Market Definition

Polycarbonate is a durable, transparent thermoplastic valued for its high impact resistance, dimensional stability, and excellent optical clarity. It serves as a lightweight alternative to glass and is ideal for applications requiring toughness and thermal resistance.

The material finds extensive use across automotive components, electrical and electronic devices, construction materials, packaging, and medical devices. Its versatility allows manufacturers to produce sheets, films, and molded parts that combine strength, safety, and design flexibility for diverse industrial and consumer applications.

Polycarbonate Market Overview

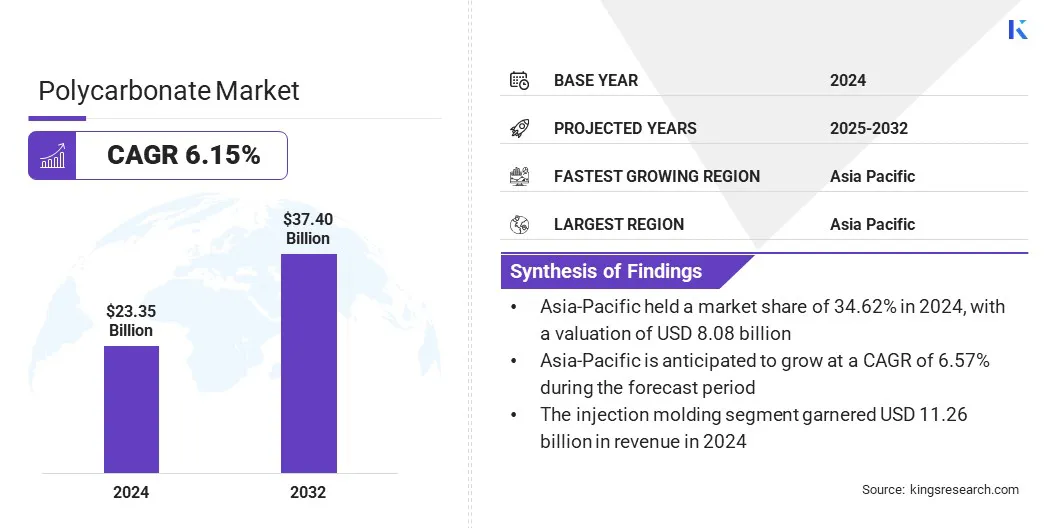

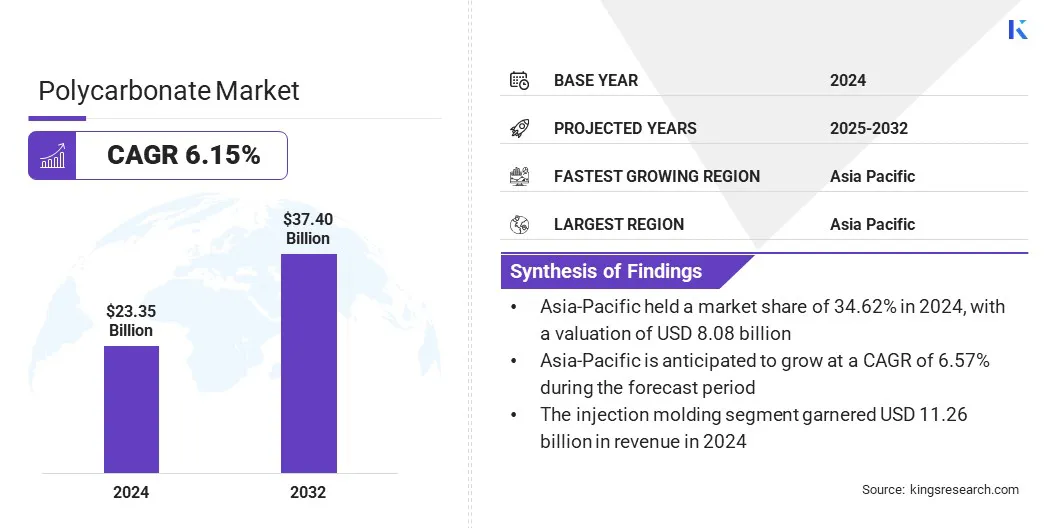

The global polycarbonate market size was valued at USD 23.35 billion in 2024 and is projected to grow from USD 24.63 billion in 2025 to USD 37.40 billion by 2032, exhibiting a CAGR of 6.15% during the forecast period.

This growth is attributed to the rising demand for lightweight, durable, and impact-resistant materials across automotive, electrical, and construction sectors. Increasing adoption of polycarbonate in high-performance packaging, consumer electronics, and medical devices is further driving market expansion.

Key Highlights

- The polycarbonate industry size was USD 23.35 billion in 2024.

- The market is projected to grow at a CAGR of 6.15% from 2025 to 2032.

- Asia-Pacific held a share of 34.62% in 2024, valued at USD 8.08 billion.

- The sheets segment garnered USD 9.98 billion in revenue in 2024.

