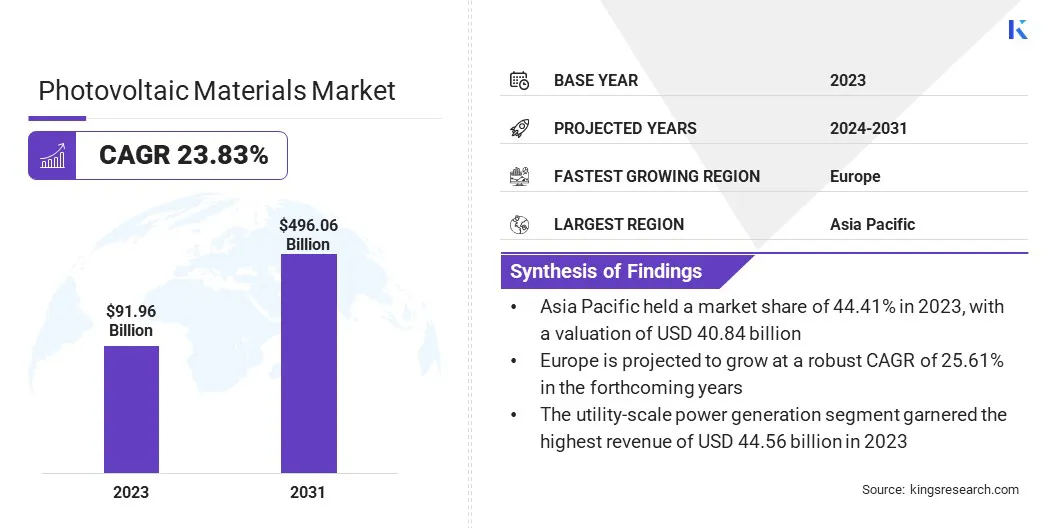

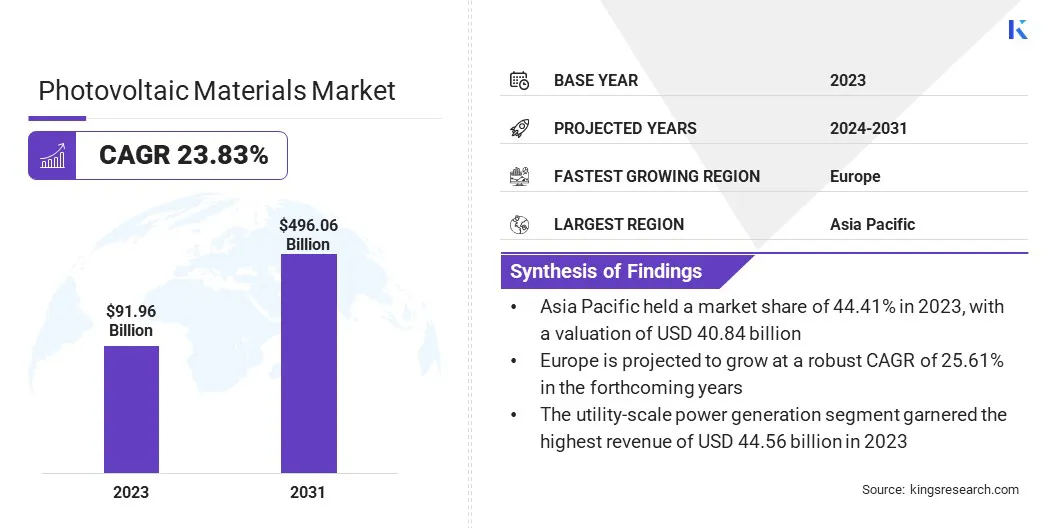

Photovoltaic Materials Market Size

The global Photovoltaic Materials Market size was valued at USD 91.96 billion in 2023 and is projected to grow from USD 111.13 billion in 2024 to USD 496.06 billion by 2031, exhibiting a CAGR of 23.83% during the forecast period. Increased use of perovskite materials and growing need for sustainable energy sources are fueling the growth of the market.

In the scope of work, the report includes services offered by companies such as American Elements, COVEME s.p.a., DuPont, Ferrotec Holdings Corporation, Wacker Chemie AG, KYOCERA Corporation, Merck KGaA, Mitsubishi Corporation, Novaled GmbH, Targray, and others.

