Market Definition

Oral proteins and peptides are biologically active macromolecules made of amino acids, used for therapeutic and nutritional purposes, with applications in treating conditions like diabetes, cancer, and hormonal imbalances. Advances in formulation and drug delivery improve their stability and bioavailability.

The market covers the development, production, and commercialization of these molecules, including therapeutic proteins (e.g., insulin, growth factors) and nutritional supplements.

Key applications include diabetes, cancer, hormonal imbalances, and autoimmune diseases, with market growth driven by advancements in drug delivery and rising demand for protein-based therapies.

Oral Proteins and Peptides Market Overview

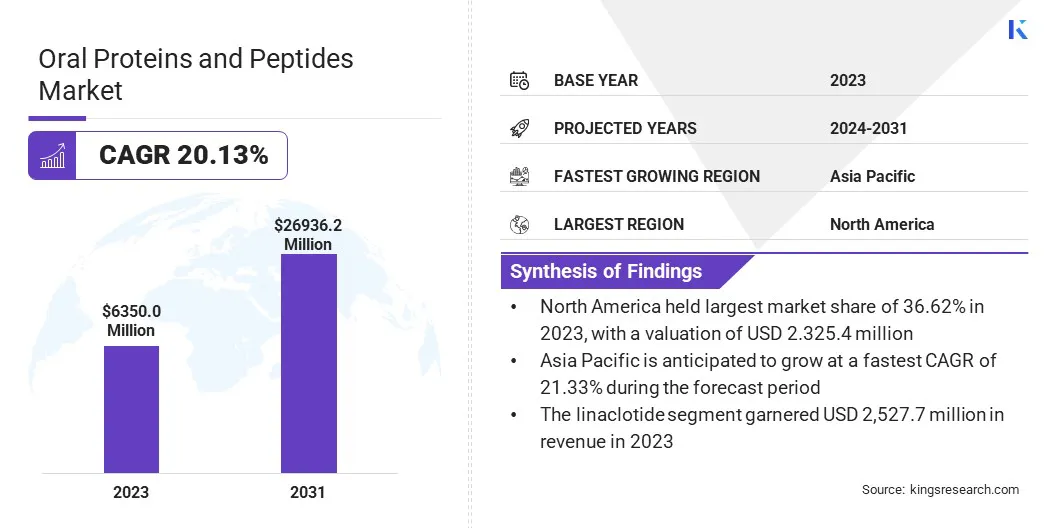

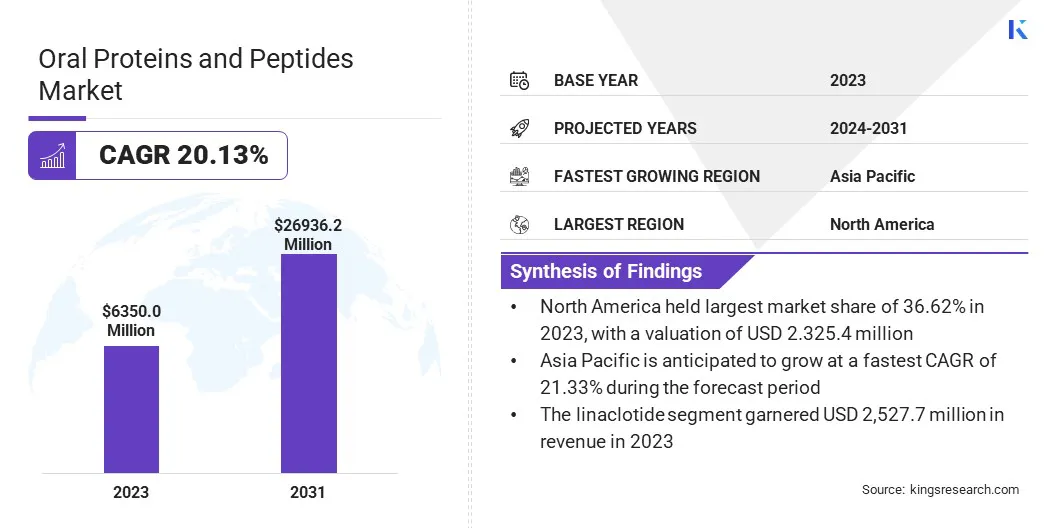

The global oral proteins and peptides market size was valued at USD 6,350.0 million in 2023 and is projected to grow from USD 7,462.0 million in 2024 to USD 26,936.2 million by 2031, exhibiting a CAGR of 20.13% during the forecast period.

