Market Definition

Polyurethane coatings are a type of protective and decorative surface finish made from polyurethane polymers. They are applied as a thin layer on surfaces to protect them from damage and improve their appearance.

The market refers to the global or regional industry involved in the production, distribution, and sales of polyurethane-based coatings. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Polyurethane Coatings Market Overview

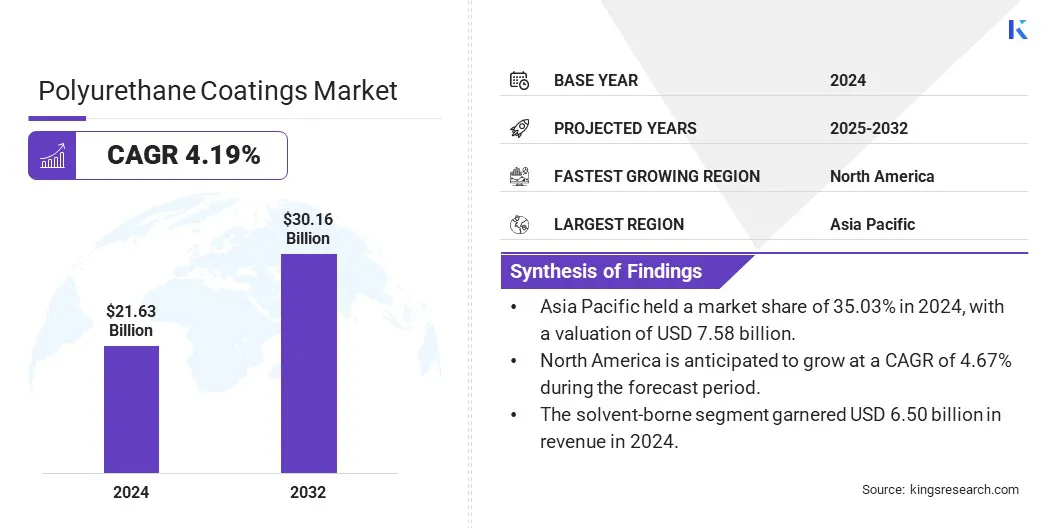

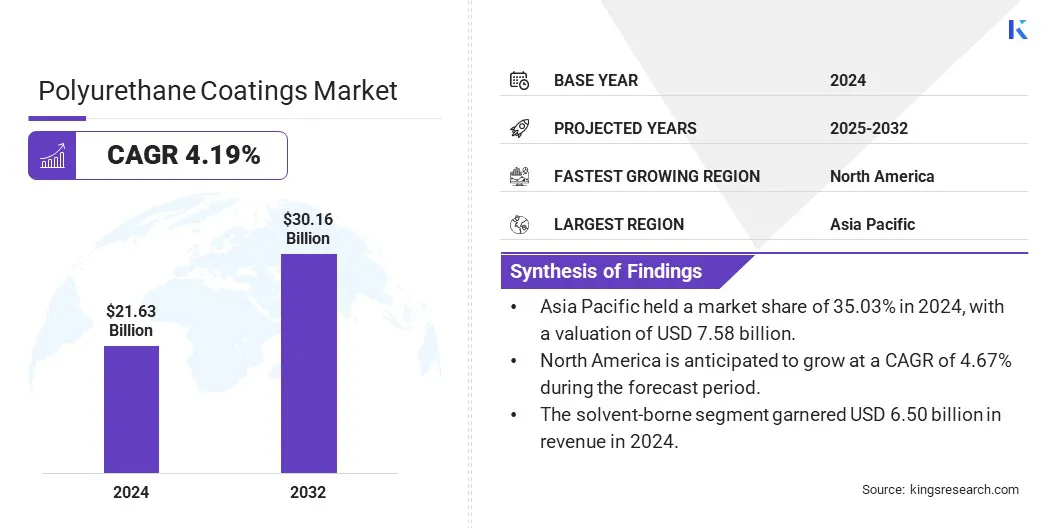

Global polyurethane coatings market size was valued at USD 21.63 billion in 2024, estimated to be valued at USD 22.48 billion in 2025 and reach USD 30.16 billion by 2032, at a CAGR of 4.19% from 2025 to 2032.

