Market Definition

The market refers to the industry focused on extracting and processing oil from oil shale, a sedimentary rock containing kerogen. Kerogen is converted into synthetic oil & gas through specialized techniques like mining and retorting.

This market is driven by technological advancements, energy demand, and environmental factors, with key players spanning global oil & energy companies.

Oil Shale Market Overview

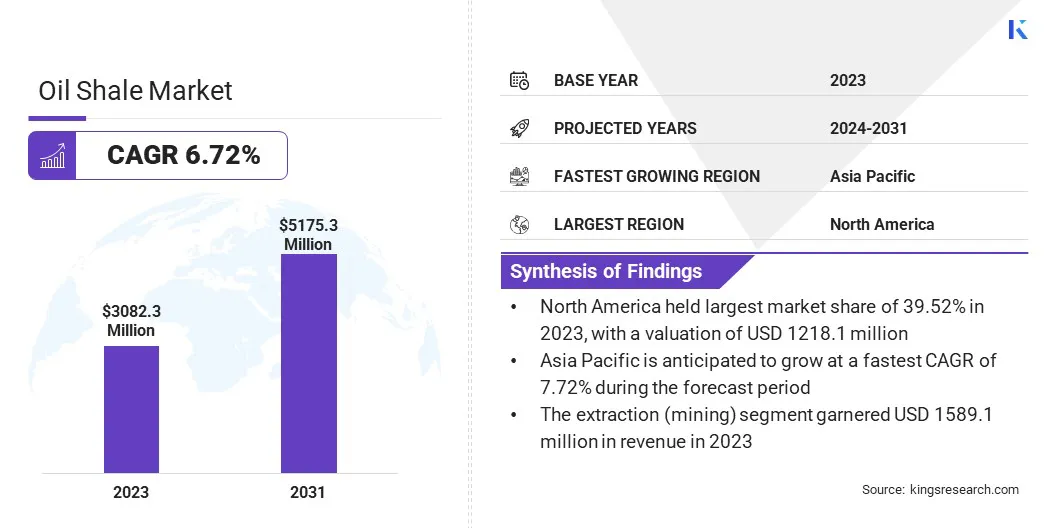

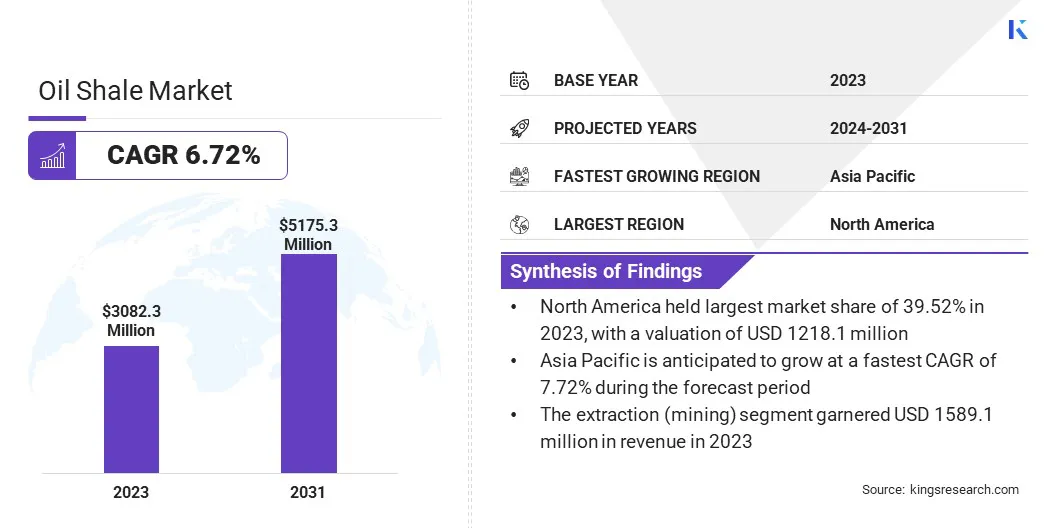

The global oil shale market size was valued at USD 3082.3 million in 2023, which is estimated to be USD 3282.5 million in 2024 and reach USD 5175.3 million by 2031, growing at a CAGR of 6.72% from 2024 to 2031.

