Market Definition

The market focuses on the development, production, and commercialization of solar energy devices that utilize organic materials, primarily conductive polymers and small organic molecules for light absorption and charge transport.

These solar cells form an emerging segment of the renewable energy sector, offering advantages such as lightweight design, flexibility, semi-transparency, and cost-effective, large-scale production via solution-based printing.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Organic Solar Cell Market Overview

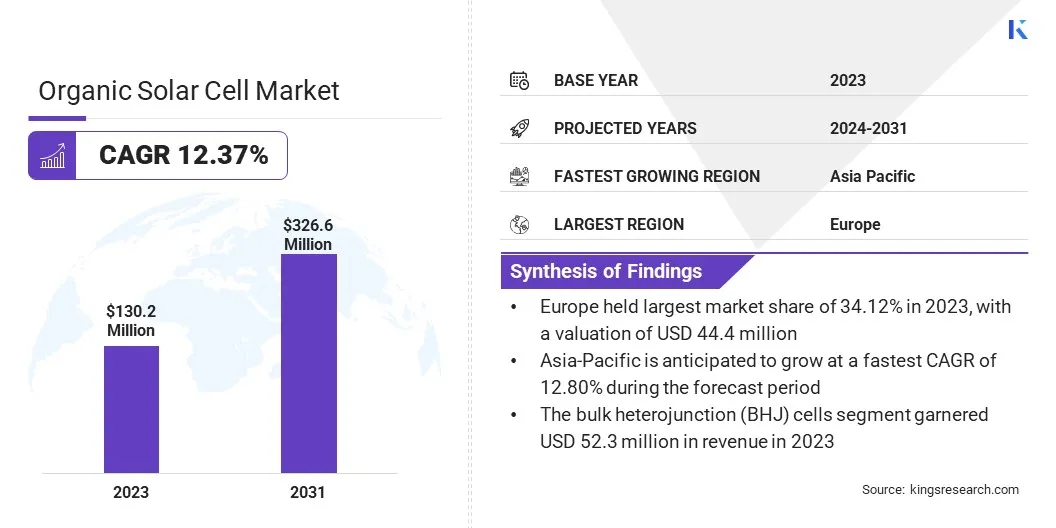

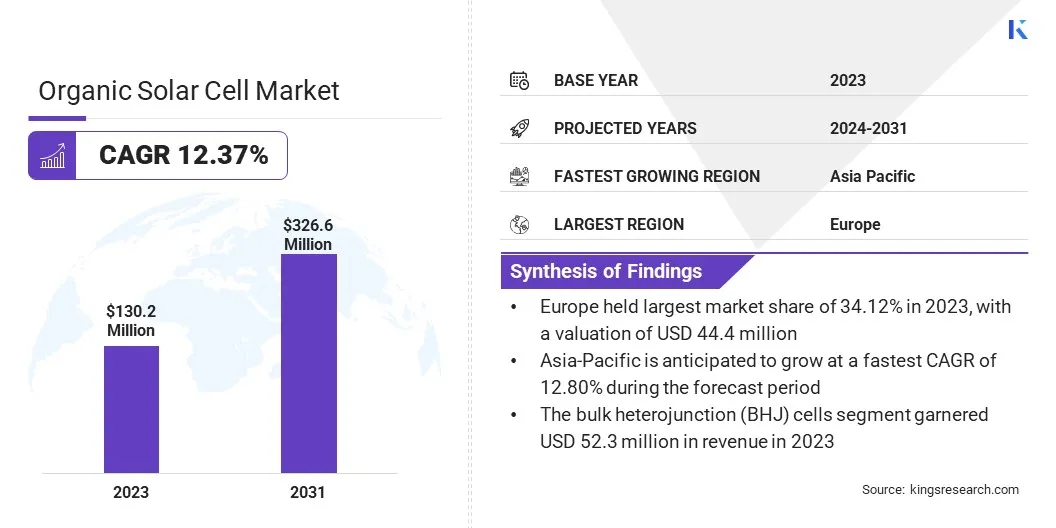

The global organic solar cell market size was valued at USD 130.2 million in 2023 and is projected to grow from USD 144.4 million in 2024 to USD 326.6 million by 2031, exhibiting a CAGR of 12.37% during the forecast period.

The market is driven by the increasing demand for lightweight, flexible, and sustainable energy solutions. Organic solar cells are gaining traction in sectors such as consumer electronics, automotive, and building-integrated photovoltaics as the global focus intensifies on reducing carbon emissions and integrating renewable energy into diverse applications.

Their unique properties such as mechanical flexibility, semi-transparency, and compatibility with roll-to-roll manufacturing position them as attractive alternatives to conventional solar technologies.

Major companies operating in the organic solar cell industry are ARMOR GROUP, BELECTRIC GmbH, infinityPV ApS, Mitsubishi Chemical Group Corporation., Sumitomo Chemical Co., Ltd., Advent Technologies, TOSHIBA CORPORATION, Heraeus Epurio, Raynergy Tek Incorporation, NanoFlex Power Corporation, PolyPV, Dracula Technologies, Epishine, Solivus, and Heliatek.