This market is registering rapid expansion, fueled by advancements in biotechnology, increasing adoption of biologics, and the increasing prevalence of chronic diseases such as diabetes, cancer, and autoimmune disorders. The shift toward patient-friendly and non-invasive drug administration has significantly increased interest in oral formulations over injectable alternatives.

Pharmaceutical companies are investing heavily in research and development to enhance the stability, absorption, and efficacy of these macromolecules, leading to the introduction of innovative drug delivery technologies such as nanoparticle carriers, permeation enhancers, and enzyme inhibitors.

Major companies operating in the oral proteins and peptides industry are Novo Nordisk A/S, AbbVie Inc., Pfizer Inc., Biocon Limited, Groupe Sanofi, Oramed Pharmaceuticals Inc, Johnson & Johnson Services, Inc., EnteraBio Ltd., Chiesi Farmaceutici S.p.A., Proxima Concepts, Tarsa Therapeutics, Inc., and Synergy Pharma.

Moreover, the expanding geriatric population, which requires long-term and convenient treatment options, is further driving demand. Collaborations between biotech firms and pharmaceutical companies are also fostering advancements in drug formulations, ensuring wider availability of effective oral therapies.

With continuous innovation and increased healthcare expenditure, the market is expected to maintain a strong growth trajectory in the coming years.

- In February 2025, Oramed Pharmaceuticals Inc. and Hefei Tianhui Biotech Co., Ltd. announced their transformative joint venture, OraTech Pharmaceuticals Inc., to accelerate the development and commercialization of oral insulin. The joint venture will focus on Oramed's Protein Oral Delivery technology and other oral drug delivery platforms.

Key Highlights:

- The oral proteins and peptides market size was valued at USD 6,350.0 million in 2023.

- The market is projected to grow at a CAGR of 20.13% from 2024 to 2031.

- North America held a market share of 36.62% in 2023, with a valuation of USD 2,325.4 million.

- The linaclotide segment garnered USD 2,527.7 million in revenue in 2023.

- The diabetes segment is expected to reach USD 10,010.4 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.33% during the forecast period.

Market Driver

"Rising Demand and Technological Innovations"

The oral proteins and peptides market is registering substantial growth, fueled by the increasing prevalence of chronic diseases and advancements in drug delivery technologies. The growing occurrence of conditions like diabetes, gastrointestinal disorders, and hormonal imbalances has led to a heightened need for effective and patient-friendly treatment solutions.

The need for innovative therapies has intensified, due to the growing global diabetic population and an increasing number of patients requiring long-term management of chronic diseases.

Oral formulations provide a convenient and non-invasive alternative to injectable drugs, improving patient compliance and treatment outcomes. This shift in preference is particularly significant among elderly patients and those with conditions requiring frequent drug administration.

Additionally, continuous advancements in drug delivery technologies are playing a crucial role in enhancing the stability, absorption, and bioavailability of oral proteins and peptides. Traditionally, proteins and peptides faced challenges such as enzymatic degradation in the gastrointestinal tract and poor permeability through the intestinal membrane.

However, innovations such as nanoparticle carriers, permeation enhancers, and enzyme inhibitors are addressing these limitations, allowing for more effective oral drug formulations.

These technological breakthroughs have led to increased research and development efforts, accelerating the approval and commercialization of new oral protein and peptide-based therapeutics.

- In September 2024, Vivtex Corporation and Equillium, Inc. announced a research and licensing agreement to develop an optimized oral formulation of EQ302, Equillium’s first-in-class bi-specific peptide inhibitor targeting IL-15 and IL-21 for gastrointestinal (GI) inflammation. The collaboration leverages Vivtex’s proprietary AI-enabled GI-ORIS screening and formulation technology to enhance the oral bioavailability of EQ302.

