Market Definition

The market includes digital platforms designed to give patients secure access to personal health records, appointment scheduling, prescription refills, and direct communication with healthcare providers.

These portals support integration with Electronic Health Records (EHRs), enabling real-time updates and better care coordination. They are used in hospitals, clinics, and private practices to improve patient engagement and streamline administrative tasks. Their scope extends across chronic care management, preventive health, and post-treatment monitoring.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Patient Portal Market Overview

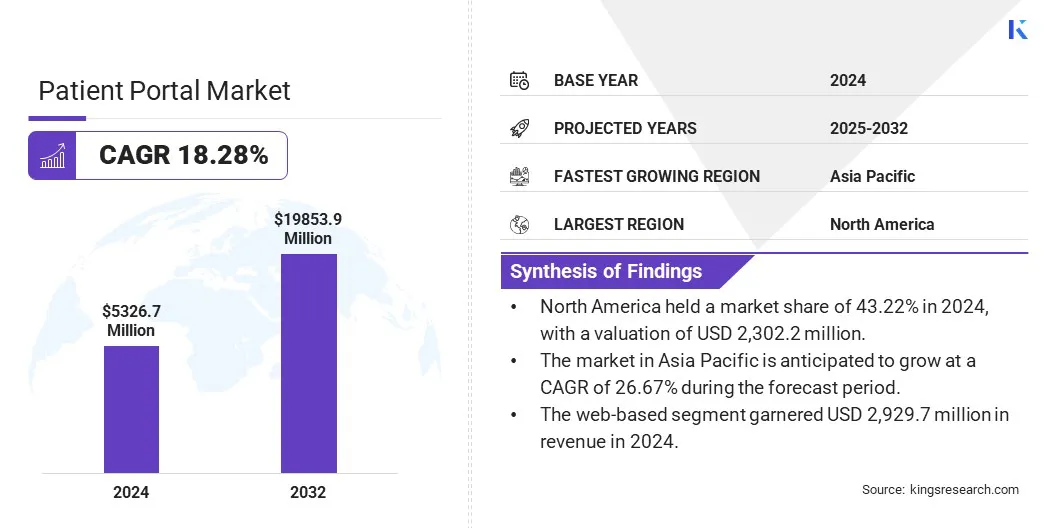

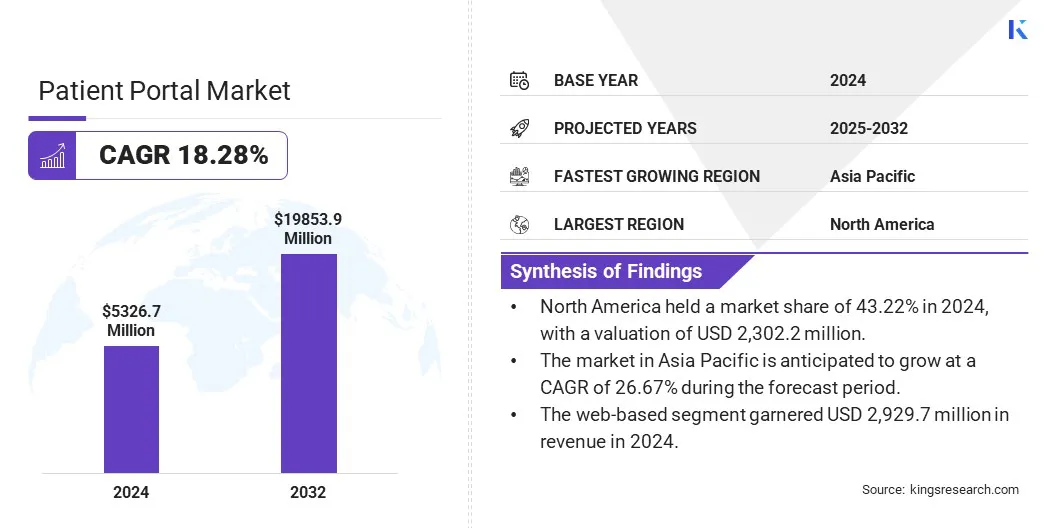

The global patient portal market size was valued at USD 5,326.7 million in 2024 and is projected to grow from USD 6,131.2 million in 2025 to USD 19,853.9 million by 2032, exhibiting a CAGR of 18.28% during the forecast period.

The market is driven by EHR integration, which enables seamless access to medical data, and ongoing technological advancements in healthcare IT. These developments enhance user experience, improve communication between patients and providers, and support efficient, patient-centered care delivery across digital platforms.

