Market Definition

Pharmaceutical grade sodium chloride is a high-purity form of sodium chloride that meets stringent quality and regulatory standards for use in medical, pharmaceutical, and laboratory applications. It is manufactured under Good Manufacturing Practices (GMP) and complies with pharmacopeial standards.

This grade of sodium chloride has a purity level of at least 99.9% and is free from contaminants such as heavy metals, endotoxins, and microbial impurities.

Pharmaceutical Grade Sodium Chloride Market Overview

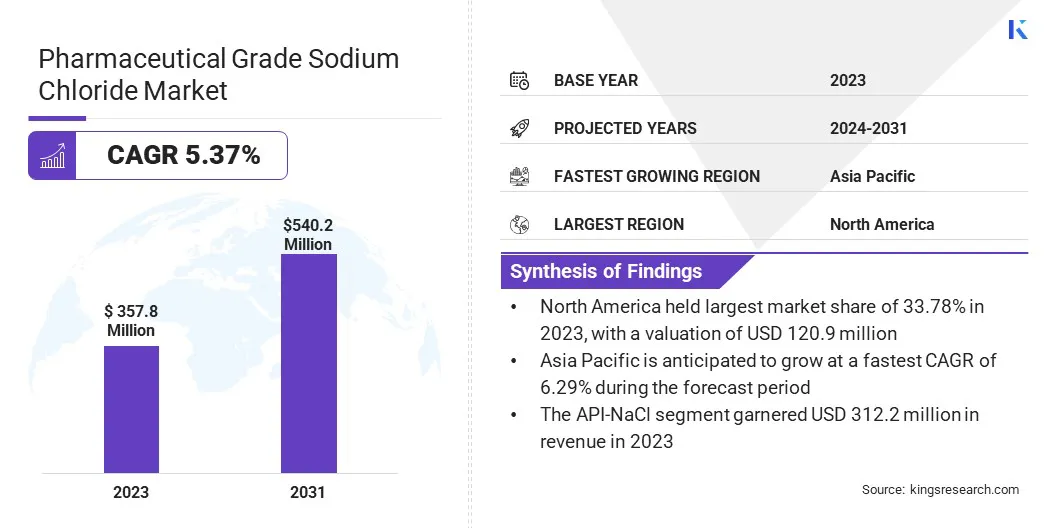

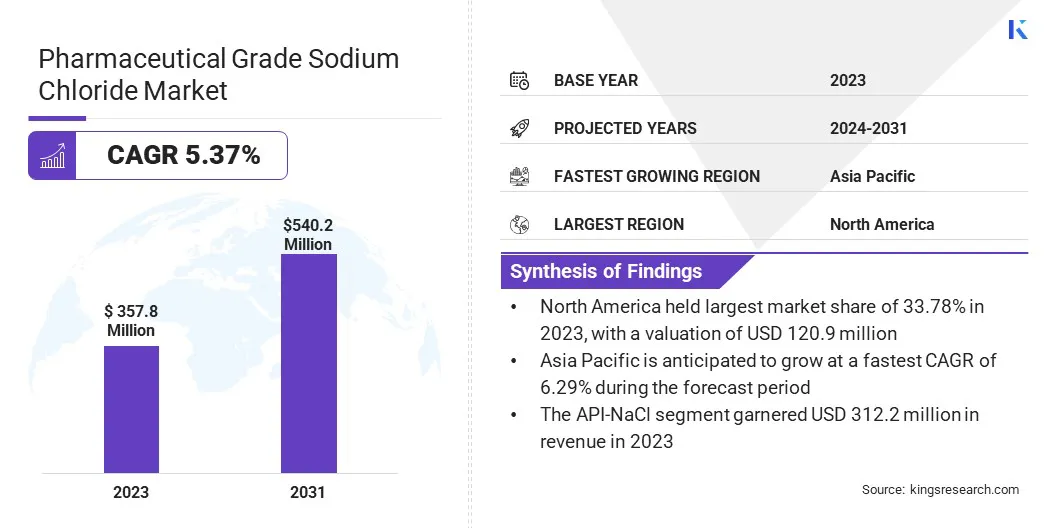

The global pharmaceutical grade sodium chloride market size was valued at USD 357.8 million in 2023 and is projected to grow from USD 374.5 million in 2024 to USD 540.2 million by 2031, exhibiting a CAGR of 5.37% during the forecast period.

