Oil and Gas Storage Service Market Size

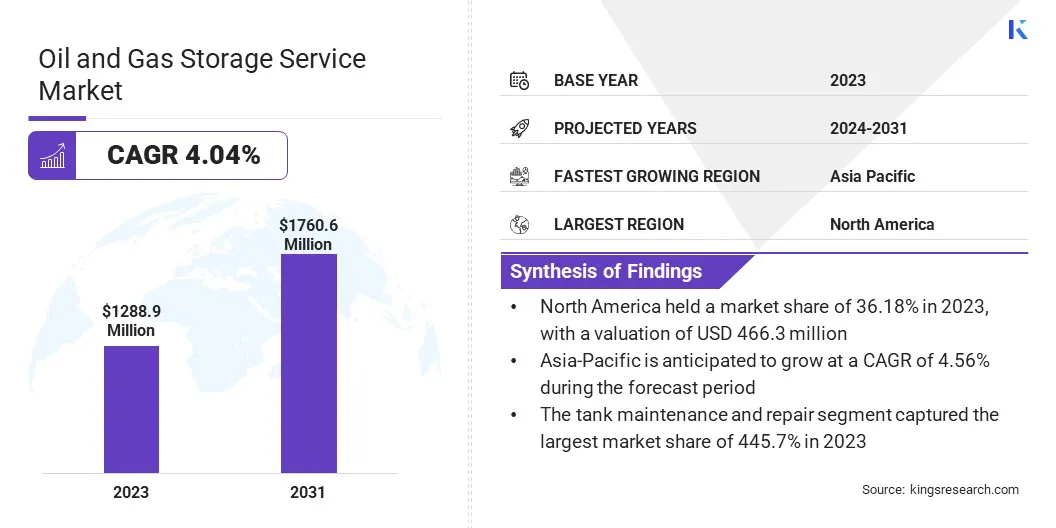

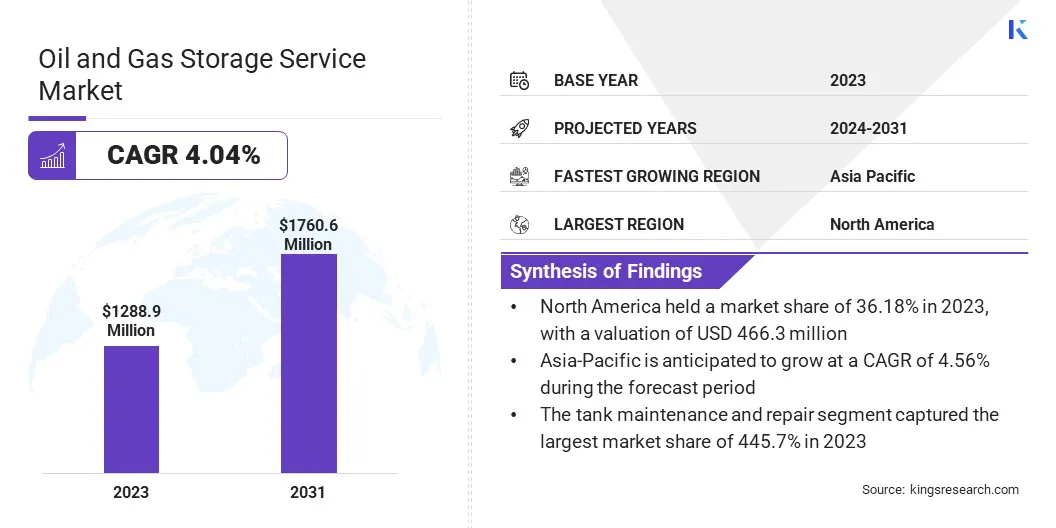

According to Kings Research, the global Oil and Gas Storage Service Market size was valued at USD 1,288.9 million in 2023 and is projected to grow from USD 1,334.3 million in 2024 to USD 1,760.6 million by 2031, exhibiting a CAGR of 4.04% during the forecast period. Rising demand for strategic petroleum reserves and increased investment in underground storage are driving the growth of the market.

