Market Definition

The market involves the manufacturing, distribution, and use of synthetic rubber gloves for utilization in healthcare, industrial, and laboratory fields. These gloves are used as a substitute for latex gloves, due to their durability against chemicals and punctures.

Nitrile Gloves Market Overview

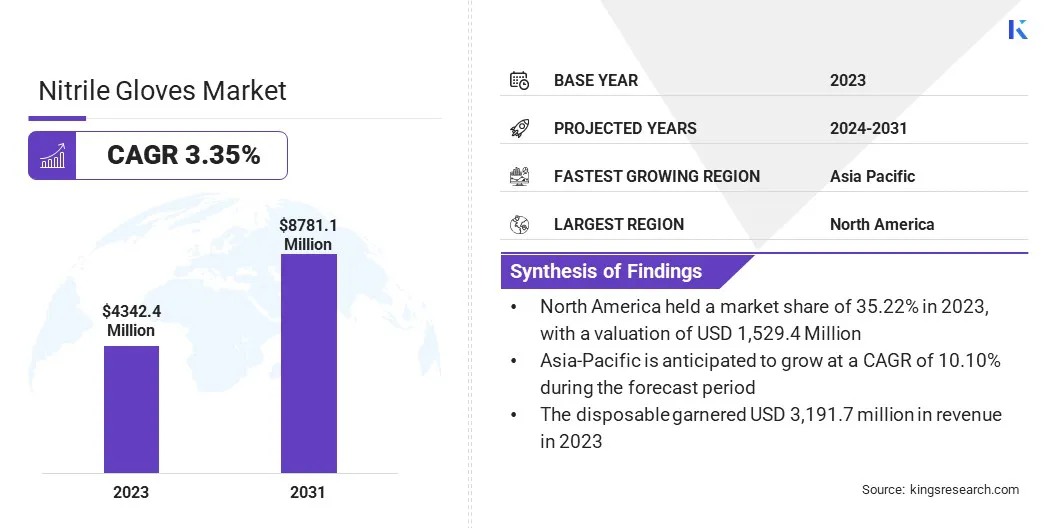

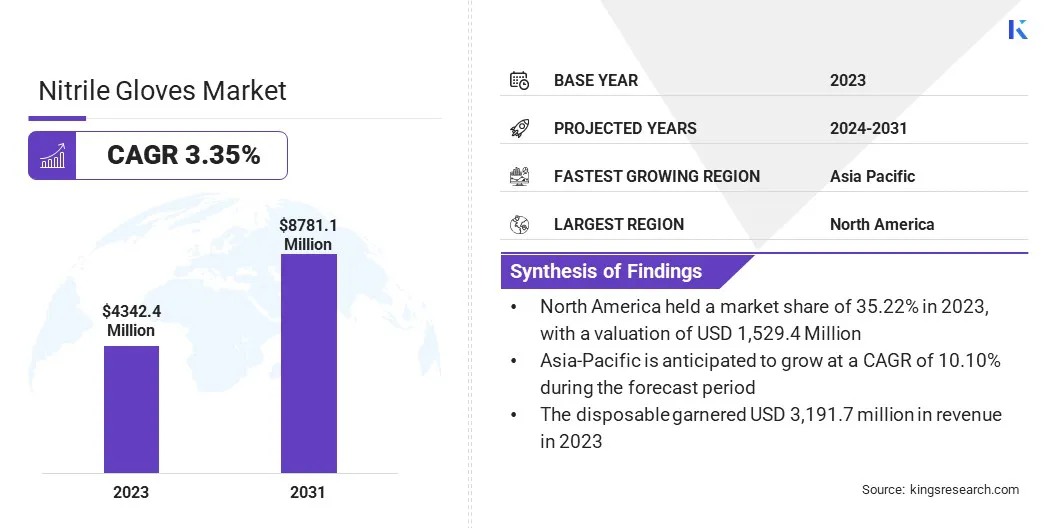

The global nitrile gloves market size was valued at USD 4,342.4 million in 2023 and is projected to grow from USD 4,698.5 million in 2024 to USD 8,781.1 million by 2031, exhibiting a CAGR of 9.35% during the forecast period.

This growth is driven by its increasing demand across key industries, including healthcare, food processing, and manufacturing, where nitrile gloves are favored for their durability, chemical resistance.

The market is also influenced by stringent regulatory requirements for personal protective equipment (PPE) and the growing awareness of hygiene and safety standards.

