Market Definition

The market encompasses the global industry involved in the manufacturing, distribution, and integration of sensors that detect objects, distances, or surface conditions using light-based technologies. This market includes a range of sensor types, such as through-beam, retro-reflective, and diffuse models.

It serves various sectors including industrial automation, packaging, material handling, consumer electronics, and automotive systems. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Photoelectric Sensor Market Overview

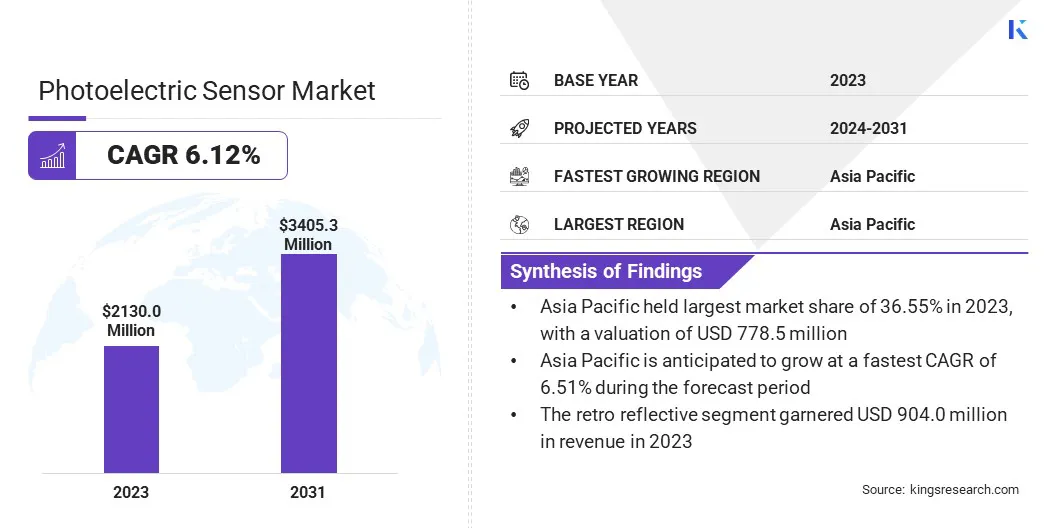

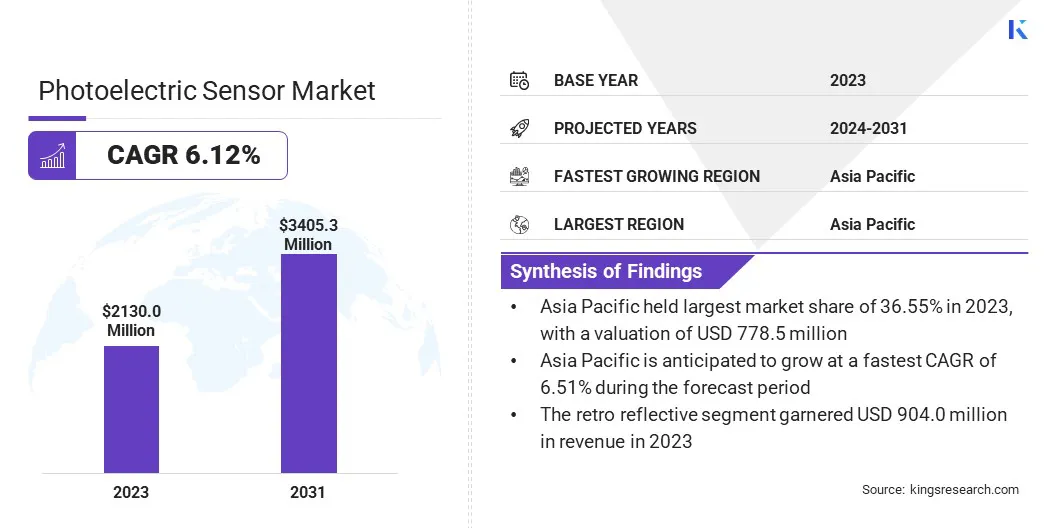

The global photoelectric sensor market size was valued at USD 2,130.0 million in 2023 and is projected to grow from USD 2,246.5 million in 2024 to USD 3,405.3 million by 2031, exhibiting a CAGR of 6.12% during the forecast period.

