Market Definition

Object-based storage is a scalable data storage architecture that organizes information into discrete units called objects, each comprising the data itself, a unique identifier, and rich metadata. This architecture is purpose-built for managing large volumes of unstructured data, including media content, system backups, IoT data, emails, and system logs. The market encompasses a wide range of solutions and services deployed across public cloud, private cloud, and hybrid environments.

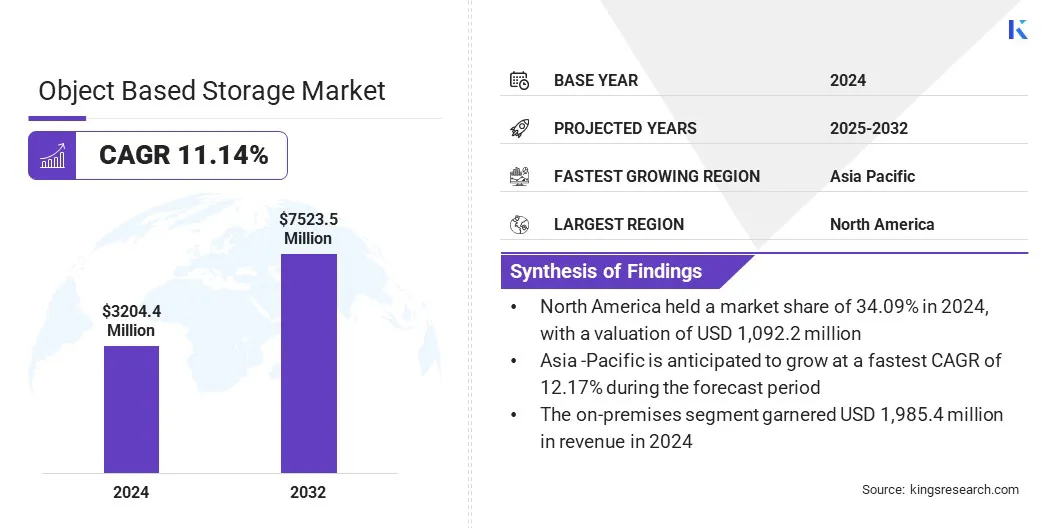

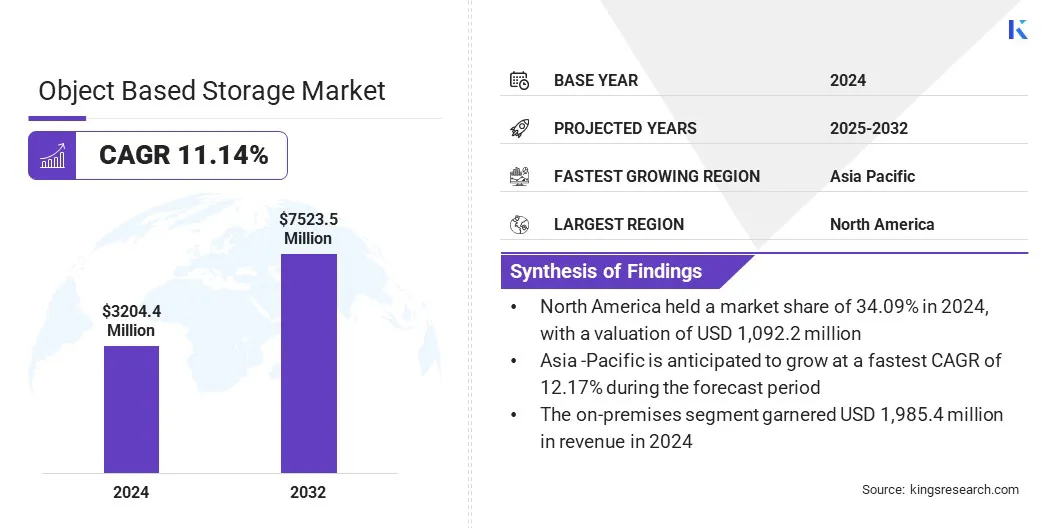

The global object based storage market size was valued at USD 3,204.4 million in 2024 and is projected to grow from USD 3,540.5 million in 2025 to USD 7,523.5 million by 2032, exhibiting a CAGR of 11.14% during the forecast period.

This growth is attributed to the rapid increase in unstructured data generated from sources such as IoT devices, video content, social media, and backups, which is prompting organizations to adopt scalable object storage solutions for efficient data management.

The market is further driven by the growing use of AI and analytics on stored objects as enterprises increasingly extract insights from metadata to support automation and data-driven decision-making across key sectors.

