Market Definition

The market involves technologies and systems designed to identify leaks in pipelines, tanks, and pressurized systems across industries such as oil & gas, water treatment, chemicals, and HVAC. It includes methods like acoustic monitoring, thermal imaging, tracer gas detection, and digital pressure analysis.

Formulations range from sensor-based platforms to smart software integration. These solutions are used to prevent product loss, ensure safety, and meet environmental standards. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Leak Detection Market Overview

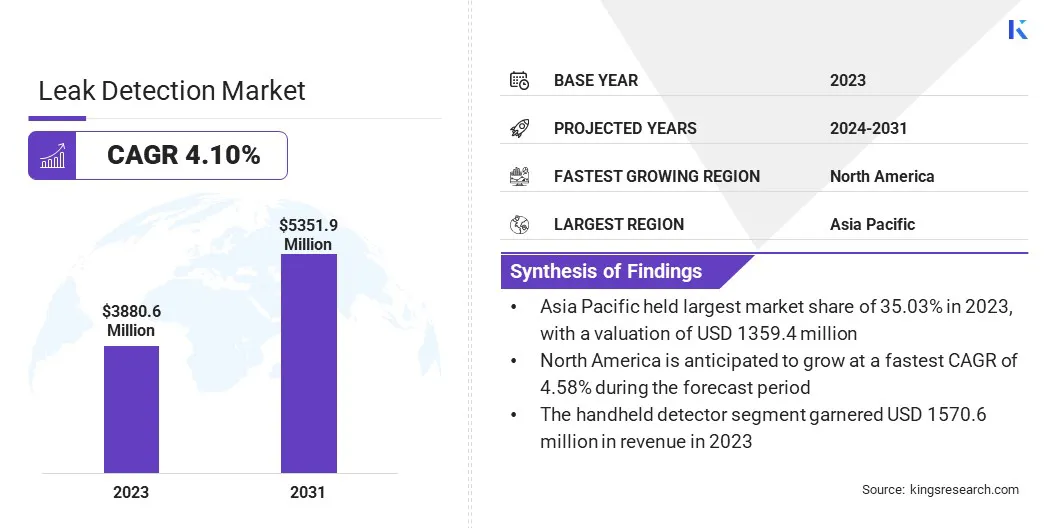

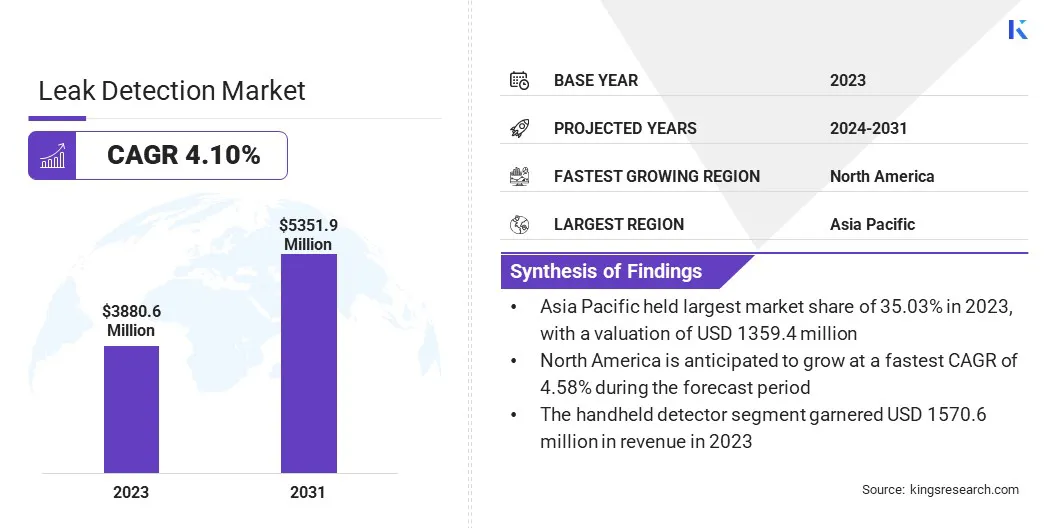

The global leak detection market size was valued at USD 3880.6 million in 2023 and is projected to grow from USD 4039.7 million in 2024 to USD 5351.9 million by 2031, exhibiting a CAGR of 4.10% during the forecast period.

