Market Definition

Non-metal electrical conduits are tubular systems used to protect and route electrical wiring in buildings and infrastructure. They are typically made from materials such as polyvinyl chloride, polypropylene, and fiber-reinforced composites, offering corrosion resistance and ease of installation compared to traditional metal conduits.

These conduits find extensive use in residential, commercial, and industrial construction projects, ensuring safe and organized electrical distribution. They are applied in wiring protection, cable management, and structural installations where durability, flexibility, and long-term reliability are essential.

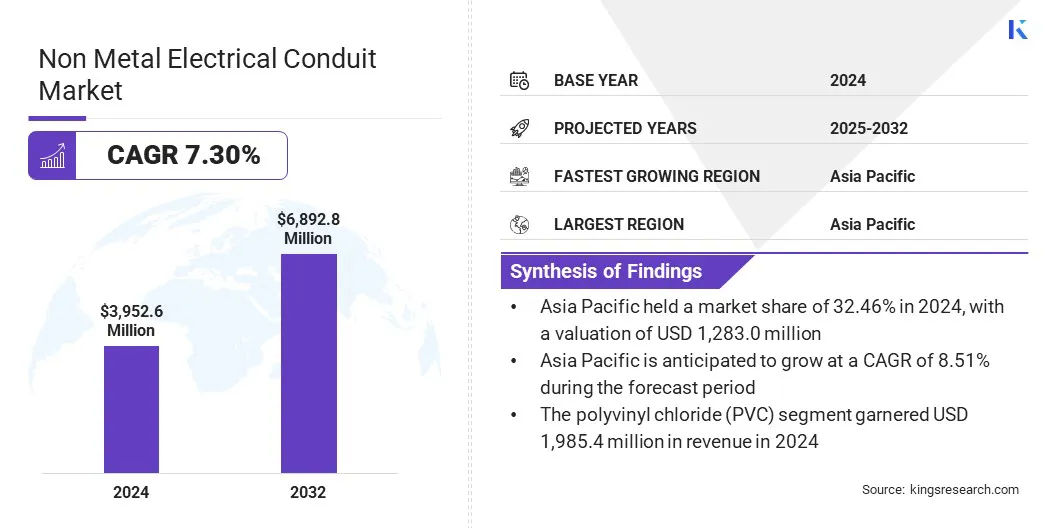

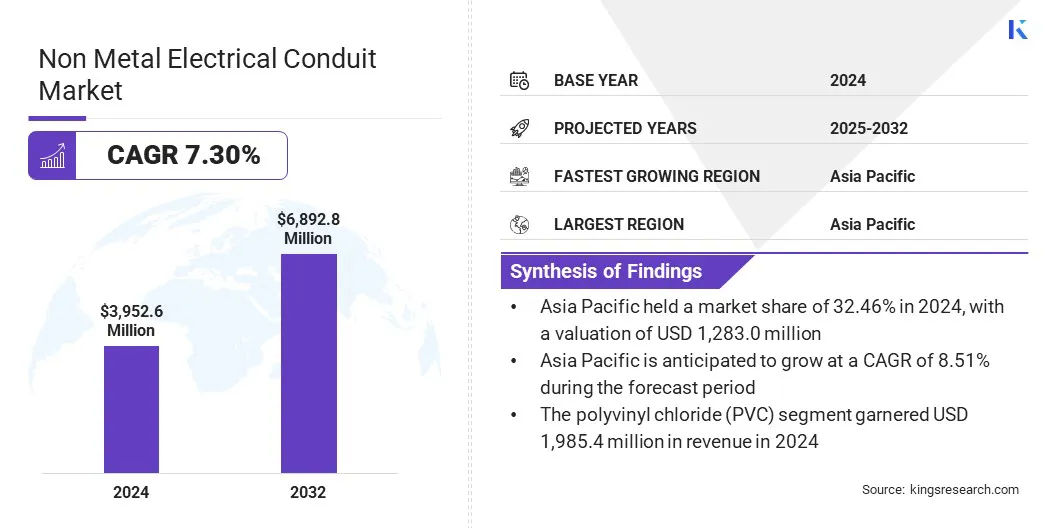

The global non-metal electrical conduit market size was valued at USD 3,952.6 million in 2024 and is projected to grow from USD 4,209.2 million in 2025 to USD 6,892.8 million by 2032, exhibiting a CAGR of 7.30% during the forecast period.

