Market Definition

The market focuses on converting plastic waste into usable fuel products through various chemical and thermal processes, such as pyrolysis, gasification, and depolymerization.

The market encompasses the development, manufacturing, and deployment of technologies that transform non-recyclable plastic materials into energy-rich fuels like diesel, gasoline, and synthetic gases. This report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Plastic to Fuel Market Overview

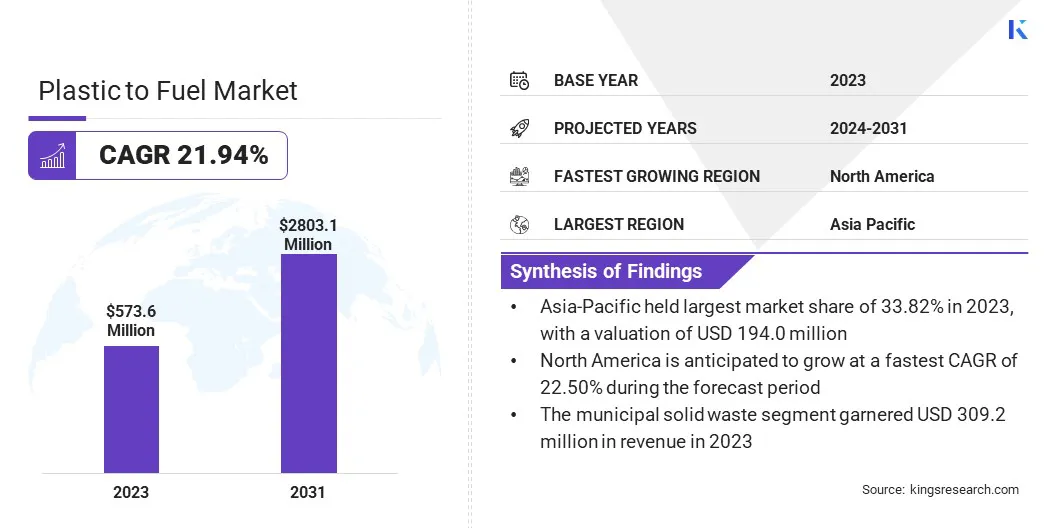

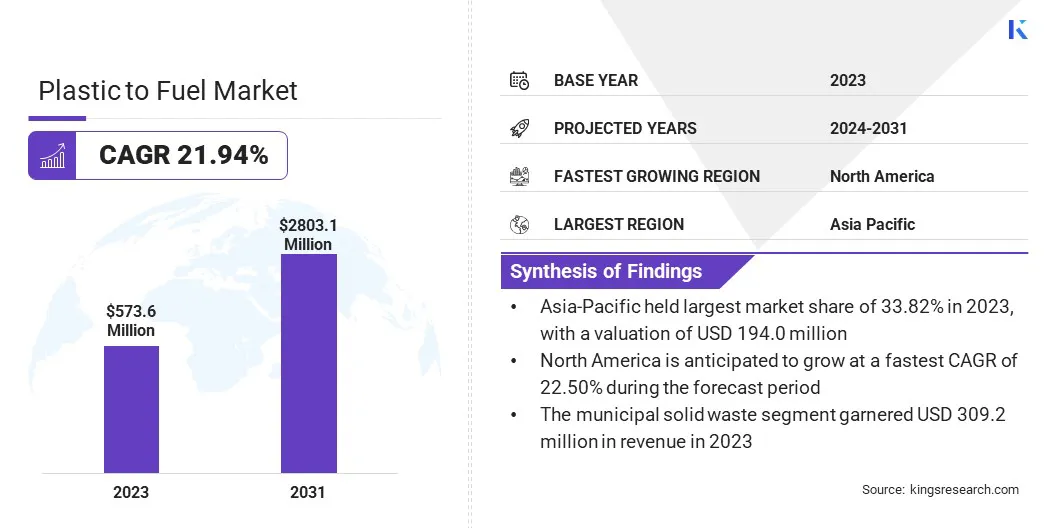

The global plastic to fuel market size was valued at USD 573.6 million in 2023 and is projected to grow from USD 699.2 million in 2024 to USD 2803.1 million by 2031, exhibiting a CAGR of 21.94% during the forecast period.