In the scope of work, the report includes services offered by companies such as AltaGas Ltd., Burns & McDonnell, Edison Spa, Enbridge, Exxon Mobil Corporation, Kawasaki Kisen Kaisha, Ltd., MAN Energy Solutions SE, Reliance Industries, Saudi Arabian Oil Co., SENSIA, and others.

The growing adoption of renewable energy storage solutions presents a significant opportunity within the oil and gas storage service market. As the global focus shifts toward more sustainable energy sources, the integration of renewable energy into traditional oil and gas storage systems is becoming increasingly prevalent. This trend is further fueled by the pressing need to ensure a reliable energy supply, reduce carbon footprints, and meet stringent environmental regulations.

- For instance, in April 2024, the Federation of Indian Petroleum Industry, referencing the US Energy Information, reported that as of March 22, 2024, working gas in storage was 41.1% above the five-year average. This highlights a significant increase in gas reserves and suggests potential implications for the market.

Hybrid energy storage solutions, which combine renewable energy with conventional storage methods, offer enhanced flexibility and efficiency. For instance, surplus renewable energy can be stored and later used to power oil and gas operations, thereby reducing dependency on fossil fuels.

Additionally, the development of technologies such as battery storage and hydrogen storage supports this integration, providing companies with opportunities to diversify their energy portfolios and capitalize on the growing demand for green energy solutions. Companies that invest in renewable energy storage are likely to gain a competitive edge, foster innovation, and align with global sustainability goals.

Oil and gas storage services refer to the facilities and infrastructure used to store crude oil, refined petroleum products, natural gas, and liquefied natural gas (LNG) during various stages of the supply chain. These services are critical in managing supply and demand imbalances, ensuring energy security, and stabilizing market prices. Storage facilities are available in several types, each tailored to specific needs.

Above-ground tanks are commonly used for storing crude oil and refined products, offering easy access and monitoring. Underground storage options, such as salt caverns and depleted reservoirs, are particularly suited for natural gas due to their ability to accommodate large volumes at high pressures. Floating storage units (FSUs) and offshore facilities provide additional flexibility, especially in areas where onshore storage is limited.

The strategic placement and capacity of these storage facilities are crucial for adapting to market dynamics, handling surplus production, and mitigating risks associated with supply disruptions. Effective storage solutions enable companies to optimize their operations, manage inventories efficiently, and maintain a steady supply chain.

Analyst’s Review

The oil and gas storage service market is characterized by the strategic initiatives of key players, who are focusing on expanding their storage capacities, enhancing operational efficiency, and diversifying their energy portfolios.

Companies are increasingly investing in the development of advanced storage technologies, such as underground storage and renewable energy integration, to maintain competitiveness in a rapidly evolving market. Growth strategies include forging strategic partnerships and acquisitions to strengthen market presence and gain access to new regions and resources.

- For instance, in June 2024, Aramco awarded over USD 25 billion in contracts to advance its strategic gas expansion, aiming to boost sales gas production by more than 60% by 2030. The contracts focus on the development of Jafurah's phase two, the expansion of Master Gas System, and the establishment of new gas rigs.

Additionally, companies are prioritizing sustainability initiatives by incorporating renewable energy storage solutions into their existing infrastructure, thereby reducing carbon footprints and meeting regulatory demands. To gain a competitive edge in this market, it is essential to manage capital-intensive projects effectively, navigate regulatory challenges, and adapt to fluctuating market conditions.

Companies that leverage technology, optimize operations, and align with global sustainability trends are well-positioned to capitalize on emerging opportunities and ensure long-term growth in the market.

Oil and Gas Storage Service Market Growth Factors

The ongoing expansion of the oil and gas industry is supporting the growth of the oil and gas storage service market. As global energy demand continues to rise, particularly in developing regions, there is an increasing need to explore and develop new oil and gas reserves.

This expansion leads to higher production volumes, highlighting the need for the development of additional storage infrastructure to manage the supply chain efficiently.

The exploration of unconventional resources, such as shale gas and tight oil, has further contributed to the growth of the industry'. This development requires specialized storage solutions that are capable of handling the unique characteristics of these resources.

