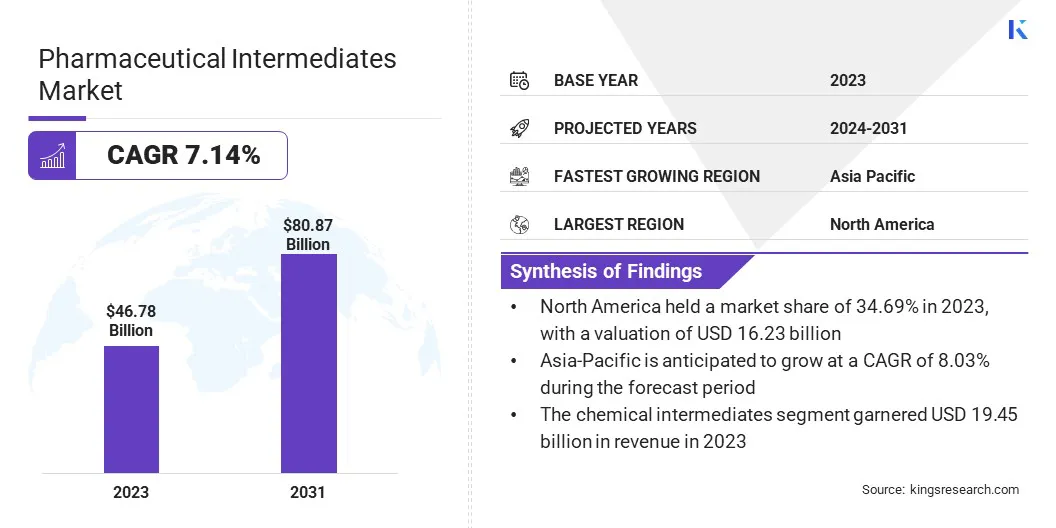

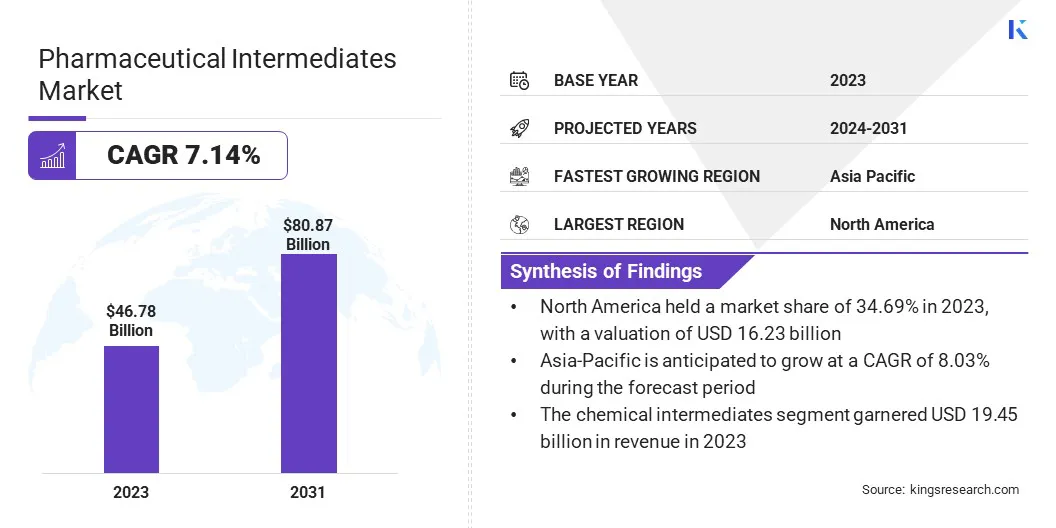

The global Pharmaceutical Intermediates Market size was valued at USD 46.78 billion in 2023 and is projected to grow from USD 49.91 billion in 2024 to USD 80.87 billion by 2031, exhibiting a CAGR of 7.14% during the forecast period. The market is expanding due to a surge in personalized medicine and advancements in drug development technologies.

The growing focus on precision medicine, which tailors treatments according to individual genetic profiles, drives the demand for specialized intermediates. Additionally, innovation in drug development enhances efficiency and reduces costs, further fueling market growth.

