Market Definition

The market encompasses the global industry engaged in the manufacturing, distribution, and utilization of PPS, a high-performance polymer characterized by a partially crystalline structure made up of repeating units of p-substituted benzene rings linked by sulfur atoms.

PPS is prized for its outstanding mechanical attributes, including resistance to heat and chemicals, dimensional stability, flame retardancy, and electrical conductivity, that make it ideal for use in demanding sectors such as automotive, electrical and electronics, aerospace, coatings, and industrial applications.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Polyphenylene Sulfide Market Overview

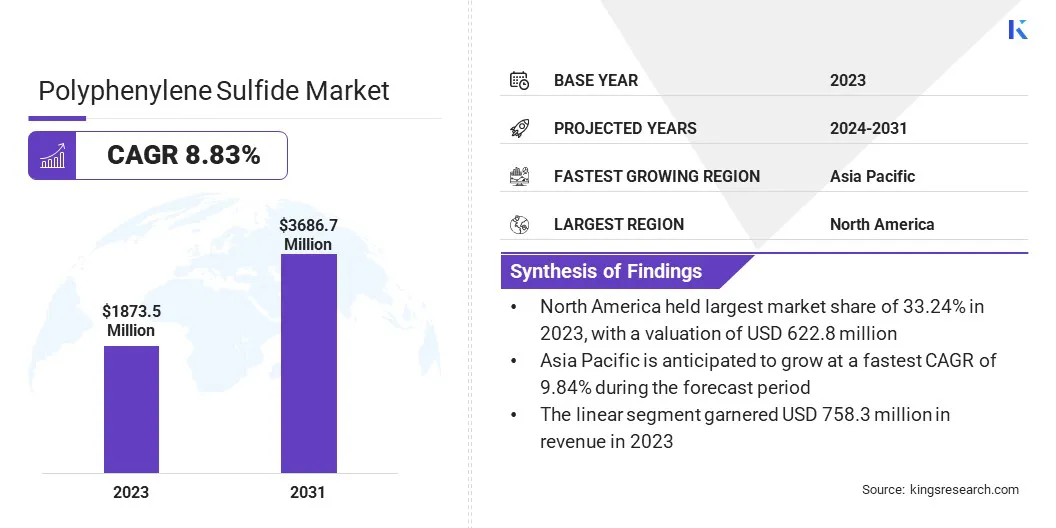

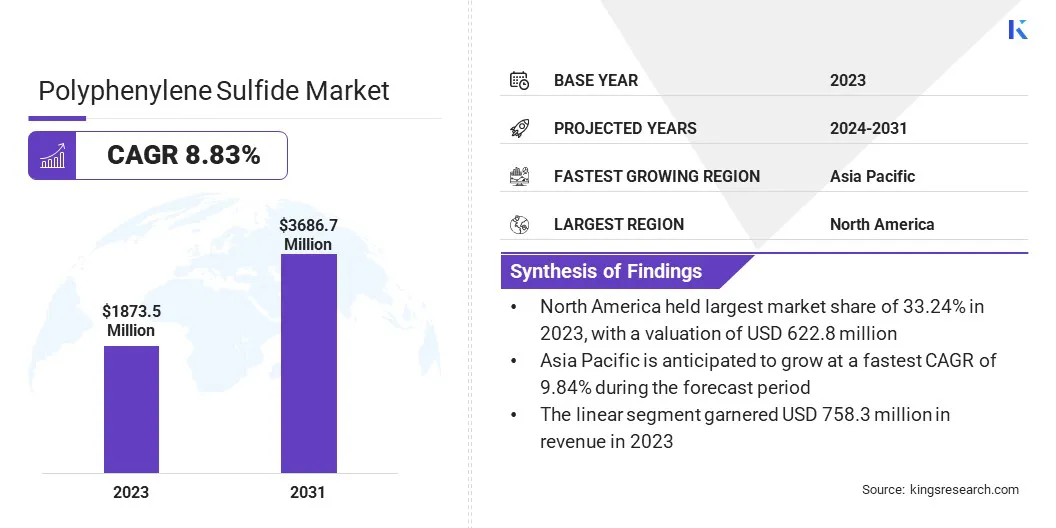

The global polyphenylene sulfide market size was valued at USD 1873.5 million in 2023 and is projected to grow from USD 2038.9 million in 2024 to USD 3686.7 million by 2031, exhibiting a CAGR of 8.83% during the forecast period.