The market is driven by the rising demand in the petrochemical and refining industry, where operational safety and environmental compliance are critical. Advancements in sensing and monitoring technologies have improved early detection and response times, making these systems essential for maintaining efficiency and preventing costly incidents.

Major companies operating in the leak detection industry are Honeywell International Inc., ABB, Siemens, FLIR Systems, Inc., Emerson Electric Co., Xylem Inc., Mueller Water Products, Inc., Pentair plc, ClampOn AS, KROHNE Messtechnik GmbH, Atmos International, Perma-Pipe International Holdings, Inc., Gutermann AG, Wilco AG, and SGS Société Générale de Surveillance SA.

Environmental regulations across regions are pushing industries to adopt advanced monitoring systems. Government bodies are enforcing strict penalties for oil spills, gas leaks, and water contamination.

This has increased the demand for real-time and accurate leak detection technologies. Companies in sectors such as oil & gas, chemicals, and utilities are now investing in detection systems to ensure compliance. This regulatory focus is a major contributor to the sustained growth of the market.

- ChampionX received approval from the U.S. Environmental Protection Agency (EPA) for its AOGI platform under the Methane Alternative Test Method, outlined in Subpart OOOOb of the New Source Performance Standards (NSPS). This technology combines high-definition optical gas imaging with an advanced gimbal system to detect and visualize methane leaks accurately, even in expansive areas like the Permian Basin. The system enables rapid identification of leak sources, allowing for efficient repairs and compliance with environmental regulations.

Key Highlights

Key Highlights

- The leak detection market size was valued at USD 3880.6 million in 2023.

- The market is projected to grow at a CAGR of 4.10% from 2024 to 2031.

- Asia Pacific held a market share of 35.03% in 2023, with a valuation of USD 1359.4 million.

- The handheld detector segment garnered USD 1570.6 million in revenue in 2023.

- The volatile organic compound (VOC) analyzer segment is expected to reach USD 1462.9 million by 2031.

- The aerospace segment secured the largest revenue share of 24.20% in 2023.

- The market in North America is anticipated to grow at a CAGR of 4.58% during the forecast period.

Market Driver

Rising Demand in the Petrochemical and Refining Industry

Leak detection has become critical in the petrochemical sector, where volatile and hazardous materials are transported and processed. Any leakage in such facilities poses safety risks and leads to environmental concerns.

Operators in refineries and chemical plants are adopting robust detection technologies for pipelines, storage tanks, and processing units. This rising industry-wide implementation of leak detection technologies is fueling the market, especially in regions with strong refining activities.

- In July 2024, Montrose Environmental Group implemented its Leak Detection Sensor Network (LDSN) at a U.S. Gulf Coast refinery. This system features real-time sensors that continuously monitor for leaks and utilizes the company's proprietary Sensible EDP software to aggregate data and send immediate alerts. The deployment enhances early detection of emissions, improves process safety, and contributes to better air quality in surrounding communities.

Market Challenge

High Installation and Maintenance Costs

A significant challenge affecting the growth of the leak detection market is the high cost of installing and maintaining advanced systems. This is especially critical for large-scale facilities and pipeline networks, where integration of real-time sensors and monitoring infrastructure can be financially burdensome.

Market players are offering modular and scalable solutions that allow phased implementation. Some are also investing in wireless sensor technologies to reduce installation complexity. Additionally, predictive maintenance tools and remote diagnostics are helping lower long-term operational costs, making these systems more accessible and financially viable for a broad range of end users.

Market Trend

Advancements in Sensing and Monitoring Technologies

The development of high-precision sensors, UAV-based technology, infrared cameras, and cloud-based analytics is transforming leak detection. Newer technologies provide better sensitivity, quicker response, and remote access to data.