The market is driven by the rising demand for automation across industries such as manufacturing, packaging, and logistics. These sensors play a key role in improving production efficiency and quality control by enabling accurate object detection and positioning.

Major companies operating in the photoelectric sensor industry are Rockwell Automation, Eaton, Pepperl+Fuchs SE, Balluff GmbH, Schneider Electric, Panasonic Corporation, Autonics Corporation, ifm electronic gmbh, OMRON Corporation, Baumer, wenglor sensoric GmbH, SICK AG, Contrinex S.A., Banner Engineering Corp., and KEYENCE INDIA PVT. LTD.

Additionally, the growing use of robotics and the need for compact, reliable sensing solutions in consumer electronics and automotive applications are further supporting market expansion. Technological advancements are making these sensors more precise and energy-efficient.

- In December 2023, SICK introduced its next-generation W4S miniature photoelectric sensor family, featuring compact sensors with advanced Opto-ASIC filtering, intuitive BluePilot interface, and IO-Link connectivity.

Key Highlights

- The photoelectric sensor industry size was valued at USD 2,130.0 million in 2023.

- The market is projected to grow at a CAGR of 6.12% from 2024 to 2031.

- Asia Pacific held a market share of 36.55% in 2023, with a valuation of USD 778.5 million.

- The retro reflective segment garnered USD 904.0 million in revenue in 2023.

- The automotive segment is expected to reach USD 1,057.6 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 6.33% during the forecast period.

Market Driver

"Growing Demand for High-Precision Sensors in Real-Time Dimensional Inspection"

The photoelectric sensor market is witnessing significant growth due to the increasing demand for high-precision sensors in real-time dimensional inspection. As industries push for higher automation and efficiency in manufacturing, there is a greater need for sensors that can deliver accurate and instantaneous measurements.

These high-precision sensors enable automated inspection systems to ensure product quality by detecting minute dimensional deviations in real time, thus reducing the risk of defects and improving overall production efficiency.

Growing focus on quality control, increasing need for process optimization, and rising adoption of high-precision dimensional inspection in industries such as automotive and electronics are driving the market.

- In April 2025, OPT Machine Vision introduced the SmartAxis Series of Thrubeam Measurement Sensors, designed for high-precision, real-time dimensional inspection in industrial environments. The sensors feature dual telecentric high-resolution optical lenses and advanced image processing algorithms for enhanced accuracy and efficiency in automated inspection systems.

Market Challenge

"Environmental Interference in Photoelectric Sensing"

A major challenge in the photoelectric sensor market is dealing with environmental interference that can affect sensor performance, especially in harsh industrial settings. Factors such as dust, dirt, humidity, temperature fluctuations, and strong electromagnetic fields can cause sensors to misread or fail to detect objects accurately, leading to operational inefficiencies.

These challenges are particularly pronounced in industries like manufacturing, logistics, and automotive, where sensors are crucial for high-precision tasks. To mitigate these issues, manufacturers are developing photoelectric sensors with enhanced protective features, advanced filtering systems, and the ability to operate effectively in noisy environments.

By incorporating advanced technologies like adaptive signal processing, these sensors can maintain reliable performance, even in challenging conditions, ensuring greater operational uptime and efficiency.

Market Trend

"Advancements in 3D LiDAR Sensor Technology"

The photoelectric sensor market is evolving with significant advancements in 3D LiDAR sensor technology. This trend is driven by the growing demand for more precise and efficient sensing solutions in complex applications such as industrial automation, robotics, and autonomous vehicles.

Solid-state beam steering allows for enhanced stability and accuracy in distance measurements and object detection without relying on moving mechanical parts, making these systems more durable and cost-effective.

As industries seek sensors that can provide superior performance in dynamic environments, 3D LiDAR sensors with solid-state beam steering offer a more reliable and flexible solution, with capabilities for high-resolution 3D imaging, wide field-of-view, and superior object recognition.