This growth is attributed to rising construction activities and increasing demand for safe and efficient electrical distribution systems. Widespread adoption across residential, commercial, and industrial sectors is further supported by advantages such as corrosion resistance, lightweight design, and ease of installation.

Key Highlights

- The non-metal electrical conduit industry size was recorded at USD 3,952.6 million in 2024.

- The market is projected to grow at a CAGR of 7.30% from 2025 to 2032.

- Asia Pacific held a share of 32.46% in 2024, valued at USD 1,283.0 million.

- The polyvinyl chloride (PVC) segment garnered USD 1,985.4 million in revenue in 2024.

- The residential segment is expected to reach USD 2,838.8 million by 2032.

- Europe is anticipated to grow at a CAGR of 7.04% through the projection period.

Major companies operating in the non-metal electrical conduit market are Atkore, IPEX Electrical Inc., CTUBE Inc., Robroy Industries, Champion Fiberglass, Inc., Anamet Electrical, Inc., National Pipe and Plastics, Inc, JM EAGLE, INC., Westlake Pipe & Fittings, Bahra Electric, Electri-Flex Company, ABB, PIPELIFE INTERNATIONAL GmbH, Schneider Electric, and Legrand.

Increasing focus on regulatory compliance, standardized wiring safety, and large-scale infrastructure projects is promoting wider deployment of non-metal electrical conduits worldwide. Additionally, ongoing material innovations, enhanced manufacturing processes, and supportive government policies are boosting market expansion.

- In March 2025, ABB launched redesigned Carlon two-piece electrical non-metallic tubing (ENT) fittings to improve installation efficiency in poured-in-place concrete applications. The polycarbonate features an eight-tab snap design that reduces insertion force, enhances pull-out strength, and delivers over 20% labor savings compared to traditional single-piece fittings.

How are rising construction activities driving market growth?

The growth of the non-metal electrical conduit market is primarily boosted by rising construction activities and expanding infrastructure projects across residential, commercial, and industrial sectors. Increasing investments in building developments, smart cities, and energy facilities are creating a strong demand for reliable and durable electrical distribution systems.

According to the Government of India’s Open Government Data Platform, the Annual Building Construction Cost Index from 1981 to 2022 shows a consistent increase in construction costs, reflecting steady growth in construction activities and demand for building materials.

In response, construction and industrial players are increasingly adopting non-metal conduits due to their corrosion resistance, lightweight design, and ease of installation. Ongoing urbanization, large-scale projects, and regulatory compliance requirements are further promoting wider deployment and technological improvements, supporting sustained market growth.

How is the limited load-bearing capacity hindering market expansion?

The limited load-bearing capacity poses a major challenge to the growth of the nonmetal electrical conduit market. Compared to traditional metal conduits, these products offer lower mechanical strength, restricting their use in heavy-duty, high-impact, or industrial applications and often necessitating additional protective or reinforcement. This limitation increases project complexity, installation time, and overall costs, particularly in large-scale infrastructure projects.

Furthermore, construction companies and facility managers face challenges in ensuring reliability and compliance with structural requirements, as the integration of non-metal conduits in demanding environments requires careful material selection, engineering expertise, and strict adherence to safety standards.

Ongoing research in advanced polymer composites, fiber reinforcements, and hybrid materials aims to enhance mechanical performance, supporting wider adoption and addressing load-bearing limitations.

How are advancements in material technology influencing the market?

The non-metal electrical conduit market is witnessing a notable trend toward advancements in material technology, supported by increasing demand for durable, lightweight, and corrosion-resistant solutions across residential, commercial, and industrial construction projects.

High-performance polymers, fiber-reinforced composites, and hybrid materials are being developed to enhance mechanical strength, load-bearing capacity, and resistance to environmental factors, while manufacturing processes are optimized for consistency and long-term reliability. Construction companies are adopting these innovations to achieve efficient, low-maintenance, and cost-effective alternatives to traditional metal conduits.

Leading manufacturers and research institutions are investing in advanced materials, improved extrusion techniques, and innovative composite designs to scale production and performance. Continuous improvements in conduit technology are expected to broaden applications, support safer electrical installations, and boost significant market growth over the forecast period.

|

Segmentation

|

Details

|

|

By Classification

|

Polyvinyl Chloride (PVC), Reinforced Thermosetting Resin (RTRC/FRE), Rigid Non-Metallic (RNC), and Electrical Non-Metallic Tubing (ENT)

|

|

By End Use

|

Residential, Commercial, Industrial, and Utility

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Classification (Polyvinyl Chloride (PVC), Reinforced Thermosetting Resin (RTRC/FRE), Rigid Non-Metallic (RNC), and Electrical Non-Metallic Tubing (ENT)): The polyvinyl chloride (PVC) segment earned USD 1,985.4 million in 2024, largely due to its widespread use, cost-effectiveness, and ease of installation in residential, commercial, and industrial electrical applications.