The market is driven by the rising demand for durable and heat-resistant materials in industries like automotive and electronics. The need for lightweight components to improve fuel efficiency and reduce emissions, along with the increasing use of PPS in applications such as car engines and electronic devices, is contributing to the market expansion.

Major companies operating in the polyphenylene sulfide industry are DIC Corporation, Solvay S.A, Polyplastics Co., Ltd, RTP Company, TEIJIN, Celanese Corporation, Ensinger, SK Chemicals, Kureha Corporation, BASF SE , Toray Industries, LG Chem, China Lumena New Materials Corp, Toyobo Co., Ltd, and SABIC.

Increasing environmental regulations and safety standards in key industries, such as automotive and electronics, are pushing for the adoption of higher-quality, more durable materials like PPS. This is influencing manufacturers to innovate and improve material formulations to meet stricter regulations.

Key Highlights:

- The polyphenylene sulfide industry size was valued at USD 1873.5 million in 2023.

- The market is projected to grow at a CAGR of 8.83% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 622.8 million.

- The linear segment garnered USD 758.3 million in revenue in 2023.

- The automotive segment is expected to reach USD 1007.8 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.84% during the forecast period.

Market Driver

"Advanced PPS Recycling Technology"

The development of recycling technologies is driving the polyphenylene sulfide market. Innovations that enable the recycling of high-performance materials while maintaining quality are essential.

These advancements support the increasing demand for sustainable materials. It reduces production costs and lowers CO2 emissions, making them a key factor in the expansion of the PPS market across various industries.

- In October 2023, Toray Industries, Inc. developed a new recycling technology for glass fibre-reinforced polyphenylene sulfide (PPS-GFRP), enabling the recycling of material that maintains performance comparable to virgin resins. This innovation, which reduces CO2 emissions by at least 40%, will be applied in various industrial applications and is part of Toray’s ongoing efforts to promote sustainable practices in the PPS market.

Market Challenge

"Cost Challenges in High-performance PPS"

The main challenges facing the polyphenylene sulfide market are the increasing demand for high-performance materials and the need to produce them cost effectively.

This is especially important for industries like automotive and electronics, where PPS components must meet strict requirements for durability, heat resistance, and chemical stability.

Companies are focusing on improving manufacturing processes and developing new, more efficient material formulations. These innovations aim to reduce production costs while ensuring that the materials meet the high standards required for performance and sustainability.

Market Trend

"Surge in High-performance Plastics"

The growing need for high-performance plastics in electric and electronic applications is attributed to the shift toward electrification, particularly in EVs, power electronics, and smart devices. This has led to the increasing demand for materials that can withstand high voltage, heat, and strict safety requirements.

This is pushing manufacturers to develop PPS compounds with better electrical insulation, thermal stability, and flame resistance. These features are becoming essential in modern applications where reliability and performance are critical.

This shift is boosting the market, encouraging innovation in PPS materials, and expanding their use in high-tech and energy-efficient products.

- In October 2023, Solvay launched two new grades of Ryton PPS, Ryton Supreme HV and Ryton Supreme HF, expanding its Supreme polymer range to support electrification. Ryton Supreme HV, designed for high-voltage applications, offers a 600 V comparative tracking index (CTI), an electric thermal index (RTI) >175°C, and UL94 V0 flammability ratings, making it ideal for power electronics like housings and chip carriers.

Polyphenylene Sulfide Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Linear, Cured, Branched

|

|

By Application

|

Automotive, Electrical & Electronics, Industrial, Coatings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Linear, Cured, and Branched): The linear segment earned USD 758.3 million in 2023, due to its superior thermal stability, processability, and the growing demand in high-performance applications across various industries.

- By Application (Automotive, Electrical & Electronics, Industrial, Coatings and Others): The automotive segment held 27.30% share of the market in 2023, due to the rising demand for lightweight, heat-resistant materials in automotive components.

