Market Definition

The market involves the diagnosis, prevention, and correction of misaligned teeth and jaws through various treatment solutions and services. It includes product segments such as fixed braces, removable braces, retainers, and orthodontic accessories, all aimed at dental realignment.

The market is segmented by age group, catering to both children & teenagers and adults, reflecting the increasing demand for orthodontic treatments across different life stages. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Orthodontics Market Overview

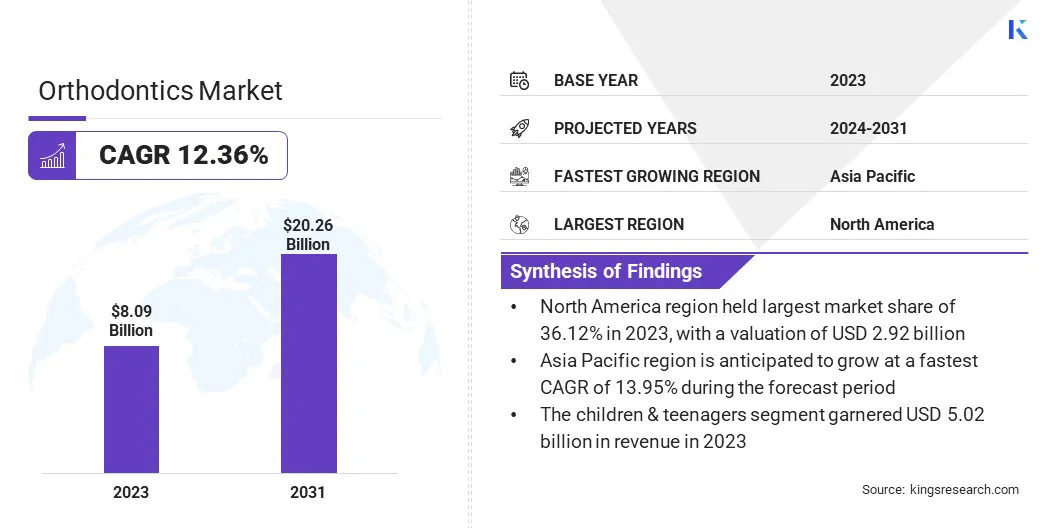

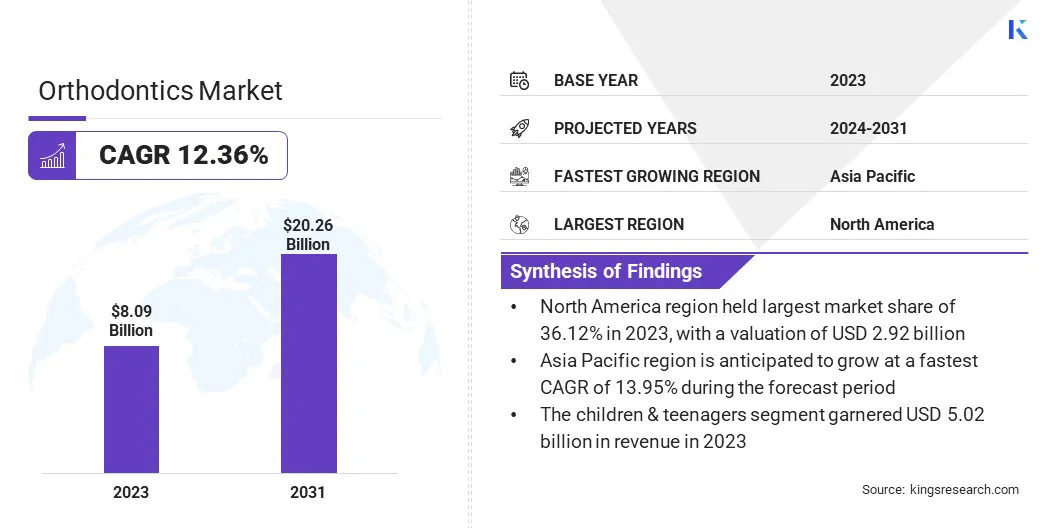

The global orthodontics market size was valued at USD 8.09 billion in 2023 and is projected to grow from USD 8.96 billion in 2024 to USD 20.26 billion by 2031, exhibiting a CAGR of 12.36% during the forecast period.

Market growth is driven by the increasing awareness of oral health. The rising awareness of dental alignment's role in oral hygiene is boosting demand for orthodontic treatments.

Educational initiatives highlighting the long-term benefits of early intervention for malocclusion and other dental issues have contributed to a rise in preventive care and cosmetic procedures. Additionally, the growing focus on aesthetics and self-care is prompting more adults to seek orthodontic treatments, fueling market growth.

Major companies operating in the orthodontics industry are Ultradent Products Inc., Dentsply Sirona, Henry Schein Orthodontics, 3M, T.P. Orthodontics, Envista Holdings, Rocky Mountain Orthodontics, Align Technology, Inc., JJ Orthodontics Pvt.Ltd., MATT ORTHODONTICS, LLC, Great Lakes Dental Technologies., American Orthodontics, Institut Straumann AG, G&H Orthodontics., and DENTAURUM GmbH & Co. KG

Moreover, breakthroughs in orthodontic technology, such as 3D printing, are reshaping market landscape. These innovations allow for highly accurate treatment planning and the production of personalized aligners and braces, improving treatment outcomes and reducing patient time in the orthodontist’s office.