- In May 2024, Lumotive and Hokuyo announced the commercial release of the world's first 3D LiDAR sensor with true solid-state beam steering. The sensor integrates Lumotive’s Light Control Metasurface (LCM) optical beamforming technology, marking a significant breakthrough in industrial automation and service robotics applications.

Photoelectric Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Diffused, Retro Reflective, Thru Beam

|

|

By End Use

|

Automotive, Military & Aerospace, Electronics & Semiconductor, Packaging, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Diffused, Retro Reflective, Thru Beam): The retro reflective segment earned USD 904.0 million in 2023 due to its ease of installation, reliable performance over long distances, and suitability for harsh industrial environments.

- By End Use (Automotive, Military & Aerospace, Electronics & Semiconductor, Packaging, and Others): The automotive segment held 32.77% of the market in 2023, due to the growing adoption of automation in vehicle assembly lines and the increasing use of sensors for safety and positioning applications.

Photoelectric Sensor Market Regional Analysis

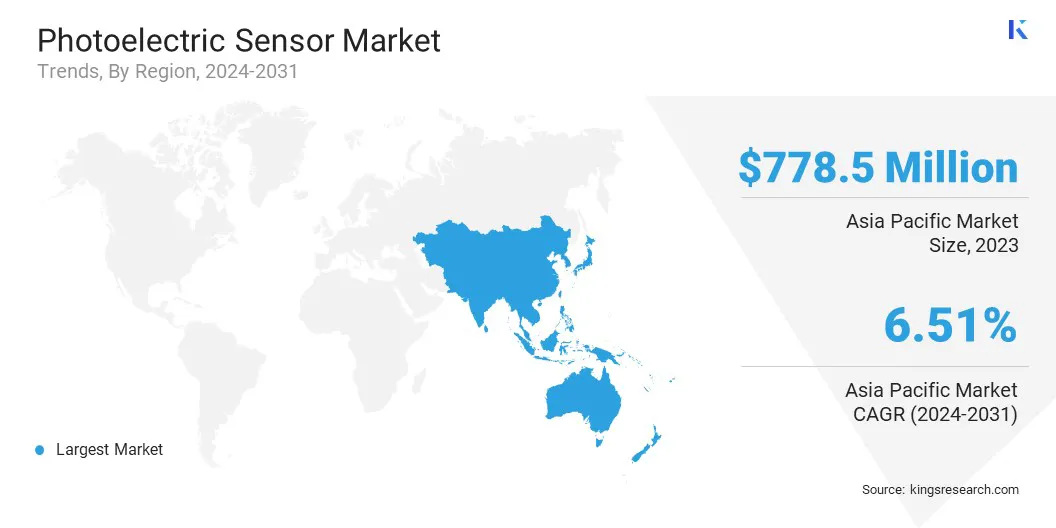

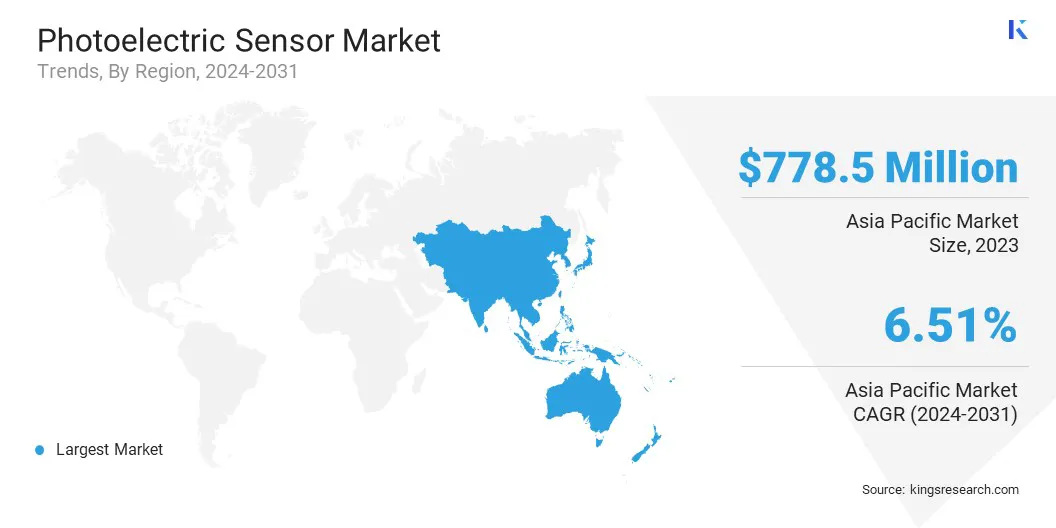

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific photoelectric sensor market share stood at around 36.55% in 2023 in the global market, with a valuation of USD 778.5 million. The region’s dominance is driven by its strong presence in electronics and consumer goods manufacturing, where photoelectric sensors are heavily used for high-speed inspection and automated assembly processes.

Japan contributes through its advanced robotics and precision machinery sectors, which rely heavily on sensor integration in robotics and CNC systems. Additionally, India’s rapid industrialization and increased investment in smart factories and automotive production are further fueling the adoption of photoelectric sensors in this region.

- In May 2024, Hikrobot introduced its latest machine vision photoelectric sensors for various distance detection applications in India. The sensors are designed to enhance factory automation and machine vision solutions across multiple industries.

Europe is expected to register the fastest growth in the photoelectric sensor industry, with a projected CAGR of 6.33% over the forecast period. Growth in this region is fueled by the widespread implementation of Industry 4.0 technologies in Germany, Italy, and France, where photoelectric sensors play a critical role in automated production and quality control systems.

Additionally, Europe’s well-established advanced manufacturing sector, including precision engineering and semiconductor equipment, is contributing to increased sensor adoption. The growing demand for miniaturized and high-performance sensors in sectors like pharmaceuticals and food processing is further driving market growth in this region.

Regulatory Frameworks