In the scope of work, the report includes solutions offered by companies such as A.R. Life Science Pvt, Ltd., Actylis, BASF, Chiracon GmbH, Codexis, Inc., Arkema, Green Vision Life Sciences, Lianhetech, Midas Pharma GmbH, Sanofi, and others.

The pharmaceutical intermediates market is expanding due to the rising prevalence of chronic diseases and increased R&D activities in the pharmaceutical industry. Additionally, the rising number of chronic diseases is contributing to the market growth.

- According to the WHO in 2023, noncommunicable diseases (NCDs) killed 41 million people annually, which equated to 74% of the global deaths. Each year, 17 million people die from an NCD before the age of 70, with 86% of these premature deaths occurring in low- and middle-income countries.

Pharmaceutical intermediates are crucial in developing drugs for cancer detection and chronic disease management. The growing need for novel therapies and diagnostics, coupled with extensive investments in drug research and development, is further fueling the market's growth.

Pharmaceutical intermediates are chemical compounds that serve as essential building blocks in the synthesis of active pharmaceutical ingredients (APIs). These intermediates undergo various chemical transformations to eventually produce the final API, which is crucial for the therapeutic efficacy of medications.

They play a pivotal role in the drug manufacturing process, ensuring that complex drug formulations meet quality and safety standards. Pharmaceutical intermediates are produced in bulk and must adhere to stringent regulatory requirements. Their importance lies in their ability to create novel and effective drugs, supporting advancements in medical treatments and healthcare outcomes.

Analyst’s Review

Collaborations between biotechnology and biopharmaceutical companies are driving market growth by enhancing the development of sustainable manufacturing processes for key intermediates and APIs. These partnerships facilitate more efficient, eco-friendly production routes, which not only improve product consistency and quality but also address environmental concerns.

- On January, 2024, Willow Biosciences Inc., a leading biotechnology company, announced a collaboration with Enterin, Inc., a clinical stage biopharmaceutical company to develop new sustainable manufacturing routes for key intermediates and active pharmaceutical ingredients (APIs) in treating neurodegenerative and metabolic disorders.

By leveraging their combined expertise, key players are advancing the market and contributing to more sustainable and effective drug development.

Increased investments in pharmaceutical research and development significantly drive the demand for pharmaceutical intermediates, which are crucial for synthesizing novel active pharmaceutical ingredients (APIs). As pharmaceutical companies intensify efforts to develop new and more effective drugs, the need for specialized intermediates grows.

These intermediates act as essential building blocks during drug formulation . Enhanced R&D activities result in the development of complex drug molecules, which require advanced intermediates. In addition, the pharmaceutical industry’s focus on cutting-edge treatments and novel drug candidates is expected to fuel the demand for intermediates and support market growth.

A key challenge in the pharmaceutical intermediates market is its stringent regulatory environment. Companies have to adhere to rigorous quality standards and compliance requirement. Additionally, the rising cost of raw materials and the complexities involved in scaling up production pose significant hurdles.

To mitigate these challenges, key players invest in advanced manufacturing technologies to improve efficiency and reduce costs. They also focus on strategic collaborations and partnerships to share expertise and resources, while ensuring regulatory compliance and product quality. By leveraging these strategies, companies can effectively navigate market challenges and sustain growth.

Pharmaceutical companies are exploring customized intermediates tailored to specific drug formulations or production processes, which is significantly propelling market growth.

This trend indicates the industry's shift toward more specialized and targeted drug development, requiring intermediates that meet precise chemical specifications. Customized intermediates are used to formulate highly specific drug compounds with enhanced efficacy and safety profiles.

As drug developers strive for precision medicine and innovative therapeutic solutions, the demand for tailored intermediates is expected to rise. This need for specialized intermediates supports advancements in drug manufacturing, is expected to drive the growth of the pharmaceutical intermediates market over the forecast period.

The market is experiencing increased adoption of advanced technologies, such as high throughput screening, bioinformatics, and combinatorial chemistry, to enhance drug candidate identification. This trend is accelerating the discovery and development of novel treatments for cancer, diabetes, and cardiovascular disorders.

Additionally, rising global disease incidence is driving this trend, further fueled by substantial increases in healthcare spending.

- According to an article published in the American Medical Association (AMA) in July 2024, health spending in the U.S. increased by 4.1% in 2022, reaching USD 4.5 trillion, or USD13,493 per capita.

This highlights the increased investment in innovative drug development, which is expected to fuel the market over the forecast period.