This market is experiencing steady growth due to the increasing prevalence of chronic diseases, which has led to a higher demand for intravenous fluids, and dialysis solutions that rely on high purity sodium chloride.

Moreover, the growing adoption of sodium chloride in laboratory research and diagnostic applications, as well as in medical device cleaning and preservation, is further contributing to the market's expansion.

Major companies operating in the pharmaceutical grade sodium chloride market are Dominion Salt, Salins Group, K+S Aktiengesellschaft, Salinen Austria Aktiengesellschaft, Südwestdeutsche Salzwerke AG, Cheetham Salt Limited, HubSalt, HALOGENS, Merck KGaA, Otsuka Chemical Co.,Ltd., Alcatraz Chemicals, Nandu Chemicals, Sumitomo Mitsui Financial Group, OASIS FINE CHEM, and Thomas Scientific LLC.

The rising healthcare expenditure, advancements in hospital infrastructure, and the increasing focus on high-quality pharmaceutical ingredients are fueling demand for pharmaceutical-grade sodium chloride worldwide. worldwide.

- In December 2024, Baxter International Inc. launched five njectable pharmaceutical products in the U.S. These products utilize 0.9% sodium chloride injection as a delivery medium, ensuring stability, compatibility, and ease of administration.

Key Highlights:

- The pharmaceutical grade sodium chloride industry size was valued at USD 357.8 million in 2023.

- The market is projected to grow at a CAGR of 5.37%% from 2024 to 2031.

- North America held a market share of 33.78% in 2023, with a valuation of USD 120.9 million.

- The API-NaCl segment garnered USD 207.1 million in revenue in 2023.

- The hemodialysis segment is expected to reach USD 150.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.29% during the forecast period.

Market Driver

"Growing Healthcare Needs and Infrastructure Expansion Driving the Market"

The pharmaceutical grade sodium chloride market is experiencing significant growth, driven by the increasing prevalence of chronic diseases and the expansion of healthcare infrastructure worldwide .

The growing number of people suffering from kidney and cardiovascular disorders has increased the demand for intravenous (IV) fluids and dialysis treatments that depend on pharmaceutical grade sodium chloride.

In addition, the growing geriatric population, which is more susceptible to such conditions, further contributes to the increasing consumption of high purity sodium chloride in healthcare facilities.

- In December 2024, Endo, Inc. launched ADRENALIN (epinephrine in 0.9% sodium chloride injection) ready-to-use premixed IV bag, the first and only FDA-approved, manufacturer-prepared epinephrine premixed bag. This new product is a part of Endo Injectable Solutions' TruDelivery portfolio, that is developed to enhance workflow efficiency, reduce medication errors, and to eliminate the need for compounding, diluting, or mixing.

Additionally, the expansion of healthcare infrastructure and rising global healthcare expenditure are playing a crucial role in market growth. Governments and private sector players are investing heavily in modernizing hospitals, clinics, and pharmaceutical manufacturing facilities, particularly in emerging economies. This has led to a greater need for high-quality pharmaceutical ingredients, including sodium chloride.

Market Challenge

"Regulatory Compliance and Production Challenges hinders the Market Growth"

The pharmaceutical grade sodium chloride market faces challenges related to stringent regulatory compliance and fluctuations in raw material availability that impact production cost and supply consistency.

Regulatory authorities impose strict quality and purity standards to ensure pharmaceutical ingredients meet the highest safety requirements. Adherence to these evolving regulations requires manufacturers to invest heavily in quality control, advanced purification technologies, and extensive testing procedures.