- In the U.S., photoelectric sensors are regulated by several government bodies that ensure their safety and performance. The Federal Communications Commission (FCC) regulates electromagnetic interference (EMI) and ensures sensors comply with electromagnetic compatibility (EMC) standards. Additionally, the National Institute of Standards and Technology (NIST) plays a role in defining measurement standards for sensors used in scientific and industrial applications.

- In Europe, sensors must comply with the CE marking requirements for conformity with EU legislation on safety, health, and environmental standards. The European Committee for Standardization (CEN) and the European Union (EU) establish relevant technical standards for sensor applications in sectors such as automotive, manufacturing, and healthcare.

Competitive Landscape

The photoelectric sensor industry is characterized by a strong focus on expanding market presence through strategic initiatives. Key participants are prioritizing product innovation by developing sensors with improved precision, design, and resistance to harsh environments.

Market players are investing in research and development to introduce multi-functional sensors that integrate seamlessly with modern automation systems. Strategic partnerships with system integrators and industrial automation firms are being leveraged to strengthen distribution networks and enhance solution offerings.

Additionally, companies are expanding their footprints in emerging markets through localized manufacturing, joint ventures, and tailored product lines designed to meet specific regional requirements.

- In March 2025, Balluff introduced a new generation of fork sensors, including an entry-level model and optimized versions. These sensors offer cost-effective, robust solutions for precise object detection, with features such as visible red transmitter light, IO-Link compatibility, and improved switching frequency for enhanced small-part detection and operational reliability.

List of Key Companies in Photoelectric Sensor Market:

- Rockwell Automation

- Eaton

- Pepperl+Fuchs SE

- Balluff GmbH

- Schneider Electric

- Panasonic Corporation

- Autonics Corporation

- ifm electronic gmbh

- OMRON Corporation

- Baumer

- wenglor sensoric GmbH

- SICK AG

- Contrinex S.A.

- Banner Engineering Corp.

- KEYENCE INDIA PVT. LTD.

Recent Developments (Product Launches)

- In November 2024, L-com, an Infinite Electronics brand, launched a new line of diffuse reflection photoelectric proximity sensors designed for industrial and warehouse automation, automotive, manufacturing, food and beverage, and robotics applications.

- In February 2024, SICK introduced the W10 photoelectric proximity sensor, the world’s first laser triangulation sensor with intuitive touchscreen operation. Designed for high versatility in object detection, the W10 features selectable operating modes, stainless steel IP69K-rated housing, and IO-Link functionality.