Market Definition

The market includes technologies and services for assessing plant traits in controlled and field conditions. It covers equipment, sensors, software, and services for data collection, processing, and analysis. The market is segmented by automation levels, including manual, semi-automated, and fully automated systems, depending on operational needs.

Key applications include quality assessment, plant research, breeding, and product development. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping industry growth.

Plant Phenotyping Market Overview

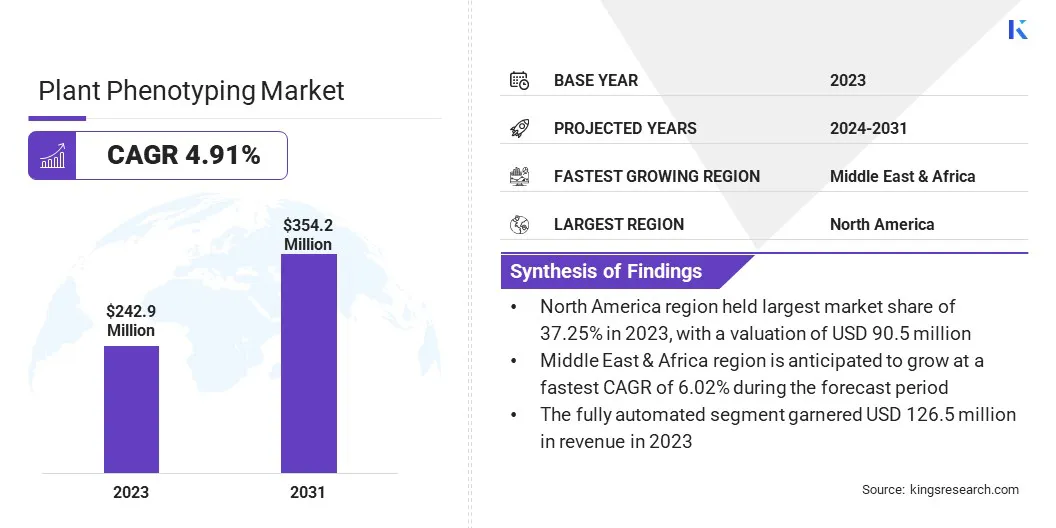

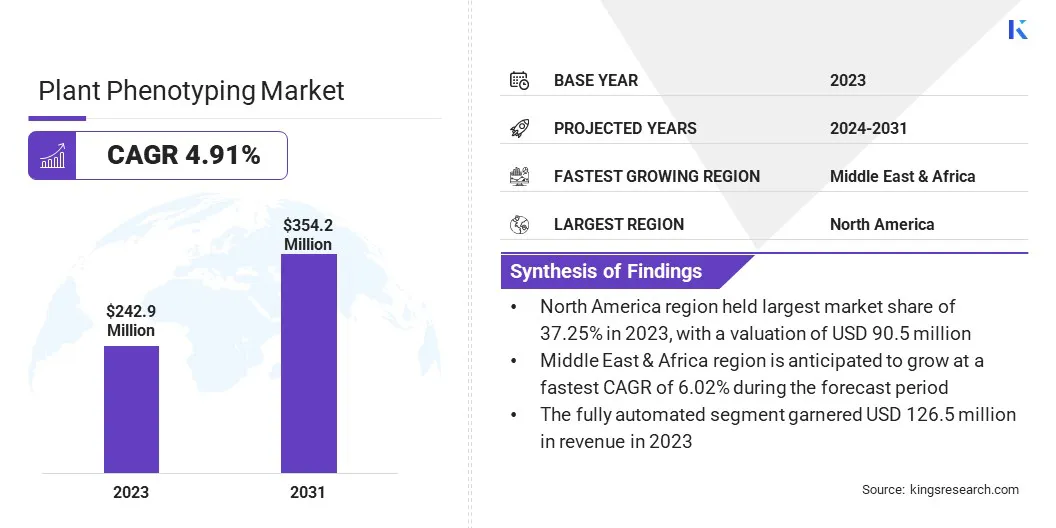

The global plant phenotyping market size was valued at USD 242.9 million in 2023 and is projected to grow from USD 253.3 million in 2024 to USD 354.2 million by 2031, exhibiting a CAGR of 4.91% during the forecast period.

