Market Definition

The portable residual current devices (RCD) market involves the manufacturing and sale of devices designed to prevent electrical shocks and fires by detecting leakage currents in electrical circuits.

These devices, often portable, are used in residential, commercial, and industrial settings to enhance electrical safety, ensuring compliance with safety regulations and increasing demand for portable solutions in temporary installations.

Portable Residual Current Devices Market Overview

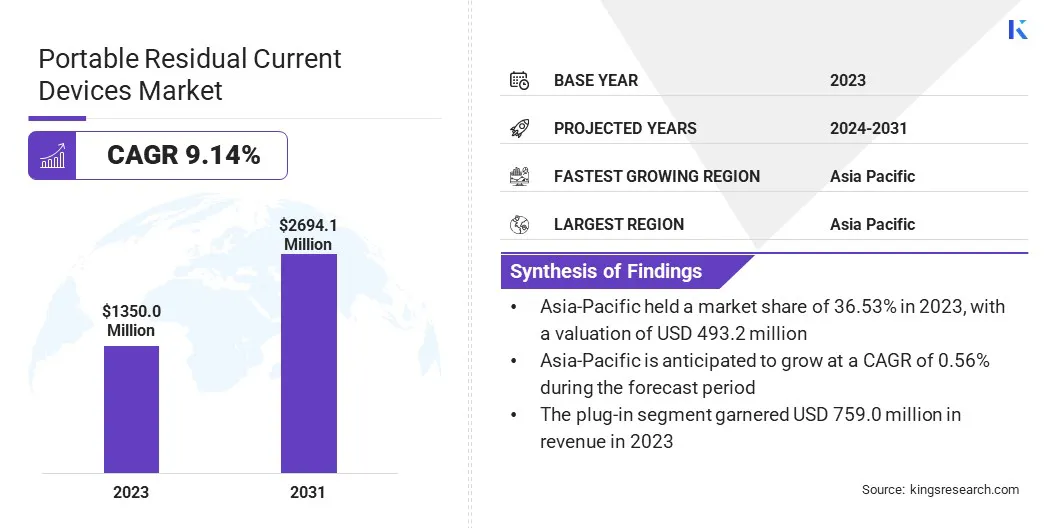

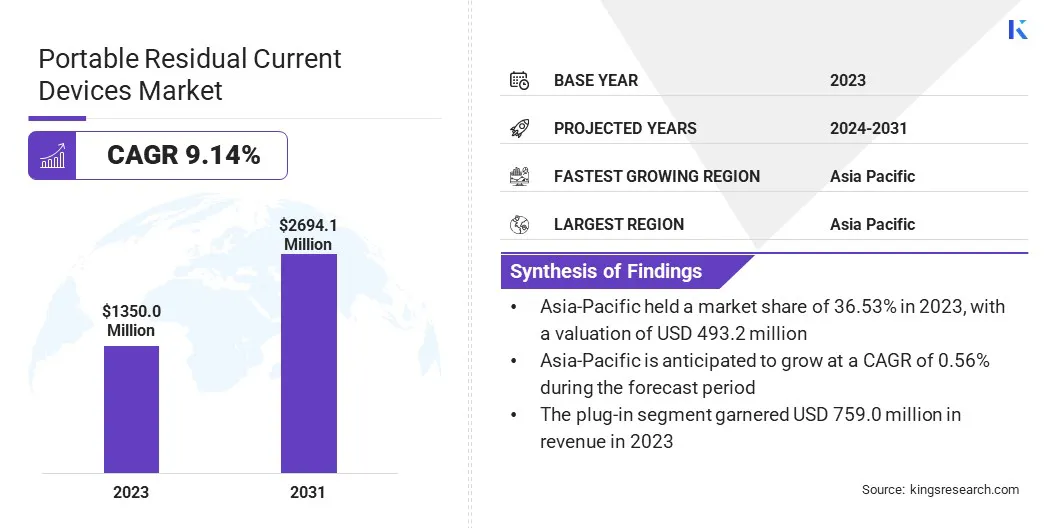

Global portable residual current devices market size was valued at USD 1,350.0 million in 2023, which is estimated to be valued at USD 1,460.5 million in 2024 and reach USD 2,694.1 million by 2031, growing at a CAGR of 9.14% from 2024 to 2031.