- For instance, in August 2023, AltaGas finalized an agreement to acquire natural gas processing and storage facilities in Canada from Tidewater Midstream for USD 650 million. The acquisition includes Pipestone's Phase I and II projects, the Dimsdale storage facility, and associated infrastructure, strengthening AltaGas's midstream capabilities.

Additionally, the expansion into new geographic regions, including offshore and remote areas, has spurred the demand for innovative storage solutions, such as floating storage units and subsea storage.

Companies are investing heavily in expanding their storage capacities to accommodate the growing production and to ensure a prompt response to market fluctuations. This trend is expected to continue as the industry seeks to meet the global energy demand for energy while also addressing the complexities of modern energy markets.

Regulatory and environmental compliance presents a significant challenge to the development of the oil and gas storage service market. As governments worldwide tighten regulations on emissions, safety standards, and environmental protection, companies are facing increasing pressure to adhere to stringent guidelines.

These regulations are intended to minimize the environmental impact of storage facilities, reduce the risk of spills and leaks, and ensure the safety of surrounding communities.

Compliance often requires substantial investments in advanced monitoring systems, safety equipment, and regular maintenance, thereby increasing operational costs. Additionally, the process of obtaining permits for new storage facilities is becoming increasingly complex and time-consuming, with often results in delays to project timelines.

The challenge is further compounded by the need to comply with varying regulations across different regions, which may complicate global operations.

However, companies are mitigating this challenge by adopting proactive strategies, such as investing in sustainable technologies, engaging in continuous regulatory monitoring, and collaborating with regulatory bodies to ensure compliance. This leads to reduce the risk of non-compliance, avoid penalties, and enhance their reputation as responsible industry players.

Oil and Gas Storage Service Market Trends

The rising demand for strategic petroleum reserves (SPR) is a prominent trend influencing the oil and gas storage service market. Governments worldwide are increasingly focusing on building and maintaining SPRs to safeguard against potential disruptions in oil supply, supported by geopolitical tensions, natural disasters, and market volatility.

These reserves act as a buffer, providing countries with the ability to stabilize their domestic energy markets and ensure continuous supply during crises. The expansion of SPRs is particularly noticeable in emerging economies, where energy security has become a critical national priority.

- For instance, in August 2024, ADNOC signed a long-term Heads of Agreement with Osaka Gas to deliver up to 0.8 million metric tonnes per annum (mmtpa) of LNG. The LNG is likely to be sourced from ADNOC's Ruwais project, with commercial operations scheduled to commence in 2028 and are likely to be shipped to Osaka Gas's destination ports.

This trend is leading to significant investments in the construction of new storage facilities, particularly underground and coastal storage sites, which offer both security and accessibility. Additionally, as global oil consumption grows, the volume of petroleum that needs to be stored in these reserves is increasing, underscoring the need for more extensive and technologically advanced storage solutions.

The growing focus on SPRs highlights the strategic importance of storage infrastructure in national energy policies, thereby stimulating growth and fostering innovation in the oil and gas storage service market.

Segmentation Analysis

The global market is segmented based on type, storage, and geography.

By Type

Based on type, the market is segmented into storage tank construction and installation, tank maintenance and repair, tank cleaning and inspection, inventory management and logistics, and others.

The tank maintenance and repair segment captured the largest oil and gas storage service market share of 445.7% in 2023, largely attributed to the growing emphasis on safety, regulatory compliance, and the longevity of oil and gas storage infrastructure.

As storage tanks are critical assets in the oil and gas industry, ensuring their integrity and operational efficiency is paramount. Regular maintenance and repair activities help prevent potential leaks, corrosion, and structural failures that lead to catastrophic environmental and financial consequences.

The stringent regulatory frameworks that govern the oil and gas industry mandate regular inspections, maintenance, and repairs of storage tanks to comply with safety and environmental standards.

Additionally, as storage facilities age, the need for more frequent and comprehensive maintenance activities increases, thereby boosting the demand. The industry’s focus on maintaining high operational standards, coupled with the rising number of storage facilities worldwide, has significantly aided the expansion of the tank maintenance and repair segment.