These advancements have expanded the applications of detection systems beyond traditional sectors. Industries now benefit from scalable, real-time monitoring. The ability to detect small leaks with higher accuracy is accelerating adoption, boosting the market globally.

- The California Public Utilities Commission report in February highlights that drone systems equipped with LiDAR and Optical Gas Imaging (OGI) sensors have been tested for leak detection in hard-to-access areas. These drone systems offer quicker detection and improved localization of gas leaks, enhancing emergency response capabilities.

Leak Detection Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Handheld Detector, Vehicle-based Detector, UAV-based Detector

|

|

By Technology

|

Volatile Organic Compound (VOC) Analyzer, Optical Gas Imaging (OGI), Laser Absorption Spectroscopy, Acoustic Leak Detection, Audio-Visual-Olfactory Inspection

|

|

By End-use Industry

|

Aerospace, Automotive, Chemical, Energy & Utilities, Food & Beverages, Oil & Gas, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Handheld Detector, Vehicle-based Detector, UAV-based Detector): The handheld detector segment earned USD 1570.6 million in 2023, due to its cost-effectiveness, portability, and widespread use across field inspections in industrial, utility, and municipal applications.

- By Technology (Volatile Organic Compound (VOC) Analyzer, Optical Gas Imaging (OGI), Laser Absorption Spectroscopy, and Acoustic Leak Detection): The Volatile Organic Compound (VOC) analyzer segment held 27.30% share of the market in 2023, due to its high sensitivity in detecting hazardous gas leaks in real time.

- By End-use Industry (Aerospace, Automotive, Chemical, and Energy & Utilities): The aerospace segment is projected to reach USD 1300.0 million by 2031, owing to its stringent safety standards and the critical need for precise monitoring of fuel, hydraulic, and pressurized systems to prevent operational failures and ensure regulatory compliance.

Leak Detection Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 35.03% share of the leak detection market in 2023, with a valuation of USD 1359.4 million. The region is undergoing rapid infrastructure upgrades, especially in energy transmission and urban utilities. Governments and private operators are investing in new pipeline networks for oil, gas, and water.

Asia Pacific accounted for 35.03% share of the leak detection market in 2023, with a valuation of USD 1359.4 million. The region is undergoing rapid infrastructure upgrades, especially in energy transmission and urban utilities. Governments and private operators are investing in new pipeline networks for oil, gas, and water.

At the same time, older pipelines are being assessed and retrofitted. These projects require both embedded and portable leak detection technologies. The growing need for safe and efficient pipeline operation across new and legacy systems is driving the market in Asia Pacific.

Moreover, utility providers in Asia Pacific are adopting smart technologies to manage urban services more efficiently. Cities are deploying sensor-based leak detection in water & gas distribution networks to reduce losses and improve service reliability.

- In April 2024, Siemens introduced its SIWA Leak Finder application at IFAT 2024. This AI-based leak detection solution has helped utilities like VA SYD in Sweden detect leaks as small as 0.5 liters per second. The solution allows sensors to connect to the cloud without specialized expertise, with data appearing in the application in less than two hours.

The leak detection industry in North America is poised for significant growth at a robust CAGR of 4.58% over the forecast period. North America has some of the most detailed regulations for leak detection, especially in the oil, gas, and chemical sectors. These regulations compel operators to invest in certified detection technologies. The demand for compliant, automated systems is steadily driving the market in North America.

- In January 2025, the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) finalized a rule mandating enhanced leak detection and repair (LDAR) protocols for gas pipelines. The rule introduces strengthened leakage survey requirements and performance standards for advanced leak detection technologies across various pipeline types, including transmission, distribution, and offshore gathering lines. This initiative aims to bolster pipeline safety and reduce methane emissions.

Furthermore, leak detection systems in North America are increasingly integrated with digital control networks and SCADA systems. The demand for cyber-resilient monitoring systems is becoming a key factor in purchase decisions, influencing the growth of the market in North America.

