Market Definition

The market involves the use of various technologies and solutions to maintain, monitor, and optimize the quality and performance of oils used in industrial machinery, equipment, and vehicles.

This includes processes such as oil filtration, purification, monitoring, and condition-based maintenance to extend the life of the oil and the equipment it lubricates. This report provides an in-depth analysis of the key drivers, trends, challenges, and competitive dynamics shaping the market.

Oil Condition Monitoring Market Overview

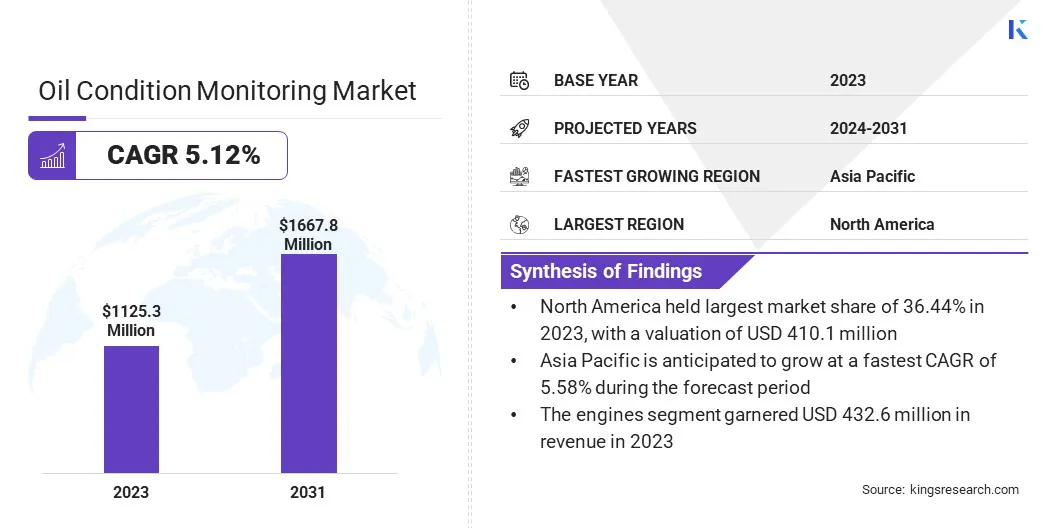

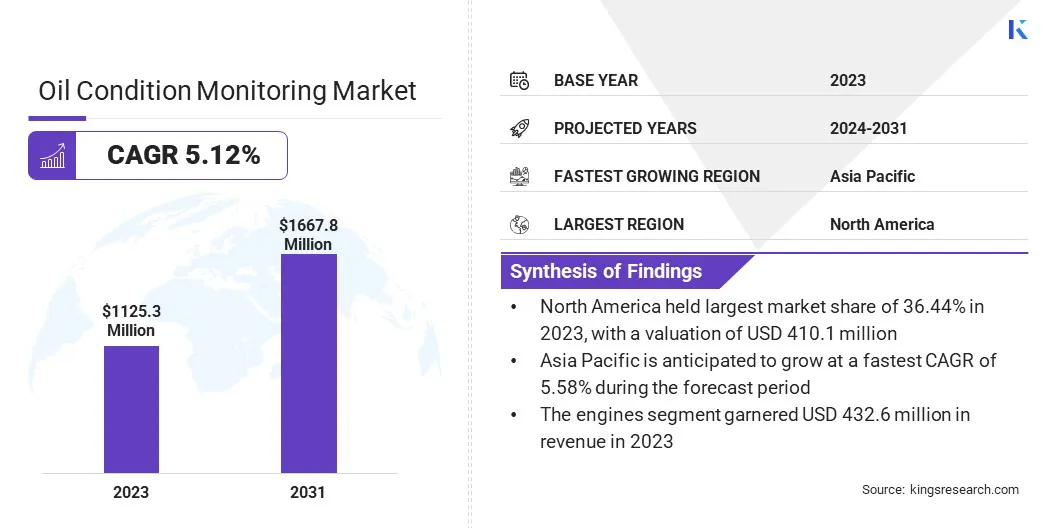

The global oil condition monitoring market size was valued at USD 1,125.3 million in 2023 and is projected to grow from USD 1,175.5 million in 2024 to USD 1,667.8 million by 2031, exhibiting a CAGR of 5.12% during the forecast period.

The market is registering significant growth, driven by increasing industrial automation, the demand for predictive maintenance, and the need for enhanced operational efficiency across various sectors. Oil condition monitoring encompasses the monitoring and management of oil quality to ensure optimal performance and longevity of machinery and equipment.

