Market Definition

Oilfield integrity management (OIM) is a structured approach used to maintain the safety, reliability, and performance of oilfield assets throughout their lifespan. It encompasses the integration of people, processes, technologies, and data to monitor, assess, and manage the integrity of wells, pipelines, and production facilities.

OIM includes inspection, maintenance, risk mitigation, and regulatory compliance, aiming to prevent failures, extend asset life, ensure environmental and personnel safety, and support efficient hydrocarbon production.

Oilfield Integrity Management Market Overview

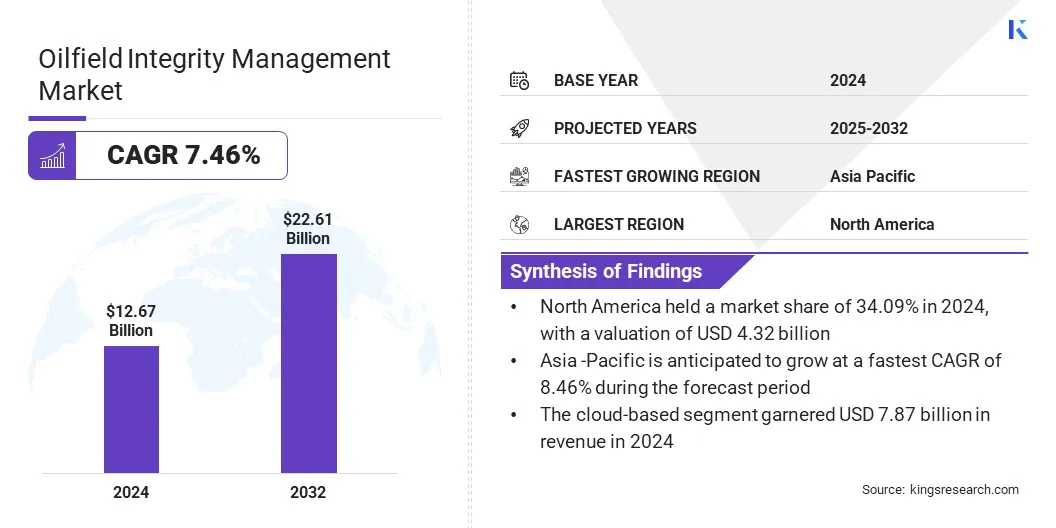

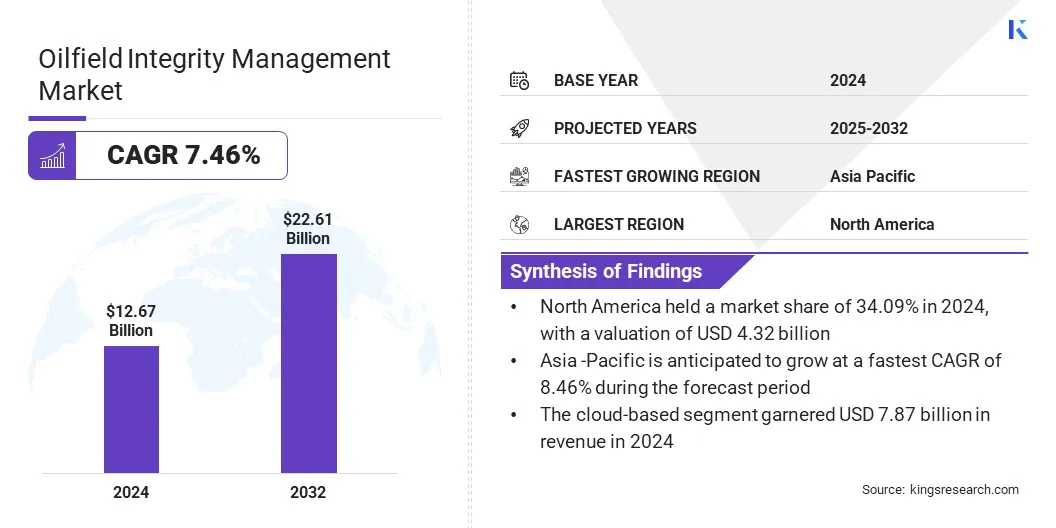

The global oilfield integrity management market size was valued at USD 12.67 billion in 2024 and is projected to grow from USD 13.59 billion in 2025 to USD 22.61 billion by 2032, at a CAGR of 7.46% during the forecast period.

The market is experiencing significant growth driven by rising investments in aging oilfield infrastructure, as operators prioritize integrity management to extend asset life, enhance reliability, and reduce risks. It is further expanding due to the rising adoption of digital inspection technologies that enable proactive maintenance, minimize downtime, and improve compliance with evolving safety and regulatory standards.

