Market Definition

The market encompasses the production, distribution, and application of medical devices designed to replace, support, or enhance ocular function in patients with various eye conditions.

This market includes a diverse range of implantable devices, such as intraocular lenses, glaucoma implants, corneal implants, orbital implants, ocular prosthetics, and retinal implants, catering to both therapeutic and cosmetic needs.

The report highlights the key drivers influencing market growth, along with an in-depth analysis of emerging trends and the evolving regulatory frameworks shaping the market trajectory.

Ocular Implants Market Overview

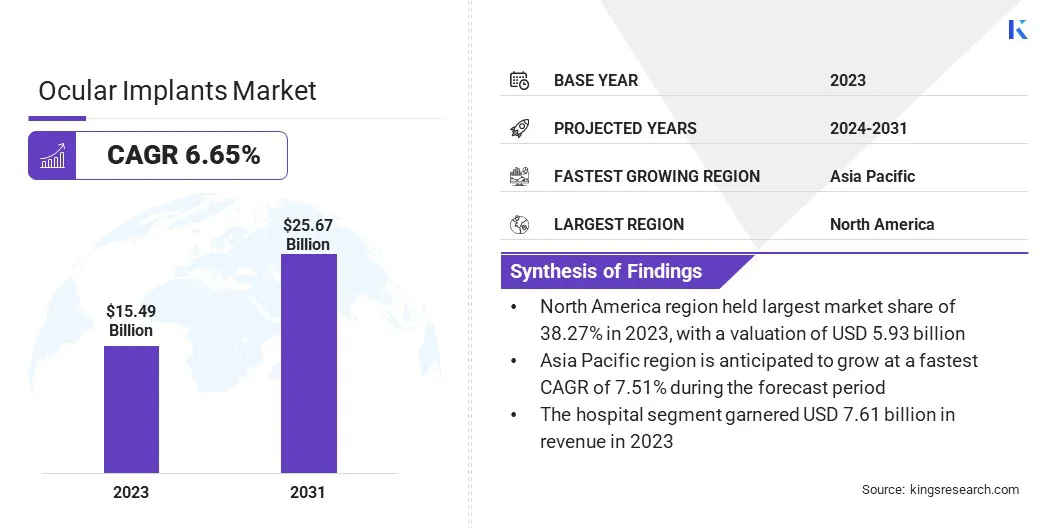

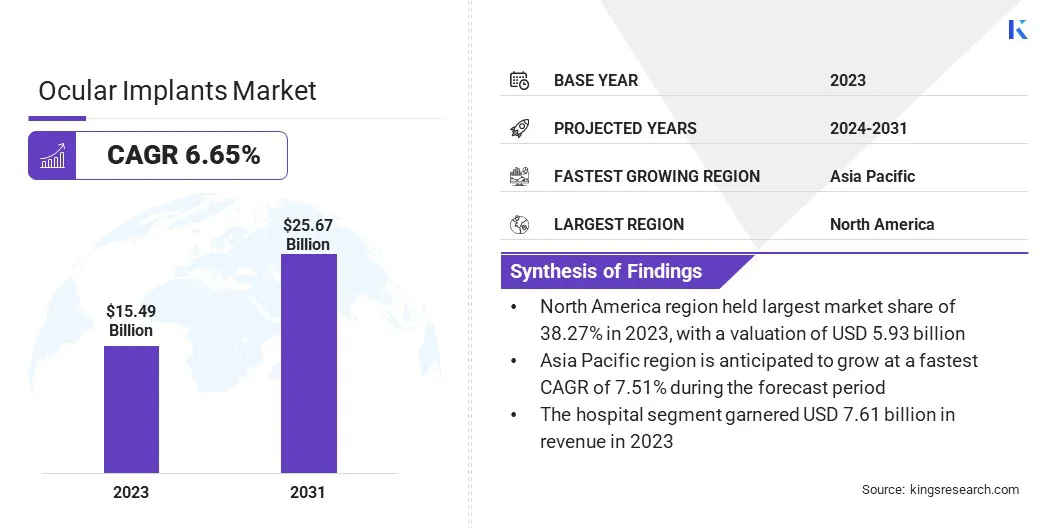

The global ocular implants market size was valued at USD 15.49 billion in 2023 and is projected to grow from USD 16.35 billion in 2024 to USD 25.67 billion by 2031, exhibiting a CAGR of 6.65% during the forecast period.

The market is driven by the rising prevalence of ophthalmic disorders such as cataracts, glaucoma, and retinal diseases, along with an increasingly aging population. Advancements in biomaterials and surgical techniques have enhanced implant efficacy, leading to improved patient outcomes and greater adoption of these medical devices.

Major companies operating in the ocular implants industry are Eyekon Medical, Carl Zeiss AG, Menicon Co., Ltd., Gulden Ophthalmics, Lenstec, MORCHER, HOYA Medical Singapore Pte. Ltd., Alcon, Santen Pharmaceutical Co., Ltd., HumanOptics Holding AG, Rayner Group, Glaukos Corporation, Johnson & Johnson Vision Care, Inc., STAAR SURGICAL, and Bausch & Lomb Incorporated.