The use of 3D printing systems streamlines the manufacturing of orthodontic devices, enhancing precision, comfort, and efficiency. These technological advancements are fostering market growth by delivering superior results and optimizing patient care.

- In April 2024, KLOwen Orthodontics launched the industry's only custom metal self-ligating (SL) solution at AAO, receiving a 2024 Ortho Innovator Honorable Mention. This solution combines low-friction ligation with custom prescriptions, offering shorter ligation appointments, faster initial alignment, and enhanced control of tooth positioning.

Key Highlights:

- The orthodontics industry size was recorded at USD 8.09 billion in 2023.

- The market is projected to grow at a CAGR of 12.36% from 2024 to 2031.

- North America held a share of 36.12% in 2023, valued at USD 2.92 billion.

- The fixed braces segment garnered USD 3.08 billion in revenue in 2023.

- The children & teenagers segment is expected to reach USD 11.66 billion by 2031.

- The dental clinics segment is expected to reach USD 11.33 billion by 2031.

- The Direct Sales segment is estimated to generate a revenue of USD 8.997 billion by 2031.

- Asia Pacific is anticipated to grow at a robust CAGR of 13.95% through the forecast period.

Market Driver

"Increasing Focus On Dental Health"

The orthodontics market is experiencing significant growth due to the increasing focus on dental health. As awareness about the importance of maintaining proper oral hygiene and the long-term benefits of dental alignment rises, more individuals are seeking orthodontic treatments.

Proper alignment improves aesthetics and reduces the risk of dental issues such as gum disease, tooth decay, and uneven wear. The growing focus on oral health is further driven by increased education about the impact of misalignment on overall well-being, leading more people to invest in orthodontic solutions.

This shift toward prioritizing dental health is fueling demand. Additionally, advancements in orthodontic technology and customization options are making treatments more effective and accessible.

- In March 2025, the World Health Organization (WHO) highlighted that oral diseases, affecting nearly 3.7 billion people, pose a significant global health burden. Following the WHO Global Oral Health Meeting in November 2024, the Bangkok Declaration – No Health Without Oral Health was adopted. This Declaration emphasizes the integration of oral health into broader public health goals, including non-communicable diseases, universal health coverage, and environmental sustainability.

Market Challenge

"High Cost of Treatment"

A major challenge impeding the expansion of the orthodontics market is the high cost of treatment, particularly for advanced solutions such as clear aligners and customized braces.

Many patients find these treatments expensive, which can limit access to orthodontic care, particularly in developing regions or for those without adequate insurance coverage. The cost barrier impacts patient adoption and limits market growth.

To mitigate this challenge, market participants are developing technology-driven solutions, such as 3D printing and digital treatment planning, which can streamline production and reduce treatment costs.

By improving efficiency and reducing material waste, these technologies can make orthodontic treatments more affordable and accessible, thereby boosting market expansion and providing access to quality care.

Market Trend

"Advancements in 3D Technology"

The global orthodontics market is experiencing substantial growth, propelled by advancements in 3D printing systems. The integration of 3D printing technology is revolutionizing orthodontic treatment by enabling the creation of highly customized aligners and braces tailored to individual patient needs.

This technology ensures a precise fit, improving treatment outcomes and enhancing patient comfort. Additionally, 3D printing systems allow for faster production of orthodontic devices, reducing lead times and streamlining treatment process.

3D printing enables more complex and accurate designs, significantly enhancing the efficiency, flexibility, and overall effectiveness of orthodontic treatments.

- In September 2023, Align Technology, Inc. introduced the Invisalign Palatal Expander System, its first direct 3D printed device based on proprietary and patented technology. The Invisalign Palatal Expanders are designed for rapid expansion and subsequent holding of the narrow maxilla (upper jaw) during treatment of growing patients with primary, mixed, or permanent dentition. It offers a safe, comfortable, and clinically effective alternative to traditional metal palatal expanders.

Orthodontics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Fixed Braces, Removable Braces, Retainers, Orthodontic Accessories

|

|

By Age Group

|

Children & Teenagers, Adults

|

|

By End User

|

Dental Clinics, Hospitals, Others

|

|

By Distribution Channel

|

Direct Sales, Distributors, Online Platforms

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Fixed Braces, Removable Braces, Retainers, Orthodontic Accessories): The fixed braces segment earned USD 3.08 billion in 2023 due to their widespread use in long-term orthodontic treatments and high effectiveness in complex dental corrections.

- By Age Group (Children & Teenagers, Adults): The children & teenagers held 62.09% of the market in 2023, due to the early intervention approach and rising prevalence of malocclusion among younger populations.

