Market Definition

The market comprises a range of biologically active formulations used in therapeutic and esthetic applications, leveraging polynucleotides for their regenerative, anti-inflammatory, and reparative properties. This market includes products and delivery systems utilized in dermatology, orthopedics, and regenerative medicine, supporting tissue repair, skin revitalization, and joint health.

The report presents a comprehensive assessment of the primary drivers propelling the market, alongside a detailed examination of regional analysis and the competitive landscape impacting industry dynamics.

Polynucleotides Injectable Market Overview

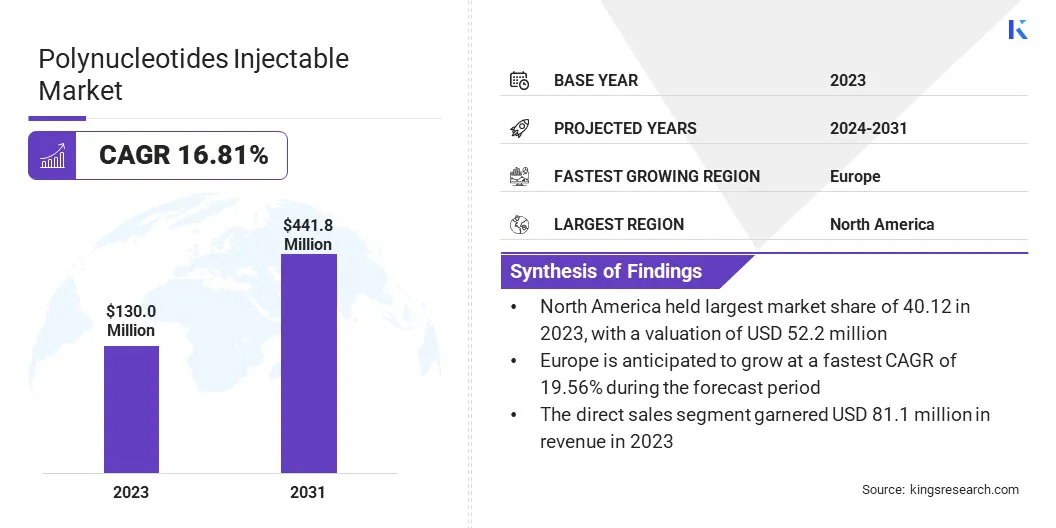

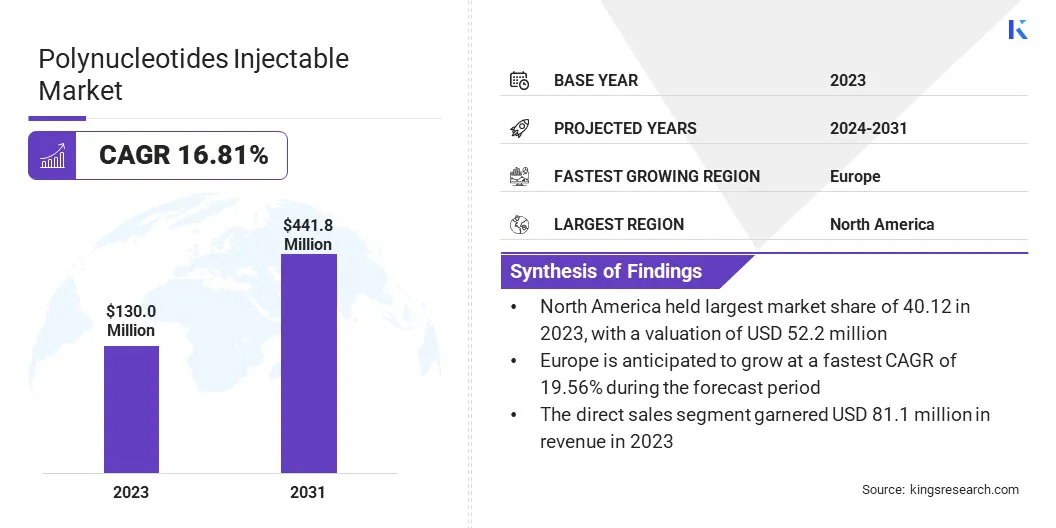

The global polynucleotides injectable market size was valued at USD 130.0 million in 2023 and is projected to grow from USD 148.9 million in 2024 to USD 441.8 million by 2031, exhibiting a CAGR of 16.81% during the forecast period.