By Storage

Based on storage, the oil and gas storage service market is classified into aboveground storage and underground storage. The aboveground storage segment is poised to record a CAGR of 4.31% through the forecast period, primarily due to its cost-effectiveness, ease of monitoring, and growing global demand for oil and gas storage solutions.

Aboveground storage tanks (ASTs) are highly favored for their lower initial construction costs compared to underground alternatives, as well as their accessibility for regular inspections, maintenance, and repair activities. This makes them an attractive option for companies looking to expand their storage capacities quickly and efficiently.

The increasing production of oil and gas, particularly in regions such as North America and the Middle East, is fueling the need for more storage facilities, and ASTs are playing a crucial role in meeting this demand.

Additionally, the growing focus on energy security, coupled with the pressing need for strategic petroleum reserves (SPRs), is fostering investments in large-scale aboveground storage infrastructure.

Technological advancements in tank design and construction materials are enhancing the durability and safety of ASTs, making them a preferred choice in the industry. The global energy consumption continues to rise, the aboveground storage segment is anticipated to experience robust growth, supported by the expanding oil and gas production and the need for efficient storage solutions.

Oil and Gas Storage Service Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

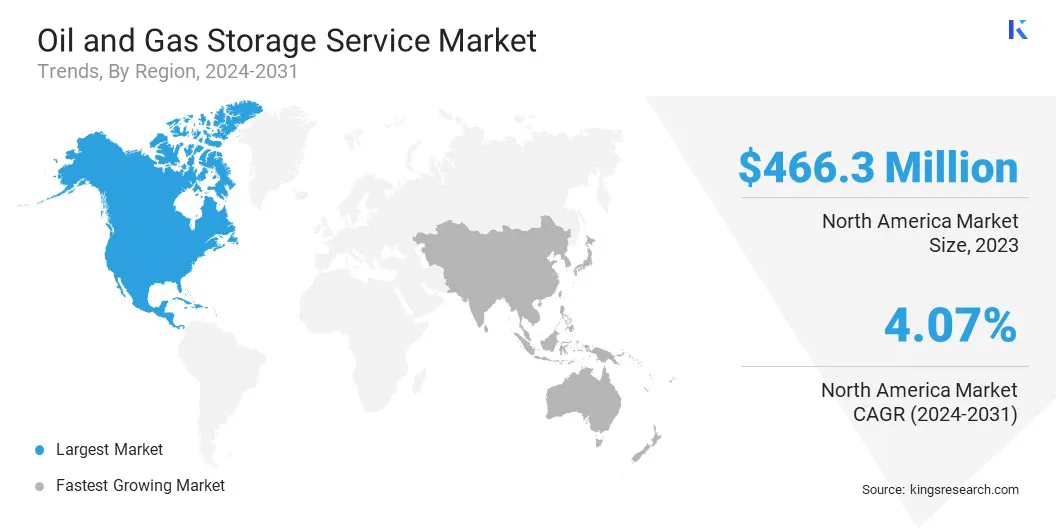

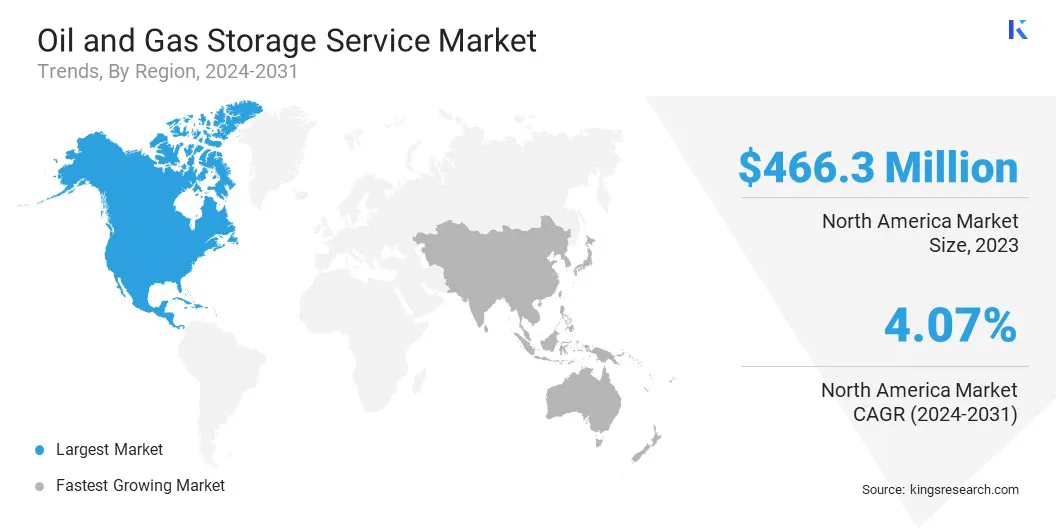

North America oil and gas storage service market accounted for a substantial share of 36.18% and was valued at USD 466.3 million in 2023, making it the largest regional market globally. This dominance is attributed to the region's well-established infrastructure, extensive oil and gas production activities, and significant investments in expanding storage capacities.

The United States, in particular, plays a pivotal role in this robust growth due to its vast network of pipelines, refineries, and storage facilities, which are crucial for managing the substantial domestic production and consumption of oil and gas. The presence of the Strategic Petroleum Reserve (SPR) in the U.S. further reinforces the region's dominating position.

Additionally, the development of unconventional oil and gas resources, such as shale, has led to the need for sophisticated storage solutions to manage the increased output. Canada, with its extensive oil sands operations, contributes significantly to regional market expansion. The region's growing focus on energy security and its ability to respond to market fluctuations further solidify its leading position in the global market.