Increasing global energy demand and the search for alternative oil sources drive the market, offering a potential solution to meet the growing need for energy amidst depleting conventional oil reserves.

Major companies operating in the global oil shale industry are AuraSource, Inc., Chevron Corporation, Exxon Mobil Corporation, INEOS Capital Limited, Shell International B.V., Shale Energy International, LLC., Intertek Group plc, Shale Energy, Oil and Natural Gas Corporation Limited, Cairn Oil & Gas, Essar, and Marathon Petroleum Corporation.

The market focuses on the development and utilization of shale oil as an alternative energy source. This market is influenced by factors such as increasing global energy demand and the need for diversification of fossil fuel sources.

Oil shale remains a key resource, due to its potential to provide significant energy supplies. Ongoing technological advancements and research continues to shape the market, improving the feasibility of oil shale as a viable option for future energy production.

- In March 2025, researchers from Yangtze University proposed a fractal-based method to evaluate comprehensive sweet spots in fractured shale oil reservoirs. The method, improving accuracy by 45.4%, uses multifractal spectrum analysis and Machine Learning (ML), significantly enhancing shale reservoir development efficiency.

Key Highlights:

- The oil shale industry size was valued at USD 3082.3 million in 2023.

- The market is projected to grow at a CAGR of 6.72% from 2024 to 2031.

- North America held a market share of 39.52% in 2023, with a valuation of USD 1218.1 million.

- The extraction (mining) technology segment garnered USD 1 million in revenue in 2023.

- The ex-situ segment is expected to reach USD 3306.5 million by 2031.

- The diesel fuel segment held a market share of 34.27% in 2023

- The cement industry segment is anticipated to register a CAGR of 7.69% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.72% during the forecast period.

Market Driver

"Increasing Global Energy Demand"

The need for alternative oil sources becomes more critical, particularly in developing economies, as global energy demand continues to rise. Oil shale, as an unconventional source, provides an opportunity to meet this demand.

Traditional oil reserves are gradually depleting. Oil shale offers a reliable and abundant option to supplement global energy supply. This growing reliance on oil shale helps diversify the energy mix and ensures energy security, making it a crucial driver of the market as the world seeks sustainable energy solutions.

- As per the United Nations (UN), the global population is projected to reach 8.5 billion by 2030 and 9.7 billion by 2050. Energy demand is expected to rise significantly. This population growth will drive the need for alternative energy sources to meet rising consumption levels.

Market Challenge

"Market Volatility"

Market volatility, driven by fluctuating crude oil prices, remains a significant challenge for the oil shale market. These price swings create uncertainty for investors, hinder long-term planning, and impact profitability.

Companies should focus on diversifying their production methods, adopting advanced technologies like fractal-based evaluation methods for sweet spots, and leveraging ML for more accurate predictions. Additionally, implementing hedging strategies and fostering long-term partnerships can help stabilize cash flow and reduce the financial risks associated with price fluctuations.

Market Trend

"Technological Advancement"

In recent years, the oil shale market registered significant technological advancements aimed at improving extraction efficiency and reducing costs. Innovations such as advanced drilling techniques, automated fracturing processes, and enhanced reservoir characterization methods have become prominent.

Additionally, the integration of ML and AI for predictive modeling, coupled with high-precision geophysical tools, has enabled more accurate identification of sweet spots. These developments contribute to optimizing production, increasing recovery rates, and addressing environmental concerns, driving the market toward more sustainable practices.

- In October 2024, Sinopec Corp. achieved breakthroughs in drilling technology, including high-density seismic acquisition and ultra-deep well drilling. Its innovations, like the Matrix Navigation system, enhanced shale oil & gas operations, contributing to projects like Shengli and Sichuan.