Major companies operating in the nitrile gloves market are ANSELL LTD., Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Top Glove Corporation Bhd, Unigloves (UK) Limited, Medline at Home., Supermax Corporation Berhad., MCR Safety, Honeywell International Inc., 3M, Dynarex Corporation, Ventyv, AMMEX, Rubberex Corporation (M) Berhad, and Superior Glove.

Ongoing advancements in glove technology, such as improved material formulations and customization, are expected to support market expansion. Additionally, sustainability trends and a shift toward latex-free products contribute to the rising adoption of nitrile gloves.

- In September 2024, Mun Australia announced the launch of GloveOn COATS Biodegradable, a groundbreaking nitrile glove featuring COATS (Colloidal Oatmeal System) technology for superior moisturizing benefits. Designed to decompose faster in landfill conditions, it offers a sustainable alternative for healthcare and industrial professionals, ensuring both hand protection and environmental responsibility.

Key Highlights:

- The nitrile gloves industry size was valued at USD 4,342.4 million in 2023.

- The market is projected to grow at a CAGR of 9.35% from 2024 to 2031.

- North America held a market share of 35.22% in 2023, valued at USD 1,529.4 million.

- The medical & healthcare segment garnered USD 1,302.7 million in revenue in 2023.

- The powdered segment is expected to reach USD 1,986.4 million by 2031.

- The durable segment is anticipated to register the fastest CAGR of 11.51% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.10% through the forecast period.

Market Driver

"Increasing Hygiene Awareness and Safety Regulations"

The nitrile gloves market is undergoing significant growth, due to the rising awareness for hygiene and safety across various industries. Superior puncture resistance, chemical protection, and hypoallergenic properties of nitrile gloves boost the adoption of nitrile gloves when compared to latex gloves.

Strict regulatory requirements related to workplace safety and infection prevention are increasing the need for top-notch protective gear. The growth of healthcare infrastructure in developing nations and the rising use of nitrile gloves in industries like automotive and chemical handling are aiding the market growth.

Furthermore, the prevalence of latex allergies is aiding the shift to nitrile gloves in healthcare, food processing, and pharmaceuticals sectors.

- In December 2023, according to Gloves.com, nitrile gloves are resistant to a wide range of chemicals, including fuels, vegetable oils, some organic solvents, greases, weak caustics, weak acids, household detergents, and petroleum products. Their chemical resistance makes them ideal for use in industries such as automotive, manufacturing, and laboratory work, ensuring enhanced safety.

Market Challenge

"Raw Material Price Instability and Supply Chain Disruptions"

The nitrile gloves market is presently facing multiple obstacles which impacts its expansion. A significant concern is the persistent instability in raw material prices, especially nitrile butadiene rubber (NBR), which has been affected by supply chain interruptions and varying global demand.

These difficulties raise production expenses and introduce unpredictability in pricing. Moreover, producers face pressure to meet the increasing demand from various sectors, including healthcare, while also ensuring consistent quality and supply.

Furthermore, operational complexity is heightened by the stringent regulatory compliance demands for product safety and quality, necessitating significant investment in research and development (R&D).

Market Trend

"Growing Hygiene awareness, Sustainability, and Innovation"

Severable notable trends are shaping the future trajectory of the nitrile gloves market. Increasing awareness of hygiene and safety across industries, particularly in healthcare and food processing, is driving the demand for nitrile gloves. There is a noticeable shift toward higher-quality, specialized gloves that offer enhanced protection against chemicals, punctures, and allergens.

Manufacturers are also focusing on sustainability, incorporating eco-friendly materials and processes into production to meet growing consumer and regulatory demands for environmentally responsible products.

Additionally, technological advancements in glove manufacturing, such as the use of automated production lines and advanced coatings, are improving product performance and efficiency.

Another emerging trend is the customization of gloves to meet specific industry needs, such as chemical resistance for industrial use or extended cuff designs for medical applications. These trends are driving innovation, with companies striving to differentiate their products and meet evolving market demands.

- In October 2024, Unigloves (UK) Limited partnered with KluraLabs for launching the CrossGuard antimicrobial nitrile glove. This unique glove uses KluraLabs' superior antimicrobial technology to kill 99.99% of chosen germs in 60 seconds. The device, which has applications for the healthcare, laboratory, and food processing sectors, improves infection control and prevents cross-contamination.