This market is registering strong growth, driven by the increasing demand for advanced regenerative therapies and non-invasive esthetic treatments. Polynucleotides, known for their ability to stimulate cell repair, improve skin elasticity, and reduce inflammation, are gaining widespread acceptance in dermatology and orthopedics.

The rising number of esthetic procedures globally is supported by the expanding availability of treatment options in medical spas, dermatology clinics, and specialized wellness centers. Additionally, the growing awareness of regenerative medicine and the broader application of polynucleotides in wound healing, joint recovery, and post-surgical care are contributing to the market growth.

Major companies operating in the polynucleotides injectable industry are PharmaResearch, AMEELA, Mastelli s.r.l., Fox Pharma Ltd, BRPHARM, DermaFocus, Promoitalia LLC, MDSS, HTL, Croma-Pharma GmbH, GENOSS Co.,Ltd., MESOESTETIC E-COMMERCE, S.L., MesoFormula, IRA Istituto Ricerche Applicate S.p.A., and LKC Pharma srl.

Technological advancements in formulation and delivery systems are further enhancing treatment efficacy and patient outcomes, making these injectables more accessible and appealing to both medical professionals and patients.

The market is also supported by increasing R&D investments and strategic collaborations among pharmaceutical and esthetic companies aiming to expand their product portfolios and address evolving consumer needs.

Key Highlights

- The polynucleotides injectable industry size was valued at USD 130.0 million in 2023.

- The market is projected to grow at a CAGR of 16.81% from 2024 to 2031.

- North America held a market share of 40.12% in 2023, with a valuation of USD 52.2 million.

- The purified polynucleotide (PN) injectables segment garnered USD 61.2 million in revenue in 2023.

- The esthetic dermatology segment is expected to reach USD 259.03 million by 2031.

- The direct sales segment is expected to reach USD 248.6 million by 2031.

- The hospitals segment is expected to reach USD 201.99 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 19.56% during the forecast period.

Market Driver

Demand for Non-invasive Esthetic Procedures and Regenerative Therapeutics

The polynucleotides injectable market is registering strong growth, fueled by the increasing preference for esthetic treatments that offer natural-looking, subtle results without extensive recovery time.

Unlike conventional dermal fillers that primarily add volume, polynucleotide injectables work at the cellular level to improve skin hydration, elasticity, and overall texture. This approach appeals to individuals seeking rejuvenation treatments that enhance skin quality while preserving facial harmony.

- In August 2024, the International Society of Aesthetic Plastic Surgery (ISAPS) published a 14-year global analysis highlighting significant growth in both surgical and nonsurgical esthetic procedures, with over 34.9 million procedures performed in 2023. The report emphasized a 40% overall increase in the past four years, with nonsurgical procedures such as botulinum toxin and hyaluronic acid.

Beyond esthetics, polynucleotides exhibit distinct regenerative and therapeutic capabilities. By stimulating fibroblast activity and collagen production, they support tissue repair and accelerate skin recovery.

Their soothing properties also make them effective in managing inflammation, expanding their relevance to dermatology, wound healing, and orthopedic care. This versatility is positioning polynucleotide injectables as a valuable tool across both cosmetic and medical domains.

Market Challenge

Short Shelf Life and Storage Sensitivity

A significant challenge in the market is the short shelf life and high sensitivity of these biopolymer-based formulations to environmental factors such as temperature and light. Polynucleotides are derived from natural sources and are inherently more fragile than synthetic compounds.

Improper storage conditions can degrade their molecular integrity, reducing product efficacy and potentially compromising patient safety. This creates logistical complexities for manufacturers, distributors, and clinics, particularly in regions with limited access to advanced cold-chain infrastructure. It also increases the risk of product wastage and adds to operational costs.