Key Market Highlights:

- The global market size was valued at USD 3,204.4 million in 2024.

- The market is projected to grow at a CAGR of 11.14% from 2025 to 2032.

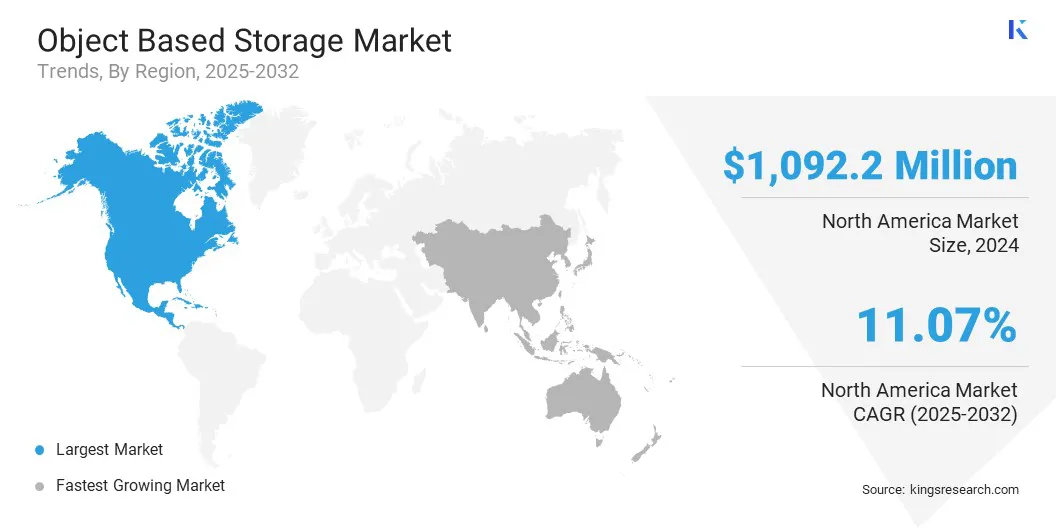

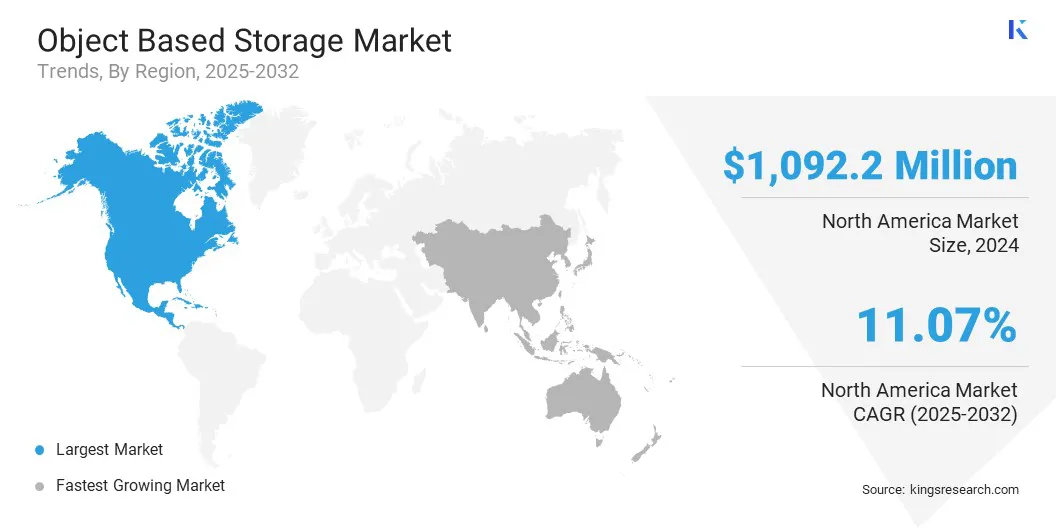

- North America held a market share of 34.09% in 2024, with a valuation of USD 1,092.2 million.

- The on-premises segment garnered USD 1,985.4 million in revenue in 2024.

- The public segment is expected to reach USD 2,874.5 million by 2032.

- The multi-node segment is anticipated to register the fastest CAGR of 11.26% during the forecast period.

- The large enterprises segment garnered USD 1,726.9 million in revenue in 2024.

- The IT and telecommunications segment held a market share of 17.27% in 2024.

- The market in Asia Pacific is anticipated to grow at a CAGR of 12.17% over the forecast period.

