Market Definition

The market comprises the development and deployment of open, interoperable, and software-driven RAN architecture that enables mobile network operators to integrate hardware and software components from multiple vendors.

This market focuses on disaggregating traditional RAN functions into virtualized and cloud-native solutions, optimizing network efficiency and flexibility. Open RAN facilitates intelligent automation, AI-driven network optimization, and seamless orchestration across 4G and 5G infrastructures.

It is widely applied in urban and rural network expansions, private enterprise networks, and industrial IoT applications, enhancing connectivity while reducing operational complexities. The market is advancing through continuous innovation in open interface standards.

Open RAN Market Overview

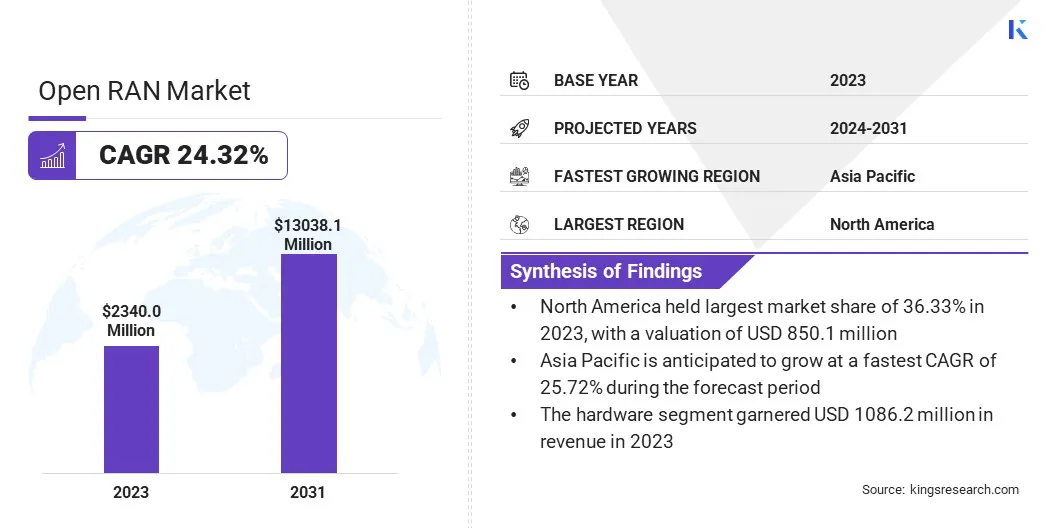

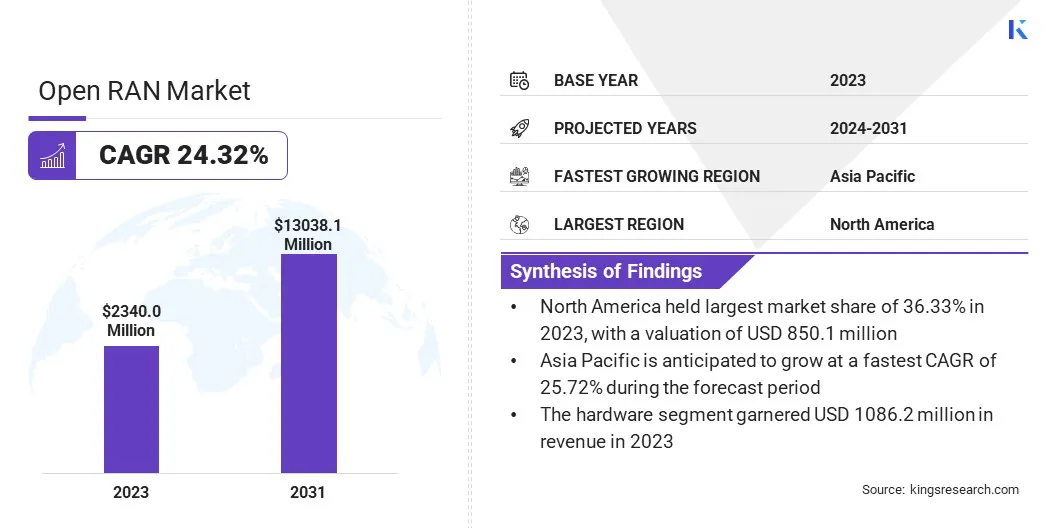

The global Open RAN market size was valued at USD 2,340.0 million in 2023 and is projected to grow from USD 2,840.8 million in 2024 to USD 13,038.1 million by 2031, exhibiting a CAGR of 24.32% during the forecast period.

The market is driven by increasing investments in network virtualization and the adoption of AI-powered RAN solutions to enhance network automation and efficiency. Additionally, regulatory support for open, interoperable networks, particularly in regions like North America and Europe, is accelerating deployments by enabling multi-vendor ecosystems and reducing reliance on proprietary solutions, fostering greater innovation and cost-effective network expansion.

Major companies operating in the open RAN industry are Mavenir, JMA Wireless, Samsung, NEC Corporation, Nokia, Telefonaktiebolaget LM Ericsson, Altiostar Networks, Inc., Parallel Wireless, Inc., Fujitsu Limited, MTI Mobile, Casa Systems, Inc., Baicells Technologies, Sercomm Corporation, Airspan Networks Holdings Inc., and Comba Telecom Systems Holdings Limited.

The growing adoption of network virtualization and cloud-native architectures is driving the market. Telecom operators are increasingly deploying virtualized RAN (vRAN) solutions, enabling software-driven network functions that enhance scalability and flexibility.

- In December 2024, Puerto Rican operator Liberty partnered with Samsung Networks Latin America to test the vendor’s O-RAN-compliant virtualized Radio Access Network (vRAN) and radios in Puerto Rico. With 5G coverage reaching 97.5% of the region, Liberty aims to leverage RAN and Open RAN technologies to strengthen and expand its network more efficiently while reducing reliance on extensive hardware infrastructure.

