Market Definition

The market encompasses the production, distribution, and sale of compact, mobile power-generating units that are capable of providing temporary electrical power. These generators are fueled by gasoline, diesel, propane, or natural gas and are designed for easy transportation and operation in various settings.

The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Portable Generator Market Overview

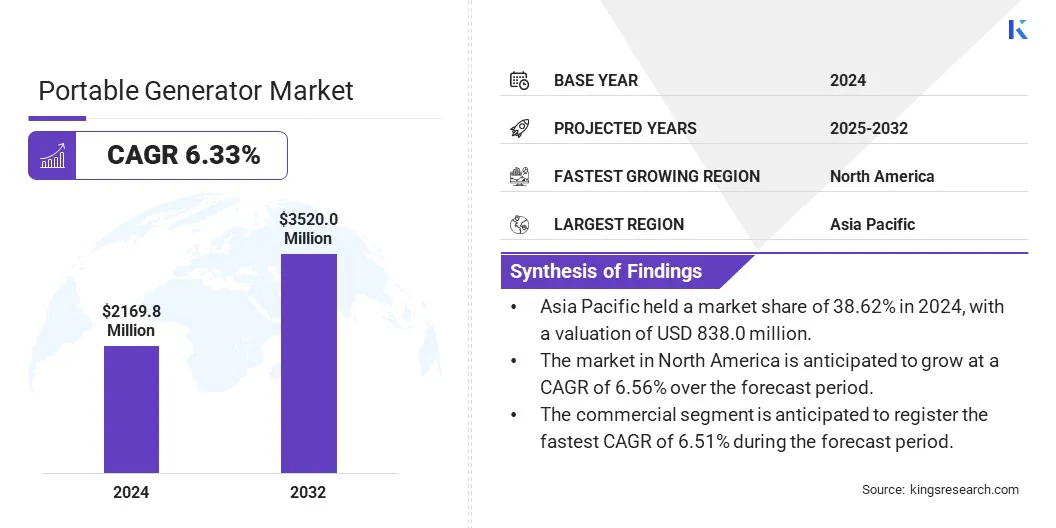

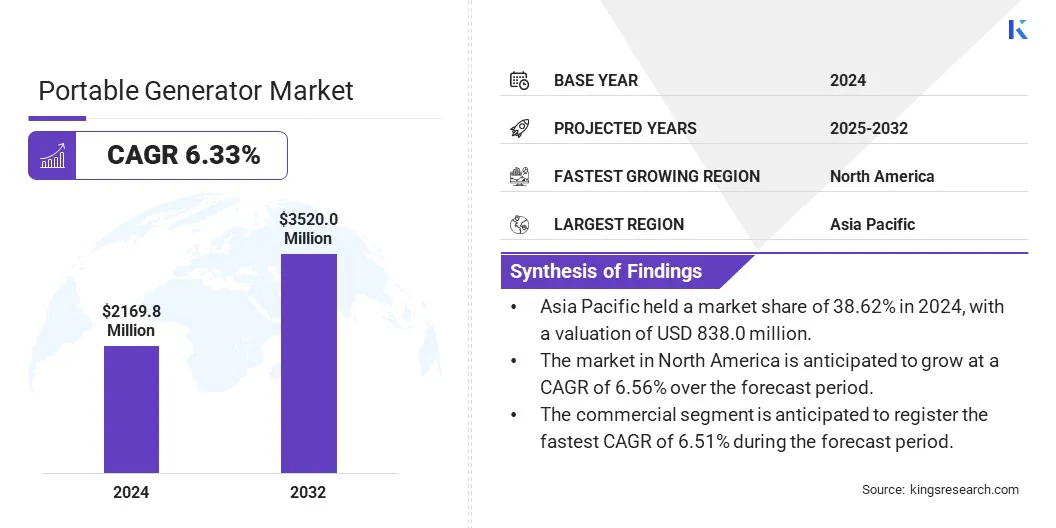

The global portable generator market size was valued at USD 2169.8 million in 2024 and is projected to grow from USD 2290.7 million in 2025 to USD 3520.0 million by 2032, exhibiting a CAGR of 6.33% during the forecast period. The market is driven by the expansion of outdoor recreational activities, which is boosting the demand for portable power solutions.

These generators provide convenient and reliable energy for camping, hiking, and other off-grid leisure pursuits. Increasing power outages caused by aging infrastructure and extreme weather events are leading to a higher demand for portable generators that support reliable backup power during emergencies.