Major companies operating in the oil condition monitoring ndustry are Fuchs SE, XADO, Afton Chemical Corporation, Flowserve, Baker Hughes, Lubrizol, Honeywell, SNF, General Electric, Shell PLC, Eaton, Parker Hannifin, Chevron, Intertek, and Bureau Veritas.

Regulatory pressures related to environmental protection and equipment efficiency are further encouraging the adoption of oil condition monitoring technologies. Additionally, the need to optimize operational performance and reduce maintenance costs is pushing industries to invest in advanced oil analysis and conditioning solutions.

- In June 2024, Eaton introduced the PFS 02, a compact in-line particle flow sensor designed for continuous contamination monitoring in hydraulic and lubrication oils. This sensor integrates measurement and evaluation into a single unit, providing real-time diagnostics to prevent equipment failures.

Key Highlights:

- The oil condition monitoring industry size was valued at USD 1,125.3 million in 2023.

- The market is projected to grow at a CAGR of 5.12% from 2024 to 2031.

- North America held a market share of 36.44% in 2023, with a valuation of USD 410.1 million.

- The engines segment garnered USD 432.6 million in revenue in 2023.

- The off-site segment is expected to reach USD 930.8 million by 2031.

- The oil and gas segment secured the largest revenue share of 37.33% in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.58% during the forecast period.

Market Driver

"Expanding Demand for Cost-efficient Maintenance in Transportation Sector"

Companies in the transportation sector are increasingly turning to oil condition monitoring to reduce their overall maintenance expenses. Fleet operators aim to optimize oil change intervals and improve fuel efficiency by relying on oil data rather than fixed maintenance schedules.

This is driving strong interest in oil monitoring solutions for commercial vehicles, aviation engines, and marine vessels. Enabling data-driven maintenance helps transportation firms reduce operational costs, boosting the market.

- According to Shell, fleet customers using its oil analysis program reduced oil consumption by up to 40%. In aviation, Rolls-Royce’s Engine Health Monitoring (EHM) system includes oil condition checks to support cost-effective engine management. These savings are significant for companies operating large fleets, making oil analysis tools a strategic investment, thereby supporting the global growth of the oil condition monitoring market.

Market Challenge

"High Initial Investment Costs"

A significant challenge hindering the growth of the oil condition monitoring market is the high initial investment costs associated with advanced monitoring systems and technologies.

The cost of implementing sophisticated sensors, software, and infrastructure to continuously monitor oil conditions can be substantial, especially for small and medium-sized enterprises.

Key market players are increasingly adopting cost-effective, scalable solutions such as cloud-based monitoring systems and predictive maintenance technologies. These innovations help reduce initial costs by offering more affordable entry points, enabling businesses to gradually scale their monitoring capabilities while ensuring long-term operational efficiency.

Market Trend

"Expansion of Oil & Gas Exploration Activities"

The oil & gas sector is registering renewed investment in exploration & production activities, particularly in offshore and remote locations. These operations involve the extensive use of hydraulic systems, turbines, and drilling equipment that require continuous performance monitoring.

Oil condition monitoring helps ensure reliability and safety in such environments by identifying contamination or lubricant degradation early. The rising need for efficient maintenance in energy production sites is contributing to the global growth of the oil condition monitoring market.

- According to the Global Energy Monitor Report 2025, new offshore discoveries accounted for at least 8 billion barrels of oil equivalent (BBOE) in announced resources. Additionally, nearly 4 bboe of offshore reserves were approved for development, while approximately 6.5 bboe entered production as new offshore projects commenced, each representing a slight increase compared to 2023. On a global scale, both onshore and offshore, at least 9 bboe were identified in new discoveries, close to 4 bboe were sanctioned for development, and around 6.5 bboe began production through newly launched projects.

Oil Condition Monitoring Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Engines, Turbines, Hydraulic Systems, Others

|

|

By Sampling Type

|

Off-site, On-site

|

|

By End-use Industry

|

Oil and Gas, Transportation, Industrial, Energy and Power, Mining

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Engines, Turbines, Hydraulic Systems, and Others): The engines segment earned USD 432.6 million in 2023, due to its critical role in ensuring optimal performance and longevity.

- By Sampling Type (Off-site and On-site): The off-site segment held 57.52% share of the market in 2023, due to its ability to provide more precise and comprehensive analysis of oil samples in controlled laboratory environments.

- By End-Use Industry (Oil and Gas, Transportation, Industrial, Energy and Power, and Mining): The oil and gas segment is projected to reach USD 556.8 million by 2031, owing to the critical need for continuous monitoring of equipment and machinery to ensure operational efficiency, prevent costly downtime, and maintain safety standards in this high-risk industry.