Cloud-native deployments support dynamic resource allocation, automation, and seamless integration with edge computing. These advancements reduce operational complexity, lower infrastructure costs, and improve network performance. Leading operators are leveraging containerized Open RAN solutions to enhance service delivery while minimizing hardware dependency.

The ability to deploy and manage Open RAN networks through cloud platforms is accelerating the transition toward more efficient and agile telecom ecosystems.

Key Highlights:

- The global Open RAN market size was valued at USD 2,340.0 million in 2023.

- The market is projected to grow at a CAGR of 24.32% from 2024 to 2031.

- North America held a market share of 36.33% in 2023, with a valuation of USD 850.1 million.

- The hardware segment garnered USD 1,086.2 million in revenue in 2023.

- The hybrid cloud segment is expected to reach USD 6,010.9 million by 2031.

- The distributed unit segment is poised for a robust CAGR of 25.13% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 25.72% during the forecast period.

Market Driver

Development of Open RAN Testing and Certification Programs

The establishment of Open RAN testing and certification programs is accelerating market adoption by ensuring interoperability and performance consistency across vendors. Organizations such as the O-RAN Alliance, Telecom Infra Project (TIP), Open6G Open Testing institutions, and industry consortiums are introducing certification frameworks to validate Open RAN components.

These initiatives enhance reliability, minimize deployment risks, and foster vendor collaboration. Operators are prioritizing certified Open RAN solutions to ensure compliance with industry standards and streamline integration efforts.

The expansion of Open RAN test labs and validation centers is strengthening market confidence, encouraging telecom providers to accelerate Open RAN deployments on a global scale.

Strategic partnerships are fostering innovation through joint R&D initiatives, interoperability testing, and Open RAN lab deployments. Telecom vendors are investing in ecosystem development to enhance Open RAN integration, improve network security, and optimize performance. Industry alliances are driving standardization efforts, ensuring seamless interoperability across Open RAN components.

