Market Definition

The market focuses on systems and solutions used to monitor, analyze, and optimize the performance, health, and lifecycle of industrial assets in manufacturing, energy, and processing facilities.

These systems include hardware, software, and services to enable predictive maintenance, reduce unplanned downtime, and improve operational efficiency. The market includes sensors, field devices, communication networks, and cloud-based platforms that support real-time data acquisition and diagnostics.

This report provides a detailed analysis of the market, including key drivers, technological advancements, regional dynamics, and competitive developments set to shape the industry's growth over the forecast period.

Plant Asset Management Market Overview

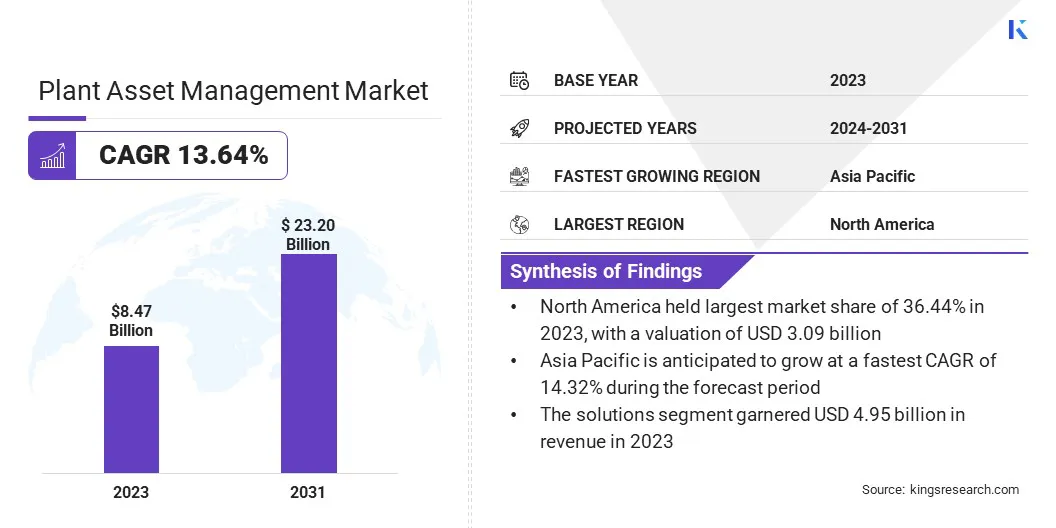

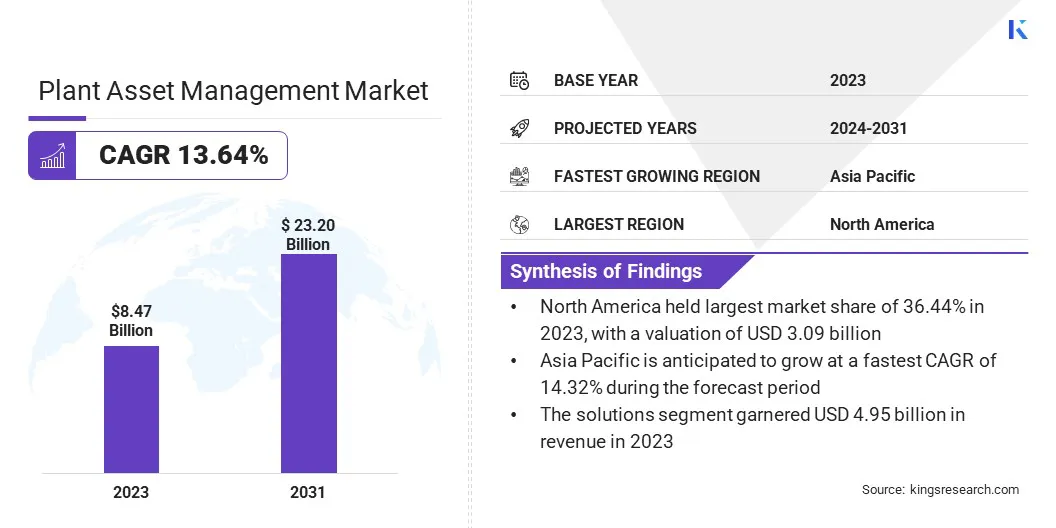

The global plant asset management market size was valued at USD 8.47 billion in 2023 and is projected to grow from USD 9.48 billion in 2024 to USD 23.20 billion by 2031, exhibiting a CAGR of 13.64% over the forecast period.

The market is experiencing steady growth, driven by increasing demand for operational efficiency, predictive maintenance, and cost-effective asset utilization across industrial sectors. Oil & gas, energy, chemicals, pharmaceuticals, and manufacturing industries are adopting digital asset management systems to minimize downtime and extend equipment lifecycle.