Market growth is driven by the increasing number of global plant phenotyping projects, with research institutions, agricultural organizations, and breeding programs increasingly focusing on plant trait analysis. This expansion, covering areas such as crop improvement to stress resilience studies, is increasing demand for advanced phenotyping technologies.

Major companies operating in the plant phenotyping industry are GARDIN, BioVox, PSI (Photon Systems Instruments) spol. s r.o., HIPHEN, PHENOSPEX, WPS, Heinz Walz GmbH, Delta-T Devices Ltd, KeyGene, Rothamsted Research, VIB, LemnaTec GmbH, LGC Limited, Qubit Systems Inc., and Wiwam.

Moreover, technological advancements such as innovations in software solutions for data analysis are improving the efficiency of complex phenotypic data. The integration of AI and machine learning is enhancing data interpretation accuarcy and plant trait prediction of plant traits.

Additionally, drone-based phenotyping systems are increasingly used to monitor large agricultural fields, providing real-time, high-resolution data on crop performance.

- In January 2025, Hiphen acquired digital phenotyping activities from Aurea Imaging. This strategic move enables Hiphen to enhance its offering of advanced predictive solutions and drone image analytics for crop science organizations worldwide. With expertise in remote sensing, computer vision, and artificial intelligence, Hiphen continues to provide high-value data to various stakeholders in the agriculture sector.

Key Highlights:

- The plant phenotyping market size was recorded at USD 242.9 million in 2023.

- The market is projected to grow at a CAGR of 4.91% from 2024 to 2031.

- North America held a market share of 37.25% in 2023, with a valuation of USD 90.5 million.

- The equipment segment garnered USD 126.3 million in revenue in 2023.

- The fully automated segment is expected to reach USD 193.44 million by 2031.

- The quality assessment segment is likely to generate a valuation of USD 128.1 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 5.90% over the forecast period.

Market Driver

Increasing Number of Plant Phenotyping Projects

The growth of the market is driven by the increasing number of plant phenotyping projects across research institutions, universities, and agricultural companies. These projects aim to study plant traits under different conditions to support crop improvement, climate adaptation, and sustainable farming.

The rising involvement of organizations in such initiatives is boosting increased demand for accurate and efficient phenotyping tools. This is promoting the integration of phenotyping into breeding programs and product development pipelines. This growing application base is supporting expansion and the development of more specialized and scalable solutions.

- In March 2025, the Community Plant Variety Office (CPVO) initiated its first molecular markers project on lettuce, titled “International harmonization and validation of a SNP set for the management of lettuce reference collection.” The project aims to enhance the efficiency of Distinctness, Uniformity, and Stability (DUS) testing by applying SNP markers to better manage reference collections and reduce the complexity and cost of field trials.

Market Challenge

High Cost of Advanced Equipment and Technology

A major challenge hampering the expansion of the plant phenotyping market is the high cost of advanced equipment and technology. The complexity of plant phenotyping systems, including imaging devices, sensors, and automated platforms, increases development and maintenance costs.

This limits access for smaller research institutions and companies, hindering widespread adoption. This challenge can be mitigated through the development of cost-effective, modular systems that can be customized for various users. Additionally, increased collaboration between research institutions and private companies can help share the financial burdens and improve access to advanced phenotyping tools.

Market Trend

Advancements in Specialized Software Solutions

A key trend influencing the market is the continuous advancements in software for phenotypic data analysis. With the growing volume of data generated by imaging systems, sensors, and environmental tools, there is a rising need for specialized software to manage and process this information.

These software platforms help researchers efficiently quantify plant traits such as growth patterns, leaf area, and stress responses. They also provide better management of large datasets, making data storage and retrieval more streamlined. Additionally, advanced visualization tools allow for easier interpretation of complex data.

As a result, these software advancements are improving the efficiency, accuracy, and scalability in plant phenotyping, supporting plant research and breeding programs.

- In March 2023, researchers from the Australian Plant Phenomics Facility’s node at Australian National University developed a new image analyser software designed to automatically calculate leaf area for plant studies. The system streamlines data collection by using computer vision techniques to record key parameters such as leaf count, area, length, and width, significantly reducing time, cost, and human error.

Plant Phenotyping Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Equipment, Sensors, Software, Services

|

|

By Level of Automation

|

Fully Automated, Semi-automated, Manual

|

|

By Application

|

Quality Assessment, Plant Research, Breeding, Product Development

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Equipment, Sensors, Software, and Services): The equipment segment earned USD 126.3 million in 2023 due to its widespread use in high-throughput phenotyping and field-based data collection.