The integration of solar power in smart grids presents a significant opportunity for the development of the photovoltaic materials market. Smart grids are advanced electrical grids designed to efficiently manage energy demand and distribution, incorporating renewable energy sources such as solar power.

As governments and utilities seek to modernize energy infrastructure, smart grids offer opportunities for solar power to play a pivotal role. Photovoltaic systems integrated into smart grids enhance energy distribution, storage, and consumption efficiency.

- In May 2024, Siemens partnered with Kuwait University to launch the GCC region’s first Distributed Energy Systems (DES) Smart Lab. This collaboration aims to advance the development of low-carbon energy systems and foster innovation in smart energy technologies, benefiting local businesses, industries, and students by promoting sustainable energy solutions.

This opportunity facilitates decentralized energy production, allowing residential and commercial buildings with photovoltaic panels to generate, store, and sell excess electricity to the grid. The advancement of energy storage technologies, such as batteries, further supports this integration by enhancing grid stability.

The development of such interconnected systems may boost the demand for advanced photovoltaic materials that offer higher efficiency and durability. As countries around the world adopt smart grids, photovoltaic material manufacturers can find substantial opportunities for growth by developing innovative, grid-compatible solutions.

Photovoltaic materials are the key components used in solar cells to convert sunlight into electricity through the photovoltaic effect. These materials, including semiconductors such as silicon, can absorb sunlight to generate electron flow and produce electric current. There are several types of photovoltaic materials, including crystalline silicon, thin-film, and emerging technologies such as perovskites.

Crystalline silicon, available in monocrystalline and polycrystalline forms, is the most widely used due to its high efficiency and reliability. Thin-film materials, such as cadmium telluride (CdTe) and copper indium gallium selenide (CIGS), are gaining traction due to their flexibility and lightweight properties. Perovskite materials, an emerging class, offer higher efficiency and lower production costs compared to traditional silicon-based cells.

Photovoltaic materials are primarily used in solar panels for residential, commercial, and industrial solar power systems. Furthermore, they are suitable for space applications, solar-powered vehicles, and off-grid energy systems, demonstrating versatility in renewable energy.

Analyst’s Review

In the photovoltaic materials market, companies are focusing on strategies to enhance efficiency, lower costs, and improve scalability. Leading players are investing heavily in research and development to innovate new materials such as perovskites, which promise significant performance improvements over traditional silicon-based photovoltaics.

Collaborations with academic institutions and partnerships with solar panel manufacturers are essential for maintaining competitiveness. Moreover, companies are focusing on expanding their global reach by entering emerging markets with growing demand for renewable energy.

- For instance, in October 2023, Canadian Solar announced the development of a 5 GW solar photovoltaic cell manufacturing facility in Jeffersonville, Indiana. This cutting-edge facility, located at River Ridge Commerce Center, is designed to produce approximately 20,000 high-power solar modules daily, significantly enhancing production capacity and meeting the increasing demand for renewable energy solutions.

Current market growth is largely attributed to increased adoption of renewable energy solutions, supported by government incentives and environmental policies aimed at reducing carbon emissions.

Key players are addressing high installation costs by offering leasing models and integrating photovoltaic materials into broader energy solutions, including smart grid technology and energy storage systems. The imperatives for success in this competitive landscape can include innovation, cost efficiency, and the ability to meet the growing demand for sustainable energy solutions across different regions.

Photovoltaic Materials Market Growth Factors

Government incentives and subsidies are propelling the growth of the photovoltaic materials market. Numerous governments worldwide are implementing policies to promote the adoption of renewable energy, particularly solar power, by providing financial support to both consumers and companies. These incentives include tax credits, rebates, feed-in tariffs, and grants, which make solar installations more affordable and attractive to residential, commercial, and industrial users.

Subsidies are designed to lower the upfront cost of solar installations, thereby accelerating the deployment of photovoltaic materials. As countries strive to meet their carbon reduction targets and transition to cleaner energy sources, these financial incentives are likely to remain crucial for increasing solar energy adoption.