- By End User (Dental Clinics, Hospitals, Others): The dental clinics segment is projected to reach USD 11.33 billion by 2031, owing to the increasing preference for specialized and convenient orthodontic care settings.

- By Distribution Channel (Direct Sales, Distributors, Online Platforms): The direct sales segment is projected to reach USD 9.00 billion by 2031, owing to strong manufacturer-clinic relationships and better cost efficiency for bulk purchasing.

Orthodontics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America orthodontics market share stood at around 36.12% in 2023, valued at USD 2.92 billion. This dominance is reinforced by the region's well-established healthcare infrastructure, high awareness regarding dental aesthetics, and a strong concentration of orthodontic professionals.

The adoption of cutting edge technologies such as AI powered treatment planning, 3D printing for orthodontic appliances, and digital intraoral scanning has further propelled regional market growth.

In addition, favorable reimbursement policies, widespread dental insurance coverage, and high levels of disposable income allow patients to invest in orthodontic treatments. The growing popularity of minimally visible orthodontic options, particularly among adults, has contributed to regional market expansion.

Major orthodontic device manufacturers based in North America, supported by a strong network of distributors and dental clinics, are curcial for ensuring the availability and continuous innovation of orthodontic solutions in the region.

Asia Pacific orthodontics industry is poised to grow at a robust CAGR of 13.95% over the forecast period. This expansion is fueled by rapid urbanization, growing middle-class populations, and rising awareness of dental care and aesthetics across emerging economies such as China, India, and Southeast Asian countries.

Additionally, improving access to dental services, expanding healthcare expenditure, and the rising presence of international orthodontic brands in the region are accelerating regional market growth.

- In September 2024, OrthoFX launched its advanced NiTime Clear Aligners in India. NiTime Clear Aligners, designed for shorter wear times, received FDA clearance under 510(k) and can treat all classes of dental malocclusions. The aligners are made with a proprietary polymer material and AirShell technology, offering enhanced predictability and improved patient compliance. The company showcased this innovation at the 58th Indian Orthodontic Conference in Bengaluru.

Regulatory Frameworks

- In the U.S., orthodontic devices, including braces, clear aligners, and retainers, are regulated by the Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act. These devices must receive FDA clearance or approval, typically through the 510(k) premarket notification process, to ensure safety and efficacy.

- In Europe, orthodontic products are regulated under the European Union Medical Device Regulation (MDR), which mandates a conformity assessment by a Notified Body. Devices must meet safety and performance standards and bear the CE mark before being marketed in the EU.

Competitive Landscape

Companies operating in the orthodontics industry are focusing on the development of cutting-edge materials and technologies, such as polymers for clear aligners, and integrating 3D printing for more precise devices. These innovations enhance comfort, effectiveness, and aesthetics.

Geographic expansion is another key strategy, with companies targeting emerging markets in Asia Pacific and Latin America. By establishing local production and forming partnerships with regional distributors, businesses can tap into the growing demand for orthodontic treatments in these rapidly expanding markets.

Strategic partnerships and collaborations are prevalent as companies partner with dental professionals, orthodontic clinics, and technology providers to expand product offerings and distribution channels. This approach allows companies to reach broader customer bases and offer tailored solutions.

Additionally, there is a growing focus on direct-to-consumer channels, with companies leveraging online platforms for virtual consultations, remote monitoring, and home delivery services to enhance accessibility and convinience in orthodontic care.

- In March 2025, OrthoFX launched a new website showcasing its complete portfolio of clear aligner systems, featuring the latest polymer innovation, AirFlex. The new generation of aligners, including AirFlex, FXBright, and FXClear, is designed to enhance predictability and improve patient compliance, offering orthodontists a broad selection of treatment options to meet their patients' needs.

List of Key Companies in Orthodontics Market:

- Ultradent Products Inc.

- Dentsply Sirona

- Henry Schein Orthodontics

- 3M

- T.P. Orthodontics

- Envista Holdings

- Rocky Mountain Orthodontics

- Align Technology, Inc.

- JJ Orthodontics Pvt.Ltd.

- MATT ORTHODONTICS, LLC

- Great Lakes Dental Technologies.

- American Orthodontics

- Institut Straumann AG

- G&H Orthodontics.

- DENTAURUM GmbH & Co. KG

Recent Developments (M&A)

- In January 2024, Align Technology, Inc. completed the acquisition of Cubicure GmbH, a leader in direct 3D printing for polymer additive manufacturing. This acquisition strenghthens Align's digital platform and enhances its 3D printing, materials, and manufacturing capabilities. Cubicure’s patented Hot Lithography technology will support the development of innovative materials and processes for 3D printed products, including Align's first direct 3D printed orthodontic device, the Invisalign Palatal Expander system.

- In April 2023, Henry Schein, Inc. acquired a majority stake in Biotech Dental S.A.S., a rapidly growing provider of dental implants, clear aligners, and innovative digital dental software based in Salon-de-Provence, France. Biotech Dental's offerings include Nemotec, a comprehensive diagnostic and planning software suite, and it is among France’s leading manufacturers of custom abutments, implants, and clear aligners.