Market Definition

The market encompasses the collection, treatment, storage, and disposal of radioactive waste generated by pressurized water, boiling water, gas-cooled, and pressurized heavy water reactors.

It includes high-level, intermediate-level, and low-level waste management solutions tailored for industrial and utility end users. The market focuses on safe containment, recycling, and disposal technologies to minimize environmental impact and ensure regulatory compliance.

Nuclear Waste Management Market Overview

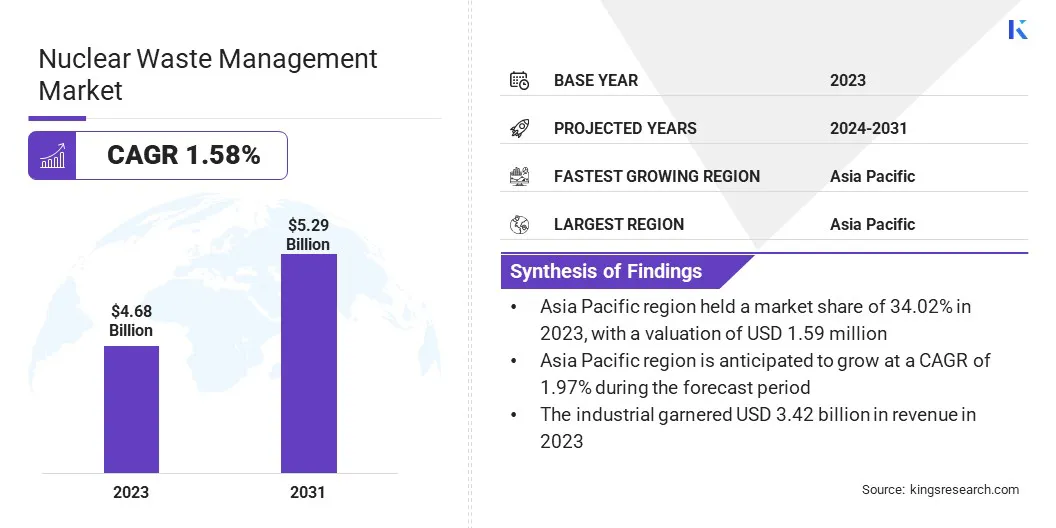

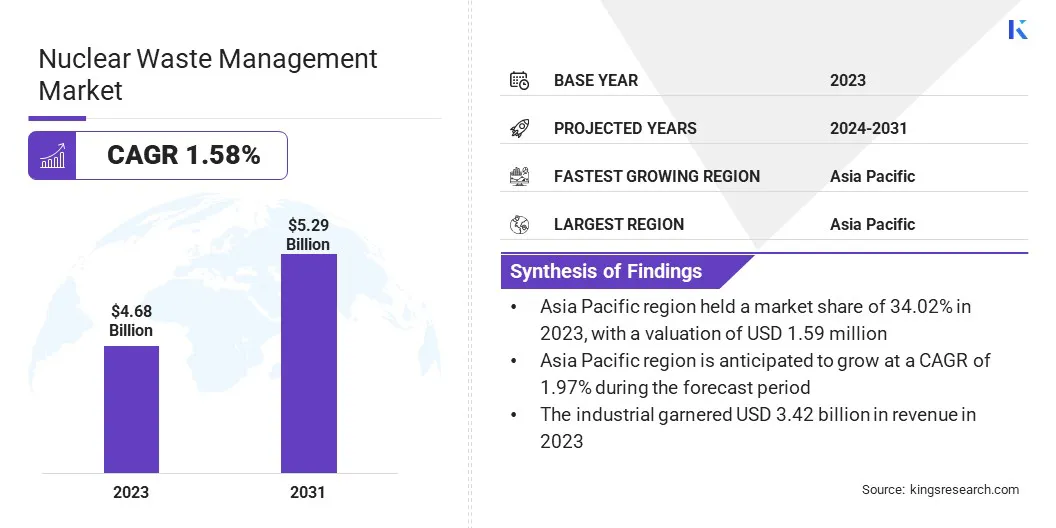

The global nuclear waste management market size was valued at USD 4.68 billion in 2023 and is projected to grow from USD 4.74 billion in 2024 to USD 5.29 billion by 2031, exhibiting a CAGR of 1.58% during the forecast period.