Key Highlights:

- The oilfield integrity management industry size was recorded at USD 12.67 billion in 2024.

- The market is projected to grow at a CAGR of 7.46% from 2025 to 2032.

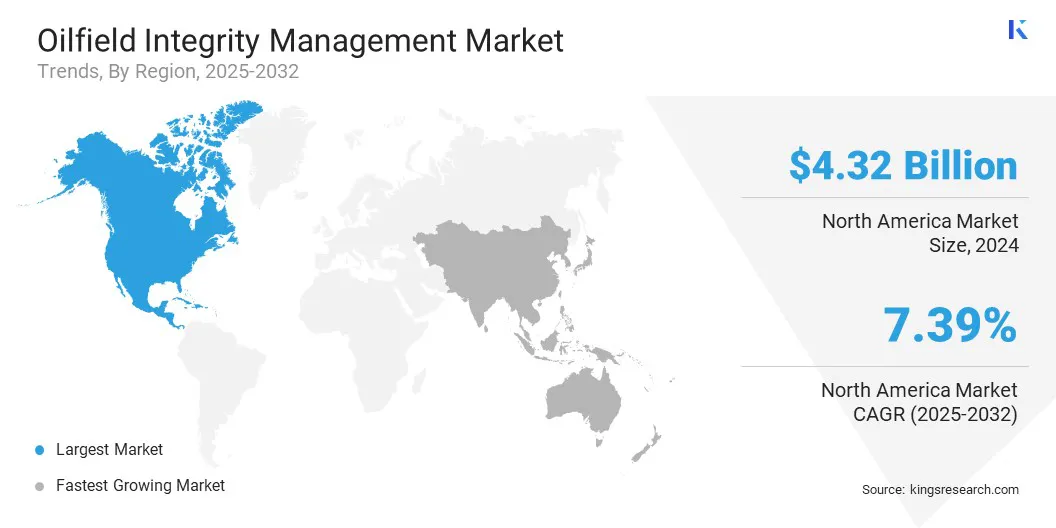

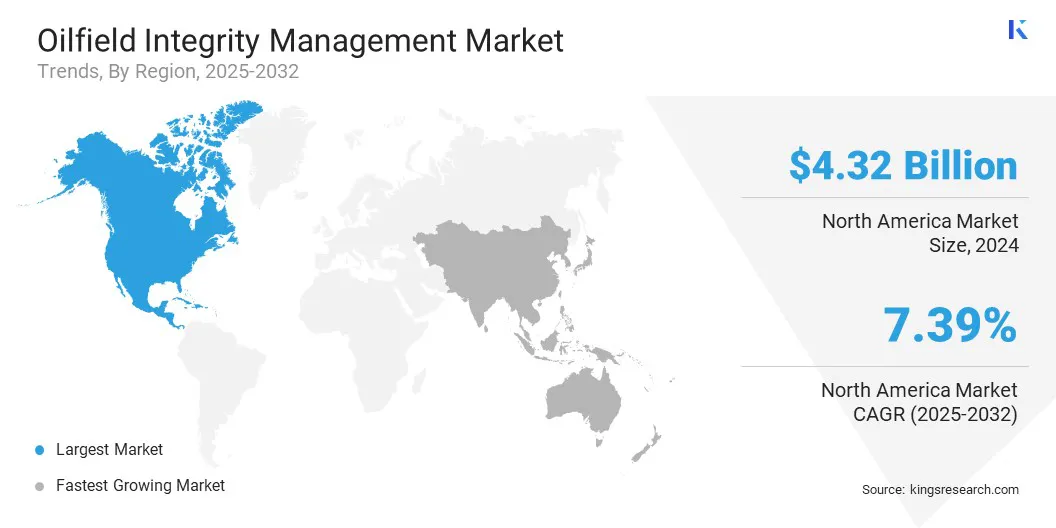

- North America held a market share of 34.09% in 2024, with a valuation of USD 4.32 billion.

- The hardware segment garnered USD 4.87 billion in revenue in 2024.

- The cloud-based segment is expected to reach USD 13.92 billion by 2032.

- The offshore segment is anticipated to witness the fastest CAGR of 7.70% during the forecast period.

- Asia Pacific is predicted to grow at a CAGR of 8.46% over the forecast period.