Major companies operating in the portable generator industry are Kirloskar, Generac Power Systems, Inc, MAHINDRA POWEROL, Yamaha Motor Co., Ltd., Cummins Inc., Himalayan Power Machine Mfg. Co., Discovery Energy, LLC dba Rehlko, ASHOK LEYLAND, Caterpillar, Honda India Power Products Ltd., Atlas Copco, Namaste Agrotech, Briggs & Stratton, Eaton, and Greaves Cotton Limited.

Advancements in portable generator technology that combine compact design with higher power efficiency and reduced fuel consumption are supporting the growth of the market. These advancements are aligning with the user demand for more efficient and reliable portable generators.

- In July 2024, Bobcat introduced its new PG40 and PG50 portable generators for the European market, featuring Stage V D24 engines and Stamford alternators. These models replace the older Stage IIIA G40 and G60 units, offering increased power output with lower fuel consumption. The PG50 delivers a true 50 kVA prime output while remaining below Diesel Exhaust Fluid system requirements, and the PG40 offers 40 kVA. Both units feature a compact, transport-friendly design with optional factory-mounted running gear.

Key Highlights:

- The portable generator industry size was valued at USD 2169.8 million in 2024.

- The market is projected to grow at a CAGR of 6.33% from 2025 to 2032.

- Asia Pacific held a market share of 38.62% in 2024, with a valuation of USD 838.0 million.

- The diesel segment garnered USD 916.7 million in revenue in 2024.

- The below 5KVA segment is expected to reach USD 1834.6 million by 2032.

- The commercial segment is anticipated to register the fastest CAGR of 6.51% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 6.56% over the forecast period.

Market Driver

Expansion of Outdoor Recreational Activities

The expansion of outdoor recreational activities is fueling the portable generator market. Activities such as camping, tailgating, RV travel, and outdoor festivals are becoming increasingly popular, Consumers are seeking reliable, mobile power sources to operate lighting, cooking equipment, and electronic devices in off-grid settings.

Portable generators offer a convenient solution by providing on-demand electricity in remote locations. Additionally, the shift toward weekend getaways and nature-based tourism is fueling the demand for compact, quiet, and fuel-efficient generator models that enhance outdoor experiences without disturbing the environment.

- According to the U.S. Bureau of Economic Analysis (BEA), the Outdoor Recreation Satellite Account reports that in 2023, outdoor recreation in the U.S. generated approximately USD 1.2 trillion in economic output. This figure accounted for around 2.3% of the nation’s Gross Domestic Product (GDP).

Market Challenge

Dependency on Fossil Fuel Supply

The reliance on fossil fuels such as gasoline, diesel, and propane presents a significant challenge for the portable generator market. These fuels are volatile, flammable, and subject to strict storage regulations, particularly in residential and urban settings. In emergencies or natural disasters, disruptions in fuel supply chains can lead to shortages and limit the usability of generators when they are needed.

Additionally, long-term storage can degrade fuel quality, increasing the risk of engine damage or failure. These factors raise safety, reliability, and accessibility concerns, especially for residential users and emergency response operations.

Companies in the market are developing dual-fuel and propane-powered models, which offer more flexibility and longer shelf-life compared to gasoline. Many manufacturers are integrating fuel-efficient engines and automatic shut-off features to reduce consumption and enhance safety. Additionally, the focus on hybrid systems that combine traditional fuel sources with solar panels or battery backups is growing, minimizing dependence on volatile fuel supply chains.

Market Trend

Shift Toward Clean Energy Generators

The portable generator market is registering a shift toward clean energy technologies, such as hydrogen fuel cell generators. This shift is supported by stricter emission regulations and high demand for low-emission and environmentally friendly power solutions.

Manufacturers are focusing on developing generators that are more compact, lightweight, and affordable while delivering reliable performance. These clean energy generators are now registering increased adoption across construction, mining, and remote area applications. Government support and funding programs are also encouraging the adoption of such technologies, making clean fuel options a rising trend in the market.

- In February 2025, UK-based AFC Energy launched its second-generation H-Power S+ 200kW hydrogen fuel cell generator, designed for construction and off-grid power applications. The upgraded unit is 34% smaller, 28% lighter, and 65% lower in cost than the previous version, enhancing its portability and affordability. It will be first deployed by Brett Aggregates under the UK government’s Red Diesel Replacement (RDR) Grant, which promotes clean energy in industrial sectors.

Portable Generator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fuel

|

Diesel, Gas, Others

|

|

By Power Rating

|

Below 5KVA, 5-15kVA, 15-45kVA, 45-75kVA

|

|

By Application

|

Residential, Commercial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fuel (Diesel, Gas, Others): The diesel segment earned USD 916.7 million in 2024, due to its widespread use in reliable and efficient power generation across industries.