To address this challenge, companies are integrating advanced analytical testing methods and automation in manufacturing, which enhance precision and minimize contamination risks to streamline regulatory approvals.

Another significant challenge is the fluctuation in raw material availability, primarily caused by environmental factors, mining restrictions and geopolitical instability that cause supply chain disruptions.

Additionally, rising production costs due to energy-intensive purification processes and the need for advanced refining technologies impact the affordability and availability of high purity sodium chloride for pharmaceutical applications.

To mitigate these risks, companies are diversifying their sourcing strategies by partnering with multiple raw material suppliers across different regions, ensuring a more stable supply chain.

Market Trend

"Increasing use of High Purity Sodium Chloride in Personalized Medicine"

The pharmaceutical grade sodium chloride market is witnessing notable trends such as the increasing adoption of high purity sodium chloride in biopharmaceutical manufacturing and the expanding use of sodium chloride in personalized medicine.

As the biopharmaceutical industry grows, the need for ultra-pure sodium chloride has surged due to its essential role in cell culture, drug formulation, and vaccine production.

The rise of biologics and gene therapies has increased the need for excipients that meet stringent purity and quality standards, ensuring product stability and effectiveness in critical pharmaceutical applications.

The expanding use of sodium chloride in personalized medicine and specialized treatments is also one of the leading trends in the global pharmaceutical-grade sodium chloride market. Pharmaceutical manufacturers are developing highly customized formulations that require precise ingredient composition and purity.

Sodium chloride plays a crucial role in these formulations by maintaining the correct osmotic balance and supporting the stability of intravenous (IV) solutions, ensuring proper hydration and electrolyte levels. In targeted drug delivery systems, sodium chloride helps in solubilizing and stabilizing active pharmaceutical ingredients, allowing for more effective and controlled release.

Additionally, in electrolyte-balancing formulations, it ensures that the right ion concentrations are maintained to match specific patient needs, particularly in cases of dehydration or electrolyte imbalances.

- In August 2023, Nexus Pharmaceuticals LLC secured U.S. FDA approval for its 0.9% Sodium Chloride Injection available in 10mL and 20mL single-dose vials. This, sodium chloride injection is a sterile, nonpyrogenic, isotonic solution used to dilute or dissolve drugs for injection.

Pharmaceutical Grade Sodium Chloride Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

API-NaCl, HD-NaCl

|

|

By Application

|

Injections, Hemodialysis, Hemofiltration Solutions, Channeling Agent, Oral Rehydration Salt, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (API-NaCl, HD-NaCl): The API-NaCl segment earned USD 207.1 million in 2023 due to its high demand in pharmaceutical formulations and stringent regulatory standards.

- By Application (Injections, Hemodialysis, Hemofiltration Solutions, and Channeling Agent): The hemodialysis segment held 27.89% of the market in 2023, due to the increasing prevalence of kidney diseases and the growing need for dialysis procedures.

Pharmaceutical Grade Sodium Chloride Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The pharmaceutical grade sodium chloride market in North America accounted for a substantial share of 33.78% in 2023 in globally, with a valuation of USD 120.9 million. The region's dominance is driven by its well-established pharmaceutical industry, regulatory frameworks, and a high demand for pharmaceutical-grade sodium chloride in critical medical applications.

This high demand is primarily attributed to the region’s advanced healthcare infrastructure, where pharmaceutical-grade sodium chloride is essential in formulations for intravenous (IV) solutions, hemodialysis, and electrolyte-balancing therapies.

The increasing focus on precision medicine and the need for customized drug formulations also contribute to the higher consumption of sodium chloride, as it plays a key role in maintaining osmotic balance and stability in specialized treatments.

Furthermore, the presence of major pharmaceutical manufacturers and ongoing research in drug formulation and biopharmaceuticals, particularly for chronic conditions like kidney disorders and cardiovascular diseases, continues to bolster the demand.