- In May 2024, the Open6G Open Testing and Integration Center (OTIC) at Northeastern University's Institute for the Wireless Internet of Things (WIoT) announced the launch of comprehensive testing and integration solutions for Open RAN. These solutions cover conformance, interoperability, and end-to-end testing in alignment with O-RAN ALLIANCE specifications. The Open6G OTIC facilitates performance and interoperability assessments, addressing key priorities outlined by the National Telecommunications and Information Administration (NTIA) in the Public Wireless Supply Chain Innovation Fund (PWSCIF) NOFO 2, which focuses on Open Radio commercialization and innovation.

Market Challenge

Integration Complexity and Interoperability Issues

The Open RAN market faces significant challenges in integrating multi-vendor solutions while ensuring seamless interoperability. Differences in hardware and software implementations often lead to compatibility issues, increasing deployment complexity and operational costs.

Companies are investing in rigorous testing frameworks, such as conformance and interoperability testing based on O-RAN Alliance specifications.

Additionally, strategic collaborations with chipset manufacturers and cloud providers are helping streamline network functions, while AI-driven automation tools are being deployed to optimize performance and reduce manual configuration efforts. These initiatives are crucial in overcoming technical barriers and accelerating large-scale Open RAN adoption.

Market Trend

Interoperability and Vendor Diversification

The Open RAN market is registering significant expansion, due to the increasing focus on interoperability and vendor diversification. Operators are shifting away from proprietary, single-vendor RAN solutions toward an open, multi-vendor ecosystem. This transformation allows greater flexibility in selecting hardware and software components, reducing vendor lock-in while fostering competition.

Open RAN enables seamless integration of best-in-class solutions from different vendors, optimizing network performance and cost efficiency. Standardized open interfaces support plug-and-play compatibility, enhancing network agility.

Operators are lowering deployment costs and driving innovation by embracing vendor-neutral solutions, creating a competitive landscape that accelerates the market growth.

- In February 2025, Parallel Wireless and Mavenir completed interoperability testing for a full 5G Non-Standalone (NSA) solution. This collaboration highlights the seamless integration of Mavenir’s advanced 5G Converged Packet Core with Parallel Wireless’ GreenRAN technology, underscoring both companies’ commitment to open and interoperable network architectures. The achievement represents a significant milestone in advancing flexible, software-driven 5G solutions and paves the way for more integrated multi-vendor RAN deployments.

Open RAN Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Deployment

|

Private, Hybrid Cloud, Public Cloud

|

|

By Unit

|

Radio Unit, Distributed Unit, Centralized Unit

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, Services): The hardware segment earned USD 1,086.2 million in 2023, due to the essential role of high-performance radio units, massive MIMO antennas, and distributed units in enabling seamless interoperability, network efficiency, and large-scale deployments across diverse telecom infrastructures.

- By Deployment (Private, Hybrid Cloud, and Public Cloud): The hybrid cloud segment held 46.72% share of the market in 2023, as it enables operators to balance cost efficiency and network performance by leveraging both private and public cloud infrastructures for optimized scalability, security, and low-latency processing.

- By Unit (Radio Unit, Distributed Unit, Centralized Unit): The distributed unit segment is poised for significant growth at a CAGR of 25.13% through the forecast period, due to its critical role in enabling flexible, low-latency processing and efficient resource allocation, which enhances network performance and scalability in multi-vendor Open RAN deployments.

Open RAN Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 36.33% share of the Open RAN market in 2023, with a valuation of USD 850.1 million. The market in North America is registering significant growth, due to increasing investments in wireless innovation.

Government agencies, telecom operators, and technology companies are allocating substantial funding to accelerate the development of next-generation wireless technologies, including Open RAN.