- By Power Rating (Below 5KVA, 5-15kVA, 15-45kVA, and 45-75kVA): The below 5KVA segment held 50.51% share of the market in 2024, due to the growing demand for compact and portable power solutions.

- By Application (Residential, Commercial, Others): The residential segment is projected to reach USD 2543.5 million by 2032, owing to increasing power backup needs in households and rising urbanization.

Portable Generator Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific portable generator market share stood at around 38.62% in 2024 with a valuation of USD 838.0 million. Rapid industrialization and urbanization across the region are supporting infrastructure development, including commercial buildings, factories, and transportation networks.

This surge in construction activities is creating a strong need for reliable and portable power solutions to ensure uninterrupted operations. Additionally, expanding manufacturing sectors require consistent power supply for efficient production processes, further increasing the demand for portable generators.

The portable generator industry in North America is set to grow at a CAGR of 6.56% over the forecast period. This growth is attributed to increasing investment in clean energy technology development, with government funding initiatives playing a key role in supporting the creation of innovative, transportable fuel cell generators designed for off-grid, emergency, and backup power applications.

These advancements are driving the development of efficient and eco-friendly power solutions that cater to the rising demand for sustainable and reliable energy sources, especially in remote and critical areas where traditional power access is limited or unavailable.

The focus on clean energy technologies is also encouraging collaborations between research institutions and industry players, accelerating innovation and commercialization of these solutions.

- In February 2025, Cal State LA, partnered with RockeTruck, Inc., received a USD 345,000 grant under the U.S. Department of Energy’s STTR program to develop a portable mobile fuel cell generator. Designed to deliver clean electric power in off-grid situations, the generator will be easily transportable and aims to serve emergency, remote, and backup power needs. RockeTruck, a developer of advanced power generation systems, is collaborating with Cal State LA to create this innovative solution as part of a broader USD 1.15 million Phase II funding initiative focused on clean energy technology development.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) is the primary regulatory authority for portable generators, addressing their safety and potential hazards. It proposed rules under the Consumer Product Safety Act (CPSA) to limit carbon monoxide (CO) emissions. It requires generators to shut off when CO levels reach a certain threshold.

- In the UK, the Health and Safety Executive (HSE) sets standards for workplace safety, including the safe use of generators and the mitigation of noise and other hazards. Additionally, it provides guidance for the electrical safety of generators and their connected systems.

- In China, the Ministry of Industry and Information Technology (MIIT) regulates the manufacturing and certification of industrial products, including portable generators. It is responsible for setting standards for product quality, safety, and performance.

Competitive Landscape

Market participants are expanding their geographic presence and service capabilities through strategic acquisitions. They are acquiring established local service providers to increase their workforce, diversify their client base, and enhance technical expertise. These acquisitions support them in broadening their service portfolio, including maintenance, repair, rental, and sales of power equipment.

Additionally, players are streamlining operations, consolidating assets, and leveraging regional infrastructure to strengthen logistics, improve coverage, and ensure consistent service delivery across multiple key markets.

- In January 2024, GenServe acquired the commercial division of Austin Welder & Generator Service, Inc., expanding its presence in Austin, Texas. GenServe, a key provider of maintenance, repair, sales, and rental services in terms of industrial generators, serves commercial and municipal clients across the Northeast region , Texas, Florida, and Illinois. The acquisition enhances GenServe’s scale and service capabilities in Texas, positioning it as a premier independent provider of backup power solutions in the region.

List of Key Companies in Portable Generator Market:

- Kirloskar

- Generac Power Systems, Inc

- MAHINDRA POWEROL

- Yamaha Motor Co., Ltd.

- Cummins Inc.

- Himalayan Power Machine Mfg.Co.

- Discovery Energy, LLC dba Rehlko

- ASHOK LEYLAND

- Caterpillar

- Honda India Power Products Ltd.

- Atlas Copco

- Namaste Agrotech

- Briggs & Stratton

- Eaton

- Greaves Cotton Limited

Recent Developments (M&A/Partnerships /Product Launches)

- In October 2024, Keysight Technologies expanded its signal generator portfolio with the launch of two new portable analog signal generators, an RF Analog Signal Generator and a Microwave Analog Signal Generator. Designed for RF engineers, these compact tools support frequencies up to 26 GHz and are optimized for wireless product development and testing.

- In September 2024, UL Solutions opened a new portable generator testing laboratory at its Toronto facility to enhance safety standards and reduce the risk of carbon monoxide (CO) poisoning. The lab focuses on testing portable generators for CO emissions and automatic shutoff technologies, supporting global manufacturers in developing safer products. This initiative aims to improve consumer protection and aligns with the growing regulatory and market demands for enhanced generator safety.