Market Definition

Polyester fiber is a synthetic textile fiber made from polyethylene terephthalate (PET) that offers durability, strength, and versatility. Polyester fiber is widely used in apparel, home textiles, industrial fabrics, technical textiles, and blended materials with natural or other synthetic fibers. The market encompasses the production, distribution, and sale of polyester fibers for various commercial, industrial, and consumer applications.

Polyester Fiber Market Overview

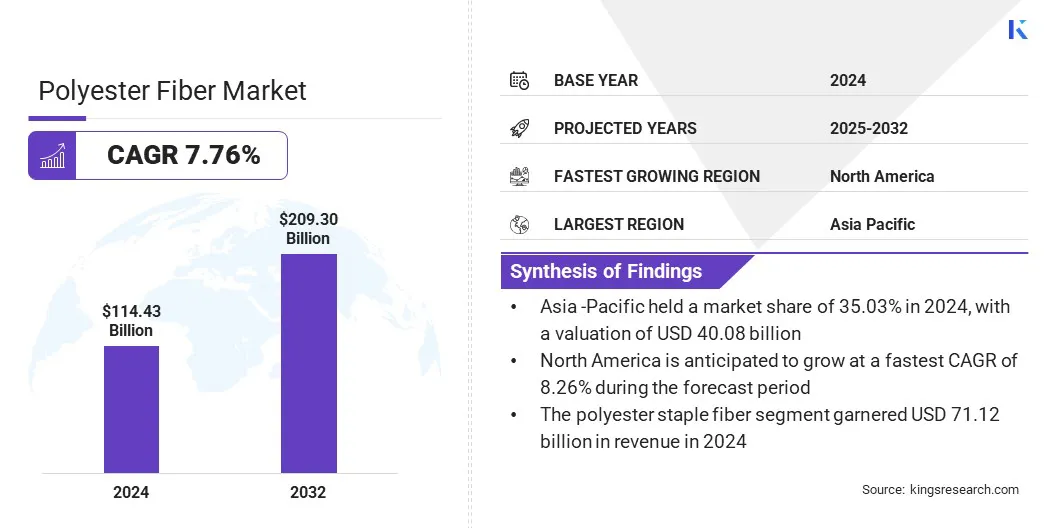

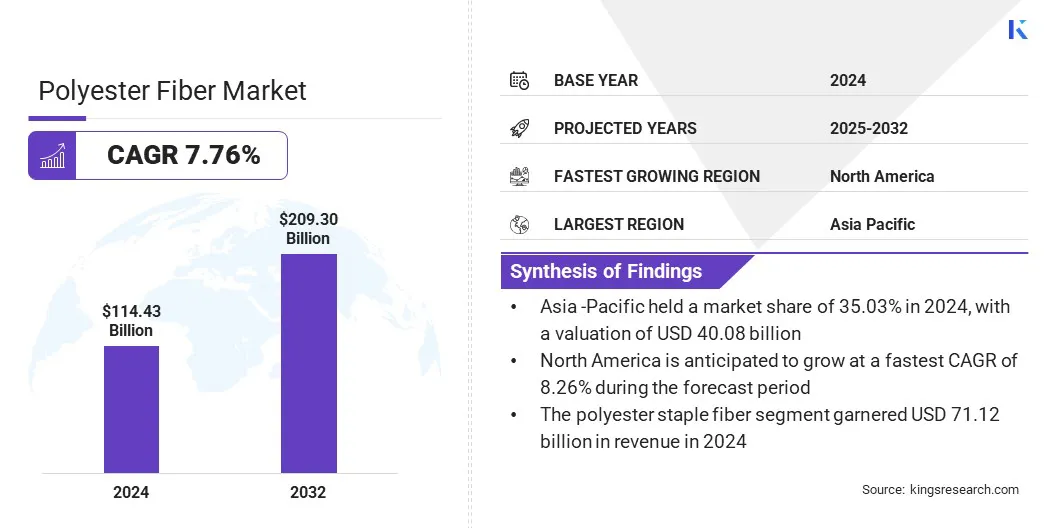

The global polyester fiber market size was valued at USD 114.43 billion in 2024 and is projected to grow from USD 122.92 billion in 2025 to USD 209.30 billion by 2032, exhibiting a CAGR of 7.76% over the forecast period.

This growth is attributed to the increasing demand for durable, low-maintenance, and cost-effective fabrics in apparel and home textiles. The increasing use of polyester fiber in industrial and technical textiles, along with its expanding applications in the automotive sector, is further fueling market growth.

Key Highlights:

- The polyester fiber industry size was recorded at USD 114.43 billion in 2024.

- The market is projected to grow at a CAGR of 7.76% from 2024 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 40.08 billion.