- In February 2024, the U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA) allocated USD 42 million as the final award from the Public Wireless Supply Chain Innovation Fund. This investment in open, interoperable networks aims to strengthen and secure the telecommunications supply chain while enhancing resilience. The shift toward open network architectures is positioning the U.S. and its global partners at the forefront of next-generation wireless innovation. The funding supports the Acceleration of Compatibility and Commercialization for Open RAN Deployments (ACCoRD) project, driving the advancement and large-scale adoption of Open RAN technologies.

Leading tech firms such as Qualcomm, Intel, and IBM are investing in Open RAN-compatible chipsets, AI-driven network automation, and software-defined radio technologies. These investments are fostering a competitive ecosystem, driving advancements in Open RAN deployments across commercial, industrial, and defense applications.

Additionally, North America is home to several Open RAN technology providers, including Mavenir, Parallel Wireless, and Dell Technologies, which are actively driving innovation in the market. These companies are developing cutting-edge Open RAN software, hardware, and network management solutions tailored for large-scale deployments.

The presence of major telecom equipment manufacturers such as Cisco and HPE, along with partnerships between vendors and operators, is accelerating the adoption of Open RAN. The robust innovation ecosystem in North America is fostering technological advancements, ensuring continuous development of interoperable and scalable Open RAN solutions.

The Open RAN market in Asia Pacific is poised for significant growth at a robust CAGR of 25.72% over the forecast period. The market in Asia-Pacific is gaining momentum, due to the increasing adoption of virtualized RAN (vRAN) solutions, enabling greater network flexibility and efficiency.

Telecom operators across the region are transitioning to software-driven architectures that decouple hardware from network functions, enhancing scalability and reducing infrastructure costs. The shift toward vRAN-powered Open RAN solutions is allowing operators to optimize spectrum utilization, accelerate 5G deployment, and improve network automation.

Leading telecom providers are collaborating with technology vendors to integrate vRAN into Open RAN networks. Thus, the market is registering a surge in deployments, strengthening the role of Asia-Pacific in next-generation wireless innovation.

- In October 2024, Samsung Electronics Co., Ltd. announced its selection as a primary vendor by KDDI to supply 4G and 5G O-RAN-compliant virtualized Radio Access Network (vRAN) solutions for Open RAN deployment in Japan. Beginning in 2025, KDDI will scale its Open RAN rollout, utilizing Samsung’s vRAN technology to leverage a fully disaggregated and software-driven architecture. The Open RAN network will integrate advanced capabilities to enhance energy efficiency, optimize performance, and enable intelligent automation, supporting KDDI’s commitment to building a more flexible and efficient next-generation mobile infrastructure.

Furthermore, the need for cost-effective and scalable network solutions to enhance rural connectivity is boosting Open RAN deployment across Asia-Pacific. Countries with large rural populations, such as India, Indonesia, and the Philippines, are leveraging Open RAN to expand mobile broadband access in remote areas.

Open RAN’s ability to provide low-cost, software-driven solutions makes it an attractive option for bridging the digital divide. Government-backed rural broadband initiatives, including India's BharatNet project and Indonesia’s Palapa Ring, are supporting Open RAN integration to improve connectivity and enable digital inclusion across underserved regions.

Regulatory Frameworks

- The UK has proactively supported Open RAN development through strategic initiatives rather than formal regulations. The UK government has committed funding to support Open RAN trials and collaborations among industry stakeholders. For example, the UK’s £30 million Future RAN Competition aims to promote Open RAN development, reflecting the government's support for open and interoperable network technologies.

- In Japan, the Ministry of Internal Affairs and Communications (MIC) supports initiatives promoting open and interoperable network architectures. Japanese operators, in collaboration with global vendors, are deploying Open RAN solutions to enhance network flexibility and innovation. The government's policies encourage technological advancement and vendor diversity in the telecommunications sector.

Competitive Landscape:

The global Open RAN industry is characterized by several market players that are adopting strategic collaborations with technology vendors to advance the implementation of multi-vendor RAN Intelligent Controller (RIC) functionality, strengthening the development of O-RAN technology.