In regions such as Europe and North America, where governments have set ambitious renewable energy goals, there is consistent demand for photovoltaic materials. In the long-term, such incentives stabilize the solar energy market, allowing manufacturers to scale production, lower costs, and innovate advanced photovoltaic materials.

The high initial investment required for solar power installations impedes the widespread adoption of photovoltaic materials. Although the long-term benefits of solar energy, such as reduced electricity bills and lower carbon footprints, are widely recognized, the substantial upfront costs of purchasing and installing solar panels remain a barrier for many consumers and businesses.

This challenge is particularly pronounced in regions with less government support or limited access to financing options. For residential and small commercial users, the cost of purchasing the necessary photovoltaic materials, inverters, and batteries can be prohibitive, hindering adoption. However, this challenge can be mitigated through innovative financing models such as solar leasing, power purchase agreements (PPAs), and community solar programs.

These models allow customers to install solar systems with little to no upfront cost while paying for the electricity generated over time. As technology advances and economies of scale are achieved, the cost of photovoltaic materials is expected to decline, further reducing the financial burden of solar power installations.

Photovoltaic Materials Market Trends

The rising adoption of bifacial solar panels is an emerging trend reshaping the landscape of the photovoltaic materials market. Bifacial panels capture sunlight from both sides, increasing the energy output compared to traditional monofacial panels that only absorb light from the front. This innovation enhances the efficiency of solar installations, particularly in locations with high levels of diffuse light or reflective surfaces such as snow or water.

Bifacial panels can offer a higher return on investment by producing more energy without requiring additional land or structural changes.

- In May 2024, KPI Green Energy introduced bifacial solar panels, a significant advancement in solar technology that captures sunlight from both sides. This innovation increases energy generation by up to 30% over traditional monofacial panels, enhancing the efficiency of solar energy systems.

As the global demand for more efficient solar solutions grows, bifacial panels are becoming an attractive option for utility-scale solar farms and commercial installations. Their ability to increase energy production while reducing the cost per watt is fueling their adoption across different markets.

Advancements in photovoltaic materials used in bifacial panels are leading to the development of more durable and weather-resistant solutions, thus expanding their use in various environments and conditions.

Segmentation Analysis

The global market has been segmented on the basis of type, application, end user, and geography.

By Type

Based on type, the market has been bifurcated into silicon-based materials, inorganic compounds-based materials, organic materials, and perovskite materials. The silicon-based materials segment captured the largest photovoltaic materials market share of 61.10% in 2023, primarily attributed to their widespread use and proven efficiency in photovoltaic applications.

Silicon is the most established material for solar cells due to its superior semiconductor properties, reliability, and high energy conversion efficiency. Both monocrystalline and polycrystalline silicon cells are well-known for their durability, making them a preferred choice for residential, commercial, and utility-scale solar installations.

In addition, technological advancements in silicon-based materials have continued to improve the overall efficiency of solar panels, leading to increased adoption. Economies of scale in silicon production have reduced cost, making these materials more affordable and accessible.

Furthermore, the robust infrastructure for manufacturing silicon-based solar cells, along with their long lifespan and low degradation rates, ensures their continued dominance in the photovoltaic industry. The growing demand for clean energy and government incentives for solar power installations further contribute to the growth of the silicon-based materials segment.

By Product

Based on product, the market has been classified into front sheet, encapsulant, back sheet, and others. The encapsulant segment is poised to record a staggering CAGR of 25.09% through the forecast period, mainly stimulated by the increasing demand for durable and high-performance solar modules.

Encapsulants are critical components that protect photovoltaic cells from environmental factors, such as moisture, UV radiation, and physical damage, ensuring the longevity and efficiency of solar panels.

The growing demand for advanced encapsulation materials is fueled by the expansion of solar energy installations across various sectors, particularly in harsh environments with extreme weather conditions. Manufacturers are developing new encapsulant materials with improved thermal stability, better light transmission, and enhanced mechanical properties, which is expected to boost segmental growth.

Additionally, the trend toward more efficient and cost-effective photovoltaic modules is projected to foster innovation in encapsulants, making them essential for the next generation of solar technologies.

