Market Definition

The global market encompasses technologies and systems that use photoacoustic principles to capture detailed images for medical and research applications. It covers two primary types, photoacoustic tomography (PAT) and photoacoustic microscopy (PAM), as well as their combined use across diverse fields.

The market is segmented by imaging type into pre-clinical imaging, which supports research and development activities, and clinical imaging, which assists in patient diagnostics and monitoring. The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Photoacoustic Imaging Market Overview

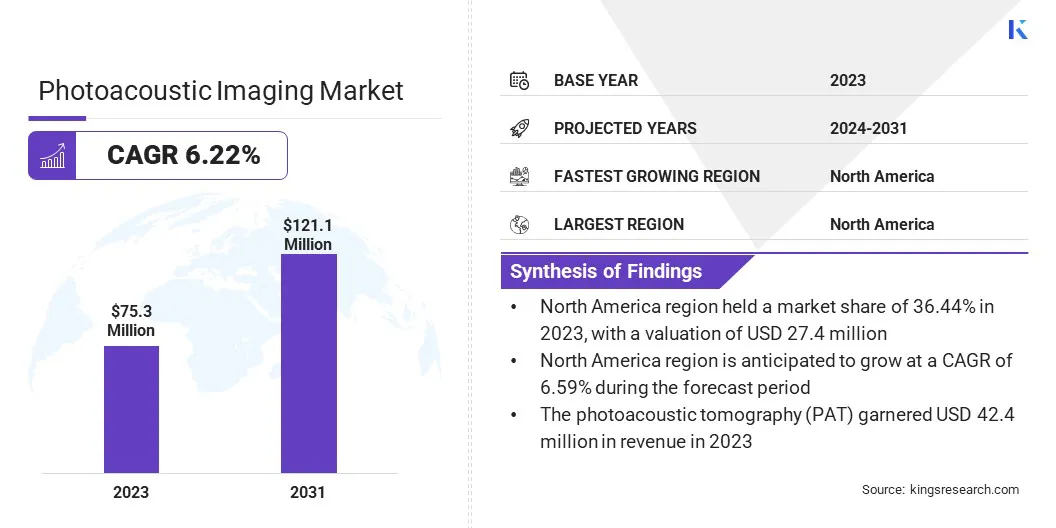

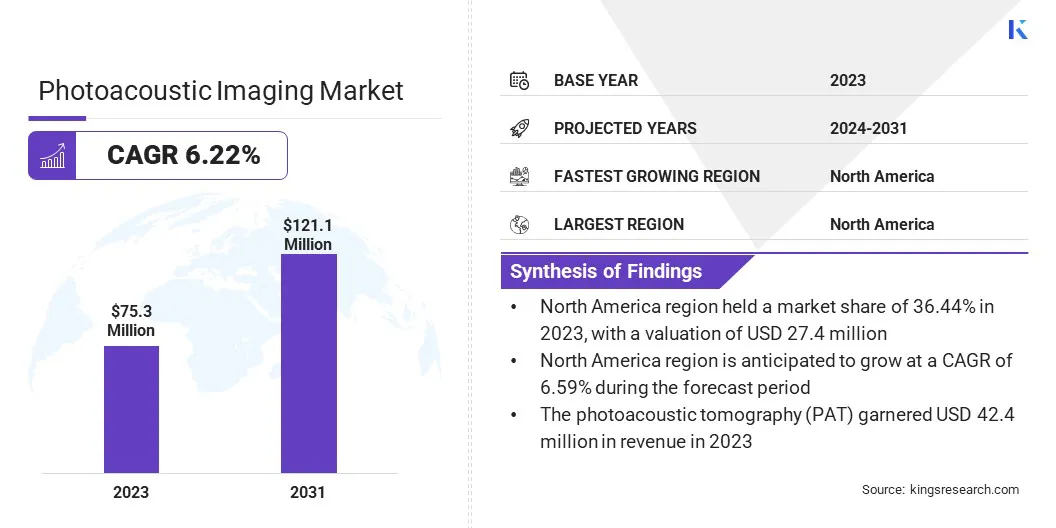

The global photoacoustic imaging market size was valued at USD 75.3 million in 2023 and is projected to grow from USD 79.4 million in 2024 to USD 121.1 million by 2031, exhibiting a CAGR of 6.22% during the forecast period.

