Market Definition

The market focuses on systems integrated into electric and plug-in hybrid vehicles to convert AC from external power sources into DC for charging the vehicle’s battery. These chargers play a crucial role in energy conversion and battery management, supporting varying power levels, depending on vehicle specifications.

The market encompasses hardware design, control algorithms, thermal management, and compatibility with global grid standards. OBCs are used across passenger cars, light commercial vehicles, and electric buses, ensuring efficient charging performance.

The report highlights the primary market drivers, alongside significant trends, regulatory frameworks, and the competitive landscape, shaping the market expansion in the coming years.

On-board Charger Market Overview

The global on-board charger market size was valued at USD 5.32 billion in 2023 and is projected to grow from USD 6.28 billion in 2024 to USD 21.55 billion by 2031, exhibiting a CAGR of 19.27% during the forecast period.

The market is driven by the increasing deployment of AC charging infrastructure, which supports overnight and residential EV charging. Additionally, the integration of smart charging capabilities into on-board systems is enhancing grid responsiveness and energy efficiency, aligning with evolving EV architectures and accelerating market expansion.

Major companies operating in the on-board charger industry are Aptiv Global Operations Limited, BorgWarner Inc., Hyundai Mobis Co., Ltd., Eaton Corporation plc., Mitsubishi Electric Corporation, Infineon Technologies AG, Bel Power Solutions, Current Ways Inc., Toyota Industries Corporation, Innoelectric GmbH, Bosch, Lear Corporation, Delta Electronics, Murata Manufacturing Co., Ltd., and Sanken Electric Co., Ltd.

The market is registering significant growth, due to the rising volume of electric and plug-in hybrid vehicles entering global markets. Automakers are integrating advanced charging systems to ensure compatibility with varying regional power grids and charging speeds.

Increased investment in EV manufacturing, particularly across Asia and Europe, is accelerating the demand for efficient on-board charging solutions.

- According to the International Energy Agency’s 2024 report, electric car sales reached nearly 14 million units in 2023, with China, Europe, and the U.S. accounting for 95% of the total. This marked a year-on-year increase of 35%, with 3.5 million more Electric Vehicles (EVs) sold compared to 2022. Weekly registrations in 2023 exceeded 250,000 units and surpassed the entire annual sales volume recorded in 2013, highlighting a dramatic shift in market adoption over the past decade.

Key Highlights:

- The on-board charger industry size was valued at USD 5.32 billion in 2023.

- The market is projected to grow at a CAGR of 19.27% from 2024 to 2031.