Stricter electrical safety regulations across residential, commercial, and industrial sectors are propelling market expansion. Governments and regulatory bodies are mandating the use of protective devices such as RCDs to reduce electrical hazards, enhancing safety and boosting demand.

Major companies operating in the global portable residual current devices industry are Emerson Electric Co., ELEGRP, Eaton, Doepke Schaltgeräte GmbH, ABB, Schneider Electric, Legrand, Honeywell HBT, Hubbell, Vertiv Group Corp., Leviton Manufacturing Co., Inc., Elektron Berlin GmbH, R. STAHL AG, Hager Ltd, Mitsubishi Electric Corporation, and others.

The market is experiencing steady growth as demand for electrical safety devices increases across various sectors. These devices, designed to detect leakage currents and prevent electrical hazards, are widely used in residential, commercial, and industrial applications.

The market is characterized by technological advancements in portable designs, improved ease of use, and regulatory safety requirements. Key players are expanding their product offerings to cater to diverse customer needs in both permanent and temporary electrical installations.

- In October 2024, Littelfuse introduced the RCMP20 Residual Current Monitor Series for Mode 2 and Mode 3 EV charging stations. This product enhances electrical safety by detecting AC and DC fault currents, supporting high-current, compact charging stations to improve safety and compliance.

Key Highlights:

- The global portable residual current devices market size was recorded at USD 1,350.0 million in 2023.

- The market is projected to grow at a CAGR of 9.14% from 2024 to 2031.