- The polyester staple fiber segment garnered USD 71.12 billion in revenue in 2024.

- The solid segment is expected to reach USD 115.99 billion by 2032.

- The PCDT polyester segment is anticipated to witness the fastest CAGR of 8.00% over the forecast period.

- The textile & apparel segment held a share of 28.08% in 2024.

- North America is anticipated to grow at a CAGR of 8.26% over the forecast period.

Major companies operating in the polyester fiber market are Reliance Industries Limited, Indorama Ventures, SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY, TORAY INDUSTRIES, INC, Tongkun Holding Group, Alpek Polyester, TEIJIN FRONTIER CO., LTD, Xin Feng Ming Group, Bombay Dyeing & Manufacturing Company Ltd, NAN YA PLASTICS CORPORATION, Hengli Group Co., Ltd, Aditya Birla Group, Huvis Corp, Far Eastern Group, and UNIFI, Inc.

The growing focus on sustainable polyester production is driving the market by increasing the availability of recycled fibers and promoting circular manufacturing. Additionally, the development of recycled polyester fibers is advancing sustainable manufacturing by converting post-consumer waste into high-quality fibers. It is also enhancing resource efficiency and encouraging broader adoption of eco-friendly polyester fibers across apparel, home textiles, and industrial applications.

- In August 2025, Loop Industries, Inc. announced that the company aims to acquire a site in Gujarat, India, for its “Infinite Loop” manufacturing facility. The facility will produce sustainable PET plastic from recycled materials, with an initial capacity of 70,000 metric tons and potential expansion to 100,000 metric tons.

Market Driver

Increasing Demand for Sustainable and Eco-friendly Products

The growth of the polyester fiber market is propelled by the increasing demand for sustainable and eco-friendly products. Recycled, renewable, and bio-based polyester fibers offer reduced environmental impact while maintaining durability and versatility.

The emphasis on circularity and environmental responsibility is prompting manufacturers to adopt sustainable production processes and develop eco-friendly fiber solutions. This is enabling brands to meet consumer demand and regulatory requirements for greener textile products across apparel, home furnishings, and industrial applications such as automotive textiles, filtration materials, industrial ropes and nets, geotextiles, and protective fabrics.

- In July 2024, Indorama Ventures joined a consortium of seven companies across five countries to establish a supply chain for highly sustainable polyester fiber. The initiative focuses on replacing fossil-based materials with CO₂-derived, renewable, and bio-based inputs.

Market Challenge

Fluctuating raw material prices

A key challenge in the polyester fiber market is the fluctuating cost of raw materials. Polyester production relies heavily on petroleum-derived inputs such as purified terephthalic acid (PTA) and monoethylene glycol (MEG). Volatility in global crude oil prices directly impacts the availability and pricing of these inputs. This instability increases production costs and hampers supply chain planning for manufacturers.

To address this challenge, market players are investing in backward integration in PTA and MEG production internalizing the supply of these critical feedstocks to ensure continuity and reduce reliance on external suppliers Players are also focusing on recycled polyester production to reduce dependence on petroleum-based raw materials and meet sustainability requirements.

Market Trend

Development of Recycled and Eco-Friendly Polyester Fibers

A key trend influencing the polyester fiber market is the growing development of recycled and eco-friendly fibers. Manufacturers are producing polyester fibers from post-consumer plastic waste, discarded textiles, and bio-based inputs to reduce environmental impact and promote circularity.

These fibers maintain durability, softness, and performance comparable to virgin polyester while meeting sustainability goals. This trend supports the adoption of sustainable polyester solutions across apparel, home textiles, and industrial applications, enabling brands to offer eco-friendly products and improve the sustainability of their supply chains.

- In May 2025, Teijin Limited launched a recycled polyester fiber designed to mimic the softness, texture, and breathability of natural fibers like cotton and wool. The recycled polyester fiber is made from post-consumer plastic waste and aims to contribute to sustainability in the textile industry while providing durability and consistent performance.

Polyester Fiber Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polyester Staple Fiber, Polyester Filament Yarn

|

|

By Form

|

Solid, Hollow

|

|

By Grade

|

PET Polyester, PCDT Polyester

|

|

By Application

|

Textile & Apparel, Home Furnishing, Automotive, Industrial, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Polyester Staple Fiber and Polyester Filament Yarn): The polyester staple fiber segment earned USD 71.12 billion in 2024 due to its widespread use in apparel, home textiles, and industrial fabrics for durability and cost-effectiveness.

- By Form (Solid and Hollow): The solid segment held 54.42% of the market in 2024, driven by its higher strength, versatility, and suitability for spinning and weaving applications.

- By Grade (PET Polyester and PCDT Polyester): The PET polyester segment is projected to reach USD 119.15 billion by 2032, owing to its superior mechanical properties, chemical resistance, and extensive adoption in textiles and technical fabrics.