Segmentation Analysis

The global market has been segmented on the basis of product, application, end user, and geography.

By Product

Based on product, the pharmaceutical intermediates market has been segmented into chemical intermediates, bulk drug intermediates, and custom intermediates. The chemical intermediates segment accounted for the highest revenue of USD 19.45 billion in 2023.

This growth is driven by the increasing need for specialized chemicals in drug development, agrochemical formulations, and industrial processes. Innovations in chemical synthesis and advancements in technology are enhancing the production and efficiency of intermediates, further propelling market expansion.

Additionally, the shift towards sustainable and eco-friendly chemical processes is creating new opportunities within the segment. As industries seek to improve product performance and reduce environmental impact, the chemical intermediates segment is expected grow significantly over the forecast period.

By Application

Based on application, the market has been categorized into analgesics, ant-inflammatory drugs, cardiovascular drugs, anti-diabetic drugs, anti-cancer drugs, and others. The analgesics segment captured the largest pharmaceutical intermediates market share of 18.85% in 2023. Advances in drug formulation and the development of new analgesic compounds are enhancing treatment options and efficacy.

- For instance, in March 2022, Vertex Pharmaceuticals announced positive results for its non-opioid analgesic candidate, VX-548, in Phase II trials.

The segment is also benefiting from growing awareness of pain management and the availability of over-the-counter (OTC) analgesics. Additionally, the shift toward personalized medicine and improved drug delivery systems is contributing to market expansion. As healthcare providers focus on effective pain management and patients seek better management options, the analgesics segment is expected to see continued growth and innovation.

By End User

Based on end user, the market has been categorized into pharmaceutical & biotechnology companies, research laboratories & academics, and contract research organizations. The pharmaceutical & biotechnology companies segment is expected to account for the highest revenue of USD 58.38 billion by 2031, mainly driven by increased investments in research and development, technological advancements, and a growing demand for novel and effective treatments.

These companies are at the forefront of developing new therapies and advancing drug discovery processes, particularly in fields like oncology, rare diseases, and personalized medicine. The surge in strategic collaborations, mergers, and acquisitions is further fueling market expansion.

Additionally, the emphasis on biologics and advanced therapeutics is creating new opportunities. Continued innovation by these companies to address unmet medical needs is expected to drive the segment growth and significantly contribute to market expansion.