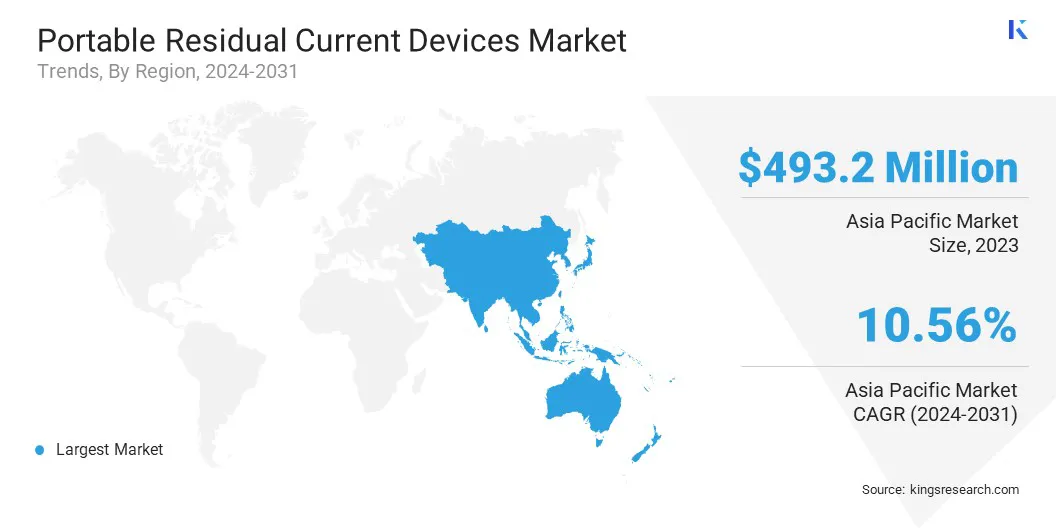

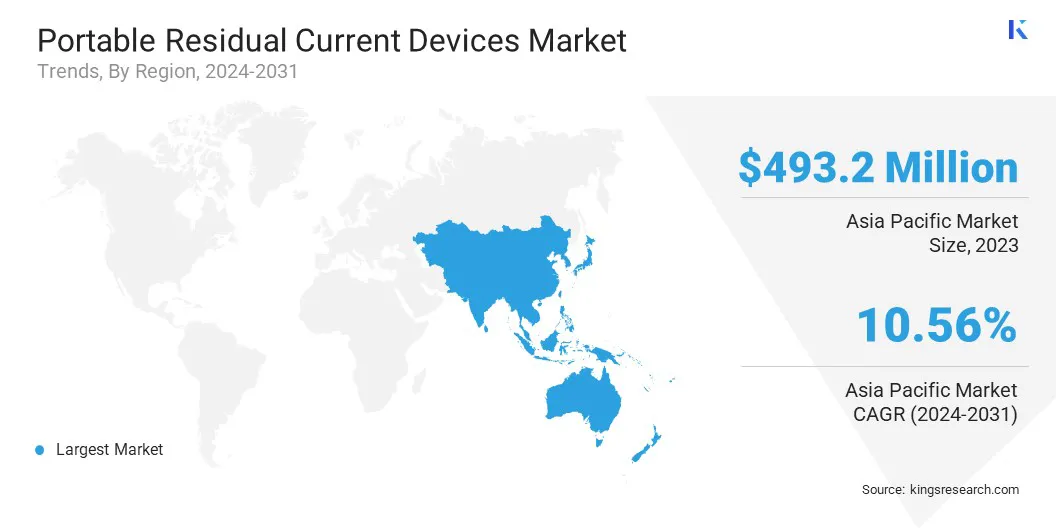

- Asia-Pacific held a market share of 36.53% in 2023, with a valuation of USD 493.2 million.

- The plug-in technology segment garnered USD 759.0 million in revenue in 2023.

- The construction segment is expected to reach USD 989.4 million by 2031.

- North America is anticipated to grow at a CAGR of 8.14% during the forecast period.

Market Driver

"Rising Awareness of Electrical Hazards"

Rising awareness of electrical hazards is propelling the expansion of the portable residual current devices market. Concerns over electrical shock and fire risks are driving both consumers and industries to prioritize safety in electrical installations.

This growing awareness is fueling demand for portable RCDs, which effectively detect leakage currents and prevent accidents. With increased focus on safety standards and regulations, portable RCDs are becoming essential in residential, commercial, and industrial sectors, contributing to market expansion.

- In October 2024, Mitsubishi Electric introduced a new range of modular DIN rail components (MDRC), including Residual Current Devices (RCDs). These RCDs are designed to meet the growing demand for high-performance protection solutions in industrial and commercial applications.

Market Challenge

"Complex Installation Requirements"

A key challenge impeding the growth of the portable residual current devices market is the complex installation requirements. Many portable RCDs need specific installation procedures, which can be difficult for users without electrical expertise, potentially leading to installation errors.

This poses a risk to user safety and product performance. To address this challenge, manufacturers can offer comprehensive user manuals, clear installation guidelines, and video tutorials. Additionally, providing professional installation services and ensuring plug-and-play functionality can simplify the process and enhance safety and user experience.

Market Trend

"Ongoing Technological Advancements"

Continuous technological advancements is emerging as a significant trend in the portable residual current devices market. Manufacturers are innovating RCD designs to improve their portability, ease of installation, and performance. These advancements focus on making devices more compact, user-friendly, and adaptable to various electrical systems.

Enhanced features such as better fault detection, faster response times, and improved thermal management are being incorporated to meet modern safety demands, driving the adoption of portable RCDs across residential, commercial, and industrial applications.

- In March 2024, ABB launched its FlexLine series, featuring modular protection devices such as MCBs, RCDs, and AFDDs. With push-in technology for easy installation, FlexLine reduces wiring time by 50% and enhances flexibility.