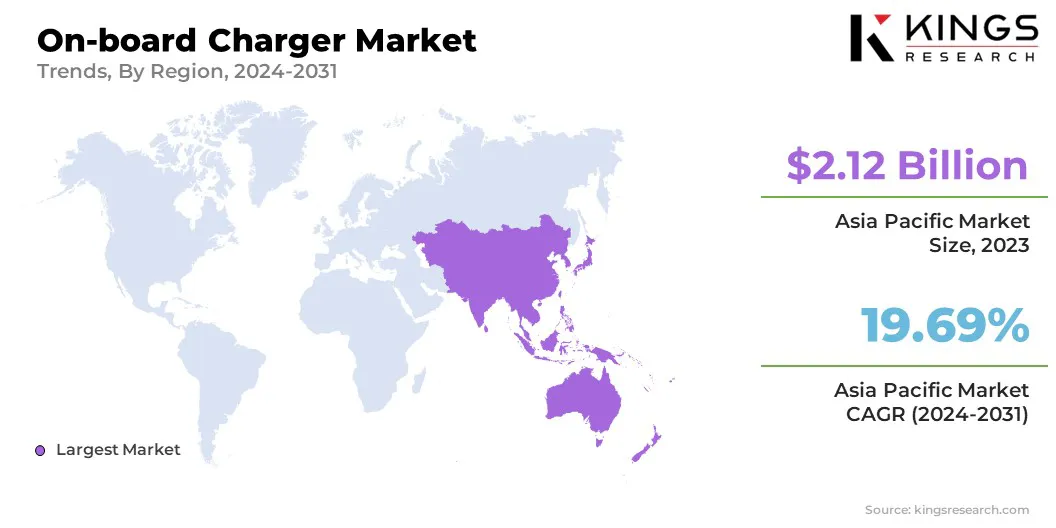

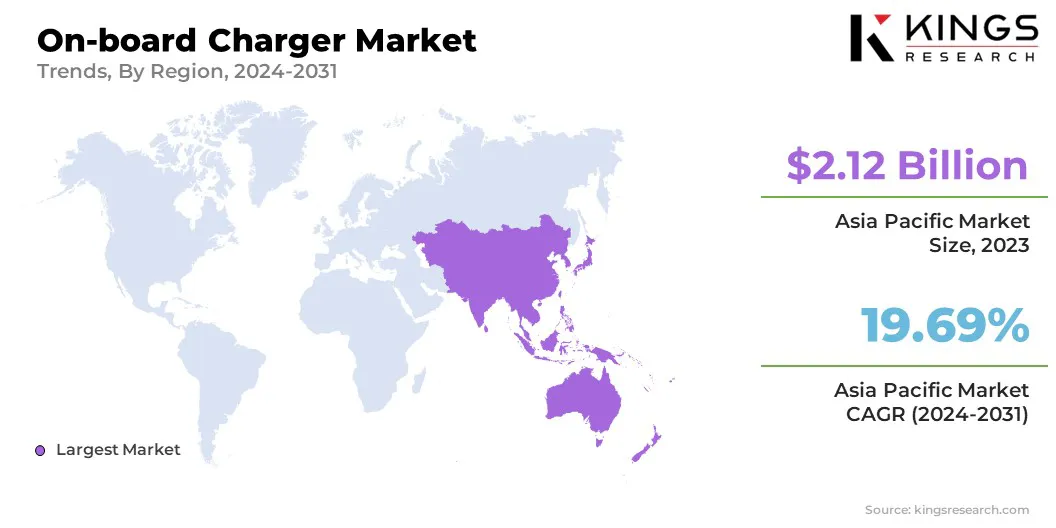

- Asia Pacific held a market share of 39.84% in 2023, with a valuation of USD 2.12 billion.

- The less than 11 kW segment garnered USD 2.39 billion in revenue in 2023.

- The passenger car segment is expected to reach USD 14.36 billion by 2031.

- The battery electric vehicle (BEV) segment secured the largest revenue share of 78.67% in 2023.

- The market in Europe is anticipated to grow at a CAGR of 19.45% during the forecast period.

Market Driver

"Growing Deployment of AC Charging Infrastructure"

The widespread rollout of EV charging stations is influencing the growth of the on-board charger market. Residential, workplace, and public AC charging networks offer cost-effective and scalable solutions for EV owners, encouraging the adoption of OBCs capable of handling standard and high-voltage AC inputs.

With governments investing in nationwide charging infrastructure, vehicle manufacturers are prioritizing OBC efficiency and compatibility, thereby reinforcing their importance within the EV powertrain ecosystem.

- In its 2024 report, the International Energy Agency (IEA) stated that public charging infrastructure expanded by over 40% in 2023, with fast chargers growing at a faster rate, rising by 55%, compared to slow chargers. By the end of 2023, fast chargers accounted for more than 35% of the total public charging stock.

Market Challenge

"Thermal Management in High-power On-board Chargers"

A significant challenge impacting the growth of the on-board charger market is effective thermal management, especially in high-power systems designed for fast charging. Excessive heat generation during operation can lead to reduced efficiency, component degradation, and safety concerns.

Companies are developing advanced cooling systems such as liquid-cooled housings and integrated thermal management modules. Manufacturers are also incorporating heat-resistant materials and compact designs that enhance heat dissipation.

These innovations are helping to ensure performance stability, extend product lifespan, and maintain safety standards, thereby supporting broader adoption across EV platforms.

Market Trend

"Integration of Smart Charging Capabilities"

The on-board charger market is being driven by the integration of smart charging features that support two-way communication between the vehicle and the grid. These chargers allow real-time energy management, dynamic load balancing, and scheduled charging to align with energy pricing models.

Such functionalities are becoming essential in regions advancing toward smart grid adoption. Automakers are aligning their OBC technology with these developments to offer added value through energy optimization and grid reliability.

- In October 2024, Nissan unveiled plans to introduce cost-effective bi-directional charging on select EV models by 2026. This initiative centers around Vehicle-to-Grid (V2G) technology, which allows EV owners to supply electricity from their car batteries to their homes or feed it back into the grid. The company intends to initially launch the V2G solution in the UK, followed by a broader rollout across European markets, offering consumers the flexibility of both AC and DC-based V2G capabilities.

On-board Charger Market Report Snapshot

|

Segmentation

|

Details

|

|

By Power Output

|

Less than 11 kW, 11 kW to 22 kW, More than 22 kW

|

|

By Vehicle Type

|

Passenger Car, Buses, Vans, Medium & Heavy Duty Vehicles, Boats, Others

|

|

By Propulsion Type

|

Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Power Output (Less than 11 kW, 11 kW to 22 kW, More than 22 kW): The less than 11 kW segment earned USD 2.39 billion in 2023, due to its compatibility with AC charging infrastructure commonly used in residential and workplace settings.

- By Vehicle Type (Passenger Car, Buses, Vans, Medium & Heavy Duty Vehicles, Boats, Others): The passenger car segment held 65.68% share of the market in 2023, due to the rising adoption of EVs in urban mobility, supported by favorable policies and expanding AC charging infrastructure.