The market is driven by advancements in medical imaging technologies and an increasing demand for non-invasive diagnostic methods. The growing prevalence of chronic diseases, such as cancer and cardiovascular disorders, which require early detection and accurate imaging techniques is driving market growth.

Major companies operating in the photoacoustic imaging industry are TomoWave Laboratories, Inc., InnoLas Laser GmbH, Seno Medical, ADVANTEST CORPORATION, ENDRA Life Sciences Inc., kibero, FUJIFILM VisualSonics, Inc., Cyberdyne Care Robotics GmbH, illumiSonics Inc., Aspectus GmbH, iThera Medical GmbH, HÜBNER Photonics, Litron Lasers, LUMIBIRD, and PreXion Inc.

The growing demand for advanced imaging technologies in research and clinical settings is a key driver of the market.

This technology offers high-resolution, real-time, and deep tissue imaging with minimal patient discomfort. Its ability to enable early and accurate disease detection, especially for conditions like cancer, supports better diagnosis and treatment planning. As a result, healthcare providers are increasingly adopting photoacoustic imaging to enhance patient outcomes and improve clinical decision-making.

- In October 2024, researchers from the Indian Institute of Technology Indore (IIT Indore) developed a compact and cost-effective cancer screening device utilizing photoacoustic technology. This device is designed to facilitate early-stage cancer detection for breast cancer.

Key Highlights:

- The photoacoustic imaging market size was recorded at USD 75.3 million in 2023.

- The market is projected to grow at a CAGR of 6.22% from 2024 to 2031.

- North America held a market share of 36.44% in 2023, with a valuation of USD 27.4 million.

- The photoacoustic tomography (PAT) segment garnered USD 42.4 million in revenue in 2023.

- The pre-clinical segment is expected to reach USD 65.4 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.01% during the forecast period.

Market Driver

Focus on Early Detection of Cancer

The global market is significantly driven by the increasing focus on the early detection of cancer. As cancer rates continue to rise globally, early detection has become crucial for improving treatment outcomes and survival rates.

Photoacoustic imaging plays a key role in this area by offering a non-invasive, high-resolution method to detect abnormal tissue and tumors at an early stage. This technology combines the advantages of optical and ultrasound imaging, providing detailed images of tissue structures without the need for radiation, making it ideal for cancer screening and diagnosis.

As healthcare systems worldwide emphasize preventive care and early diagnosis, photoacoustic imaging is becoming an essential tool in oncology accelerating the higher adoption of photoacoustic imaging solutions.

- In September 2024, researchers from Northeastern University developed a 3D imaging system for early lung cancer detection. This innovative system incorporates a miniaturized probe, and high-resolution 3D imaging to detect tumors at their earliest stages, before they grow and spread. The technology aims to differentiate between malignant and benign tumors.

Market Challenge

High Cost of Equipment and Technology

A major challenge in the photoacoustic imaging market is the high cost of equipment and technology, which limits its widespread adoption, especially in emerging markets. Photoacoustic imaging systems require specialized hardware and software for accurate imaging and reconstruction, which increases their price.

This cost barrier makes it difficult for many institutions to implement these technologies despite their potential benefits. To address this challenge, market players are developing cost-effective, compact systems that retain high-quality imaging capabilities. Innovations in miniaturization and the use of more affordable materials for manufacturing are further lowering production costs.

Market Trend

Integration with Android-based Applications

A key trend in the global market is the integration with Android-based applications for image reconstruction. This allows for real-time processing and analysis of photoacoustic tomography (PAT) images directly on mobile devices, such as smartphones and tablets.

By integrating these applications, healthcare professionals can access, analyze, and share images instantly, providing greater flexibility and convenience in clinical and research settings. This mobile integration speeds up decision-making and enhances collaboration among specialists, allowing them to remotely monitor and evaluate patients' conditions.

- In April 2023, researchers from Iowa State University's Department of Electrical and Computer Engineering developed the first-ever Android application for photoacoustic tomography (PAT) image reconstruction. This innovative mobile application is built on Python and designed for use in low-resource settings.