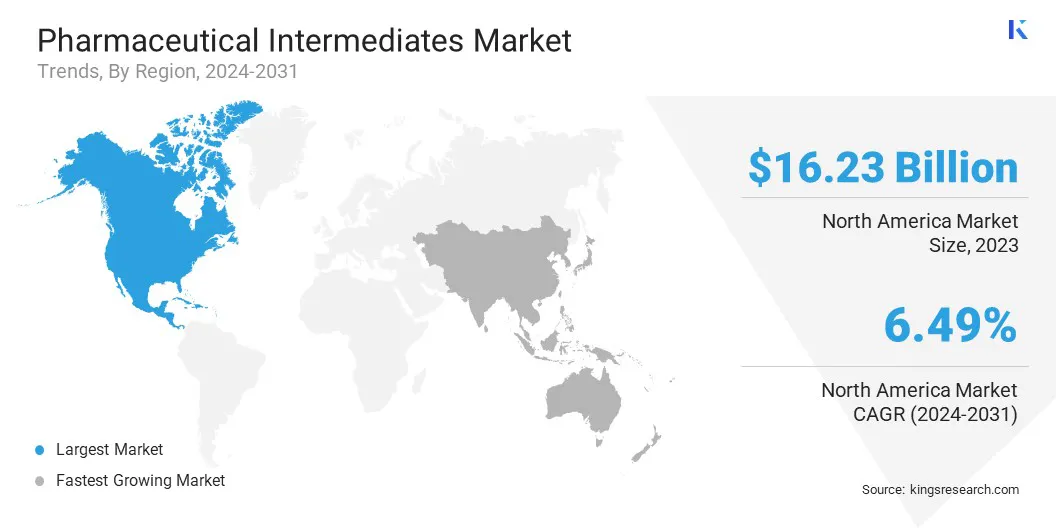

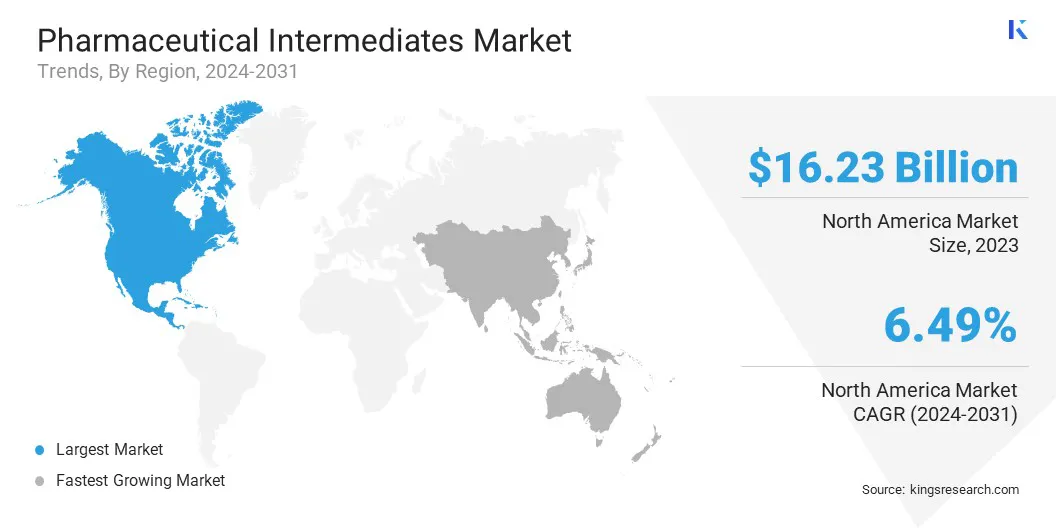

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America pharmaceutical intermediates market share stood around 34.69% in 2023 in the global market, with a valuation of USD 16.23 billion. The market in North Ameirca is driven by advanced healthcare infrastructure and substantial R&D investments.

The U.S. and Canada lead in drug development due to the increasing prevalence of chronic diseases like cancer and diabetes, fueling the demand for specialized intermediates in new formulations. The focus on personalized medicine and biotechnology innovations, combined with a supportive regulatory environment in the region, will likely accelerate market expansion.

As pharmaceutical companies continue to develop novel therapies and improve drug efficacy, the North American market is expected to experience steady and significant growth.

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 8.03% over the forecast period, due to the expanding pharmaceutical industry, increasing healthcare spending, and the rising prevalence of chronic diseases. Countries like China and India have become major manufacturing hubs due to their cost-effective production and significant R&D investments.

Government initiatives to improve healthcare infrastructure and favorable regulatory policies are also fueling market expansion. Key players in the region are focusing on strategic collaborations, mergers, and acquisitions, as well as investing in advanced manufacturing technologies.

- For instance, in March 2022, Sumitomo Chemical Co., Ltd. announced the construction of a new manufacturing plant for active pharmaceutical ingredients (APIs) and intermediates for small molecule drugs at its Oita Works in Japan. This project would enhance the company's capacity to supply high-quality APIs and intermediates to meet the growing demand for small molecule drugs. The new plant is scheduled to begin operations in September 2024.

These efforts are enhancing the market presence of companies and driving the demand for high-quality pharmaceutical intermediates.

Competitive Landscape

The global pharmaceutical intermediates market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategies, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Pharmaceutical Intermediates Market

- R. Life Science Pvt, Ltd.

- Actylis

- BASF

- Chiracon GmbH

- Codexis, Inc.

- Arkema

- Green Vision Life Sciences

- Lianhetech

- Midas Pharma GmbH

- Sanofi

Key Industry Development

- December 2023 (Partnership): Ami Organics Limited, a leading global manufacturer of advanced pharmaceutical intermediates, announced an agreement with Fermion to supply two additional active pharmaceutical ingredients (APIs). This partnership was aimed at expanding Ami Organics' product portfolio and enhancing its position in the global pharmaceutical market by meeting the growing demand for specialized APIs.

The global pharmaceutical intermediates market has been segmented as below:

By Product

- Chemical Intermediates

- Bulk Drug Intermediates

- Custom Intermediates

By Application

- Analgesics

- Ant-inflammatory Drugs

- Cardiovascular Drugs

- Anti-Diabetic Drugs

- Anti-Cancer Drugs

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Research Laboratories & Academics

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America