Market Challenge

"Bioavailability and Manufacturing Hurdles"

The oral proteins and peptides market faces several challenges, primarily related to low bioavailability and stability issues, which impact the effectiveness of therapeutics. The poor absorption and enzymatic degradation of oral proteins and peptides in the gastrointestinal tract pose significant hurdles to their therapeutic effectiveness.

These macromolecules are highly susceptible to breakdown by digestive enzymes such as pepsin, trypsin, and chymotrypsin, which rapidly degrade them before they can reach systemic circulation. Additionally, their large molecular size and hydrophilic nature limit their permeability across the intestinal epithelium, further reducing bioavailability.

Pharmaceutical companies are developing advanced drug delivery systems such as enzyme inhibitors, permeation enhancers, and nanoparticle-based carriers, which protect the drug from degradation and improve intestinal absorption.

Another significant challenge is the high production costs and complex manufacturing processes associated with oral protein and peptide-based drugs. Unlike conventional small-molecule drugs, these biologics require specialized formulation techniques to maintain stability and efficacy, leading to increased development costs.

Additionally, large-scale production and storage require stringent conditions, further adding to the expenses. Companies are putting their investments into novel formulation technologies and cost-effective manufacturing techniques, such as recombinant DNA technology and bioengineered delivery systems, to improve efficiency and scalability.

Market Trend

"Patient-centric Innovations and Rising Investments in Research"

The oral proteins and peptides market is registering significant transformation, driven by the growing shift toward patient-centric treatment approaches and rising investments in research and development.

The demand for non-invasive drug administration methods is increasing, as healthcare providers and pharmaceutical companies prioritize convenience and improved patient adherence. Oral formulations offer a more accessible and comfortable alternative to injections, making them particularly appealing for patients with chronic conditions requiring long-term treatment.

This trend is further supported by advancements in formulation technologies that enhance the stability and bioavailability of oral biologics, leading to a surge in their adoption.

In addition to shifting patient preferences, rising investments in research and development are playing a crucial role in market expansion. Pharmaceutical companies and biotech firms are focusing on developing novel oral peptide formulations, leveraging innovative drug delivery technologies such as lipid-based carriers, permeation enhancers, and enzyme inhibitors.

These efforts are leading to an expanding pipeline of advanced therapeutics aimed at improving drug absorption and therapeutic efficacy.

With increasing clinical trials, regulatory approvals, and strategic collaborations between industry players, the market is expected to register sustained innovation, bringing new and more effective oral protein and peptide-based treatments to the global healthcare landscape.

Oral proteins and peptides Market Report Snapshot

|

Segmentation

|

Details

|

|

By Drug Type

|

Linaclotide, Plecanatide, Calcitonin, Others

|

|

By Application

|

Diabetes, Gastrointestinal Disorders, Bone Diseases, Hormonal Disorders, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Drug Type (Linaclotide, Plecanatide, Calcitonin, Others): The linaclotide segment earned USD 2,527.7 million in 2023, due to its effectiveness in managing gastrointestinal disorders and its increasing adoption in prescription treatments.

- By Application (Diabetes, Gastrointestinal Disorders, Bone Diseases, Hormonal Disorders, Others): The diabetes segment held 34.14% share of the market in 2023, due to the rising diabetic population and advancements in oral peptide-based drug formulations.

Oral Proteins and Peptides Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial share of 36.62% in the oral proteins and peptides market in 2023, with a valuation of USD 2,325.4 million. This dominance is primarily driven by the strong presence of leading pharmaceutical and biotechnology companies actively investing in research and development for advanced oral protein and peptide therapeutics.

The region benefits from high healthcare expenditure, well-established regulatory frameworks, and favorable reimbursement policies that support the adoption of innovative biologics. The increasing prevalence of chronic diseases such as diabetes, gastrointestinal disorders, and osteoporosis has further propelled the demand for oral peptide-based therapies.

Additionally, the presence of cutting-edge drug delivery technologies and continuous advancements in formulation techniques has enhanced the bioavailability and effectiveness of oral protein drugs.

The rising preference for patient-friendly, non-invasive treatment options, along with expanding clinical trials and FDA approvals for novel oral biologics, is expected to sustain North America’s market leadership in the coming years.