The market is driven by the increasing reliance on nuclear power for energy generation, leading to a higher accumulation of radioactive waste. Additionally, government regulations mandating safe disposal and storage solutions are propelling advancements in waste management technologies.

Major companies operating in the nuclear waste management industry are Perma-Fix, The State Atomic Energy Corporation ROSATOM, Fortum, TÜV SÜD, Fluor Corporation, Orano, John Wood Group PLC, Bechtel Corporation, GE Vernova, Holtec International, Framatome, Svensk Kärnbränslehantering AB, Augean, Veolia, and Westinghouse Electric Company LLC.

Governments and industry players are prioritizing safer disposal, recycling, and minimization strategies to enhance sustainability. Efficient waste solutions will be crucial for ensuring regulatory compliance and environmental safety.

Key Highlights:

- The nuclear waste management industry size was valued at USD 4.68 billion in 2023.

- The market is projected to grow at a CAGR of 1.58% from 2024 to 2031.

- Asia Pacific held a market share of 34.02% in 2023, with a valuation of USD 1.59 billion.

- The low level segment garnered USD 2.04 billion in revenue in 2023.

- The pressurized water segment is expected to reach USD 1.42 billion by 2031.

- The industrial segment is expected to reach USD 3.89 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 1.59% during the forecast period.

Market Driver

Growing Nuclear Energy Adoption and Waste Accumulation

The nuclear waste management market is driven by the increasing reliance on nuclear power as a sustainable energy source. Governments across the world are expanding nuclear capacity to meet rising electricity demand while reducing carbon emissions.

This shift is accelerating the accumulation of radioactive waste, necessitating advanced storage, treatment, and disposal solutions. The regulatory push for safer disposal mechanisms, coupled with advancements in encapsulation and vitrification techniques, reinforces market expansion.

Nuclear energy is crucial in global energy transition strategies. Thus, investments in innovative waste management solutions will be critical for ensuring environmental safety and regulatory compliance.

- In December 2024, according to the Department of Atomic Energy of India, the country’s nuclear power generation capacity has registered substantial growth over the past decade, nearly doubling to 8,180 MW in 2024 from 4,780 MW in 2014. This expansion has been propelled by key strategic initiatives, including the bulk approval of 10 reactors, enhanced funding allocations, partnerships with Public Sector Undertakings (PSUs), and selective private sector involvement.

Market Challenge

High Costs and Long Project Timelines

Major challenges in the nuclear waste management market are the high cost and extended timeline required for the development and implementation of waste disposal facilities. Constructing deep geological repositories or advanced processing plants demands substantial financial investment, stringent regulatory approvals, and extensive scientific research.

Additionally, public opposition and legal challenges often lead to project delays, further escalating costs. Governments and industry stakeholders can address this challenge through public-private partnerships (PPPs) and international collaboration. Multiple stakeholders can expedite waste management projects while ensuring cost efficiency by sharing technological expertise and financial resources.

Market Trend

Advancements in Nuclear Waste Reduction Technologies

A key trend shaping the market is the development of advanced technologies aimed at significantly reducing the volume and long-term radioactivity of nuclear waste. Innovations in waste treatment, isotope separation, and transmutation are enabling more efficient processing of radioactive materials, minimizing the need for extensive storage and disposal solutions.

These advancements are particularly focused on extracting and reprocessing long-lived radioactive isotopes, converting them into less hazardous forms. Amid growing regulatory and environmental concerns surrounding nuclear waste disposal, governments and industry players are increasingly prioritizing waste minimization strategies to enhance sustainability and operational efficiency.

The nuclear sector is shifting toward solutions that not only improve waste management but also optimize resource utilization, reinforcing the long-term viability of nuclear energy.

- In March 2024, Transmutex secured Swiss backing for its breakthrough nuclear waste reduction technology. Verified by Nagra, the innovation can reduce waste volume by 80% and radioactive lifespan to 500 years, addressing long-term disposal challenges and enhancing the sustainability of nuclear energy as a low-emission power source.

Nuclear Waste Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Waste

|

High Level, Intermediate Level, Low Level

|

|

By Reactor

|

Pressurized Water, Boiling Water, Gas Cooled, Pressurized Heavy Water, Others

|

|

By End User

|

Industrial, Utility

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Waste (High Level, Intermediate Level, Low Level): The low level segment earned USD 2.04 billion in 2023, due to its high volume generation from nuclear power plants, hospitals, research facilities, and industrial applications.