Major companies operating in the object based storage industry are Dell Inc., Hewlett Packard Enterprise Development LP, Pure Storage Inc., Amazon Web Services Inc., Huawei Cloud Computing Technologies Co. Ltd., Microsoft, Hitachi Vantara LLC, Fujitsu, Google LLC, MinIO Inc., Wasabi Technologies, Backblaze, Cloudian Inc., IBM Corporation, and Nutanix Inc.

Object Based Storage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Cloud-based, On-premises

|

|

By Type

|

Private, Public, Hybrid

|

|

By Architecture

|

Single-node, Multi-node, Hyper-converged

|

|

By Organization

|

Large Enterprises, Small & Medium Enterprises

|

|

By Vertical

|

IT and Telecommunications, BFSI, Government & Defense, Healthcare, Media and Entertainment, Retail & E-commerce, Manufacturing, Energy & Utilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Object Based Storage Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for 34.09% share of the object based storage market in 2024, with a valuation of USD 1,092.2 million. The dominance is attributed to the increasing deployment of hybrid cloud infrastructures in the region that support file and object storage capabilities.

Enterprises in the region are adopting solutions that enable consistent data access across cloud and on-premises environments while ensuring performance at scale to meet the growing demand for reliability and operational continuity.

This region is registering strong interest in technologies that manage unstructured data efficiently and support enterprise continuity through built-in disaster recovery and advanced data protection.

The market is also benefiting from rising investment activity by private players aimed at expanding innovation in storage software platforms. Investors in the region are supporting companies that offer solutions with integrated orchestration tools and immutable storage to meet enterprise needs for secure and resilient data management, thereby contributing to the market expansion in the region.

- In July 2024, a private equity consortium led by Vista Equity Partners acquired a majority stake in a cloud storage software provider specializing in hybrid file and object storage platforms. The investment was made at a USD 1.2 billion valuation to support the company’s efforts to expand product innovation and go-to-market initiatives.

The object based storage industry in Asia Pacific is set to grow at a robust CAGR of 12.17% over the forecast period. This growth is attributed to the rising demand for scalable and high-performance storage solutions across the region.

Key players in the region are actively investing in digital transformation initiatives that require efficient storage infrastructure to manage increasing volumes of unstructured data. The market is also registering the adoption of AI-driven applications that generate continuous data streams, reinforcing the need for flexible storage architectures.

The market is further expanding as enterprises prioritize cost-effective solutions that support both frequent and infrequent data access.

Regional distributors and technology providers are forming strategic partnerships to enhance access to advanced storage offerings. This collaboration is enabling faster deployment of object-based storage systems across Asia Pacific, contributing to the market growth in the region.

- In April 2024, Wasabi Technologies partnered with VSTECS Singapore, a leading ICT distributor, to expand the availability of high-performance object storage solutions in Asia Pacific.

Object Based Storage Market Overview

The market is expanding, due to the widespread adoption of cloud services by governments, which are prompting the demand for object-based storage solutions that manage and secure large volumes of unstructured government data.

- In December 2024, according to the Press Information Bureau (PIB), over 300 government departments are now utilizing cloud services, accelerating the expansion of digital public infrastructure in India.

Market Driver

Rapid Growth of Unstructured Data

The rapid growth of unstructured data is driving the object-based storage solutions market. Organizations across various sectors are generating massive volumes of data from sources such as video surveillance, IoT sensors, digital imaging, social media platforms, and business applications.

Conventional storage systems often lack the capacity, adaptability, and affordability to handle this surge efficiently, resulting in slower performance and increased operational expenses.

Object-based storage addresses these challenges by offering a highly scalable architecture that enables efficient data management, long-term retention, and seamless access. Its metadata-driven structure further supports advanced analytics, compliance, and archival use cases in increasingly data-centric environments.

- In January 2024, Amidata launched a secure cloud storage service built on Quantum’s ActiveScale object storage platform to manage growing volumes of unstructured data. The solution supports scalable and cost-effective storage for backup, archiving, and AI-driven workloads.

Market Challenge

Limited performance for transactional workloads

A major challenge limiting the adoption of object-based storage in transactional environments is its performance constraint which results from its design focus on scalability over low-latency access. Object storage is not optimized for rapid read and write operations, making it less suitable for real-time applications that require consistent performance.

This limitation reduces its effectiveness in handling high-frequency transactions and often leads enterprises to rely on alternative or hybrid storage solutions to meet the demands of latency-sensitive workloads.

Object based storage market players are implementing hybrid storage architectures that integrate object storage with high-performance block or file systems to support latency-sensitive workloads.

They are also incorporating caching mechanisms and performance optimization layers to enhance data access speeds within object storage environments for supporting latency-sensitive applications.