Oil Condition Monitoring Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America .

North America oil condition monitoring market share stood at around 36.44% in 2023, with a valuation of USD 410.1 million. Environmental regulations in North America, such as the Clean Air Act in the U.S. and similar policies in Canada, have raised the focus on efficient equipment management.

This growing regulatory pressure to maintain cleaner operations in industries like manufacturing, transportation, and power generation is directly contributing to the growth of the market in the region.

Moreover, the growth of crude oil production in North America is significantly boosting the demand for oil condition monitoring systems. Increasing production, particularly from shale reserves, is boosting the need to monitor the condition of machinery and equipment used in extraction and refining processes.

- A recent report from the U.S. Energy Information Administration (EIA) reveals that U.S. crude oil production increased by 270,000 barrels per day (bpd) in 2024, reaching an average of 13.2 million bpd. The Permian region, located in western Texas and southeastern New Mexico, led the nation in production, contributing 48% of the total U.S. crude oil output in 2024.

The oil condition monitoring industry in Asia Pacific is poised for significant growth at a robust CAGR of 5.58% over the forecast period. The expanding energy sector in Asia-Pacific, particularly in countries with large oil reserves, is a significant driver of the market.

Increasing oil exploration & extraction activities, especially in offshore and deep-water drilling, is boosting the need for effective oil condition monitoring solutions.

Furthermore, with the region’s growing vehicle fleet, especially in emerging economies, the demand for reliable engine and vehicle maintenance is increasing. This rising demand for vehicle maintenance solutions contributes to the expansion of the market.

Regulatory Frameworks

- In the U.S., oil condition monitoring is primarily governed by the regulations set by the Environmental Protection Agency (EPA). The Spill Prevention, Control, and Countermeasure (SPCC) rule under the Clean Water Act requires facilities to monitor oil conditions to prevent spills into water bodies. Additionally, the Oil Pollution Act (OPA) mandates response plans for oil spills and the safe handling of oil.

- In the UK, oil condition monitoring is regulated by the Health and Safety Executive (HSE), which ensures that oil companies follow safe practices during oil operations. The Oil Pollution Preparedness, Response, and Cooperation (OPRC) regulations require operators to be prepared for oil spills and monitor oil conditions to prevent environmental hazards. Additionally, the Environmental Protection Act mandates that companies assess and manage risks related to oil handling, ensuring that monitoring systems are in place to detect potential issues early and maintain compliance with environmental standards.

- In China, the oil condition monitoring industry is regulated under the Regulation on the Safety Production of Offshore Oil, which focuses on safety and risk management in offshore oil operations. This regulation requires oil operators to implement oil condition monitoring systems to detect potential hazards and minimize the risk of spills.

Competitive Landscape

The oil condition monitoring industry is characterized by intense competition, with several key players focusing on technological innovation, product diversification, and strategic collaborations to enhance their market position.

Companies are increasingly investing in advanced oil condition monitoring systems, including filtration, monitoring, and condition-based maintenance technologies, to optimize the performance and lifespan of machinery and reduce operational costs.

The trend of integrating IoT and AI-driven solutions for real-time monitoring, predictive maintenance, and data analytics is growing, enabling industries to improve equipment efficiency and reduce downtime.

List of Key Companies in Oil Condition Monitoring Market:

- Fuchs SE

- XADO

- Afton Chemical Corporation

- Flowserve

- Baker Hughes

- Lubrizol

- Honeywell

- SNF

- General Electric

- Shell PLC

- Eaton

- Parker Hannifin

- Chevron

- Intertek

- Bureau Veritas

Recent Developments (Product Launch)

- In March 2024, CM Technologies introduced the WBS IR Analyser, an advanced oil condition monitoring system aimed at enhancing diesel engine performance. Employing infrared technology, this solution rapidly assesses essential parameters, including base number, soot, and water content, in both cylinder and system oils. The WBS IR Analyser provides instant and dependable results without the requirement for costly reagents, making it a cost-effective and efficient tool for monitoring oil conditions.

- In December 2023, Tan Delta Systems launched the SENSE-2 kit, featuring the OQSx-G2 sensor for real-time oil quality analysis. It utilizes full-spectrum holistic (FSH) technology to detect oil degradation and contamination at the molecular level, optimizing maintenance, reducing costs, and preventing equipment failures. The plug-and-play system integrates seamlessly with existing equipment, supports various oil types, and enables on-site and remote diagnostics for enhanced reliability across industries.