The market in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 21.33% over the forecast period. This growth is fueled by increasing healthcare investments, expanding pharmaceutical manufacturing capabilities, and the growing burden of chronic diseases such as diabetes, osteoporosis, and hormonal disorders.

Countries like China, India, and Japan are emerging as key markets, due to their rapidly improving healthcare infrastructure and rising demand for innovative treatment solutions. Government initiatives supporting biopharmaceutical research, along with the growing number of clinical trials and regulatory approvals, are accelerating the adoption of oral protein and peptide therapeutics.

Additionally, the increasing focus on affordability and accessibility of biologics, coupled with rising disposable incomes and greater awareness of advanced treatment options, is driving the market.

With a large patient pool and increasing adoption of novel drug delivery technologies, Asia Pacific is poised to become a highly lucrative region for growth in the market.

Regulatory Framework:

- In the U.S., the Food and Drug Administration (FDA) regulates oral proteins and peptides under the Biologics Control Act and the Federal Food, Drug, and Cosmetic Act. These products must undergo rigorous clinical trials to ensure safety, efficacy, and bioavailability before receiving approval.

- In Europe, the European Medicines Agency (EMA) oversees the approval of oral proteins and peptides through its Committee for Medicinal Products for Human Use (CHMP). The EMA requires compliance with Good Manufacturing Practices (GMP) and extensive clinical evaluations before granting market authorization.

- In China, the National Medical Products Administration (NMPA) regulates oral protein and peptide-based drugs under the Drug Administration Law. The regulatory framework has been strengthened to align with international standards, requiring strict preclinical and clinical assessments for drug approval.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), under the Ministry of Health, Labour and Welfare (MHLW), oversees the regulation of oral proteins and peptides. Japan follows a stringent approval process, including extensive pharmacokinetic and bioequivalence studies, before granting approvals.

- In India, the Central Drugs Standard Control Organization (CDSCO), under the Ministry of Health and Family Welfare (MoHFW), regulates oral proteins and peptides. The approval process follows the New Drugs and Clinical Trials Rules requiring comprehensive clinical evaluations and adherence to GMP guidelines.

Competitive Landscape:

The oral proteins and peptides industry is characterized by a significant presence of both established pharmaceutical companies and emerging biotech firms. This dynamic market is propelled by ongoing research and development, strategic collaborations, and innovations in oral biologic delivery systems.

Companies are actively working to enhance the bioavailability and stability of oral proteins and peptides through novel drug delivery technologies, including nanoparticles, permeation enhancers, and enzyme inhibitors.

Mergers, acquisitions, and partnerships are common strategies adopted by key players to strengthen their market presence and expand product portfolios. Additionally, increasing investments in clinical trials and regulatory approvals for new oral protein-based therapeutics are shaping the competitive landscape.

Emerging biopharmaceutical firms are playing a crucial role by introducing cutting-edge technologies that address challenges related to drug absorption and degradation. The market is expected to evolve rapidly, with continuous innovations and strategic initiatives driving future growth.

- In July 2024, Pfizer announced the advancement of a once-daily formulation of oral GLP-1 receptor agonist danuglipron, selecting a preferred modified release version for further dose optimization studies. The investigational therapy, aimed at obesity and blood sugar control, has shown promise in a twice-daily form. Pfizer seeks to establish a competitive position in the oral GLP-1 market to address unmet medical needs.

List of Key Companies in Oral Proteins and Peptides Market:

Recent Developments (Acquisition/New Product Launch)

- In December 2024, AbbVie announced the acquisition of Nimble Therapeutics, including its lead asset, an investigational oral peptide inhibitor in preclinical development for psoriasis and a pipeline of other novel oral peptide candidates for autoimmune diseases. The acquisition also includes Nimble’s proprietary peptide synthesis platform, which enables the discovery and optimization of oral peptide therapeutics.

- In September 2024, Lonza launched the Innovaform Accelerator, a Center of Excellence for capsule-based drug delivery solutions. The facility supports formulation and encapsulation innovations for oral peptides, proteins, and other therapeutics, helping improve solubility, bioavailability, and targeted drug release.