- In July 2024, the Federal Bureau of Investigation (FBI) issued a warning highlighting the growing cyber threats facing the U.S. renewable energy sector. Cybercriminal groups are increasingly attempting to disrupt power generation, steal intellectual property, or hold critical operational data for ransom, driven by geopolitical agendas or financial gain.

Regulatory Frameworks

- The U.S. follows FDA guidelines that regulate gene-editing therapies through rigorous clinical trials and approvals, while the NIH RAC oversees federal gene-editing research. Human germline editing remains under strict moratoriums for clinical use.

- The U.S. Environmental Protection Agency (EPA) regulates leak detection under the Resource Conservation and Recovery Act (RCRA), requiring underground storage tanks to have certified monitoring systems. Leak Detection and Repair (LDAR) programs mandate continuous monitoring of components like valves and flanges to control emissions of hazardous air pollutants and VOCs.

- The European Union (EU) mandates leak detection under directives such as the Industrial Emissions Directive (IED) and REACH. EN 13160 governs equipment classifications, while national agencies enforce system performance. Operators handling dangerous substances must ensure early leak detection and rapid containment, especially in sectors like refining, manufacturing, and chemical storage.

- Japan’s High Pressure Gas Safety Act mandates periodic inspection of pipelines, tanks, and related gas facilities. Leak detection technologies must meet Ministry of Economy, Trade and Industry (METI) standards. Facilities are legally bound to operate under stringent monitoring, especially in densely populated or high-risk industrial areas, to prevent gas-related incidents.

- South Korea’s Ministry of Environment requires leak detection for facilities handling toxic or hazardous materials under the Chemicals Control Act. Storage tanks and pipelines must be equipped with sensors and double containment systems. Leak events must be reported immediately, and facilities are subject to inspections to ensure adherence to pollution prevention mandates.

Competitive Landscape

Market players in the leak detection market are focusing on advancing their technologies to meet evolving safety and regulatory needs. Several key utility providers are refining sensor accuracy, improving real-time data capabilities, and integrating AI for faster leak identification.

These innovations are helping operators detect issues earlier, reduce maintenance costs, and comply with stricter standards. Such advancements are playing a key role in improving system reliability and operational efficiency.

- In October 2024, SGS Australia launched an acoustic leak detection method aimed at maintaining the integrity of fuel systems. This technology can detect even minor leaks without the need to disconnect tanks or pipes, allowing for assessments while tanks are between 10% and 90% full. The method offers fast, reliable results and supports on-site report generation, facilitating quick decision-making and minimizing operational disruptions.

List of Key Companies in Leak Detection Market:

- Honeywell International Inc.

- ABB

- Siemens

- FLIR Systems, Inc.

- Emerson Electric Co.

- Xylem Inc.

- Mueller Water Products, Inc.

- Pentair plc

- ClampOn AS

- KROHNE Messtechnik GmbH

- Atmos International

- Perma-Pipe International Holdings, Inc.

- Gutermann AG

- Wilco AG

- SGS Société Générale de Surveillance SA

Recent Developments (Expansion/Product Launch)

- In June 2024, FLIR introduced the ADGiLE system, a fixed-mounted methane monitoring solution featuring Optical Gas Imaging (OGI) with edge detection analytics. Designed for the oil & gas industry, it provides continuous leak detection across various equipment, helping companies meet environmental goals.

- In April 2024, Gutermann launched the ZONESCAN AI Logger, an advanced leak detection device integrating AI and automatic correlation. It offers high-precision leak pinpointing with time synchronization precision of ≤1 millisecond and typical leak indication precision of ≤1 meter. The device utilizes NB-IoT for seamless data transmission and features a user-friendly interface for easy management.

- In 2024, Atmos International deployed its Atmos Eclipse unit on a river-crossing pipeline section in the UK. The non-intrusive, solar-powered leak detection system measures flow, pressure, and temperature, effectively detecting leaks in challenging scenarios. It supports various communication methods for real-time data transmission.