Advancements in organic photovoltaic materials and device architectures are supporting the market expansion. Innovations that enhance power conversion efficiency, improve long-term stability, and reduce production costs are making organic solar cells more commercially viable.

These developments enable scalable and cost-effective deployment, particularly in applications requiring lightweight and adaptable energy solutions, further fueling the market.

- In January 2025, researchers at Åbo Akademi University in Finland made a key breakthrough in organic solar cell technology by addressing an unknown loss mechanism. By applying a silicon oxide nitrate (SiOxNy) passivation layer, they reduced recombination losses, achieving over 18% efficiency and a projected lifespan of over 16 years, enhancing the commercial potential of organic photovoltaics.

Key Highlights

Key Highlights

- The organic solar cell industry size was valued at USD 130.2 million in 2023.

- The market is projected to grow at a CAGR of 12.37% from 2024 to 2031.

- Europe held a market share of 34.12% in 2023, with a valuation of USD 44.4 million.

- The bulk heterojunction (BHJ) cells segment garnered USD 52.3 million in revenue in 2023.

- The building-integrated photovoltaics (BIPV) segment is expected to reach USD 113.6 million by 2031.

- The automotive segment is anticipated to register the fastest CAGR of 13.92% during the forecast period.

- The commercial segment garnered USD 52.3 million in revenue in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.80% during the forecast period.

Market Driver

"Expansion of Building-Integrated Photovoltaics (BIPV)"

The organic solar cell market is registering significant growth, primarily driven by the rising adoption of BIPV as a sustainable energy solution in urban infrastructure. The demand for solar technologies that integrate seamlessly with building materials without compromising design or functionality is growing as cities aim to meet stricter energy efficiency standards and reduce carbon emissions.

Organic solar cells, with their lightweight, flexible, and semi-transparent properties, offer an ideal solution for facades, rooftops, and windows, leading to their increased adoption in residential, commercial, and public construction projects focused on renewable energy integration.

- In May 2024, YKK AP Inc. revealed a strategic partnership with Kandenko to further develop BIPV. This collaboration is focused on improving the integration of renewable energy solutions into architectural designs, supporting YKK AP's commitment to sustainable building technologies.

Market Challenge

"Low Power Conversion Efficiency (PCE) of Organic Solar Cells"

The low power conversion efficiency (PCE) of organic solar cells presents a key challenge to their widespread adoption and market expansion. Recent innovations have improved laboratory-scale efficiencies; however, commercial devices still lag behind conventional silicon-based photovoltaics, which deliver higher energy output per unit area.

This efficiency gap stems from the intrinsic limitations of organic materials, such as lower charge carrier mobility and limited light absorption across the solar spectrum, which restrict overall energy conversion. As a result, organic solar cells are less suitable for applications where space constraints demand maximum power density.

Although they offer benefits in flexibility and lightweight design, the lower efficiency reduces their appeal in large-scale installations and energy-intensive applications. Bridging this performance gap is crucial for the technology’s broader competitiveness in the renewable energy market.

Continued research into new donor-acceptor materials, optimized device architectures, and tandem cell configurations is essential. Additionally, improving charge transport layers and developing scalable, high-yield manufacturing techniques can enhance efficiency and accelerate commercial viability.

Market Trend

"Sustainable and Renewable Energy"

The focus on sustainable and renewable energy is boosting the organic solar cell market. Amid rising global concerns over climate change, a shift toward cleaner energy sources has been observed. Organic solar cells, with their flexibility and eco-friendly properties, are ideal for applications like BIPV and portable electronics.

Advances in materials and manufacturing are enhancing their efficiency, making them more competitive with traditional photovoltaics. Increased investments in renewable energy infrastructure and stricter environmental regulations are boosting the use of organic solar cells, supporting the transition to a sustainable energy future.

- In April 2024, researchers from the University of Hong Kong (HKU) announced a major breakthrough in organic solar cell technology. The team explored a new electron-accepting molecule called Y6, which, when polymerized, demonstrated exceptional potential for creating efficient and stable organic photovoltaic (OPV) devices. This discovery paves the way for more durable and efficient organic solar cells, with potential applications across various industries, including construction, electronics, and wearable technology.

Organic Solar Cell Market Report Snapshot

| Segmentation |

Details |

| By Structure Type |

Single-layer Organic Solar Cells , Multilayer Organic Solar Cells, Bulk Heterojunction (BHJ) Cells, and Others |

| By Installation Type |

Building-Integrated Photovoltaics (BIPV), Portable Devices, Automotive Integration, and Others |

| By Application |

Consumer Electronics, Building & Construction, Automotive, and Power Generation |

| By End User |

Residential, Commercial, and Industrial |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, U.A.E. , Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Structure Type (Single-layer Organic Solar Cells, Multilayer Organic Solar Cells, Bulk Heterojunction (BHJ) Cells, and Others): The bulk heterojunction (BHJ) cells segment earned USD 52.3 million in 2023, due to their superior efficiency, enhanced charge separation capabilities, and widespread adoption in commercial and research applications.