Oil Shale Market Report Snapshot

|

Segmentation

|

Details

|

|

By Process

|

Extraction (mining), Retorting, Refining

|

|

By Method

|

In-Situ, Ex-Situ

|

|

By Product

|

Diesel Fuel, Gasoline Fuel, Liquid Petroleum Gas, Kerosene, Others

|

|

By End User

|

Automobile Fuel, Chemical Industry, Cement Industry, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Process (Extraction, Retorting, Refining): The extraction (mining) segment earned USD 1589.1 million in 2023, due to the increased demand for shale oil and enhanced extraction technologies.

- By Method (In-Situ, Ex-Situ): The ex-situ segment held 62.75% share of the market in 2023, due to technological advancements in processing and efficient resource recovery methods.

- By Product (Diesel Fuel, Gasoline Fuel, Liquid Petroleum Gas, Kerosene, Others): The diesel fuel segment is projected to reach USD 1805.2 million by 2031, owing to growing demand for alternative fuels and shale oil refining.

- By End User (Automobile Fuel, Chemical Industry, Cement Industry, Others): The cement industry segment is anticipated to register a CAGR of 7.69% during the forecast period, driven by the increasing use of shale-based raw materials for cement production.

Oil Shale Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a oil shale market share of around 39.52% in 2023, with a valuation of USD 1218.1 million. North America remains the dominating region in the market, with the U.S. leading the way in production and technological innovations. The region benefits from well-established infrastructure, abundant shale resources, and a robust energy sector.

The development of hydraulic fracturing and horizontal drilling technologies has significantly boosted shale oil production, making North America a global leader. Continued investments in exploration and advancements in extraction methods are likely to sustain its dominant position in the market.

The oil shale industry in Asia Pacific is poised for significant growth at a robust CAGR of 7.72% over the forecast period. Asia Pacific is expected to be the fastest-growing market for oil shale, driven by rising energy demand, industrialization, and government initiatives promoting alternative energy sources.

Countries like Iran, China and India are increasing their focus on developing shale oil resources to enhance energy security and reduce dependence on imports. Technological advancements in extraction and processing techniques are further supporting growth, making Asia Pacific a key area for investment in the market.

- In December 2024, Tehran University, in collaboration with NIOC, developed technology for extracting shale oil from reservoirs. This breakthrough, using toxic coke technology, marks a significant advancement in Iran's oil shale industry, particularly for the Ghalikouh reserves in Lorestan.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) protects public health and the environment by regulating emissions and enforcing environmental standards related to oil shale extraction, while sponsoring research and development.

- In India, the Ministry of Petroleum and Natural Gas (MoPNG) regulates the exploration, development, and production of oil shale resources.

- In the EU, the European Environment Agency (EEA) provides independent information on the environment, guidelines on sustainable resource extraction practices, and environmental monitoring.

Competitive Landscape:

Companies in the oil shale industry are making strategic acquisitions to expand their resource base, enhance production capabilities, and increase market share. These transactions allow firms to access valuable reserves, improve technological expertise, and streamline operations.

Companies in the market pursue acquisitions to strengthen their competitive position, optimize costs, and secure long-term profitability as the demand for energy grows and market conditions evolve. Such strategic moves help in diversifying portfolios and adapting to changes in energy market dynamics.

- In May 2023, INEOS Energy completed a USD 1.4 billion acquisition of approximately 2,300 wells in the Eagle Ford shale from Chesapeake Energy. This acquisition marks INEOS Energy's entry as an operator in the U.S. onshore oil & gas market.

List of Key Companies in Oil Shale Market:

- AuraSource, Inc.

- Chevron Corporation

- Exxon Mobil Corporation

- INEOS Capital Limited

- Shell International B.V.

- Shale Energy International, LLC.

- Intertek Group plc

- Shale Energy

- Oil and Natural Gas Corporation Limited

- Cairn Oil & Gas

- Essar

- Marathon Petroleum Corporation

Recent Developments (Exploration)

- In April 2023, Essar Exploration and Production began shale gas exploration in West Bengal’s Ranigunj field, planning to drill two wells. The field is estimated to have 1.6 trillion cubic feet of recoverable shale gas. Essar aims to enhance coal bed methane production while contributing significantly to West Bengal’s economy.