Offshore Lubricants Market Overview

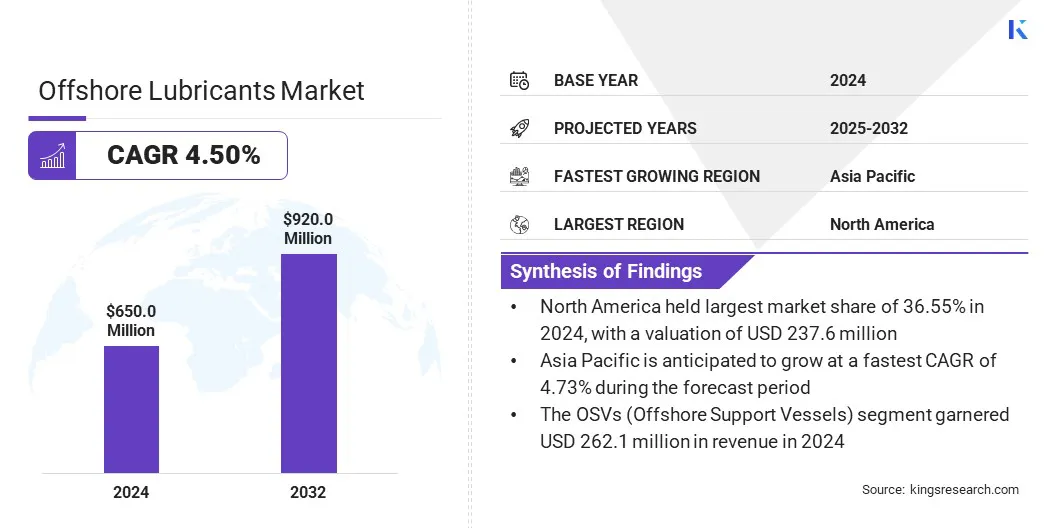

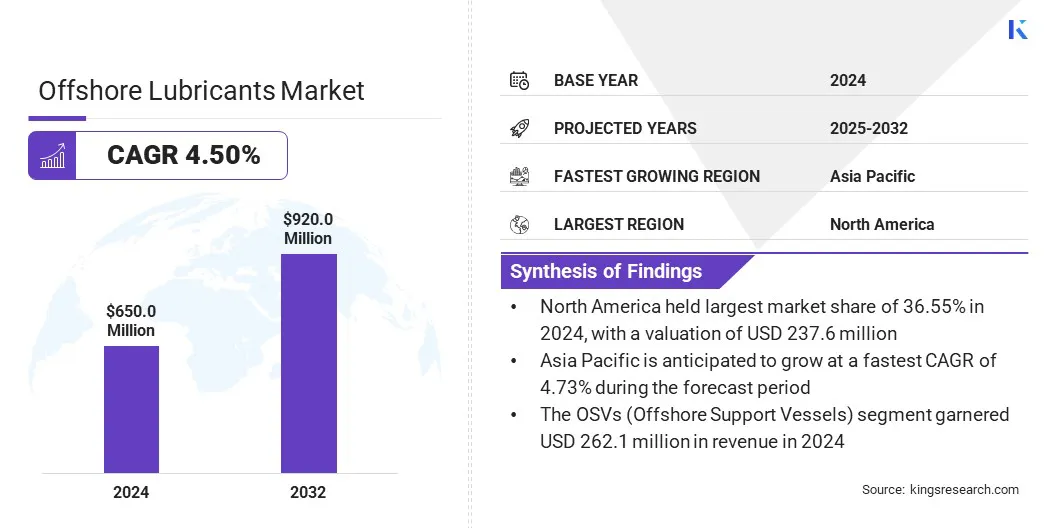

According to Kings Research, the global offshore lubricants market size was valued at USD 650.0 million in 2024 and is projected to grow from USD 675.8 million in 2025 to USD 920.0 million by 2032, exhibiting a CAGR of 4.50% during the forecast period. The market is growing due to the increasing global offshore exploration and production activities.

Rising investments in deepwater and ultra-deepwater projects are creating a strong demand for high-performance lubricants that support equipment durability in extreme conditions. The market is further benefiting from the expanding fleet of offshore support vessels and floating platforms.

Key Market Highlights:

- The offshore lubricants industry size was valued at USD 650.0 million in 2024.

- The market is projected to grow at a CAGR of 4.50% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 237.6 million.

- The engine oil segment garnered USD 243.4 million in revenue in 2024.

- The OSVs (offshore support vessels) segment is expected to reach USD 351.9 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 5.13% over the forecast period.

Major companies operating in the offshore lubricants market are Shell plc, Exxon Mobil Corporation, BP p.l.c., Chevron Corporation, TotalEnergies, China Petroleum & Chemical Corporation, LUKOIL, Aegean Oil S.A., Hinduja Group, Quaker Chemical Corporation, Valvoline Global Operations, Repsol, North Sea Lubricants, FUCHS, and Cosan.

Market expansion is propelled by advancements in lubricant formulations that enhance operational efficiency. Additionally, favorable government initiatives for offshore resource development and sustained energy demand are supporting this growth, particularly in regions with untapped offshore reserves. These factors contribute to a positive outlook for offshore lubricant suppliers and service providers.

- For instance, in May 2025, Clariant announced its participation in Inter Lubric 2025, to be held at the Shanghai New International Expo Centre. At booth N5E05 in Hall N5, the company will highlight its comprehensive offshore lubricant solutions portfolio, tailored to address the evolving performance demands of contemporary industrial operations.

Growth in Offshore Exploration Boosts Demand for Specialized Lubricants

The growth of the market is propelled by the global rise in offshore oil and gas exploration and development activities.