Additionally, market players are adopting software-defined storage solutions to gain greater control and flexibility in managing performance requirements. These strategies allow enterprises to overcome performance limitations while preserving the scalability and cost-efficiency of object-based storage.

Market Trend

Growing use of AI and analytics on stored objects

The growing use of AI and analytics on stored objects is transforming the way enterprises manage and extract value from unstructured data. Object storage platforms are supporting this shift through scalable architectures and metadata-driven structures that facilitate efficient data analysis and classification.

Organizations are integrating AI tools within storage environments to generate insights, improve workflows, and enable automation. This shift is gaining momentum in healthcare finance and media where fast data interpretation drives innovation and informed decision-making.

- In March 2025, Huawei launched an AI-ready data storage solution aimed at supporting telecom carriers in their transition toward technology-focused business models. The offering includes a data lake architecture and diverse storage services designed to manage large volumes of unstructured data from applications such as smart homes and digital factories.

Market Segmentation:

- By Deployment (Cloud-based and On-premises,): The on-premises segment earned USD 1,985.4 million in 2024, due to greater control over data security and compliance.

- By Type (Private, Public and Hybrid): The public segment held 38.61% share of the market in 2024, due to the rising demand for scalable and cost-effective storage solutions.

- By Architecture (Single-node, Multi-node and Hyper-converged): The single-node segment is projected to reach USD 3,012.9 million by 2032, propelled by ease of deployment and lower infrastructure costs.

- By Organization (Large Enterprises and Small & Medium Enterprises): The large enterprises segment earned USD 1,726.9 million in 2024, owing to high-volume data generation and complex storage requirements.

- By Vertical (IT and Telecommunications, BFSI, Government & Defense, Healthcare, and Media and Entertainment): The BFSI segment is anticipated to register the fastest CAGR of 12.04% during the forecast period, due to the increasing focus on secure & scalable storage for regulatory compliance and data analytics

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) oversees data privacy and consumer protection in storage systems, including object-based storage. It regulates the ways in which organizations collect, store, and share user data, ensuring compliance with privacy standards and preventing unfair or deceptive practices.

- In China, the Cyberspace Administration of China (CAC) regulates data security, privacy, and cross-border data flows related to object-based storage in China. It enforces the Personal Information Protection Law (PIPL) and the Data Security Law, overseeing how enterprises store and manage data.

- In India, the Ministry of Electronics and Information Technology (MeitY) oversees data governance and IT regulations impacting object-based storage. It implements the Digital Personal Data Protection Act (DPDPA) regulating how data is stored, processed, and protected. The MeitY ensures that enterprises maintain data integrity, privacy, and security, particularly for sensitive personal information and government-related digital infrastructure.

Competitive Landscape

Major players in the object based storage market are actively expanding their portfolios to address the evolving needs of AI-driven research and high-performance computing workloads. They are integrating all-flash file and object storage platforms within scalable architectures to enable comprehensive data management across both hot and cold tiers.

These integrated solutions are handling the growing volume of unstructured data generated through simulations, advanced analytics, and scientific applications. Providers are also prioritizing seamless data access, high-speed processing, and optimized storage efficiency to support increasingly complex and data-intensive environments.

Additionally, market participants are developing unified infrastructures that accommodate active and archival data to allow organizations to scale performance and capacity in line with ongoing research and computational demands from data-intensive industries.

- In February 2024, XENON Systems acquired Quantum’s Myriad all-flash file and object storage platform alongside ActiveScale object storage to support AI-driven research and high-performance computing workloads.

Key Companies in Object Based Storage Market:

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Pure Storage, Inc

- Amazon Web Services, Inc

- Huawei Cloud Computing Technologies Co., Ltd

- Microsoft

- Hitachi Vantara LLC

- Fujitsu

- Google LLC

- MinIO, Inc

- Wasabi Technologies

- Backblaze

- Cloudian, Inc

- IBM Corporation

- Nutanix, Inc.

Recent Developments (M&A)

- In May 2025, DataCore Software acquired StarWind to strengthen its hyper-converged infrastructure (HCI) offerings for edge, SMB, and remote office deployments. This acquisition completes the company’s transformation into a full-spectrum storage provider, integrating block, file, object, and container storage solutions.

- In October 2024, Storj Labs, a distributed cloud storage provider acquired PetaGene, a storage company specializing in distributed file systems. The acquisition adds a high-performance file storage client to Storj’s portfolio, enhancing its ability to serve data-intensive workloads across AI, media, and entertainment sectors.