maintain operational efficiency.

The automated material handling euipment encompasses automated guided vehicles, autonomous mobile robots, robotic arms, and drones, each tailored to specific applications within diverse sectors such as e-commerce, manufacturing, automotive, pharmaceuticals, and food and beverage, which is anticipated to foster segmental growth.

By Type

Based on type, the market is divided into unit load and bulk load. The unit load segment captured the largest automated material handling equipment market share of 65.09% in 2023. The unit load segment plays a crucial role in enhancing operational efficiency and productivity for businesses across multiple industries.

It encompasses a range of sophisticated systems such as automated storage and retrieval systems (AS/RS), palletizers, conveyors, and automated guided vehicles, tailored to handle large volumes of goods efficiently.

Key factors propelling segmental growth include the imperative for streamlined warehouse management in response to the expanding e-commerce and retail sectors, coupled with advancements in technology that enhance the performance and cost-effectiveness of unit load handling.

By Vertical

Based on vertical, the automated material handling equipment market is classified into automotive, semiconductor & electronic, e-commerce, third party logistics, metals & heavy machinery and others. The e-commerce segment is set to capture the largest market share of 33.12% by 2031. The segment is experiencing robust growth due to the rapid expansion of online retail.

This segment includes a variety of automated solutions designed to optimize the complex logistics processes of e-commerce fulfillment centers and warehouses. Key factors facilitating this growth include the surging demand for swift order fulfillment to meet consumer expectations, the need to navigate labor shortages and rising costs, and the competitive landscape of the e-commerce industry.

Automated Material Handling Equipment Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific automated material handling equipment market share stood around 37.69% in 2023 in the global market, with a valuation of USD 21.45 billion. The regional market growth is largely attributed to an expanding industrial base, booming e-commerce activities, and significant investments in manufacturing and logistics infrastructure.

China, Japan, and South Korea are leading the market due to their advanced technological capabilities and robust industrial sectors.

China, being the largest market in the region, benefits from its vast manufacturing base and a strong shift toward automation. Japan's mature market is characterized by technological innovations in robotics and precision automation, while South Korea emphasizes smart factories and advanced manufacturing techniques.

Government initiatives aimed at promoting smart manufacturing and Industry 4.0, along with efforts to reduce labor costs and enhance operational efficiency, further bolster domestic market growth

Europe is anticipated to witness a significant growth at a CAGR of 8.91% over the forecast period. This growth is facilitated by strong industrial automation, a robust manufacturing sector, and substantial investments in research and development. Germany, the U.K., and France are leading the market due to their advanced technological infrastructure and focus on innovation.

The regional market growth is propelled by advancements in logistics and warehouse automation, fueled by significant investments in e-commerce infrastructure. France emphasizes integrating automation across various sectors, supported by government initiatives and technological advancements. High labor costs in Europe have prompted the adoption of automated solutions to enhance efficiency and reduce operational costs.

Additionally, a strong emphasis on sustainability and green technologies compels companies to adopt energy-efficient systems, thereby supporting Europe market.

Competitive Landscape

The automated material handling equipment market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Automated Material Handling Equipment Market

- Daifuku Co., Ltd.

- KION GROUP AG

- Schaefer Systems International, Inc.

- Honeywell International Inc.

- Toyota Material Handling International

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- Hanwha Corporation

- KUKA AG

- Flex-Line Automation

Key Industry Development

- March 2024 (Expansion): OTTO Motors, a leader in autonomous mobile robots (AMRs) and recently acquired by Rockwell Automation, announced its foray into autonomous production logistics, marking a significant advancement in manufacturing innovation. By integrating OTTO Motors into its portfolio, Rockwell Automation has expanded its material handling capabilities, providing a holistic solution to optimize operations across entire facilities. This acquisition strengthened Rockwell Automation's position in the market, offering enhanced efficiency and flexibility in industrial automation through cutting-edge AMR technology.

The global automated material handling equipment market is segmented as:

By Product

- Robots

- Automated Storage and Retrieval System

- Conveyor Systems

- Sortation Systems

- Cranes

- Warehouse Management System

- Collaborative Robots

- Autonomous Mobile Robots

- Automated Guide Vehicles

By Type

By Vertical

- Automotive

- Semiconductor & Electronic

- E-Commerce

- Third Party Logistics

- Metals & Heavy Machinery

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America