Major companies operating in the oilfield integrity management market are SLB, Halliburton Energy Services, Inc., Siemens, Emerson Electric Co., IBM Corporation, Oracle, Aker Solutions, John Wood Group PLC, SGS SA, Oceaneering International, Inc., Baker Hughes Company, TechnipFMC plc, ABS Group of Companies, Inc., TWI Ltd, and ROSEN Group.

Sustained crude oil production is driving the market by increasing the need for continuous monitoring, maintenance, and risk mitigation of offshore assets. Offshore oil producers are investing in advanced integrity solutions to ensure operational safety, prevent failures, and meet regulatory standards amid steady production across key offshore regions.

- The U.S. Energy Information Administration (EIA) projects crude oil production in the Federal Offshore Gulf of Mexico to average 1.80 million barrels per day in 2025 and 1.81 million in 2026. This continued offshore activity is driving demand for oilfield integrity management solutions.

Market Driver

Growing Investments in Aging Oilfield Infrastructure

A major factor driving the oilfield integrity management market is its growing adoption to ensure safety, reliability, and compliance of aging oilfield infrastructure. Oil and gas operators are prioritizing upgrades, retrofits, and integrity monitoring as existing wells, pipelines, and facilities approach the end of their design life, aiming to prevent failures and unplanned shutdowns.

This shift is fueling the demand for advanced inspection technologies, predictive maintenance tools, and asset management systems that support long-term operational performance across onshore and offshore oilfield environments.

- In April 2024, the U.S. Department of Transportation and the Pipeline and Hazardous Materials Safety Administration awarded a USD 2.45 million grant to CPS Energy to replace aging gas infrastructure in San Antonio. This reflects growing government support for infrastructure modernization, driving the demand for oilfield integrity management solutions focused on safety and reliability.

Market Challenge

High Implementation and Operational Costs

A key challenge impacting the oilfield integrity management market is the high implementation and operational costs of deploying comprehensive integrity solutions. Advanced monitoring systems, inspection tools, and predictive maintenance technologies require substantial upfront investment, which can be a barrier for smaller operators. These costs are further compounded by specialized personnel, ongoing maintenance, and integration with existing infrastructure.

To address this challenge, market players are developing cost-effective and scalable integrity management solutions for varying operational budgets. They are offering modular systems that allow phased implementation, which reduces upfront investment.

Additionally, the adoption of cloud-based platforms and remote monitoring technologies is lowering infrastructure costs and minimizing on-site personnel requirements. Vendors are also providing subscription-based and integrated service packages to ease financial pressure on smaller operators.

Market Trend

Sustainability and Emissions Reduction

A key trend influencing the oilfield integrity management market is the increasing alignment of operational practices with sustainability and emissions reduction goals. Players in the market are deploying real-time emissions monitoring systems, electrifying production assets, and phasing out routine flaring to lower their environmental impact.

This shift prompts the development of cleaner and compliant oilfield operations that meet Environmental, Social, and Governance (ESG) standards. These initiatives are helping companies reduce their carbon footprint, improve regulatory alignment, and maintain operational integrity across sustainable energy landscapes.

- In November 2024, TotalEnergies announced its plans to install real-time methane leak detection systems across its operated upstream assets by the end of 2025. This initiative supports the company’s goal of reaching near-zero methane emissions by 2030 and aligns oilfield integrity efforts with broader sustainability and ESG commitments.

Oilfield Integrity Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware (Asset Integrity Management, Data Management, Pipeline Integrity, Corrosion Management, Predictive Maintenance & Inspection, Regulatory & Compliance Solutions, Others), Software, Services (Professional, Managed)

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Application

|

Onshore, Offshore

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, and Services): The hardware segment earned USD 4.87 billion in 2024, due to the increasing deployment of smart sensors and field instruments for real-time monitoring.

- By Deployment (Cloud-based and On-premises): The cloud-based segment held 62.15% of the market in 2024, due to the growing demand for scalable and remote access to integrity data and analytics.

- By Application (Onshore and Offshore): The onshore segment is projected to reach USD 12.87 billion by 2032, owing to the widespread adoption of predictive maintenance and regulatory compliance requirements.

Oilfield Integrity Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America oilfield integrity management market share stood at 34.09% in 2024, with a valuation of USD 4.32 billion. This dominance is attributed to the integration of advanced production chemical technologies that support long-term asset performance. Key players in the region are enhancing their operational reach by combining specialized chemical treatments with lifecycle asset management.

They are using advanced production chemical technologies to manage corrosion, scale, and flow assurance more effectively, sustaining production and extending asset life across complex oilfield environments.

Companies are also aligning their asset management strategies with broader operational goals to improve performance from well completion to decommissioning. The market is expanding from improved service coverage due to the consolidation of production-focused solutions with global delivery systems. These efforts are allowing North America to support efficient asset operation and ensure long-term system reliability.