- By Propulsion Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)): The Battery Electric Vehicle (BEV) segment is projected to reach USD 17.24 billion by 2031, owing to the higher dependency of BEVs on efficient and reliable onboard AC charging systems for primary energy replenishment.

On-board Charger Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific on-board charger market share stood at around 39.84% in 2023, with a valuation of USD 2.12 billion. The transition toward electric mobility for city bus services, ride-hailing fleets, and last-mile delivery vehicles in urban corridors is creating high-volume demand for OBC-equipped vehicles.

- In February 2025, Alexander Dennis announced the delivery of an additional nine Enviro500EV zero-emission double-deck buses to MTR Corporation in Hong Kong. These units are part of a broader order comprising 35 next-generation Enviro500EV buses.

These fleet segments primarily utilize overnight AC charging at depots or charging hubs, where the role of onboard chargers is critical for operational continuity. This sustained demand across public and commercial applications is driving the market in Asia Pacific.

Furthermore, EV manufacturers across Asia Pacific are engineering platforms tailored to regional infrastructure capabilities, with a focus on compatibility with standard AC charging. This emphasis on efficient and compact OBC systems is enhancing the cost-performance ratio of EVs in the region, directly contributing to the growth of the market.

The on-board charger industry in Europe is poised for significant growth at a robust CAGR of 19.45% over the forecast period. Corporate fleet operators in Europe are increasingly transitioning to EVs in response to ESG targets and tax incentives tied to emissions reductions.

Company vehicles are often charged at offices or homes using AC power sources, placing on-board chargers at the center of the charging process. This institutional transition is scaling up the demand for OBC-equipped EVs, advancing the growth of the market in the region.

Moreover, the adoption of home energy systems that combine solar panels, battery storage, and EV charging is gaining traction in Europe. These setups typically rely on AC charging via smart on-board chargers capable of syncing with renewable inputs and optimizing charging schedules.

Regulatory Frameworks

- The U.S. mandates that new EVs be equipped with a conductive charger inlet port meeting the Society of Automotive Engineers (SAE) standard J1772. Additionally, EVs must have an on-board charger with a minimum output of 3.3 kilowatts (kW). These requirements do not apply to EVs capable only of Level 1 charging, which has a maximum power of 12 amperes (amps), a branch circuit rating of 15 amps, and continuous power of 1.44 kW.

- The UK has introduced the Publicly Accessible Standards (PAS) 1899, providing guidelines for the installation of accessible EV charge points. This standard aims to ensure that charging infrastructure is user-friendly and accessible to all individuals, including those with disabilities.

- China has established the GB/T standards for EV charging interfaces. These standards specify requirements for both AC and DC charging, including connector configurations and communication protocols. On April 1, 2024, updated GB standards for charging systems came into effect, further refining these specifications.

Competitive Landscape:

Market players are increasingly focusing on the development of advanced on-board chargers that align with the evolving architecture and performance demands of specific EV platforms.

By engineering compact, multi-functional systems tailored to off-highway vehicles and high-voltage battery systems, companies are strengthening their product portfolios while supporting OEM requirements.

This targeted approach is enabling more efficient vehicle integration, reducing design complexity, and improving operational reliability. These factors are directly contributing to the growth of the market across specialized EV segments.

- In February 2025, Danfoss Group introduced the Editron ED3 on-board charger, tailored for off-highway EVs. This integrated three-in-one solution, combining an AC charger, DC ePTO, and AC ePTO, aims to simplify machine architecture and enhance system integration. The ED3 supports onboard charging of up to 44 kW for high-voltage battery-electric and off-highway equipment. It includes AC ePTO capabilities for powering single- and three-phase auxiliary systems while the vehicle is in use, along with DC ePTO functionality for operating HVAC systems or heaters during operation.

List of Key Companies in On-board Charger Market:

- Aptiv Global Operations Limited

- BorgWarner Inc.

- Hyundai Mobis Co., Ltd.

- Eaton Corporation plc.

- Mitsubishi Electric Corporation

- Infineon Technologies AG

- Bel Power Solutions

- Current Ways Inc.

- Toyota Industries Corporation

- Innoelectric GmbH

- Bosch

- Lear Corporation

- Delta Electronics

- Murata Manufacturing Co., Ltd.

- Sanken Electric Co., Ltd.

Recent Developments (Product Launch)

- In April 2025, ZAPI GROUP presented its next-generation electrification and fleet management solutions at bauma 2025. The company highlighted a range of innovations from its extensive product lineup, showcasing advanced high-power on-board DC/DC converters, inverters, and battery chargers specifically designed for construction and industrial vehicles.

- In October 2024, Nissan revealed plans to introduce affordable on-board bi-directional charging on select EV models starting in 2026. This initiative marks a strategic move toward realizing the company's broader goal of establishing a sustainable energy ecosystem.