- By Application (Textile & Apparel, Home Furnishing, Automotive, Industrial, and Others): The home furnishing segment is anticipated to witness the fastest CAGR of 8.29% over the forecast period, driven by increasing demand for durable, easy-to-maintain, and cost-effective furnishings.

Polyester Fiber Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polyester fiber market share stood at 35.03% in 2024, valued at USD 40.08 billion. This dominance is driven by the rapid expansion of the textile and apparel manufacturing industry across the region.

Increasing investment by regional players in recycled polyester and sustainable fiber manufacturing is enhancing production capacity and supporting the adoption of eco-friendly polyester solutions. Additionally, increasing adoption of polyester in technical textiles, including automotive and construction, is further fueling market growth across the region.

- In August 2025, Sangam (India) Limited acquired a Recycled Polyester Staple Fibre (RPSF) manufacturing unit for USD 5.9 million. Through this acquisition, Sangam aims to secure a reliable supply of recycled polyester to meet around 50% of its daily fiber requirement.

North America is poised for significant growth at a CAGR of 8.26% over the forecast period. This growth is driven by the increasing demand for durable, cost-effective, and low-maintenance fabrics in apparel and home textiles in the region. The rising popularity of blended fabrics that combine polyester with cotton, wool, or other fibers to enhance fabric performance and versatility is supporting market expansion.

Growing application of polyester in industrial and technical textiles, due to its strength, chemical resistance, and durability, further fuels market growth. Additionally, technological advancements by regional players in recycled, biodegradable, and high-performance polyester fibers are improving product quality and sustainability, thereby driving broader adoption of polyester fibers across the region.

- In April 2025, UNIFI launched REPREVE with CiCLO technology, a recycled polyester and nylon fiber enhanced with biodegradable properties. This enables synthetic fibers to naturally break down in soil and seawater and reduce microplastic pollution.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the market by overseeing environmental compliance in manufacturing processes, including chemical safety, emissions control, and waste management. It enforces standards under laws such as the Toxic Substances Control Act (TSCA) and Resource Conservation and Recovery Act (RCRA), ensuring sustainable production and reduced environmental impact.

- In the UK, the Environment Agency (EA) regulates polyester fiber manufacturing by overseeing waste management, chemical safety, and environmental compliance. It enforces regulations such as the Environmental Permitting Regulations and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). The EA ensures sustainable production, minimizes pollution, and promotes recycling and circular polyester fiber initiatives.

- In China, the Ministry of Ecology and Environment (MEE) regulates polyester fiber production by enforcing environmental protection laws and standards. It oversees emissions, chemical usage, and waste disposal in manufacturing facilities. Regulations such as the “Circular Economy Promotion Law” guide sustainable practices, promoting recycling and eco-friendly fiber production.

- In India, the Central Pollution Control Board (CPCB) regulates the market by monitoring compliance with environmental laws, including wastewater discharge standards, air pollution control, and chemical management. It enforces regulations such as the Environment (Protection) Act, ensuring manufacturers adopt sustainable production methods and manage the environmental impacts of polyester fiber manufacturing.

Competitive Landscape

Major players in the polyester fiber industry are actively expanding production capacities to meet the growing demand for polyester fibers across apparel, home textiles, and industrial applications. They are investing in technological advancements to develop high-performance and sustainable fibers, including recycled and biodegradable options.

Additionally, players are focusing on strategic partnerships and collaborations to scale circular polyester fiber production, strengthen supply chains, and increase the availability of high-quality and sustainable fibers.

- In January 2025, Ambercycle partnered with Benma to scale the production of cycora circular polyester fibers. The partnership strengthens Ambercycle’s and Benma’s capabilities in sustainable fiber production and expands the availability of high-quality circular fibers.

Top Key Companies in Polyester Fiber Market:

- Reliance Industries Limited

- Indorama Ventures

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- TORAY INDUSTRIES, INC

- Tongkun Holding Group

- Alpek Polyester

- TEIJIN FRONTIER CO., LTD

- Xin Feng Ming Group

- Bombay Dyeing & Manufacturing Company Ltd

- NAN YA PLASTICS CORPORATION

- Hengli Group Co., Ltd

- Aditya Birla Group

- Huvis Corp

- Far Eastern Group

- UNIFI, Inc.

Recent Developments

- In May 2025, Indorama Ventures expanded its deja fiber and filament yarn portfolio to include PET fibers made from discarded textile waste, bio-based inputs, and hard-to-recycle materials. Through this expansion, Indorama Ventures aims to actively drive circularity and decarbonization efforts in the global textile industry and to support the upcoming European Ecodesign for Sustainable Products Regulation (ESPR).