Major companies operating in the plant asset management industry are Siemens, ABB, Schneider Electric SE, Honeywell International Inc., Emerson, Rockwell Automation, Inc., General Electric, IBM, Bentley Systems, Inc., Yokogawa Electric Corporation, Endress+Hauser AG, SAP SE, Oracle, AVEVA Group Plc, and Aspen Technology, Inc.

The shift toward Industry 4.0 and the integration of IoT and cloud-based platforms are also enhancing real-time monitoring and analytics, accelerating market growth. Rising demand to streamline maintenance and minimize unplanned outages is driving increased investment in smart sensors, AI-based diagnostics, and centralized plant asset management platforms.

- In October 2023, Gecko Robotics launched Cantilever, an AI-driven asset management platform that integrates data from robotic inspections, fixed sensors, and partner systems into a unified software solution. Cantilever enables real-time analysis and decision-making regarding asset health, allowing organizations to shift from reactive to predictive maintenance strategies.

Key Highlights:

- The plant asset management industry size was recorded at USD 8.47 billion in 2023.

- The market is projected to grow at a CAGR of 13.64% from 2024 to 2031.

- North America held a market share of 36.44% in 2023, with a valuation of USD 3.07illion.

- The solutions segment garnered USD 4.95 billion in revenue in 2023.

- The cloud segment is expected to reach USD 13.91 billion by 2031.

- The production assets segment secured the largest revenue share of 58.42% in 2023.

- The oil and gas is poised for a robust CAGR of 15.35% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 14.32% during the forecast period.

Market Driver

"Growing Adoption of Industry 4.0"

The ongoing shift toward Industry 4.0 is significantly driving growth in the plant asset management market. The integration of Internet of Things (IoT) devices and cloud-based platforms is enhancing real-time monitoring, predictive maintenance, and decision-making.

These capabilities optimize asset utilization, reduce downtime, and improve operational efficiency for industries with high maintenance costs and stringent performance standards.

- In May 2023, Honeywell expanded its Honeywell Forge Performance+ software suite by introducing new cloud-native solutions to help organizations deliver digital transformation and performance goals through intelligent operations. These enhancements aim to increase productivity and drive key digitalization outcomes in industrial settings.

Market Challenge

"Data Security and Integration Issues"

One of the key challenges facing the plant asset management market is ensuring the integration and security of data from various devices and platforms. As organizations adopt IoT-based systems and cloud-based platforms for asset management, the volume of data generated and transmitted across networks increases significantly.

To address this issue, key players are investing in advanced cybersecurity protocols and developing integrated platforms that support seamless communication between legacy systems and new digital solutions. This includes implementing end-to-end encryption, multi-factor authentication, and continuous monitoring to safeguard critical data.

Market Trend

"Technological Advancements in the Assessment Process"

A significant trend in the plant asset management (PAM) market is the increasing integration of artificial intelligence (AI), Internet of Things (IoT), and cloud-based technologies. This leads to enhanced operational efficiency and reduced downtime.

Industries such as oil & gas, chemicals, manufacturing, and energy are adopting these advanced solutions to optimize asset performance and ensure compliance with regulatory standards.

- In March 2025, Siemens launched a new AI-powered predictive maintenance module within its XHQ Operations Intelligence platform. This module leverages real-time data from IoT sensors and historical performance analytics to forecast equipment failures, enabling proactive maintenance scheduling and minimizing unplanned downtime. The integration of such advanced technologies is reshaping how industries manage their assets, driving the demand for sophisticated PAM solutions.

Plant Asset Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions, Services

|

|

By Deployment

|

On-Premises, Cloud

|

|

By Asset Type

|

Production Assets, Automation Assets

|

|

By End-use Industry

|

Energy and Power, Oil and Gas, Manufacturing, Automotive, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solutions, Services): The solutions segment earned USD 4.95 billion in 2023 due to its critical role in enabling real-time monitoring, predictive maintenance, and lifecycle optimization of industrial assets.

- By Deployment (On-Premises, Cloud): The cloud segment held 58.68% of the market in 2023, due to its high adoption for offering scalable infrastructure, remote accessibility, and real-time data analytics.

- By Asset Type (Production Assets, Automation Assets): The production assets segment is projected to reach USD 12.60 billion by 2031, owing to the continuous need for real-time monitoring and maintenance of critical equipment such as turbines, compressors, and industrial machinery.