- By Installation Type (Building-Integrated Photovoltaics (BIPV), Portable Devices, Automotive Integration, and Others): The building-integrated photovoltaics (BIPV) segment held 35.09% share of the market in 2023, due to the growing demand for esthetically integrated renewable energy solutions in urban infrastructure and rising emphasis on sustainable building practices.

- By Application (Consumer Electronics, Building & Construction, Automotive, and Power Generation): The consumer electronics segment is projected to reach USD 109.5 million by 2031, owing to the increasing demand for lightweight, flexible, and energy-efficient power sources in portable and wearable devices.

- By End User (Residential, Commercial, and Industrial): The industrial segment is anticipated to grow at a CAGR of 12.92% during the forecast period, due to the increasing adoption of organic solar solutions for sustainable energy and carbon footprint reduction in industrial operations.

Organic Solar Cell Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Europe organic solar cell market share stood at around 34.12% in 2023, with a valuation of USD 44.4 million. This dominance is primarily attributed to Europe’s robust renewable energy policies, strong government support for sustainable technologies, and increasing investments in green infrastructure.

Europe organic solar cell market share stood at around 34.12% in 2023, with a valuation of USD 44.4 million. This dominance is primarily attributed to Europe’s robust renewable energy policies, strong government support for sustainable technologies, and increasing investments in green infrastructure.

The region's commitment to reducing carbon emissions and transitioning to clean energy has led to a higher adoption of organic solar cells. Furthermore, the presence of leading research institutions and innovation-driven companies accelerates technological advancements, supporting the market growth in the region.

- In February 2025, Greatech, a German innovator in energy-efficient wireless systems, unveiled the Sensoco Loomair Solar, a CO₂ sensor powered by light for smart buildings. This advanced sensor combines Epishine’s indoor solar cells with e-peas’ power management integrated circuit (PMIC) for efficient energy conversion, ensuring uninterrupted performance.

The organic solar cell industry in Asia Pacific is poised for significant growth at a robust CAGR of 12.80% over the forecast period. This growth is supported by the rising energy demand, rapid urbanization, and increasing adoption of renewable energy technologies across countries such as China, Japan, and India.

Governments are introducing supportive policies aimed at enhancing clean energy infrastructure and promoting sustainable energy solutions, which is driving investment in organic solar cell technologies. The growing focus on reducing carbon footprints and transitioning to green energy is further contributing to the regional market expansion.

Additionally, the presence of leading manufacturing hubs and a growing ecosystem of local innovators are fostering technological advancements and facilitating wider adoption of organic solar cells in the region.

Regulatory Frameworks

- In the European Union (EU), the Renewable Energy Directive (RED II) regulates the promotion and use of renewable energy. It sets binding renewable energy targets for 2030, with the goal of achieving at least 32% of total energy from renewable sources.

- In the U.S., the Energy Policy Act of 2005 (EPA 2005) regulates various aspects of energy production and consumption, with a focus on enhancing energy efficiency and promoting renewable energy technologies.

- Organic solar cells are regulated by the IEC 61730-1:2023 standard globally, which sets safety requirements for photovoltaic modules, ensuring safe electrical and mechanical operation to prevent hazards.

Competitive Landscape

The organic solar cell industry is characterized by companies focusing on innovation and strategic initiatives to strengthen their market position and expand their global presence. Key players are investing in advanced research and development to enhance the efficiency, stability, and scalability of organic solar cells.

Strategic collaborations and partnerships with material suppliers, research institutions, and application developers are common approaches to accelerating commercialization and creating more sustainable and cost-effective solutions.

Companies are also focusing on expanding production capacities and improving manufacturing processes to meet the increasing demand for flexible and lightweight solar solutions across diverse sectors like BIPV, consumer electronics, and automotive. Moreover, market participants are prioritizing sustainability in their product development, aligning with the growing emphasis on renewable energy.

List of Key Companies in Organic Solar Cell Market:

- ARMOR GROUP

- BELECTRIC GmbH

- infinityPV ApS

- Mitsubishi Chemical Group Corporation.

- Sumitomo Chemical Co., Ltd.

- Advent Technologies

- TOSHIBA CORPORATION

- Heraeus Epurio

- Raynergy Tek Incorporation

- NanoFlex Power Corporation

- PolyPV

- Dracula Technologies

- Epishine

- Solivus

- Heliatek

Recent Developments (Product Launches)

- In April 2024, Sentinum GmbH introduced a temperature and humidity sensor powered solely by light, in collaboration with Epishine. This groundbreaking sensor incorporates Epishine’s organic indoor solar cells and supports Mioty and LoRa communication protocols, providing a sustainable, battery-free alternative to conventional sensor technologies.