- In July 2025, SLB completed its USD 7.75 billion acquisition of oilfield services firm ChampionX to strengthen its production chemical capabilities and enhance asset management across the oilfield lifecycle. This integrates ChampionX’s production-focused technologies and customer base with SLB’s global operations, improving integrity, reliability, and performance from well completion to decommissioning.

Asia Pacific oilfield integrity management industry is set to grow at a CAGR of 8.46% over the forecast period. This growth is attributed to the expansion of upstream oil and gas activities supported by investment in offshore drilling assets and integrated field services across the region.

Market players are enhancing operational capabilities through acquisitions that enable deeper participation in complex drilling, work-over, and well management services. These developments are driving the rapid expansion of the market by strengthening asset performance and lifecycle reliability.

Additionally, regional players are contributing to market growth by integrating technical expertise with diversified oilfield service offerings to meet the rising demand for long-cycle asset support. The market is also experiencing steady growth from increased private sector involvement in offshore operations..

- In August 2025, Hazoor Multi Projects Ltd. acquired Quippo Oil & Gas Infrastructure to enter India’s upstream oil and gas sector. The acquisition aims to expand Hazoor’s capabilities into energy services by integrating Quippo’s drilling assets, technical expertise, and oilfield service offerings.

Regulatory Frameworks

- The Bureau of Safety and Environmental Enforcement (BSEE) regulates oilfield operations in the U.S. It oversees structural integrity, well control, and environmental protection, mandating regular inspections, integrity testing, and safety system audits.

- In China, the Ministry of Emergency Management (MEM) oversees industrial safety, including oilfield integrity. It enforces structural safety standards, supervises pipeline inspections, and mandates emergency preparedness for oil and gas operations. MEM ensures risk assessment, environmental safety, and integrity control in upstream activities in onshore and offshore fields under national jurisdiction.

- In the UK, the Health and Safety Executive (HSE) regulates oil and gas integrity under the Control of Major Accident Hazards (COMAH) and Offshore Installations Safety regulations. HSE oversees asset condition, corrosion management, and safety case approvals. It enforces a goal-based approach, requiring operators to demonstrate ongoing integrity and risk mitigation.

- In India, the Directorate General of Hydrocarbons (DGH) regulates upstream oil and gas operations, ensuring asset integrity through guidelines on well integrity, production safety, and field inspections. DGH mandates operators to maintain integrity logs, submit risk assessments, and follow safety protocols to ensure sustainable and failure-free oilfield operations.

Competitive Landscape

Major players operating in the oilfield integrity management industry are expanding their service portfolios through strategic acquisitions to strengthen asset integrity and upstream well services. They are integrating specialized expertise to offer end-to-end maintenance and monitoring solutions across the oil and gas value chain.

Market players are enhancing operational efficiency by incorporating advanced diagnostics and remote inspection tools. Players are also focusing on geographic diversification to support regional energy goals and meet rising demand for reliability and sustainability. Additionally, oilfield service providers are aligning their offerings with evolving industry requirements to serve as comprehensive solution providers amid rising operational and regulatory complexities.

- In December 2024, NMDC LTS signed a definitive agreement to acquire a 70% stake in Emdad to expand its presence in the oilfield integrity management. The acquisition allows NMDC to integrate Emdad’s capabilities in upstream well services, asset integrity, and maintenance.

Key Companies in Oilfield Integrity Management Market:

- SLB

- Halliburton Energy Services, Inc

- Siemens

- Emerson Electric Co

- IBM Corporation

- Oracle

- Aker Solutions

- John Wood Group PLC

- SGS SA

- Oceaneering International, Inc

- Baker Hughes Company

- TechnipFMC plc

- ABS Group of Companies, Inc

- TWI Ltd

- ROSEN Group

Recent Developments (M&A/Partnerships/Agreements/Product Launch)

- In February 2025, Saipem and Subsea7 signed a memorandum of understanding to merge and form Saipem7. The proposed entity will combine offshore engineering, construction, and integrity management capabilities, supported by an expanded vessel fleet and workforce. The merger aims to enhance global service coverage and improve operational efficiency across energy infrastructure projects.

- In June 2024, Baker Hughes introduced a suite of hydrogen-focused Panametrics sensor technologies to enhance safety and operational efficiency across hydrogen and industrial applications. The new offerings include XMTCpro for precise gas concentration monitoring, HygroPro XP for accurate moisture detection in gases and liquids, and T5MAX Transducer for improved flow measurement.