This growth is attributed to the increasing volume of plastic waste generated worldwide, coupled with the need for sustainable waste management solutions and alternative energy sources.

Furthermore, growing regulatory pressure to reduce carbon emissions and promote circular economy practices has accelerated the adoption of alternative fuel sources derived from plastic waste.

Major companies operating in the plastic to fuel industry are Agilyx, Plastic2Oil, Veolia, Klean Industries Inc., SUEZ, VADXX, Alterra Energy, LLC, Biffa, Neste, BRADAM Group, LLC, Beston Group, PLASTIC ENERGY, Cassandra Oil AB, EC21 Inc., and Brightmark.

Continuous advancements in pyrolysis and other thermochemical conversion technologies, along with the increasing economic viability of fuel recovery systems, are further driving the market by improving conversion efficiency and reducing processing costs. The expanding demand for low-emission fuels, particularly in emerging economies, is expected to support long-term market development.

- In March 2025, the Press Information Bureau (PIB) announced that the Technology Development Board (TDB), operating under the Department of Science and Technology (DST) partnered with APChemi Private Limited, to produce and commercialize purified pyrolysis oil, supporting the development of circular plastics and sustainable chemicals as part of India’s efforts toward circular economy and reducing reliance on imported crude oil.

Key Highlights

- The plastic to fuel industry size was valued at USD 573.6 million in 2023.

- The market is projected to grow at a CAGR of 21.94% from 2024 to 2031.

- Asia-Pacific held a market share of 33.82% in 2023, with a valuation of USD 194.0 million.

- The pyrolysis segment garnered USD 220.6 million in revenue in 2023.

- The polyethylene segment is expected to reach USD 839.2 million by 2031.

- The commercial & industrial waste segment is anticipated to witness the fastest CAGR of 22.29% during the forecast period.

- The Sulfur segment garnered USD 214.3 million in revenue in 2023.

- The market in North America is anticipated to grow at a CAGR of 22.50% during the forecast period.

Market Driver

"Rising Plastic Waste Generation"

The plastic to fuel market is propelled by the rising generation of plastic waste worldwide. With the widespread use of plastic in packaging, consumer goods, automotive components, and industrial applications, the volume of discarded plastic has grown substantially. Single-use plastics and low recycling rates have further heightened the issue, resulting in significant environmental and waste management challenges.

- In February 2024, the United Nations Environment Programme (UNEP) published a report titled "Beyond an Age of Waste: Turning Rubbish into a Resource," calling for a shift from waste-centric models to a circular economy. The report warns that without substantial efforts to reduce waste, global municipal waste could grow by two-thirds by 2050, with annual costs reaching USD 640 billion. It emphasizes the need to embrace zero-waste practices and circular economy solutions to address both environmental and economic challenges.

The inefficiencies of conventional recycling methods, especially for contaminated or multi-layered plastics, have intensified the demand for alternative solutions. Further, the accumulation of non-recyclable plastic in landfills and ecosystems is highlighting the need for scalable and sustainable waste-to-energy technologies.

The growing plastic waste crisis is compelling governments, industries, and environmental organizations to invest in innovative disposal strategies. As a result, plastic to fuel technologies are gaining traction as a viable means of converting waste into energy resources, supporting circular economy initiatives and reducing the environmental impact of plastic pollution.

Market Challenge

"Technological Limitations and Process Efficiency"

The technological limitations of plastic-to-fuel conversion processes is a critical challenge to the growth and scalability of the market, particularly in regions lacking access to advanced waste processing infrastructure.

While methods such as pyrolysis and gasification offer promising pathways for converting plastic waste into usable fuel, these technologies often struggle to handle mixed or contaminated plastic streams, which are common in real-world waste scenarios.

Variation in feedstock composition can result in inconsistent fuel quality, lower conversion efficiency, and higher maintenance requirements due to equipment fouling and residue buildup.

Additionally, the presence of additives, multilayer materials, and non-thermoplastics can complicate thermal decomposition, potentially producing harmful byproducts or lowering energy recovery rate.