Asia Pacific is expected to register fastest growth in the pharmaceutical grade sodium chloride industry, with a projected CAGR of 6.29% over the forecast period. The rapid expansion is fueled by the booming pharmaceutical and biotechnology sectors in China, India, Japan, and South Korea.

The increasing healthcare investments and supportive government initiatives to strengthen local pharmaceutical manufacturing drives the market in this region.

The growing prevalence of chronic diseases, including diabetes and renal disorders, has escalated the need for hemodialysis and hemofiltration solutions, which are critical for managing these conditions. Hemodialysis, for instance, requires pharmaceutical-grade sodium chloride in its solutions to maintain the proper electrolyte balance and osmotic pressure during the filtration process.

This has significantly contributed to the rising demand for high-purity sodium chloride, further driving the market. In addition, China and India are emerging as key players in the production of Active Pharmaceutical Ingredients (APIs) and excipients. APIs are the active components in drug formulations, while excipients are inactive ingredients that support the stability, delivery, and effectiveness of the drug.

Both countries are becoming important suppliers of cost-effective pharmaceutical-grade sodium chloride, catering not only to their domestic markets but also to international demand. Their competitive pricing and large-scale manufacturing capabilities make them integral to the global supply chain of pharmaceutical-grade sodium chloride.

Regulatory Framework

- In the U.S., the U.S. Food and Drug Administration (FDA) regulate pharmaceutical-grade sodium chloride under Good Manufacturing Practices (GMP) and the United States Pharmacopeia standards. These regulations ensure that the product meets strict purity and safety requirements.

- In Europe, the European Medicines Agency (EMA) oversees the regulation of pharmaceutical-grade sodium chloride, which complies with the European Pharmacopoeia. This ensures uniform quality standards across all EU member states.

- In China, the National Medical Products Administration (NMPA) regulates pharmaceutical-grade sodium chloride in accordance with the Chinese Pharmacopoeia.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) enforces compliance with the Japanese Pharmacopoeia, ensuring that pharmaceutical sodium chloride meets high-quality standards for medical applications.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates pharmaceutical-grade sodium chloride under the Indian Pharmacopoeia.

Competitive Landscape:

The pharmaceutical grade sodium chloride industry is characterized by a number of participants. Market players compete based on product purity, production capacity, and distribution networks.

Companies with advanced manufacturing capabilities and well-integrated supply chains hold a strong position by ensuring consistentency in product quality and availability. Strategic partnerships with pharmaceutical and biotechnology firms, as well as healthcare institutions, further enhance market reach.

Additionally, market participants focus on geographic expansion to cater to the growing demand in emerging economies, where rising healthcare investments drive the need for high-quality pharmaceutical ingredients.

- In December 2024, Lakeside Holding Limited signed a USD 1.5 million sales agreement with Sinopharm Holding Hubei New Special Medicine Co., Ltd. The deal includes the supply of sodium bicarbonate, glucose, and glucose sodium chloride.

List of Key Companies in Pharmaceutical Grade Sodium Chloride Market:

- Dominion Salt

- Salins Group

- K+S Aktiengesellschaft

- Salinen Austria Aktiengesellschaft

- Südwestdeutsche Salzwerke AG

- Cheetham Salt Limited

- HubSalt

- HALOGENS

- Merck KGaA

- Otsuka Chemical Co.,Ltd.

- Alcatraz Chemicals

- Nandu Chemicals

- Sumitomo Mitsui Financial Group

- OASIS FINE CHEM

- Thomas Scientific LLC

Recent Developments (Partnership)

- In February 2025, Brenntag Specialties Pharma partnered with K+S Minerals and Agriculture GmbH for the distribution of three high-purity pharmaceutical salts, including Sodium Chloride (API and Excipient Grade) and Potassium Chloride (API). This collaboration strengthens Brenntag’s pharmaceutical portfolio with high-quality ingredients for pharmaceutical, medical nutrition, biopharma, and dietary supplement applications.