- By Level of Automation (Fully Automated, Semi-automated, and Manual): The fully automated segment held a share of 52.09% in 2023, fueled by increasing demand for high-efficiency systems that reduce manual intervention and improve data accuracy.

- By Application (Quality Assessment, Plant Research, Breeding, and Product Development): The quality assessment segment is projected to reach USD 128.1 million by 2031, propelled by growing focus on evaluating crop traits for yield, resistance, and nutritional value.

Plant Phenotyping Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America plant phenotyping market share stood at around 37.25% in 2023, valued at USD 90.5 million. This growth is attributed to strong investments in agricultural research and technology development. The presence of leading research institutions, universities, and biotechnology companies has contributed significantly to this growth.

Moreover, North America has a well-established infrastructure for precision agriculture and plant breeding, boosting the demand for phenotyping technologies. The region's focus on improving crop yields and addressing food security challenges boosts the adoption of advanced phenotyping solutions.

Asia Pacific plant phenotyping industry is poised to grow at a CAGR of 5.90% over the forecast period. This growth is fostered by the increasing need for efficient crop management and improvement of agricultural productivity in countries such as China and India. With a large agricultural base, the region is experiencing increased adoption of plant phenotyping technologies to support breeding programs and enhance crop resilience.

Government initiatives and private investments in agricultural research are further fueling regional market growth. The rising demand for food security and sustainable farming practices in Asia Pacific is further accelerating the use of advanced phenotyping solutions.

- In March 2025, the International Genetically Engineered Machines (IGI) team conducted CRISPR training workshops in New Delhi, India, at the Indian Agricultural Research Institute (IARI). Funded by the Gates Foundation, the workshops aimed to enhance crop resilience and production through genome editing. Fifty-four researchers, including early career scientists and graduate students, participated in hands-on training and discussions.

Regulatory Frameworks

- In the U.S, agencies such as the US Department of Agriculture (USDA) and the Environmental Protection Agency (EPA) regulate plant phenotyping, particularly in field trials involving transgenic plants. Data collected in these trials must comply with environmental and biosafety standards.

- In Europe, plant phenotyping is supported by frameworks such as the European Plant Phenotyping Network (EPPN) and EMPHASIS, an initiative under the European Strategy Forum on Research Infrastructures (ESFRI). These frameworks focus on standardizing phenotyping protocols, data sharing, and coordinating infrastructure across member states.

Competitive Landscape

The plant phenotyping market is moderately consolidated, with a mix of established companies and specialized technology providers competing through innovation, system integration, and service capabilities. Key players are focused on developing advanced imaging systems, sensor technologies, and automation platforms to enhance data accuracy and throughput.

Many expand their product portfolios through in-house R&D and collaborations with research institutions. Strategic partnerships are leveraged to integrate complementary technologies and strengthen global distribution networks.

Additionally, several firms invest in AI-based image analysis and data management platforms to improve phenotypic data interpretation. Customizing solutions for specific research or commercial requirements is also a common strategy, while participation in industry and public-private research projects ensures alignment with evolving scientific standards.

- In January 2025, Syngenta Crop Protection and TraitSeq announced a collaboration to develop high-performance biostimulants using artificial intelligence (AI). Syngenta will leverage its extensive crop biology expertise with TraitSeq’s AI-driven methods to identify biomarkers for plant health and stress response. This partnership aims to enhance plant resilience and efficiency, supporting sustainable agricultural practices and Syngenta’s regenerative efforts.

List of Key Companies in Plant Phenotyping Market:

- GARDIN

- BioVox

- PSI (Photon Systems Instruments) spol. s r.o.

- HIPHEN

- PHENOSPEX

- WPS

- Heinz Walz GmbH

- Delta-T Devices Ltd

- KeyGene

- Rothamsted Research

- VIB

- LemnaTec GmbH

- LGC Limited

- Qubit Systems Inc.

- Wiwam

Recent Developments (Partnerships)

- In August 2023, Pairwise and Bayer launched a five-year, multi-million-dollar collaboration aimed at advancing gene-edited short-stature corn. The initiative will focus on refining this corn for integration into Bayer's Preceon Smart Corn System, building on their prior collaboration that led to the transfer of 27 novel traits into Bayer’s testing programs.