Major companies operating in the patient portal industry are Epic Systems Corporation, Cerner Corporation, athenahealth, Inc., eClinicalWorks, NextGen Healthcare, Inc., Greenway Health, LLC, General Electric Company, McKesson Corporation, Medfusion, Inc., Solutionreach, Inc., Updox, LLC, SimplePractice, LLC, My Clients Plus, LLC, Mend VIP, Inc., and Veradigm LLC.

The growth of the market is influenced by the rising patient demand for better involvement in their healthcare. Patients seek direct access to their medical records, lab results, and treatment plans.

This transparency empowers individuals to take charge of their health decisions. Healthcare providers leverage patient portals to improve communication, thus fostering trust and satisfaction. Enhanced patient engagement drives the adoption of these platforms, encouraging continuous use and integration into healthcare workflows.

- In June 2024, MEDITECH launched its redesigned Patient and Consumer Health Portal, now built on a cloud-based framework to enhance accessibility and simplify deployment. Available through the MHealth app, the portal enables patients to securely access their health information from any location.

Key Highlights

- The patient portal market size was valued at USD 5,326.7 million in 2024.

- The market is projected to grow at a CAGR of 18.28% from 2025 to 2032.

- North America held a market share of 43.22% in 2024, with a valuation of USD 2,302.2 million.

- The web-based segment garnered USD 2,929.7 million in revenue in 2024.

- The integrated patient portals segment is expected to reach USD 15,723.0 million by 2032.

- The providers segment secured the largest revenue share of 73.00% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 26.67% during the forecast period.

Market Driver

EHR Integration

The patient portal market benefits from seamless integration with EHR systems. This connection allows real-time updates on patient data, improving clinical workflows and accuracy. Healthcare providers gain quick access to critical information, reducing errors and enhancing care coordination.

It also ensures patients with timely updates and reminders, which strengthens the portal’s value, encouraging healthcare organizations to invest in patient portal solutions.

- In March 2024, the Captain James A. Lovell Federal Health Care Center (Lovell FHCC) in the U.S. launched a new Federal Electronic Health Record (FEHR) system. This initiative aimed to simplify the patient experience and enhance data sharing capabilities between the Department of Veterans Affairs (VA) and the Department of Defense (DOD), facilitating more coordinated care for beneficiaries.

Market Challenge

Data Privacy and Security Concerns

Data privacy and security concerns pose challenges to the market growth. Patients are often hesitant to use digital platforms, due to the fear of unauthorized access or misuse of sensitive health information.

Key players are adopting advanced encryption technologies, multi-factor authentication, and strict access controls. Many are also aligning with regional data protection regulations such as HIPAA, GDPR, or PIPL to build trust. Regular security audits and transparency in data handling practices are further helping vendors reassure users and maintain compliance in a highly regulated environment.

Market Trend

Technological Advancements in Healthcare IT

Advances in cloud computing, mobile technology, and data security contribute to the market expansion. Improved infrastructure enables scalable, user-friendly portals accessible on multiple devices. Enhanced security features protect patient information, addressing privacy concerns.

These technological improvements support wider adoption and better user experiences, encouraging healthcare providers to upgrade their patient engagement tools.

- In September 2024, Nova Scotia Health in Canada collaborated with Google Cloud to implement AI-driven solutions through cloud infrastructure. This partnership focuses on improving patient care, streamlining administrative workflows, and enhancing clinical decision-making by leveraging advanced capabilities like natural language processing.

Patient Portal Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment Mode

|

Web-based, Cloud-based, On-premise

|

|

By Portal Type

|

Integrated Patient Portals, Standalone Patient Portals

|

|

By End User

|

Providers, Payers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment Mode (Web-based, Cloud-based, On-premise): The web-based segment earned USD 2,929.7 million in 2024, due to its cost-effective deployment, easy accessibility through standard browsers, and minimal need for specialized infrastructure or software installation.

- By Portal Type (Integrated Patient Portals, Standalone Patient Portals): The integrated patient portals segment held 69.78% share of the market in 2024, due to their seamless connectivity with EHR, enabling efficient clinical workflows and comprehensive patient data access within a unified platform.

- By End User (Providers, Payers, Others): The providers segment is projected to reach USD 14,080.4 million by 2032, as healthcare organizations prioritize enhanced patient engagement and care coordination through secure, integrated digital platforms.

Patient Portal Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 43.22% share of the patient portal market in 2024, with a valuation of USD 2,302.2 million. Healthcare systems in North America, especially large hospital networks and outpatient centers, have widely adopted EHR. This creates a strong foundation for integrating patient portals.