Companies are investing in the development of more stable formulations with extended shelf lives. Simultaneously, improving packaging technologies with better insulation and UV protection, along with offering clear handling and storage protocols for practitioners, can help maintain product quality throughout the supply chain.

Market Trend

Advanced Formulations and Professional Training

The polynucleotides injectable market is evolving rapidly, with innovation and education emerging as key trends. A major development is the rise of advanced formulations that combine polynucleotides with other active agents like hyaluronic acid and biostimulators.

These synergistic products are designed to address multiple skin concerns simultaneously, enhancing hydration, promoting regeneration, and improving overall esthetic outcomes with greater longevity. The emphasis on specialized training and skill development for esthetic practitioners is growing.

Professional education is becoming essential to ensure safe and effective treatments as polynucleotides require nuanced application techniques and a deep understanding of skin physiology. This focus on clinical excellence reflects the broader shift toward science-based esthetic medicine and reinforces the importance of practitioner competence in delivering consistent, high-quality results.

- In January 2024, Amedica announced its partnership with Acquisition Aesthetics Training Academy to launch polynucleotide-specific training courses for 2024. The collaboration focuses on education around Ameela, a sterile, absorbable intradermal injectable solution based on polynucleotides from wild salmon, emphasizing treatment techniques, safety, and optimal results.

Polynucleotides Injectable Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Purified Polynucleotide (PN) Injectables, Polynucleotide-Hyaluronic Acid (PN-HA) Injectables, Polynucleotide-based Biostimulators

|

|

By Application

|

Esthetic Dermatology, Wound Healing & Scar Treatment, Orthopedic & Sports Medicine, Ophthalmology, Others

|

|

By Distribution Channel

|

Direct Sales, Pharmacies & Specialty Clinics, Online Platforms

|

|

By End User

|

Hospitals, Dermatology & Esthetic Clinics, Regenerative Medicine Centers

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Purified Polynucleotide (PN) Injectables, Polynucleotide-Hyaluronic Acid (PN-HA) Injectables, Polynucleotide-based Biostimulators): The Purified Polynucleotide (PN) Injectables segment earned USD 61.2 million in 2023, due to its high biocompatibility and effectiveness in promoting skin regeneration.

- By Application (Aesthetic Dermatology, Wound Healing & Scar Treatment, Orthopedic & Sports Medicine, Ophthalmology, Others): The aesthetic dermatology segment held 57.09% share of the market in 2023, due to the rising demand for anti-aging and skin revitalization treatments.

- By Distribution Channel (Direct Sales, Pharmacies & Specialty Clinics, Online Platforms): The direct sales segment is projected to reach USD 248.6 million by 2031, owing to strong partnerships between manufacturers and clinical providers ensuring streamlined product access.

- By End User (Hospitals, Dermatology & Aesthetic Clinics, and Regenerative Medicine Centers): The hospitals segment is projected to reach USD 201.99 million by 2031, owing to the increasing adoption of polynucleotide injectables in post-surgical recovery and wound care treatments.

Polynucleotides Injectable Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 40.12% share of the polynucleotides injectable market in 2023, with a valuation of USD 52.2 million. This dominance is largely attributed to the region’s early adoption of advanced injectable therapies, a well-established esthetic medicine infrastructure, and high patient spending capacity.

The presence of leading esthetic and regenerative medicine companies, particularly in the U.S., along with a strong base of board-certified dermatologists and plastic surgeons, has supported widespread clinical usage of polynucleotide-based products.

Additionally, the increasing awareness and demand for minimally invasive treatments across urban centers have further accelerated regional market growth. Clinical research initiatives and frequent esthetic conferences in the region also play a key role in educating practitioners and driving adoption.

The market in Europe is expected to register the fastest growth, with a projected CAGR of 19.56% over the forecast period. This growth is fueled by the expanding acceptance of biostimulatory injectables across countries like Italy, France, and Germany, where polynucleotides are already widely integrated into esthetic protocols.

The region’s favorable regulatory landscape for biologically derived injectables and the growing popularity of combination therapies, particularly PN-HA formulations, have enhanced product uptake. Moreover, the influence of European esthetic trends emphasizing natural, regenerative solutions continues to drive demand, especially within private dermatology clinics and medispas in cities such as Milan, Paris, and Munich.