Advancements in resin technologies have significantly strengthened the market. Enhanced formulations now offer improved properties such as durability, flexibility, and chemical resistance, making them ideal for high-performance applications across various sectors.

Major companies operating in the polyurethane coatings industry are AkzoNobel N.V., Valspar, Axalta Coating Systems, LLC, BASF SE, Jotun, PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, TUFF COAT POLYMERS PVT. LTD., TIB Chemicals AG, Sudarshan Paints & Coatings, Specialty Coating Systems Inc., Berger Paints India Limited, Metcon Coatings & Chemicals India Private Limited, Angel Coating Pvt. Ltd., and others.

The market is experiencing steady growth, driven by their high demand across automotive, construction, and industrial applications.

Known for their durability, chemical resistance, and superior finish, these coatings are preferred for protective as well as aesthetic purposes. Technological advancements and sustainability trends are also encouraging innovation in waterborne and high-solid polyurethane formulations, further boosting the market.

- In March 2025, BASF Coatings expanded production at its Caojing plant in Shanghai, China, doubling polyester and polyurethane resin capacity to 18,800 metric tons annually. This growth supports rising automotive demand in Asia Pacific. Additional electrocoat binder capacity is planned from 2026, enhancing BASF’s leadership in automotive coatings.

Key Highlights:

- The polyurethane coatings market size was recorded at USD 21.63 billion in 2024.

- The market is projected to grow at a CAGR of 4.19% from 2025 to 2032.

- Asia Pacific held a market share of 35.03% in 2024, with a valuation of USD 7.58 billion .

- The solvent-borne segment garnered USD 6.50 billion in revenue in 2024.

- The automotive segment is expected to reach USD 9.03 billion by 2032.

- North America is anticipated to grow at a CAGR of 4.67% during the forecast period.

Market Driver

Advancements in Resin Technologies

The market is witnessing strong growth due to continuous advancements in resin technologies. These advancements focus on improving critical performance attributes such as hardness, flexibility, abrasion resistance, and environmental compliance.

With increasing demand for coatings that can withstand harsh conditions and complex manufacturing processes, advanced polyurethane formulations are becoming essential.

They support the development of coatings tailored for specific, high-end applications in sectors like automotive, electronics, and packaging. As a result, companies investing in next-generation resin technologies are well-positioned to meet evolving customer and regulatory demands.

- In November 2024, Lubrizol launched Sancure 20898, a new polyurethane dispersion designed for premium packaging coatings and durable inks. Engineered for hot stamp foil applications, Sancure offers a unique combination of hardness and flexibility in high-quality, resilient finishes ideal for holographic and high-gloss packaging..

Market Challenge

Environmental and Regulatory Pressures

Environmental and regulatory pressures pose a significant challenge for the polyurethane coatings market, as emission limits and growing sustainability expectations restrict the use of traditional solvent-based formulations. These regulations compel manufacturers to invest in cleaner technologies, which can be costly and hard to implement.

A key solution is developing waterborne and high-solid polyurethane coatings that meet performance standards with a lower environmental impact. Additionally, innovation in bio-based raw materials offers a sustainable pathway for long-term market compliance and growth.

Market Trend

Rise of Intumescent Coatings

Intumescent polyurethane systems are specialized coatings that expand when exposed to heat, forming a protective char layer that insulates surfaces and delays fire damage. The market is adopting these systems in electric vehicles to enhance fire safety and protect battery components during thermal events.

This trend is driven by stricter safety regulations and the need for lightweight, efficicent fire protection solutions. As a result, intumescent coatings are becoming essential in developing safer, more durable automotive materials.

- In May 2025, Huntsman expanded its automotive portfolio with POLYRESYST EV5005, an intumescent polyurethane coating system that enhances passive fire protection in electric vehicles. Unveiling at the Battery Show Europe, it complements other innovations like SHOKLESS battery foams and VITROX lightweight casing systems for advanced EV safety.