These operations require robust and reliable lubrication solutions to maintain the efficiency and longevity of critical offshore machinery and equipment under harsh conditions such as high pressure, saltwater exposure, and variable temperatures.

As exploration intensifies, there is an increased demand for high-performance lubricants that reduce equipment downtime and maintenance costs, thereby enhancing operational productivity.

- In March 2025, Cairn Oil & Gas and 2H Offshore partnered to develop a significant offshore project on India’s West Coast. The collaboration focuses on the integrated delivery of offshore platforms for the designated block under the offshore Discovered Small Fields (DSF) blocks, marking the largest development of its kind and targeting significant oil equivalent recovery.

Operational Reliability Under Harsh Offshore Conditions

A significant challenge hindering the expansion of the offshore lubricants market is maintaining lubricant performance under extreme offshore conditions, including high pressure, fluctuating temperatures, and continuous exposure to saltwater and contaminants.

These factors accelerate lubricant degradation, reduce equipment reliability, and increase the frequency of maintenance.

To overcome this challenge, companies are developing advanced lubricant formulations with enhanced thermal and oxidative stability, as well as superior water resistance and load-carrying capacity. These innovations help extend service intervals and ensure consistent performance in demanding offshore environments.

Additionally, condition monitoring systems are being deployed to track lubricant health in real time, enabling predictive maintenance and reducing the risk of unexpected equipment failures during critical operations.

Surging Adoption of Bio-Based and Synthetic Lubricants

The market is witnessing increased adoption of high-performance bio-based and synthetic lubricants.

These formulations provide enhanced protection to equipment by minimizing friction and wear, thereby extending lubricant service life and reducing operational downtime. Their enhanced stability under demanding offshore conditions further supports improved machinery reliability.

Furthermore, these lubricants align with sustainability goals by being biodegradable and environmentally friendly, aiding compliance with stringent regulations.

This underscores the offshore oil and gas sector’s commitment to integrating operational efficiency with environmental responsibility, boosting demand for advanced lubricants and fostering innovation.

- In May 2025, the Press Information Bureau (PIB) reported the development of an eco-friendly lubricant formulation by scientists, delivering enhanced friction reduction, wear resistance, and operational performance. This innovation presents a sustainable alternative to traditional lubricants, supporting the industry's shift toward environmental compliance and performance efficiency.

Offshore Lubricants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Engine Oil, Hydraulic Fluid, Gear Oil, Grease, Others

|

|

By End Use

|

Offshore Rigs, FPSOs (Floating, Production, Storage & Offloading Vessels), OSVs (Offshore Support Vessels

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Engine Oil, Hydraulic Fluid, Gear Oil, Grease, and Others): The engine oil segment earned USD 243.4 million in 2024 due to its critical role in maintaining offshore engine performance under high loads and extreme conditions.

- By End Use (Offshore Rigs, FPSOs (Floating, Production, and Storage & Offloading Vessels), and OSVs (Offshore Support Vessels): The OSVs (offshore support vessels) segment held a share of 40.32% in 2024, owing to the growing demand for offshore support operations, including supply, maintenance, and transportation services.

Offshore Lubricants Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America offshore lubricants market accounted for a substantial share of 36.55% in 2024, valued at USD 237.6 million. This dominance is reinforced by high offshore activity in the Gulf of Mexico, where extensive oil and gas production requires continuous lubrication support for rigs, platforms, and marine vessels.

Well-developed offshore and strong participation from major oilfield service companies contributes to the consistent demand. The presence of numerous leading lubricant manufacturers and offshore service providers further enhances local supply capabilities and reduces operational downtime, reinforcing the region's dominance .

The Asia-Pacific offshore lubricants industry is expected to register the fastest CAGR of 5.13% over the forecast period, spurred by the rising offshore investments in China, India, Malaysia, and Indonesia. The region is witnessing increasing offshore drilling and field development projects.

Demand for offshore lubricants is rising due to the growing fleet of offshore support vessels and floating production systems in Southeast Asia. Moreover, the emergence of regional oilfield operators and local marine service providers is contributing to the growing consumption of lubricants across new and expanding offshore assets.

Regulatory Frameworks

- In the U.S., the Bureau of Safety and Environmental Enforcement (BSEE) regulates offshore lubricants within the oil and gas sector. BSEE enforces safety and environmental standards for offshore exploration, development, and production activities, including the use of lubricants critical to these operations.

- In Europe, offshore lubricants are regulated by the European Union (EU) . The EU enforces regulations that emphasize safety, environmental protection, and emergency response for lubricants used in offshore oil and gas operations.

- In India, the Petroleum and Natural Gas Regulatory Board (PNGRB) oversees the refining, processing, storage, and distribution of petroleum products, including offshore lubricants. The Ministry of Petroleum and Natural Gas (MoPNG) oversees lubricant standards and compliance in the oil and gas sector.

Competitive Landscape

The offshore lubricants market is characterized by key players focusing on product innovation, portfolio diversification, and strategic partnerships to strengthen their market position. Companies are investing in advanced lubricant formulations tailored for extreme offshore conditions, ensuring better equipment protection and extended service life.

Numerous players are expanding their distribution networks in high-growth regions to enhance service reach and reduce lead times. Long-term supply agreements with offshore operators and service providers are being used to secure consistent demand.

Several players are leveraging digital platforms to offer remote monitoring of lubricant performance, enabling timely replacement and optimizing operational uptime.

Key Companies in Offshore Lubricants Market:

- Shell plc

- Exxon Mobil Corporation

- BP p.l.c.

- Chevron Corporation

- TotalEnergies

- China Petroleum & Chemical Corporation

- LUKOIL

- Aegean Oil S.A.

- Hinduja Group

- Quaker Chemical Corporation

- Valvoline Global Operations

- Repsol

- North Sea Lubricants

- FUCHS

- Cosan