Several European manufacturers are actively innovating in this segment, and partnerships with esthetic training academies have helped ensure consistent practitioner skill development.

Regulatory Frameworks

- In the U.S., polynucleotide injectables are regulated by the U.S. Food and Drug Administration (FDA) under the Center for Drug Evaluation and Research (CDER) if used as drugs, or the Center for Biologics Evaluation and Research (CBER) if considered biologics.

- In the European Union (EU), these products are regulated under the European Medicines Agency (EMA) through the Committee for Medicinal Products for Human Use (CHMP).

- In China, the National Medical Products Administration (NMPA) oversees the approval of polynucleotide injectables, categorizing them under therapeutic biologics or innovative drugs.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) evaluates polynucleotide injectables under the Pharmaceutical and Medical Device Act (PMD Act). If considered regenerative or gene therapy products, they are regulated under the Act on the Safety of Regenerative Medicine.

- In India, such injectables are regulated by the Central Drugs Standard Control Organization (CDSCO) under the Drugs and Cosmetics Act, 1940. If they fall under biologics, approval is required from the Biological Division of CDSCO, and clinical trials must follow the New Drugs and Clinical Trials Rules, 2019.

Competitive Landscape

The polynucleotides injectable market is characterized by strategic product innovation, portfolio diversification, and targeted regional expansion. Key market players are actively investing in the development of next-generation polynucleotide formulations, including hybrid injectables that combine polynucleotides with hyaluronic acid or peptides to enhance regenerative outcomes and differentiate their offerings in a crowded market.

Companies are also focusing on clinical validation through rigorous trials to build credibility and support regulatory approvals across multiple regions. Strategic collaborations with dermatology clinics, esthetic practitioners, and regenerative medicine centers are being leveraged to strengthen market penetration and build brand loyalty. In addition, partnerships with medical training institutes and the organization of practitioner workshops are being used to drive product adoption by ensuring safe and effective administration techniques.

Market participants are further expanding their global footprint by entering into exclusive distribution agreements and adapting formulations to meet region-specific regulatory and consumer preferences. Digital marketing, practitioner-focused educational content, and influencer-driven branding in the esthetic space are also emerging as key tools to boost visibility and consumer engagement in premium markets.

- In March 2024, Croma-Pharma announced its partnership with Megalabs through the divestiture of its Brazilian affiliate and a strategic distribution agreement covering Latin America and the Caribbean. The collaboration grants Megalabs distribution rights for Croma’s hyaluronic acid fillers, polynucleotide injectables, skincare products, and future technologies. This move aims to strengthen Megalabs’ dermatology portfolio and expand Croma’s reach in emerging esthetic markets across the region.

List of Key Companies in Polynucleotides Injectable Market:

- PharmaResearch

- AMEELA

- Mastelli s.r.l.

- Fox Pharma Ltd

- BRPHARM

- DermaFocus

- Promoitalia LLC

- MDSS

- HTL

- Croma-Pharma GmbH

- GENOSS Co.,Ltd.

- MESOESTETIC E-COMMERCE, S.L.

- MesoFormula

- IRA Istituto Ricerche Applicate S.p.A.

- LKC Pharma srl

Recent Developments (Product Launches)

- In July 2024, HTL Biotechnology completed the registration of its “Sodium DNA Raw Material Main Document” (Polynucleotides) as a medical device in China. This milestone marks a significant advancement in the company’s expansion into the Chinese market, strengthening its position as a global supplier of pharmaceutical-grade polynucleotides used in injectable medical devices for regenerative, anti-aging, and anti-inflammatory treatments.

- In April 2023, Croma-Pharma launched its new polynucleotide-based injectable product line, PhilArt, designed for esthetic and regenerative applications. The product range, formulated with long-chain polynucleotides, is intended for use on the face, scalp, eye area, neck, décolleté, and hands. Supported by over 100 clinical studies, PhilArt targets a wide range of skin types and age groups, reinforcing Croma-Pharma’s commitment to innovation in biostimulatory treatments.