These partnerships enable seamless integration of AI-driven automation, energy efficiency solutions, and network optimization tools, fostering greater interoperability and innovation within the telecom ecosystem. Leveraging multi-vendor collaboration, companies are enhancing network intelligence, reducing operational complexities, and improving overall performance.

This approach accelerates the adoption of O-RAN solutions, driving technological advancements and reinforcing market expansion as operators increasingly prioritize flexible, software-defined, and efficient network architectures.

- In February 2025, Verizon, in partnership with Samsung Electronics Co., Ltd. and Qualcomm Technologies, Inc., successfully implemented multi-vendor RAN Intelligent Controller (RIC) functionality within its commercial network. This achievement represents a major step forward in O-RAN technology, highlighting the role of AI in enhancing network efficiency. The deployment ensures that Verizon customers benefit from an optimized network experience. As part of this initiative, Verizon integrated Samsung's AI-powered Energy Saving Manager (AI-ESM) with the Qualcomm Dragonwing RAN Automation Suite’s RIC to enhance energy efficiency across its network infrastructure.

List of Key Companies in Open RAN Market:

- Mavenir

- JMA Wireless

- Samsung

- NEC Corporation

- Nokia

- Telefonaktiebolaget LM Ericsson

- Altiostar Networks, Inc.

- Parallel Wireless, Inc.

- Fujitsu Limited

- MTI Mobile

- Casa Systems, Inc.

- Baicells Technologies

- Sercomm Corporation

- Airspan Networks Holdings Inc.

- Comba Telecom Systems Holdings Limited

Recent Developments (Collaboration/Agreements/Product Launch)

- In November 2024, Mavenir collaborated with Intel to develop advanced AI/ML-powered Open RAN solutions designed to address complex cell edge challenges affecting user quality of experience. This partnership enabled Mavenir to achieve a significant milestone in Open RAN technology by showcasing an AI-driven TDD 32TRX massive Multiple-Input Multiple-Output (mMIMO) solution, highlighting the potential for enhanced network performance and efficiency.

- In March 2025, Samsung Electronics Co., Ltd. announced its collaboration with NVIDIA to drive advancements in AI-RAN technologies. This partnership reflects Samsung's dedication to strengthening the Open RAN ecosystem and expanding computing platform options. The initiative focuses on facilitating seamless AI integration into mobile networks by broadening the Central Processing Unit (CPU) ecosystem and enhancing collaboration with Graphics Processing Unit (GPU) providers.

- In December 2024, Nokia announced that it secured a contract for over 3,000 sites from German carrier Deutsche Telekom (DT) to support its multi-vendor Open RAN (O-RAN) network deployment in Germany. As part of the agreement, Nokia will provide equipment from its O-RAN-compliant 5G AirScale portfolio, powered by energy-efficient ReefShark System-on-Chip technology. This includes modular, high-capacity baseband solutions and high-performance Habrok Massive MIMO radios, designed to enhance network coverage and capacity.

- In November 2024, Viettel launched its Open RAN 5G network, utilizing in-house developed equipment alongside 5G RAN platforms from Qualcomm Technologies. The deployment of Viettel’s O-RAN Massive MIMO 5G network delivers high-speed connectivity and enhanced capacity for mobile users in Vietnam. This implementation integrates Qualcomm’s X100 5G RAN Platform for virtualized Distributed Units (vDUs), the QRU100 5G RAN Platform for Massive MIMO Radio Units, and the Edgewise Suite for RAN management, optimizing network efficiency and performance.

- In December 2024, Mavenir and Boost Mobile achieved a significant industry milestone by completing the first inter-vendor Open RAN handover using the 3GPP Xn interface on the operator’s greenfield 5G network. This development demonstrated seamless interoperability between Open RAN and traditional RAN nodes. The Xn interface facilitates connectivity across diverse network elements, enhancing interoperability and enabling greater vendor flexibility within the same deployment region.