Polyphenylene Sulfide Market Regional Analysis

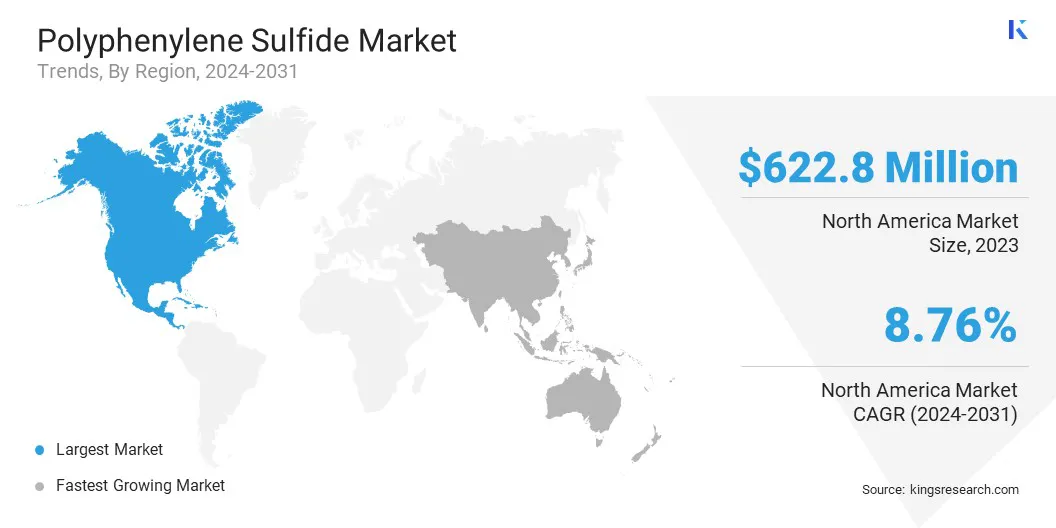

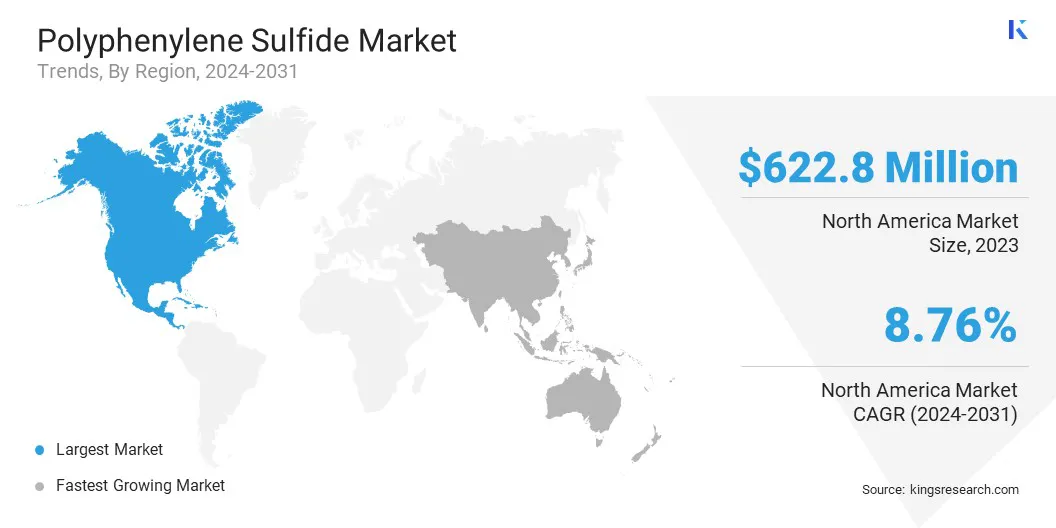

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America polyphenylene sulfide market share stood at around 33.24% in 2023, with a valuation of USD 622.8 million. North America is the leading region in the market, largely due to its well-established automotive and aerospace industries.

These sectors require high-performance, heat-resistant materials for essential components such as engine parts, fuel systems, and electrical connectors. The U.S. and Canada are major consumers of PPS, driven by the growing demand for lightweight, durable materials.

Furthermore, the increasing adoption of EVs in both countries is boosting the demand for PPS. The excellent thermal stability and electrical insulation properties of PPS are critical for battery management systems and power electronics in EVs.

The polyphenylene sulfide industry in Asia Pacific is poised for significant growth at a robust CAGR of 9.84% over the forecast period. Asia Pacific is the fastest growing market for PPS, fueled by rapid industrialization and a booming automotive industry.