- By End Use (Residential, Commercial, Industrial, and Utility): The residential segment held a share of 42.57% in 2024, mainly attributed to rapid urbanization, growing housing developments, and increasing demand for safe and organized electrical wiring systems.

What is the market scenario in Asia-Pacific and Europe region?

Based on region, the global non-metal electrical conduit market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific non-metal electrical conduit market share stood at 32.46% in 2024, valued at USD 1,283.0 million. Rapid urbanization, expanding infrastructure projects, and increasing industrialization are reinforcing this dominance. Additionally, substantial investments in residential, commercial, and smart city developments are accelerating adoption across construction and industrial sectors.

Strategic initiatives by local and international manufacturers, along with supportive building regulations, present growth prospects. Continuous advancements in high-performance polymers, fiber-reinforced materials, and manufacturing technologies are further promoting the deployment of non-metal electrical conduits across the region.

The Europe non-metal electrical conduit industry is set to grow at a CAGR of 7.04% over the forecast period. This growth is fueled by increasing investments in modern infrastructure, smart buildings, and industrial upgrades across the region. Government regulations, building codes, and initiatives promoting electrical safety are boosting the adoption of non-metal conduit solutions in the region.

Increasing construction activities across residential, commercial, and industrial sectors are creating strong opportunities for wider deployment. Moreover, advancements in high-performance polymers, fiber-reinforced composites, and manufacturing technologies are fostering adoption, positioning Europe as a key market for non-metal electrical conduits.

Regulatory Frameworks

- In the U.S., the National Electrical Code (NEC), NFPA 70, governs the installation and use of electrical conduit systems. It establishes safety standards for wiring methods, material types, and installation practices, ensuring that non-metal conduits such as polyvinyl chloride (PVC) and high-density polyethylene (HDPE) comply with fire resistance, mechanical protection, and performance criteria.

- In Canada, the Canadian Electrical Code (CEC), CSA C22.1, regulates the use of electrical conduits in residential, commercial, and industrial settings. It defines performance requirements for non-metal conduit materials, including PVC and fiberglass, to ensure resistance to corrosion, impact, and environmental degradation while maintaining electrical safety.

- In India, the Central Electricity Authority (Measures Relating to Safety and Electric Supply) Regulations, 2010, govern electrical installations and materials. It specifies safety and construction standards for conduit systems, requiring non-metal conduits used in wiring installations to provide sufficient mechanical and thermal protection in line with national building and electrical codes.

Competitive Landscape

Companies operating in the non-metal electrical conduit industry are maintaining competitiveness through investments in advanced polymer and composite materials, enhanced manufacturing processes, and innovative conduit designs. They are focusing on expanding product portfolios and improving operational efficiency to meet growing demand across residential, commercial, and industrial construction projects.

Leading players are offering solutions such as polyvinyl chloride (PVC), reinforced thermosetting resin (RTRC), and electrical non-metallic tubing (ENT), supported by strategic collaborations, joint ventures, and regional expansion efforts.

Rising focus on partnerships with contractors, regulators, and technology providers is further accelerating adoption and ensuring compliance with building codes. Additionally, companies are enhancing product performance, durability, and fire-retardant properties while leveraging automation, digital monitoring, and integrated service offerings to maintain a competitive edge.

Top Key Companies in Non-Metal Electrical Conduit Market:

- Atkore

- IPEX Electrical Inc.

- CTUBE Inc.

- Robroy Industries

- Champion Fiberglass, Inc.

- Anamet Electrical, Inc.

- National Pipe and Plastics, Inc.

- JM EAGLE, INC.

- Westlake Pipe & Fittings

- Bahra Electric

- Electri-Flex Company

- ABB

- PIPELIFE INTERNATIONAL GmbH

- Schneider Electric

- Legrand

Recent Developments (Product Launch)

- In August 2025, ABB launched new labor- and space-saving electrical solutions to enhance data center infrastructure. The portfolio includes Color-Keyed aluminum narrow-tongue lugs, T&B Liquidtight Systems cable entry plates, and Ocal PVC-coated conduit adapters, developed to meet the growing electrical demands of modern data centers.