Polyurethane Coatings Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Solvent-borne, Water-borne, Powder, Radiation-based

|

|

By End Use

|

Automotive, Construction, Electrical & Electronics, Textile & Apparels, Wood & Furniture, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Solvent-borne, Water-borne, Powder, Radiation-based): The solvent-borne segment earned USD 6.50 billion in 2024 driven by its strong demand for durable and high-performance coatings across various industries, supporting steady market growth.

- By End Use (Automotive, Construction, Electrical & Electronics, Textile & Apparels, Wood & Furniture, Others): The automotive segment held 29.90% of the market in 2024, fueled by increasing vehicle production and the demand for advanced protective coatings in automotive manufacturing.

Polyurethane Coatings Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polyurethane coatings market share stood at 35.03% in 2024 in the global market, with a valuation of USD 7.58 billion. The region dominates the market due to rapid industrialization, urbanization, and expanding automotive and construction sectors.

Rising consumer demand, increasing infrastructure development, and growth in manufacturing hubs like China, India, and Japan fuel market expansion. Additionally, favorable government policies and investments in sustainable technologies drive the advanced polyurethane coatings adoption.

Additionally, cost advantages and growing awareness of high-performance coatings strengthen its leadership, making Asia Pacific a critical market for global polyurethane coatings growth.

North America is also poised for significant growth at a CAGR of 4.67% over the forecast period. North America is currently the fastest-growing region in the polyurethane coatings industry, propelled by growth in the automotive and construction sectors. Favorable government policies and incentives encouraging industrial development have accelerated market growth.

Additionally, increasing investments by key industry players to enhance manufacturing capabilities contribute significantly to market growth. The growing focus on sustainability and innovation in coating technologies is driving demand for advanced, eco-friendly polyurethane coatings.

These factors position North America as a dynamic and rapidly expanding market with a high growth potential in the polyurethane coatings industry.

Regulatory Frameworks

- In U.S., the Environmental Protection Agency (EPA) protects individuals and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- The Regulation on the registration, evaluation, authorisation and restriction of chemicals (REACH) protects human health and the environment from the risks that can be posed by chemicals.

- The Bureau of Indian Standards (BIS) is the National Standard Body of India, established under the BIS Act of 2016. It is responsible for the coordinated development of standardization, certification, and quality marking of goods.

Competitive Landscape

Companies in the polyurethane coatings market are actively investing in innovation and sustainability to meet evolving industry demands. Leading players are developing advanced formulations, such as bio-based coatings, to align with environmental regulations and consumer preferences.

Strategic partnerships and acquisitions are being pursued to expand production capabilities and enhance market presence. Additionally, companies are focusing on improving application technologies, like spray and powder coating methods, to increase efficiency and performance. These efforts reflect a commitment to delivering high-quality, eco-friendly solutions across various industries.

- In February 2023, Huntsman launched the POLYRESYST IC6005 intumescent polyurethane system for construction, a new bio-based coating, and the higher molecular weight JEFFAMINE M-3085 amine at the European Coatings Show. These products offer enhanced fire protection, durability, and advanced raw materials for coating formulations.

List of Key Companies in Polyurethane Coatings Market:

- AkzoNobel N.V.

- Valspar

- Axalta Coating Systems, LLC

- BASF SE

- Jotun

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- TUFF COAT POLYMERS PVT. LTD.

- TIB Chemicals AG

- Sudarshan Paints & Coatings

- Specialty Coating Systems Inc.

- Berger Paints India Limited

- Metcon Coatings & Chemicals India Private Limited

- Angel Coating Pvt. Ltd.

Recent Developments (Sustainable Production/Expansion)

- In May 2025, Evonik transitioned its global polyurethane additive production, including amine and silicone platforms, to green electricity. This move reinforces the company's commitment to meeting the demand for sustainable solutions across automotive, construction, and consumer goods.

- In March 2023, Covestro launched a new polyurethane elastomers plant in Shanghai to meet the growing Asia-Pacific demand. The multi-million-dollar investment supports renewable energy industries by producing durable materials for offshore wind turbines and photovoltaic panels, reinforcing sustainability and circular economy goals in the region.