Portable Residual Current Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Plug-in, Clamp-on

|

|

By Application

|

Construction, Manufacturing, Residential, Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Plug-in and Clamp-on,): The plug-in segment earned USD 759.0 million in 2023, mainly due to increased demand for easy-to-install, portable, and cost-effective RCD solutions in both residential and commercial settings.

- By Application (Construction, Manufacturing, Residential, Healthcare, and Others): The construction segment held a share of 37.61% in 2023, propelled by rapid infrastructure development, strict electrical safety regulations, and a growing need for portable protection devices on construction sites.

Portable Residual Current Devices Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific portable residual current devices market captured a notable share of around 36.53% in 2023, valued at USD 493.2 million. This dominance is reinforced by rapid industrialization, increasing construction activities, and growing residential developments.

Countries such as China, India, and Japan are focusing on electrical safety due to rising electrical hazards and stringent regulations. Additionally, the expansion of the EV charging infrastructure and the integration of smart technologies have fueled the demand for portable RCDs. The region's growing awareness of electrical safety is further fueling growth.

- In May 2024, Bituo Technik, a Chinese company, introduced the BRCS01C-05-H1, a built-in DC 6mA residual current sensor designed to reduce nuisance tripping in AC EV chargers. This innovation ensures reliable and accurate protection and complies with IEC 61851-1 standards for EV charging safety.

North America portable residual current devices industry is set to grow at a CAGR of 8.14% over the forecast period. This growth is projected to ongoing technological advancements and increasing awareness of electrical safety.

The rising adoption of renewable energy sources, such as solar panels and electric vehicles, has created a strong demand for advanced protection devices. Moreover, stringent safety standards and regulations in countries such as the U.S. and Canada are promoting the use of portable RCDs in residential, commercial, and industrial applications, fueling rapid regional market expansion.

Regulatory Frameworks

- The National Electrical Code (NEC), or NFPA 70, is a U.S. standard for the safe installation of electrical wiring and equipment. It is part of the National Fire Codes series published by the National Fire Protection Association (NFPA).

- The ‘CE’ appear mark found on products in the European Economic Area (EEA), indicates that the products meet stringent safety, health, and environmental protection standards.

Competitive Landscape

The global portable residual current devices market is characterized by a number of participants, including both established corporations and emerging players. Recent strategic acquisitions have focused on expanding technological capabilities, product portfolios, and market reach.

These acquisitions aim to integrate advanced technologies such as IoT, expand into emerging markets, and improve safety, reliability, and innovation while ensuring compliance with evolving regulatory standards .

- In February 2023, Mitsubishi Electric Corporation acquired Scibreak AB, a Swedish firm known for its expertise in direct current circuit breakers (DCCBs). This move enhances Mitsubishi Electric's ability to advance high-voltage direct current technologies, driving global renewable energy initiatives.

List of Key Companies in Portable Residual Current Devices Market:

- Emerson Electric Co.

- ELEGRP

- Eaton

- Doepke Schaltgeräte GmbH

- ABB

- Schneider Electric

- Legrand

- Honeywell HBT

- Hubbell

- Vertiv Group Corp.

- Leviton Manufacturing Co., Inc.

- Elektron Berlin GmbH

- STAHL AG

- Hager Ltd

- Mitsubishi Electric Corporation

Recent Developments (Milestone/Launch)

- In May 2024, ABB marked the 100th anniversary of its Miniature Circuit Breakers (MCBs), which have significantly advanced electrical safety. Known for their compact and flexible designs, these MCBs continue to lead the industry, supporting the transition to sustainable energy and ensuring safety across residential, commercial, and industrial sectors.

- In December 2024, Schneider Electric launched Acti9 Active, a modular circuit protection range for the UK market. This innovative solution integrates RCD, MCB, AFDD, and over-voltage protection, providing sustainable, energy-efficient, and smart connectivity to support eco-friendly electrical installations across various high-risk buildings.