- By Reactor (Pressurized Water, Boiling Water, Gas Cooled, and Pressurized Heavy Water): The pressurized water segment held 26.78% share of the market in 2023, due to its widespread adoption in commercial nuclear power generation, accounting for the majority of operational reactors globally.

- By End User (Industrial, Utility): The industrial segment is projected to reach USD 3.89 billion by 2031, owing to increasing nuclear applications in pharmaceuticals, manufacturing, and medical research.

Nuclear Waste Management Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 34.02% share of the nuclear waste management market in 2023, with a valuation of USD 1.59 billion. The market in the region is driven by the rapid expansion of nuclear energy, increasing reactor decommissioning activities, and government-backed initiatives for long-term waste disposal solutions.

Rising electricity demand and commitments to low-carbon energy have led to the higher adoption of nuclear power, intensifying the need for efficient waste management infrastructure. Governments in the region are actively developing deep geological repositories, enhancing reprocessing technologies, and implementing stricter regulatory frameworks to ensure safe disposal of high-level and low-level nuclear waste.

The market in North America is poised to grow at a significant CAGR of 1.59% over the forecast period, driven by strict regulatory frameworks, increasing decommissioning of aging reactors, and advancements in nuclear waste storage technologies.

The presence of well-established waste management infrastructure, including deep geological repositories, interim storage solutions, and advanced reprocessing techniques, supports market expansion.

- In March 2024, the Nuclear Waste Management Organization (NWMO) selected the Township of Ignace and Wabigoon Lake Ojibway Nation as host communities for Canada’s deep geological repository for used nuclear fuel. This strategic decision supports long-term waste management, aligns with climate & environmental goals, and fosters economic growth.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) regulates the management and disposal of high-level radioactive waste and spent nuclear fuel, overseeing long-term storage solutions. The Environmental Protection Agency (EPA) sets radiation protection standards, ensuring that nuclear waste management aligns with public health and environmental safety regulations.

- In Europe, the European Commission oversees nuclear waste management, ensuring safety, compliance, and sustainable disposal practices. Individual countries enforce these regulations through national regulatory bodies, which oversee waste storage, disposal, and long-term management within their jurisdictions.

Competitive Landscape

Leading market players focus on strategic partnerships, government contracts, and research-driven innovations to enhance waste disposal, recycling, and containment solutions. Key companies are investing in deep geological repositories, advanced reprocessing technologies, and modular storage solutions to address long-term waste management challenges.

Additionally, cross-border collaborations between regulatory bodies and industry leaders are shaping market dynamics, ensuring compliance with evolving safety standards.

Amid growing investments in nuclear infrastructure, particularly in Europe, North America, and Asia-Pacific, competition is intensifying among engineering firms, waste management specialists, and nuclear technology providers to secure large-scale contracts and expand their global footprint.

- In January 2025, the United States Department of Energy (DOE) Advanced Research Projects Agency-Energy (ARPA-E) announced USD 40 million for 11 projects under the Nuclear Energy Waste Transmutation Optimized Now (NEWTON) program to advance transmutation technologies for reducing used nuclear fuel waste. SHINE Technologies is developing a molten salt transmutation target integrated with an external neutron source to recycle nuclear waste efficiently. This innovation aims to lower disposal costs, waste volume, and long-term environmental impact.

List of Key Companies in Nuclear Waste Management Market:

- Perma-Fix

- The State Atomic Energy Corporation ROSATOM

- Fortum

- TÜV SÜD

- Fluor Corporation

- Orano

- John Wood Group PLC

- Bechtel Corporation

- GE Vernova

- Holtec International

- Framatome

- Svensk Kärnbränslehantering AB

- Augean

- Veolia

- Westinghouse Electric Company LLC.

Recent Developments (New Product Launch)

- In March 2025, Holtec launched “Mission 2030” to build SMR-300 reactors at Michigan’s Palisades site, targeting commercial operation by 2030. The project includes restarting the 800-MW Palisades plant and co-locating two SMR-300s. Holtec also strengthened its collaboration with Hyundai Engineering & Construction to establish a 10-GW network of SMR-300s across North America, beginning with the Palisades project.