Asia-Pacific is projected to grow at a CAGR of 4.56% in the forthcoming years, facilitated by rapid industrialization, urbanization, and increasing energy demand across the region. Countries such as China, India, and Southeast Asian nations are experiencing significant growth in energy consumption, underscoring the necessity for the expansion of oil and gas storage infrastructure to ensure a stable energy supply.

The region's strategic focus on enhancing energy security and reducing dependency on external sources is propelling investments in both onshore and offshore storage facilities. Additionally, the development of new refineries and LNG terminals is boosting the demand for storage services.

The shift toward diversifying energy portfolios, including the integration of renewable energy storage solutions with traditional oil and gas storage, is further contributing to the growth of the regional market.

Governments in the region are actively investing in expanding their strategic petroleum reserves (SPRs) to mitigate risks associated with supply disruptions. Asia-Pacific is emerging as a key region in the global oil and gas storage service market, with significant opportunities for market players to capitalize on the increasing demand.

Competitive Landscape

The global oil and gas storage service market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

Key Companies in Oil and Gas Storage Service Market

- AltaGas Ltd.

- Burns & McDonnell

- Edison Spa

- Enbridge

- Exxon Mobil Corporation

- Kawasaki Kisen Kaisha, Ltd.

- MAN Energy Solutions SE

- Reliance Industries

- Saudi Arabian Oil Co.

- SENSIA

Key Industry Developments

- August 2024 (Acquisition): Aramco secured a definitive agreement to acquire a 22.5% stake in Rabigh Refining and Petrochemical from Sumitomo Chemical for USD 702 million. This acquisition aims to bolster Aramco's strategic presence in Saudi Arabia's refining and petrochemical sector.

- June 2024 (Partnership): Birchcliff Energy and AltaGas expanded their partnership to optimize operations and enhance LPG connectivity to premium markets. Birchcliff is expected to take over the operations of AltaGas' Gordondale deep-cut gas processing facility, under a long-term contract operating agreement.

- March 2023 (Acquisition): Enbridge acquired the Tres Palacios natural gas storage facility in Texas for USD 335 million, thus enhancing its Gulf Coast storage portfolio. The acquisition was part of a deal with Crestwood Equity Partners LP and Brookfield Infrastructure Partners, adding substantial strategic value to Enbridge's natural gas assets.

The global oil and gas storage service market is segmented as:

By Type

- Storage Tank Construction and Installation

- Tank Maintenance and Repair

- Tank Cleaning and Inspection

- Inventory Management and Logistics

- Others

By Storage

- Aboveground Storage

- Underground Storage

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America