To address this, technology developers are focusing on enhancing process flexibility and feedstock tolerance through innovations in reactor design, catalyst optimization, and real-time process monitoring. Collaborative research and pilot projects are also being undertaken to validate performance at scale and ensure compliance.

These advancements aim to improve conversion efficiency, reduce operational costs, and support the broader adoption of plastic to fuel technologies as a sustainable waste management solution.

Market Trend

"Integration of Advanced Catalytic Pyrolysis for Enhanced Fuel Yield"

Innovation in catalytic pyrolysis and gasification methods is improving the yield of usable fuels and enabling the processing of a wider variety of mixed and contaminated plastics.

These advancements allow the breakdown of complex plastic polymers at lower temperatures, reducing energy consumption and minimizing the production of harmful byproducts. The integration of advanced catalysts in pyrolysis processes is improving fuel quality and consistency, making the process economically viable.

Additionally, upgrades in reactor design and process monitoring are increasing operational efficiency, reducing costs, and ensuring better control over emissions. These technological developments are paving the way for more scalable, cost-effective, and eco-friendly plastic-to-fuel solutions, driving the growth of the market.

- In November 2024, Waste Energy Corp. announced plans to launch plastic to fuel facilities in the U.S. using pyrolysis and AI technologies. The first plant will begin operations in 2025 with a capacity ranging from 20 to 200 tons per day.

Plastic to Fuel Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Pyrolysis, Depolymerization, Gasification

|

|

By Plastic

|

Polyethylene, Polyethylene Terephthalate, Polypropylene, Polystyrene, and others

|

|

By Source

|

Municipal Solid Waste, Commercial & Industrial Waste

|

|

By End Fuel

|

Sulfur, Crude Oil, Hydrogen, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Pyrolysis, Depolymerization and Gasification): The pyrolysis segment earned USD 220.6 million in 2023, due to its efficiency in converting plastic waste into high-quality fuel through thermal decomposition at relatively low temperatures.

- By Plastic (Polyethylene, Polyethylene Terephthalate, Polypropylene, Polystyrene, and others): The polyethylene segment held 29.90% of the market in 2023, owing to its widespread use in packaging materials and its compatibility with plastic-to-fuel conversion processes, making it a significant feedstock for energy recovery.

- By Source (Municipal Solid Waste, Commercial & Industrial Waste): The municipal solid waste segment is projected to reach USD 1480.9 million by 2031, on account of the large volumes of plastic waste generated from households and urban areas, which presents a significant opportunity for fuel conversion technologies.

- By End Fuel (Sulfur, Crude Oil, Hydrogen, and Others): The crude oil segment is anticipated to grow at a CAGR of 22.28% during the forecast period, driven by the increasing demand for liquid fuels derived from plastic waste as a sustainable alternative to traditional petroleum sources.

Plastic to Fuel Market Regional Analysis

Based on region, the plastic to fuel industry has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific plastic to fuel market share stood at around 33.82% in 2023, with a valuation of USD 194.0 million. This dominance is attributed to the region's rapid industrial growth, high levels of plastic waste generation, and the strong presence of key manufacturers such as China, India, and Japan.

Furthermore, increasing investments in plastic-to-fuel infrastructure, along with rising government initiatives to promote waste-to-energy technologies, continue to support market growth.

Favorable policies aimed at reducing plastic waste and promoting sustainable energy solutions, along with a growing focus on circular economy practices, further strengthen Asia Pacific’s leadership in the market.

- In June 2023, the Department of Science and Technology (DST) in India developed a mobile plant for converting plastic waste into hydrocarbon oil. This innovation, named ICT-Poly Urja, employs an indigenously developed Cu@TiO₂ catalyst to achieve over 85% feedstock conversion, producing high-quality HC-Oil with a calorific value of 42 MJ/kg.

The plastic to fuel industry in North America is poised for significant growth at a robust CAGR of 22.50% over the forecast period. This growth is attributed to the increasing need for sustainable waste management solutions and the rising demand for alternative fuel sources derived from plastic waste.