- The injection molding segment is expected to reach USD 18.13 billion by 2032.

- The automotive & transportation segment is anticipated to witness the fastest CAGR of 6.43% over the forecast period.

- Europe is anticipated to grow at a CAGR of 5.91% through the projection period.

Major companies operating in the polycarbonate market are Covestro AG, SABIC, Mitsubishi Chemical Group Corporation, TEIJIN LIMITED, LG Chem, Asahi Kasei Advance Corporation, Formosa Chemicals & Fibre Corp, LOTTE Chemical CORPORATION, Ensinger, RTP Company, Westlake Plastics, Avient Corporation, Americhem, BARLOG Plastics GmbH, and Celanese Corporation.

The growing focus on enhancing product safety, design flexibility, and energy efficiency is fueling widespread adoption of polycarbonate across industries. Additionally, continuous advancements in processing technologies, innovative formulations, and expanding industrial infrastructure are accelerating market development.

- In November 2023, Covestro’s polycarbonate compounding plant in Newark, Ohio, obtained ISCC PLUS certification. This allows the supply of Makrolon RE grades with up to 89% recycled content, enhancing the company’s sustainable offerings and expanding the availability of circular polycarbonate solutions across North America.

Market Driver

Rising Demand in Automotive and Transportation Sectors

The growth of the polycarbonate market is fueled by rising demand for lightweight, durable, and impact-resistant materials in the automotive and transportation sectors. Increasing emphasis on fuel efficiency, vehicle safety, and regulatory compliance is prompting greater adoption in components such as headlamp lenses, interior panels, glazing, and exterior trims.

Polycarbonate’s combination of strength, thermal stability, and design flexibility makes it an ideal choice for both structural and aesthetic applications, distinguishing it from alternative plastics and glass materials.

Rapid advancements in processing technologies, growing consumer preference for safer and more efficient vehicles, and expanding automotive production are further supporting this growth. Manufacturers are increasingly integrating polycarbonate to enhance performance, reduce weight, and meet evolving environmental and safety standards.

- In June 2024, Teijin unveiled a new production line for Panlite polycarbonate sheets and films at its Matsuyama plant in Japan. The line targets rising demand for automotive interiors and electronic components, with projected annual sales of USD 17 million by fiscal 2027.

Market Challenge

Sustainability and Environmental Compliance Concerns

Environmental sustainability and compliance concerns pose significant challenges to the growth of the polycarbonate market. The material’s limited recyclability, environmental persistence, and potential landfill accumulation create regulatory and ecological concerns. Increasing consumer demand for sustainable products further pressures manufacturers to adopt greener practices and minimize waste.

These concerns are particularly pronounced in regions with stringent plastic disposal laws and high consumer awareness, where non-compliance can result in fines, reputational damage, and restricted market access. The need for sustainable production methods, incorporation of recycled content, and effective end-of-life management increases complexity and cost for producers.

To address these concerns, manufacturers are investing in chemical recycling technologies, circular economy initiatives, and lifecycle management strategies. Innovations in eco-friendly formulations, enhanced recyclability, and sustainable sourcing aim to reduce environmental impact while supporting regulatory compliance and long-term market growth.

- In April 2024, Covestro AG launched polycarbonates from chemically recycled materials via a mass balance approach. The RP series delivers the same performance as conventional polycarbonates for automotive, electronics, and medical applications while supporting circular economy objectives.

Market Trend

Advancements in Polycarbonate Processing Technologies

The polycarbonate market is witnessing a notable shift toward advanced and efficient processing technologies, fueled by rising demand for high-performance and customizable components.

Innovations in injection molding, extrusion, and 3D printing enable the precise manufacturing of complex parts while improving material utilization and reducing production waste. This trend is particularly evident in construction, consumer electronics, and industrial equipment, where design flexibility, durability, and operational efficiency are critical.

Manufacturers are focusing on automated processes, optimized material formulations, and novel processing methods to enhance performance and reduce costs. Integration of sustainable practices and resource-efficient technologies is further supporting the adoption of advanced polycarbonate solutions. The growing emphasis on innovation and efficiency is aiding market expansion.

Polycarbonate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Sheets, Films, and Others

|

|

By Processing Type

|

Injection Molding, Extrusion, and Others

|

|

By Application

|

Automotive & Transportation, Electrical & Electronics, Construction, Packaging, Medical Devices, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Sheets, Films, and Others): The sheets segment earned USD 9.98 billion in 2024, mainly due to strong demand for construction, automotive, and electronic applications requiring durable and transparent materials.

- By Processing Type (Injection Molding, Extrusion, and Others): The injection molding segment held a share of 48.21% in 2024, propelled by its ability to produce complex, high-precision components efficiently for automotive, consumer electronics, and industrial applications.