Technological progress in ophthalmology, including the integration of smart implants and improved surgical precision, is supporting the market expansion. Additionally, the rising healthcare expenditure and a growing emphasis on vision restoration are positioning the market for continued development, offering advanced solutions for both functional and esthetic needs.

- In August 2024, Injectsense, a leading digital health company, successfully conducted the first human implantation and wireless Intraocular Pressure (IOP) measurements using its ultraminiature implantable sensor. The innovative device, which has secured FDA breakthrough designation, marks a significant milestone in advancing real-time ocular health monitoring and precision treatment in ophthalmology.

Key Highlights:

- The ocular implants industry size was valued at USD 15.49 billion in 2023.

- The market is projected to grow at a CAGR of 6.65% from 2024 to 2031.

- North America held a market share of 38.27% in 2023, with a valuation of USD 5.93 billion.

- The intraocular lenses segment garnered USD 6.54 billion in revenue in 2023.

- The polymethyl methacrylate segment is expected to reach USD 7.65 billion by 2031.

- The cataract surgery segment is expected to reach USD 11.40 billion by 2031.

- The hospitals segment is expected to reach USD 12.38 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.51% during the forecast period.

Market Driver

Rising Prevalence of Ocular Disorders

The market is registering robust growth, primarily driven by the increasing prevalence of ocular disorders such as cataracts, glaucoma, and retinal diseases. The incidence of age-related eye conditions has risen significantly amid the growing global population, boosting the demand for surgical solutions like intraocular lenses, glaucoma implants, and retinal implants.

Cataracts, in particular, remain one of the most common causes of vision impairment, especially among the elderly, which has created a steady need for intraocular lenses in cataract surgeries. Additionally, the rising prevalence of conditions like glaucoma and retinal disorders has further amplified the demand for specialized ocular implants.

- In August 2023, the World Health Organization (WHO) reported that approximately 2.8 billion people were affected by short-sightedness, with this figure expected to rise from 2.6 billion in 2020 to 3.4 billion by 2030, further driving the demand for ocular implants.

Market Challenge

High Cost of Advanced Implants and Surgical Procedures

A major challenge in the ocular implants market is the high cost of advanced implants and surgical procedures, which limits accessibility for a significant portion of the global population, particularly in developing regions.

The sophisticated materials and technologies used in high-quality implants, such as hydrophobic and hydrophilic acrylics, as well as the specialized nature of the surgeries, result in elevated costs.

Manufacturers and healthcare providers could focus on cost-reduction strategies, such as improving manufacturing efficiencies, developing more affordable implant materials without compromising quality, and expanding insurance coverage for advanced ocular surgeries.

Market Trend

Using AI to Develop Advanced Ocular Implants

A key trend in the market is the increasing adoption of AI-driven implants, which is transforming the design and customization of these devices. This allows for the analysis of patient-specific data, enabling the creation of highly personalized implants that are optimized for individual anatomical requirements.

This AI-powered approach enhances the precision and effectiveness of ocular implants, improving surgical outcomes and patient satisfaction. Additionally, AI is streamlining the design and manufacturing process, enabling quicker iterations and more efficient production.

The integration of AI into the market is driving innovation, offering substantial opportunities for growth and improving the overall quality of care in ophthalmic surgeries.

- In January 2025, Rayner introduced the world’s first spiral intraocular lens at the ESCRS congress in Barcelona. Powered by AI, the RayOne Galaxy IOL incorporates an innovative non-diffractive spiral optic design, providing a smooth and continuous full range of vision with minimal dysphotopsia and zero loss of transmitted light.

Ocular Implants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Intraocular Lenses, Glaucoma Implants, Corneal Implants, Orbital Implants, Ocular Prosthetics, Retinal Implants

|

|

By Material

|

Polymethyl Methacrylate, Silicone, Hydrophobic Acrylic, Hydrophilic Acrylic, Other Biocompatible Materials

|

|

By Application

|

Cataract Surgery, Glaucoma Treatment, Retinal Disorders, Corneal Disorders, Cosmetic and Prosthetic Applications, Others

|

|

By End User

|

Hospitals, Ophthalmic Clinics and Ambulatory Surgery Centers, Research Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Intraocular Lenses, Glaucoma Implants, Corneal Implants, Orbital Implants, Ocular Prosthetics, Retinal Implants): The intraocular lenses segment earned USD 6.54 billion in 2023, due to the high prevalence of cataracts and the increasing adoption of premium lenses offering enhanced vision correction.

- By Material (Polymethyl Methacrylate, Silicone, Hydrophobic Acrylic, and Hydrophilic Acrylic): The polymethyl methacrylate segment held 30.30% share of the market in 2023, due to its durability, biocompatibility, and extensive use in ocular prosthetics and intraocular lenses.