The region's strong commitment to reducing plastic waste and its focus on advancing renewable energy solutions are key drivers of market expansion. Additionally, the growing adoption of circular economy practices and government incentives for waste-to-energy technologies are boosting market development.

Ongoing investments in plastic to fuel technology infrastructure and advancements in processing efficiency are enhancing the scalability and economic viability of these systems, ensuring a broader application across various industries in North America.

- In October 2023, Argonne National Laboratory announced that advanced recycling of post-consumer plastics has the potential to reduce greenhouse gas emissions by as much as 23%, offering a sustainable alternative to conventional plastic production methods. The study underscores the transformative potential of pyrolysis technology in fostering a more sustainable plastics industry.

Regulatory Frameworks

- In India, the Plastic Waste Management (Second Amendment) Rules, 2022 govern plastic waste collection, recycling, and disposal, enforcing Extended Producer Responsibility (EPR) and setting targets to reduce waste and promote a circular economy.

- In the U.S., the Toxic Substances Control Act (TSCA) regulates the production, importation, and disposal of chemicals, including those derived from plastic waste. It ensures the safety of chemicals before they enter the market and allows the Environmental Protection Agency EPA to enforce safety standards and assess potential environmental and health risks.

- In the European Union, Directive 2008/98/EC on waste regulates the management and disposal of waste, prioritizing prevention, recycling, and recovery. It ensures environmentally sound waste management practices while promoting a circular economy and allows member states to implement more specific waste handling regulations.

Competitive Landscape

The plastic to fuel industry is characterized by a mix of established multinational companies and emerging regional players, all competing to expand their presence and enhance technological capabilities.

Market leaders are focusing on strategic partnerships, acquisitions, and investments in innovative waste-to-energy technologies to stay ahead in the competitive landscape. Efforts are being taken to improve the efficiency of conversion processes and enhance the quality of fuel output, particularly by integrating advanced catalytic and pyrolysis technologies.

Moreover, several companies are aligning with sustainability initiatives and collaborating with waste management firms to provide integrated plastic waste solutions. Technological innovation, regulatory compliance, and environmental sustainability are crucial for shaping the competitive dynamics of the market as global demand for cleaner energy sources and reduced plastic waste grows.

- In June 2023, Neste announced a USD 126.2 million investment to build a liquefied waste plastic upgrading unit at its Porvoo refinery in Finland. A part of Project PULSE, the facility will process up to 150,000 tons of liquefied plastic waste annually into high-quality feedstock for new plastic production. Supported by a USD 153.5 million grant from the EU Innovation Fund, the project is slated for completion in 2025.

List of Key Companies in Plastic to Fuel Market:

- Agilyx

- Plastic2Oil

- Veolia

- Klean Industries Inc.

- SUEZ

- VADXX

- Alterra Energy, LLC

- Biffa

- Neste

- BRADAM Group, LLC

- Beston Group

- PLASTIC ENERGY

- Cassandra Oil AB

- EC21 Inc

- Brightmark

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2024, Lummus Technology announced an investment in Resynergi to scale its Continuous Microwave Assisted Pyrolysis (CMAP) technology, which converts plastic waste into high-quality materials 20 times faster than traditional methods. This collaboration aims to reduce the carbon footprint of plastics production and meet the growing demand for recycled materials.

- In September 2023, Braskem partnered with Vitol S.A. to purchase pyrolysis oil derived from plastic waste, produced by WPU – Waste Plastic Upcycling A/S in Denmark. This partnership is part of Braskem's efforts to improve the circularity of its products and its sustainability objectives.

- In September 2023, Mitsui O.S.K. Lines, Ltd and Idemitsu Kosan Co., Ltd. launched a project to recycle marine plastic waste into oil. The initiative involves using "Seabin" devices to collect plastic debris, which will then be converted into renewable chemicals and fuel oils by Idemitsu's subsidiary.

- In June 2023, Lummus Technology partnered with MOL Group to advance the chemical recycling of plastics at MOL's facilities in Hungary and Slovakia. Lummus will provide its pyrolysis technology to convert plastic waste into valuable chemicals, supporting MOL’s goal of net-zero emissions by 2050.