By Application

Based on application, the photovoltaic materials market has been divided into residential, commercial, industrial, and utility-scale power generation. The utility-scale power generation segment garnered the highest revenue of USD 44.56 billion in 2023, propelled by the increasing deployment of large solar farms and renewable energy projects worldwide.

The rising global demand for clean energy, supported by government mandates, climate goals, and corporate sustainability initiatives, has led to substantial investments in utility-scale solar power projects. These large-scale installations are capable of generating vast amounts of electricity, which can be integrated into national grids to meet energy needs more sustainably.

The availability of vast land areas, technological advancements in solar panels, and the declining costs of photovoltaic materials have made utility-scale solar projects economically viable.

Additionally, supportive policies such as long-term power purchase agreements (PPAs) and tax incentives for renewable energy investments are prompting developers to focus on utility-scale installations. The ability of these projects to deliver a high return on investment and achieve economies of scale is further bolstering the expansion of the segment.

Photovoltaic Materials Market Regional Analysis

Based on region, the global market has been segmented into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific photovoltaic materials market accounted for a notable share of 44.41% and was valued at USD 40.84 billion in 2023. This expansion is primarily stimulated by rapid advancements in solar energy infrastructure across key countries such as China, India, and Japan. This dominance is reinforced by the substantial investments in renewable energy initiatives, particularly in China, which is the world’s largest producer and consumer of solar energy.

China's favorable government policies, extensive manufacturing base for photovoltaic materials, and large-scale solar power projects have significantly contributed to this considerable growth.

- In March 2024, BASF, in collaboration with Jiangsu Worldlight New Material, launched a total solution photovoltaic (PV) frame. This polyurethane composite frame with a water-borne coating reduces the product carbon footprint by 85% compared to aluminum frames and cuts VOC emissions by over 90%, offering a sustainable alternative for PV systems.

India is accelerating its solar energy expansion through the National Solar Mission, boosting demand for photovoltaic materials. Furthermore, the increasing electricity demand in Asia-Pacific, coupled with a rising focus on reducing carbon emissions, is compelling countries to adopt solar energy as a sustainable solution.

The growth of residential, commercial, and utility-scale solar installations across the region, supported by strong government incentives and declining solar panel costs, is anticipated to position Asia-Pacific as the largest market for photovoltaic materials.

Europe is projected to grow at a robust CAGR of 25.61% in the forthcoming years, largely due to the region's strong commitment to renewable energy adoption and stringent environmental policies. The European Union’s Green Deal, which aims for carbon neutrality by 2050, is fueling the expansion of solar energy installations across member states.

Countries such as Germany, Spain, and France are at the forefront of deploying large-scale solar projects and are actively promoting the adoption of photovoltaic systems for residential and commercial use. Government incentives, including feed-in tariffs and subsidies, are making solar energy more accessible and affordable for both consumers and businesses.

Moreover, Europe is heavily investing in research and development to improve solar panel efficiency and integrate advanced photovoltaic materials, such as perovskites, into the market. As solar technology costs decline and grid parity increases, the demand for photovoltaic materials in Europe is anticipated to rise.

Competitive Landscape

The global photovoltaic materials market report provides valuable insights, highlighting the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Photovoltaic Materials Market

Key Industry Development

- June 2024 (Expansion): DuPont and Desun Energy introduced flexible solar panels featuring DuPont Tedlar frontsheet at Intersolar Europe 2024. The Tedlar frontsheet offers mechanical toughness, abrasion resistance, and high light transmittance. Desun displayed these panels at its booth, highlighting their potential to enhance outdoor solar energy applications and improve the consumer experience.

The global photovoltaic materials market has been segmented:

By Type

- Silicon-based Materials

- Monocrystelline Silicon

- Polycrystelline Silicon

- Amorphous Silicon

- Inorganic Compounds-based Materials

- Gallium Arsenide (GaAs)

- Cadmium Telluride (CdTe)

- Cadmium Sulfide (CdS)

- Copper Indium Gallium Selenide (CIGS)

- Copper Indium Selenide (CIS)

- Others

- Organic Materials

- Perovskite Materials

By Product

- Front Sheet

- Encapsulant

- Back Sheet

- Others

By Application

- Residential

- Commercial

- Industrial

- Utility-Scale Power Generation

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America