Photoacoustic Imaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Photoacoustic Tomography (PAT), Photoacoustic Microscopy (PAM)

|

|

By Imaging Type

|

Pre-clinical, Clinical

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Photoacoustic Tomography (PAT), Photoacoustic Microscopy (PAM)): The photoacoustic tomography (PAT) segment earned USD 42.4 million in 2023 due to its growing use in deep tissue imaging, non-invasive diagnostics, and its ability to provide high-resolution images without the risks associated with ionizing radiation.

- By Imaging Type (Pre-clinical, Clinical): The pre-clinical held 53.22% of the market in 2023, due to rising research activities in oncology, neurology, and cardiovascular studies, driven by the demand for accurate, real-time imaging technologies that support drug development and disease modeling.

Photoacoustic Imaging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America photoacoustic imaging market share stood around 36.44% in 2023 in the global market, with a valuation of USD 27.4 million. This dominance is due to the presence of advanced healthcare infrastructure, high adoption of innovative imaging technologies and significant investments in medical research.

Major universities, research institutions, and hospitals actively support the development and clinical use of photoacoustic imaging. In addition, the presence of leading market players, strong academic-industry collaborations, and an increasing number of clinical trials using photoacoustic imaging technologies have fueled demand. Government funding for cancer research and neurological studies has further accelerated market growth across the United States and Canada.

Asia Pacific is poised to grow at a significant growth at a CAGR of 6.01% over the forecast period. The growth is due to the rising healthcare expenditure, expanding research initiatives and increasing focus on early disease detection. Countries like China, Japan, and India are investing heavily in medical imaging technologies.

Growing collaborations between research organizations and healthcare companies are further strengthening the adoption of photoacoustic imaging across pre-clinical and clinical applications.

- In March 2025, researchers from the Indian Institute of Science (IISc) announced the development of a non-invasive technique for detecting glucose using photoacoustic sensing. The method involves shining a laser beam on biological tissue, causing it to absorb the light and generate ultrasonic sound waves. By analyzing these sound waves, the team was able to measure glucose concentrations in the tissue. This breakthrough offers a painless alternative to traditional blood glucose monitoring, which involves invasive needle pricks.

Regulatory Frameworks

- In the U.S, photoacoustic imaging systems are regulated by the Food and Drug Administration (FDA) under the Center for Devices and Radiological Health (CDRH), where they are classified as medical imaging devices and require 510(k) clearance before being marketed for clinical use.

- In Europe, photoacoustic imaging devices must comply with the Medical Device Regulation (MDR) (EU) 2017/745, which mandates strict clinical evaluation, conformity assessments, and CE marking before commercialization.

- In India, photoacoustic imaging devices are regulated by the Central Drugs Standard Control Organization (CDSCO) under the Medical Device Rules, 2017, where such devices are classified based on risk and require registration and approval for clinical use.

Competitive Landscape

The key players are actively investing in research and development to introduce advanced imaging systems with higher resolution and improved depth penetration. Many are expanding their product portfolios by integrating photoacoustic technology with ultrasound and optical imaging systems to enhance diagnostic capabilities.

Partnerships with research institutions and healthcare organizations are becoming a common strategy to accelerate clinical adoption and validate new technologies. Companies are focusing on securing regulatory approvals across major markets to support commercialization efforts. Strategic collaborations with hospitals and academic centers are being used to conduct clinical studies and generate strong clinical evidence.

- In July 2023, Seno Medical announced the inclusion of its Imagio Breast Imaging System in the 2023 update of the Digital Imaging and Communications in Medicine (DICOM) Standards. The system uses photoacoustic imaging to provide functional and anatomical breast imaging without the need for contrast agents. This integration improves interoperability with existing imaging systems and supports broader clinical adoption.

List of Key Companies in Photoacoustic Imaging Market:

- TomoWave Laboratories, Inc.

- InnoLas Laser GmbH

- Seno Medical

- ADVANTEST CORPORATION

- ENDRA Life Sciences Inc.

- kibero

- FUJIFILM VisualSonics, Inc.

- Cyberdyne Care Robotics GmbH

- illumiSonics Inc.

- Aspectus GmbH

- iThera Medical GmbH

- HÜBNER Photonics

- Litron Lasers

- LUMIBIRD