- By End-use Industry (Energy and Power, Oil and Gas, Manufacturing, Automotive, Others): The oil and gas segment is poised for significant growth at a CAGR of 15.35% through the forecast period, attributed to its high dependency on continuous monitoring and predictive maintenance technologies to ensure operational safety, minimize unplanned downtime, and manage aging infrastructure.

Plant Asset Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America .

The North America plant asset management market share stood at 36.44% in 2023 in the global market, with a valuation of USD 3.09 billion. North America dominates the market due to an advanced industrial infrastructure, a high adoption of digitalization, and strong investments in Industry 4.0 technologies.

The U.S. and Canada lead in terms of IoT, AI, and cloud implementation, crucial for modern plant asset management solutions. A strong focus on operational efficiency, reducing downtime, and enhancing predictive maintenance across industries such as manufacturing, energy, and utilities is further fueling the demand for sophisticated plant asset management systems.

- For instance, in 2024, the U.S. government introduced incentives under the Infrastructure Investment and Jobs Act to modernize manufacturing processes, which is expected to boost the adoption of smart sensors and digital solutions for better asset management. This is anticipated to strengthen North America's lead in the market

Asia Pacific plant asset management industry is poised for significant growth at a robust CAGR of 14.32% over the forecast period. This growth can be attributed to the rapid industrialization, infrastructure development, and adoption of digital technologies in the region.

The demand for advanced asset management systems is increasing as industries in countries like China, India, Japan, and South Korea embrace smart manufacturing and automation to enhance operational efficiency and competitiveness.

The shift toward Industry 4.0 is driving significant investments in IoT, artificial intelligence (AI), and cloud-based technologies, which are integral components of modern PAM solutions. Governments across the region are actively promoting initiatives to digitalize industrial sectors, creating a favorable environment for the growth of the market.

Regulatory Frameworks

- In the U.S., plant asset management is regulated by the Governmental Accounting Standards Board (GASB) Statement No. 34, which emphasizes asset condition assessments and maintenance over time.

- Additionally, the Internal Revenue Service (IRS) governs asset depreciation through the Modified Accelerated Cost Recovery System (MACRS), directly influencing asset life cycle management.

- Across the European Union, the asset management landscape is unified by ISO 55000, while EU infrastructure funding frameworks require adherence to long-term asset planning.

- EU directives on industrial safety and sustainability, particularly the Industrial Emissions Directive (IED), mandate robust asset tracking, preventive maintenance, and performance auditing across energy-intensive sectors.

- China regulates plant and fixed asset management through government-issued policies like the “Measures for the Management of Fixed Assets” under the People's Bank of China. These rules mandate formal classification, depreciation, and disposal procedures, with increasing alignment toward ISO 55000 standards as part of industrial modernization and digital transformation efforts.

- India governs plant asset management under AS 10 for Property, Plant, and Equipment, focusing on valuation, depreciation, and disposal. Additionally, Ind AS 16, aligned with global IAS 16 standards, sets the financial reporting norms for tangible assets. These standards are applicable to public enterprises, infrastructure firms, and regulated sectors.

Competitive Landscape:

The plant asset management industry is highly competitive, with key players focusing on technological advancements and strategic partnerships to strengthen their market presence.

Leading companies are investing in AI-driven diagnostics, predictive maintenance tools, and IoT integration to enhance operational efficiency and reduce downtime for industries.

They are also expanding their product portfolios to include cloud-based solutions and advanced analytics for real-time monitoring and decision-making. To gain a competitive edge, players are forming collaborations with industrial enterprises and research institutions.

- In February 2024, Schneider Electric launched EcoStruxure Plant Lean Management, a digital solution designed to enhance productivity and digitalization in manufacturing. This platform aggregates data from industrial operations to develop key performance indicators (KPIs) for short-interval management (SIM) meetings, enabling shop floor teams to review production cycles and address issues promptly.

List of Key Companies in Plant Asset Management Market:

- Siemens

- ABB

- Schneider Electric SE

- Honeywell International Inc.

- Emerson

- Rockwell Automation, Inc.

- General Electric

- IBM

- Bentley Systems, Inc.

- Yokogawa Electric Corporation

- Endress+Hauser AG

- SAP SE

- Oracle

- AVEVA Group Plc

- Aspen Technology, Inc.

Recent Developments (Product Launch)

- In November 2023, ABB introduced the ABB Ability SmartMaster, a digital asset performance management platform designed for the verification and condition monitoring of instrumentation and field devices across industries such as water, wastewater, chemical, and oil & gas. This platform remotely gathers, analyzes, and verifies diagnostic data from instruments without interrupting ongoing measurement tasks. SmartMaster is compatible with a wide range of ABB and third-party field devices, including flow meters, level meters, temperature, and pressure sensors.