Key countries such as China, Japan, and South Korea are registering significant demand for high-performance materials in various sectors, including automotive, electronics, and manufacturing. The demand for lightweight and heat-resistant materials is gradually rising, making PPS a preferred choice.

Moreover, the region is registering an increase in EV adoption, which further drives the need for PPS, owing to its superior thermal stability and electrical insulation properties. These factors position Asia Pacific as a major driver of the PPS market.

Regulatory Framework

- In Europe, the REACH Regulation (EC 1907/2006) outlines the requirements for the registration, evaluation, authorization, and restriction of chemicals. It places responsibility on manufacturers and importers to gather safety information on chemical substances and register it with the European Chemicals Agency (ECHA). The regulation aims to protect human health and the environment from harmful chemicals, promote innovation, and ensure the competitiveness of the EU chemicals industry.

- In the U.S., ASTM D638 (Standard Test Method for Tensile Properties of Plastics) provides guidelines for testing the tensile strength of plastics and other resin materials, which is essential for understanding their mechanical strength properties. This standard is particularly important for applications in industries like automotive and aerospace, where plastics are used as structural materials due to their strength and lightweight nature. The test specifies the use of dumbbell-shaped specimens with either a 25 mm or 50 mm gauge length and sets accuracy requirements for the test frames and accessories used, ensuring reliable results for material performance assessments.

- UL 94 is a globally recognized standard for assessing the flammability of plastic materials, particularly those used in parts for devices and appliances. Released by Underwriters Laboratories (UL), this standard evaluates how materials behave when exposed to a small open flame or radiant heat source, determining their tendency to either extinguish or spread the flame once ignited.

Competitive Landscape

Key players are actively driving innovation through the development of advanced products and sustainable manufacturing processes. Companies are taking significant strides to meet the growing market demand by enhancing the performance and recyclability of PPS materials.

They are advancing the use of plateable PPS compounds, making it suitable for a variety of applications, including electronics and automotive components. This strategic expansion allows them to serve growing customer needs in industries that require materials with superior heat resistance, chemical stability, and mechanical strength.

These players are improving the recyclability of PPS and expanding its range of applications, thus shaping the future of the PPS market and positioning themselves as key contributors to the market growth,.

- In January 2024 , DIC Corporation unveiled a new material called DIC.PPS MP-6060 BLACK, a plateable thermoplastic developed in partnership with Tsukada Riken Industry Co., Ltd. and Yoshino Denka Kogyo, Inc. This advanced compound supports the large-scale production of metal-coated PPS parts through conventional plastic-metalizing lines, without requiring any specialized surface treatment. With a strategic focus on the electric mobility and high-tech device markets, DIC is targeting annual revenue of USD 21.3 million from this product by the fiscal year 2030.

List of Key Companies in Polyphenylene Sulfide Market:

- DIC Corporation

- Solvay S.A

- Polyplastics Co., Ltd

- RTP Company

- TEIJIN

- Celanese Corporation

- Ensinger

- SK Chemicals

- kureha corporation

- BASF SE

- Toray Industries

- LG chem

- China Lumena New Materials Corp

- Toyobo Co., Ltd

- SABIC

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In January 2025, Envalior announced the opening of a new PPS compounding facility in Uerdingen, Germany, aimed at meeting the increasing demand for its Xytron material in Europe and the Americas. This facility will enhance the production of Xytron, a high-performance PPS compound renowned for its exceptional chemical and hydrolysis resistance, stable heat aging performance up to 240°C, and inherent flame retardancy that meets UL94 V0 standards.

- In September 2023, Solvay revealed that its PPS manufacturing facility in Borger, Texas, along with its Ryton PPS ECHO compounding operations in Kallo-Beveren, Belgium, had both earned independent mass balance (MB) certification under the International Sustainability and Carbon Certification (ISCC PLUS) program. These bio-circular PPS materials offer identical performance characteristics to conventional virgin PPS, enabling manufacturers to adopt more sustainable and environmentally friendly solutions without the need for additional validation or testing.

- In February 2023, Toray Industries, Inc. disclosed that its subsidiary, Toray Advanced Materials Korea Inc., will expand its TORELINA PPS resin production by an additional 5,000 metric tons annually at its Gunsan, South Korea site. This capacity increase will raise the Toray Group’s total PPS output from its facilities in Gunsan and Tokai to a market-leading 32,600 metric tons per year globally.