- By Application (Automotive & Transportation, Electrical & Electronics, Construction, Packaging, Medical Devices, and Others): The automotive & transportation segment is projected to reach USD 11.37 billion by 2032, owing to increasing demand for lightweight, durable, and impact-resistant materials in vehicle components to enhance fuel efficiency and safety.

Polycarbonate Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polycarbonate market share stood at 34.62% in 2024, valued at USD 8.08 billion. This strong position is reinforced by rapid industrialization, expanding automotive production, and growing construction activities across regions. Furthermore, the regional market benefits from increasing demand in consumer electronics, packaging, and medical device applications, where durability, impact resistance, and design flexibility are essential.

The region’s growing focus on advanced manufacturing, adoption of innovative processing technologies, and supportive government initiatives for sustainable materials and infrastructure development further propel regional market growth. Industrial modernization, rapid urbanization, and rising investments in high-performance applications position Asia Pacific as a major region for polycarbonate consumption.

- In July 2025, Teijin announced that its biomass-derived polycarbonate resin was used to create the world’s first pipe organ made entirely from bioplastic in Osaka, Japan. Produced by Teiyo Co., Ltd., the transparent pipes will be showcased at Expo 2025 Osaka. This initiative demonstrates Teijin’s dedication to sustainable innovation and the versatility of bioplastics in advanced applications.

The Europe polycarbonate industry is projected to grow at a CAGR of 5.91% over the forecast period. This growth is fueled by increasing demand for lightweight, durable, and high-performance materials across automotive, construction, and electrical sectors.

Expanding production of consumer electronics, packaging, and medical devices is driving broader adoption of polycarbonate due to its impact resistance and design versatility. Government regulations promoting energy efficiency, safety, and sustainable materials, along with investments in advanced manufacturing technologies, are supporting regional market development.

Furthermore, the focus on recyclable and eco-friendly production, coupled with urbanization and stringent environmental standards, is boosting demand. Ongoing infrastructure projects and growing adoption of innovative applications are propelling market growth.

- In March 2024, Covestro opened its first industrial-scale polycarbonate copolymer plant in Antwerp, Belgium. The facility strengthens Covestro’s capacity to produce high-quality plastics while advancing sustainable and innovative manufacturing solutions.

Regulatory Frameworks

- In the U.S., the Toxic Substances Control Act (TSCA) regulates the manufacture, import, and processing of chemical substances. It ensures the safety of chemical production and use, addressing potential health and environmental risks associated with polycarbonate and its precursors.

- In the European Union, Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) oversees the production and use of chemical substances. It mandates registration, safety evaluation, and authorization of chemicals, ensuring protection of human health and the environment in applications involving polycarbonate.

- In Japan, the Chemical Substances Control Law (CSCL) governs the manufacture, import, and use of chemical substances. It prevents environmental pollution and health hazards by controlling hazardous chemicals used in polycarbonate production.

Competitive Landscape

Companies operating in the polycarbonate industry are maintaining competitiveness through investments in advanced material formulations, sustainable production practices, and strategic mergers and acquisitions. They are developing high-performance polycarbonate grades with enhanced impact resistance, thermal stability, and design flexibility to meet growing demand across automotive, construction, electronics, and packaging applications.

Companies are also expanding their product portfolios with sheets, films, and molded components to cater to diverse industrial requirements and regulatory standards. Emphasis is placed on regional manufacturing facilities, collaborations with downstream industries, and partnerships with research institutions to strengthen supply chains and accelerate innovation.

Additionally, firms are focusing on customer-centric solutions, technical support, and value-added services while leveraging digital tools and automation technologies to enhance production efficiency and gain a competitive advantage.

- In November 2024, Deepak Chem Tech Limited announced a ₹5,000 crore (USD 568 million) investment in a polycarbonate resin plant at Dahej, Gujarat, with 165,000 metric tonnes annual capacity, set to start by Q4 FY 2028. The company also acquired Trinseo’s German polycarbonate assets, including CALIBRE technology, to meet growing domestic demand in automotive, electronics, construction, and medical sectors.

Key Companies in Polycarbonate Market:

- Covestro AG

- SABIC

- Mitsubishi Chemical Group Corporation

- TEIJIN LIMITED

- LG Chem

- Asahi Kasei Advance Corporation

- Formosa Chemicals & Fibre Corp

- LOTTE Chemical CORPORATION

- Ensinger

- RTP Company

- Westlake Plastics

- Avient Corporation

- Americhem

- BARLOG Plastics GmbH

- Celanese Corporation

Recent Developments (Partnerships/Expansion)

- In June 2025, Covestro partnered with PolySource to distribute its polycarbonate and blend products across the U.S. The collaboration aims to enhance access to high-performance polymers for the automotive, electronics, and healthcare sectors.

- In September 2023, SABIC and SINOPEC began commercial operations of their 260,000-ton polycarbonate plant at their joint venture, SSTPC, in Tianjin, China. The facility strengthens SABIC’s regional PC capacity and improves supply reliability, service, and responsiveness to market demand.