The structured digital environment allows for smooth deployment and use of portal features like messaging, lab result access, and appointment management, accelerating the growth of the regional market.

- In February 2024, AdventHealth completed its transition from Cerner to Epic Systems across 37 hospitals. This USD 660 million project provided patients with a unified, cloud-powered portal for managing appointments, viewing test results, and communicating with providers, significantly improving the digital healthcare experience.

Moreover, the rise of telehealth and remote patient care across North America has made portals essential for sharing health records, video consultations, and secure messaging. Several healthcare providers rely on portals to maintain continuity of care outside in-person visits, accelerating the market expansion.

The patient portal industry in Asia Pacific is poised for significant growth at a robust CAGR of 26.67% over the forecast period. Asia Pacific is undergoing a fast transition toward digital healthcare systems. Hospitals and clinics are modernizing their IT infrastructure to improve efficiency and reduce manual workloads.

This shift creates strong demand for patient portals that support digital communication, EHR access, and streamlined administrative processes, directly contributing to the growth of the market. Furthermore, mobile health technology adoption is high across Asia Pacific, driven by widespread smartphone usage.

Patient portals that are optimized for mobile use gain faster acceptance among patients who prefer accessing health records or scheduling appointments on their phones.

- In October 2024, the National Health Authority of India announced a partnership with Google to integrate Ayushman Bharat Health Account (ABHA) ID cards into Google Wallet starting in 2025. This integration will enable over 600 million cardholders to manage their health records digitally via smartphones.

Regulatory Frameworks

- The patient portal market in the U.S. is primarily governed by the Health Insurance Portability and Accountability Act (HIPAA), which ensures the security and privacy of patients’ electronic health information. Additionally, the 21st Century Cures Act mandates open access to EHR, promoting interoperability and prohibiting information blocking.

- In the UK, the Data Protection Act 2018 governs the processing of personal health information and is aligned with the principles of the General Data Protection Regulation (GDPR). It sets clear obligations for healthcare providers using patient portals, including lawful data processing, consent requirements, and access rights for patients. The legislation ensures that digital health platforms operate transparently and protect sensitive medical data.

- China’s Personal Information Protection Law (PIPL), implemented in 2021, imposes detailed requirements for collecting and processing health data. It mandates informed consent and restricts cross-border data transfers. Combined with the Cybersecurity Law, which enforces data localization and network security, these regulations create a tightly controlled environment for patient portals, especially those operated by foreign vendors or handling sensitive clinical information.

- In Japan, the Protection of Personal Information (APPI) Act governs the collection and use of personal data, including medical records. Under APPI, healthcare providers and tech firms offering patient portals must obtain explicit consent before using health information. They are also responsible for ensuring the accuracy and security of stored data. The regulation emphasizes transparency and user rights across all digital healthcare platforms.

Competitive Landscape

Market players are focusing on innovation and improving technology to enhance patient portal platforms. These advancements are helping patients access and share their health information more easily and securely. Companies are creating systems that encourage patient engagement and improve care coordination by upgrading features that support better data sharing and user control.

- In August 2024, Epic Systems introduced a new feature in its MyChart patient portal, allowing patients to share their medical records with health and wellness apps. This enhancement aims to improve interoperability and patient engagement by enabling seamless data exchange between healthcare providers and third-party applications. The feature empowers patients to have greater control over their health information, facilitating better coordination of care and personalized health management.

List of Key Companies in Patient Portal Market:

- Epic Systems Corporation

- Cerner Corporation

- athenahealth, Inc.

- eClinicalWorks

- NextGen Healthcare, Inc.

- Greenway Health, LLC

- General Electric Company

- McKesson Corporation

- Medfusion, Inc.

- Solutionreach, Inc.

- Updox, LLC

- SimplePractice, LLC

- My Clients Plus, LLC

- Mend VIP, Inc.

- Veradigm LLC

Recent Developments (Product Launches)

- In October 2024, eClinicalWorks introduced a suite of AI-powered enhancements to its patient engagement solutions. These tools are designed to optimize practice efficiency and improve patient interactions by providing intelligent scheduling, automated reminders, and personalized health information access. The advancements reflect eClinicalWorks' commitment to leveraging AI to enhance healthcare delivery.

- In April 2024, Solutionreach announced a new feature allowing prospective patients to request appointments directly through its patient portal. This addition is part of Solutionreach's ongoing efforts to improve the customer experience by streamlining the appointment scheduling process and enhancing patient-provider communication.