- By Application (Cataract Surgery, Glaucoma Treatment, Retinal Disorders, and Corneal Disorders): The cataract surgery segment is projected to reach USD 11.40 billion by 2031, owing to the rising geriatric population and advancements in surgical techniques.

- By End User (Hospitals, Ophthalmic Clinics and Ambulatory Surgery Centers, Research Institutes): The hospitals segment is projected to reach USD 12.38 billion by 2031, owing to the availability of advanced ophthalmic surgical facilities and increasing patient preference for specialized eye care.

Ocular Implants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 38.27% share of the ocular implants market in 2023, with a valuation of USD 5.93 billion. This dominance is attributed to the well-established healthcare infrastructure, high patient awareness, and the presence of leading medical device manufacturers in the region.

Additionally, the aging population in North America has led to a higher prevalence of cataracts and other eye disorders, driving the demand for advanced ocular implants. The region's focus on Research and Development (R&D), along with the rapid adoption of innovative technologies such as premium intraocular lenses and minimally invasive surgical techniques, further bolsters its market share.

- In May 2024, the Centers for Disease Control and Prevention (CDC) reported that 90 million Americans over 40 experience vision problems. By 2050, diabetic retinopathy, cataracts, glaucoma, and age-related macular degeneration are expected to significantly increase. Vision impairment and blindness will rise by 150%, with the cost of vision problems projected to reach USD 373 billion, a 157% increase, underscoring the need for effective interventions.

The market in Asia Pacific is poised to grow at a significant CAGR of 7.51% over the forecast period, driven by the increasing prevalence of ophthalmic disorders, particularly cataracts and glaucoma, in rapidly aging populations in countries like Japan, China, and India. The region benefits from rising healthcare investments, improving medical infrastructure, and expanding access to advanced treatments.

Additionally, the growing demand for both functional and cosmetic ocular implants, along with an increase in medical tourism in countries like India and Thailand, is expected to further fuel the market. The region's diverse population and the affordability of treatments compared to Western countries make Asia Pacific an attractive market for ocular implants.

Regulatory Frameworks

- In the U.S., the U.S. Food and Drug Administration (FDA) regulates ocular implants under the Federal Food, Drug, and Cosmetic Act. These devices must undergo premarket approval (PMA) or be cleared through the 510(k) process, depending on their classification. The FDA ensures that ocular implants, such as intraocular lenses, glaucoma implants, and retinal implants, meet safety and effectiveness standards before they can be marketed.

- In India, the Central Drugs Standard Control Organization (CDSCO) is responsible for regulating medical devices, including ocular implants. The CDSCO sets standards for the manufacturing, import, sale, and distribution of medical devices.

Competitive Landscape:

The ocular implants industry is characterized by intense competition among key players who employ a variety of strategies to maintain and expand their market presence. A common strategy is innovation in product development, with companies investing heavily in R&D to create advanced ocular implants that offer better performance, biocompatibility, and customization options.

This includes the development of novel materials such as hydrophobic and hydrophilic acrylics, as well as the integration of technologies like AI to enhance implant design and functionality. Another strategy is engaging in partnerships and collaborations. Many companies collaborate with hospitals, ophthalmic clinics, and research institutions to improve product offerings and expand their distribution networks.

These partnerships also help enhance the clinical validation of new implants, facilitating faster market approval and adoption. Companies are also investing in post-market surveillance and customer support to build trust and ensure patient satisfaction.

They aim to differentiate themselves in a market that values long-term outcomes and safety by offering comprehensive after-sales services, including patient monitoring and implant maintenance.

- In October 2023, Bausch + Lomb Corporation introduced its enVista Aspire monofocal and toric intraocular lenses with Intermediate Optimized optics. The enVista Aspire IOLs feature innovative optics that offer a depth of focus, building on the established benefits of the enVista platform to meet the vision needs of today’s digital users.

List of Key Companies in Ocular Implants Market:

- Eyekon Medical

- Carl Zeiss AG

- Menicon Co., Ltd.

- Gulden Ophthalmics

- Lenstec

- MORCHER

- HOYA Medical Singapore Pte. Ltd.

- Alcon

- Santen Pharmaceutical Co., Ltd.

- HumanOptics Holding AG

- Rayner Group

- Glaukos Corporation

- Johnson & Johnson Vision Care, Inc.

- STAAR SURGICAL

- Bausch & Lomb Incorporated.

Recent Developments (Product Launch)

- In February 2024, Johnson & Johnson MedTech announced the launch of its TECNIS PureSee purely refractive presbyopia-correcting lens in the EMEA region. Featuring a proprietary refractive design, the TECNIS PureSee IOL provides high-quality, uninterrupted vision with superior contrast and low-light performance, comparable to a monofocal IOL. This launch meets the increasing demand for advanced IOLs specifically designed to correct astigmatism and presbyopia.