Nitrile Gloves Market Report Snapshot

| Segmentation |

Details |

| By End-User Industry |

Medical & Healthcare, Food & Beverage, Automotive, Metal & Machinery, Cleanroom, Oil & Gas, Chemical & Petrochemical, Others |

| By Type |

Powdered, Powder-free |

| By Product |

Disposable, Durable |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By End-User Industry (Medical & Healthcare, Food & Beverage, Automotive, Metal & Machinery, and Cleanroom, Oil & Gas, Chemical & Petrochemical, Others): The medical & healthcare segment earned USD 1,302.7 million in 2023, due to the increasing demand for protective gear in healthcare settings, driven by hygiene and infection control measures.

- By Type (Powdered, Powder-free): The powder-free segment held 75.51% share of the market in 2023, due to the growing preference for powder-free alternatives in medical and food-related applications, driven by health concerns and allergies associated with powdered gloves.

- By Product (Disposable, Durable): The disposable segment is projected to reach USD 6,080.9 million by 2031, owing to the rising demand for single-use gloves in medical, food processing, and sanitation industries, driven by convenience and hygiene requirements.

Nitrile Gloves Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 35.22% share of the nitrile gloves market in 2023, with a valuation of USD 1,529.4 million, driven by the increasing adoption of advanced healthcare technologies, rising demand for PPE in various sectors, and stringent regulatory requirements, particularly in the healthcare and manufacturing industries.

The region's strong healthcare infrastructure and growing awareness of hygiene and safety standards also contribute to the high demand for nitrile gloves.

However, the market in Asia Pacific is anticipated to register the fastest growth at a projected CAGR of 10.10%, due to the region's growing population, increased healthcare spending, rapid industrialization, and the rising demand for protective equipment in emerging markets.

Industrialization in emerging markets further accelerates this demand, particularly in sectors such as manufacturing, construction, and healthcare, fostering robust growth in the protective equipment industry. This trend is expected to continue, supported by ongoing urbanization and government initiatives to improve healthcare infrastructure.

Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S, the Food and Drug Administration (FDA) and the Occupational Safety and Health Administration (OSHA) regulates the manufacturing of nitrile gloves and ensures performance standards, resistance, durability, and safety.

- In Europe, nitrile gloves are regulated by the European Commission for both medical and non-medical applications. Medical gloves are subject to oversight, ensuring that they meet safety and performance standards for healthcare use. Non-medical gloves, including those for industrial and chemical applications, are also regulated to ensure they meet appropriate safety and quality requirements for worker protection across various industries.

Competitive Landscape:

The nitrile gloves market is highly competitive, with established industry leaders and emerging players. Companies are increasingly adopting various strategic initiatives to maintain a competitive edge in this dynamic and fast-growing sector.

Key strategies include the launch of innovative products to meet the evolving demands of different industries, strategic collaborations and partnerships to expand market reach, as well as mergers and acquisitions to enhance capabilities and strengthen market position.

Furthermore, corporate expansions into new geographic regions and verticals are becoming common as organizations seek to capitalize on the growing demand for nitrile gloves across healthcare, industrial, and other sectors.

- In November 2024, Sybron launched an innovative line of biodegradable nitrile single-usage gloves, aimed at the hospitality, education, healthcare, and facilities management industries, while it discontinues its normal latex and nitrile gloves. These biodegradable gloves are priced comparable to standard nitrile gloves but have a reduced environmental impact, decomposing by 81% in 491 days.

List of Key Companies in Nitrile Gloves Market:

- ANSELL LTD.

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Top Glove Corporation Bhd

- Unigloves (UK) Limited

- Medline at Home.

- Supermax Corporation Berhad.

- MCR Safety

- Honeywell International Inc.

- 3M

- Dynarex Corporation

- Ventyv

- AMMEX

- Rubberex Corporation (M) Berhad

- Superior Glove

Recent Developments (M&A/Partnerships/ Acquisition /New Product Launch)

- In June, 2024, Unigloves (UK) Limited announced the acquisition of a 50% stake in Nitrex, instantly expanding its product portfolio to include over 100 industrial gloves. This strategic move strengthens Unigloves' market position, with Nitrex, a renowned name in industrial hand protection, enhancing its ability to offer a broader range of solutions across industries.

- In October, 2024, U.S. Medical Glove Company (USMGC) announced a USD 80 million contract with Medeco Protective Safety Equipment Manufacturing (ASSA ABLOY). USMGC will supply 12 proprietary glove-making machines, including 10 nitrile lines, with a 25% ownership stake in the joint venture.

- In April, 2024, ANSELL LTD announced the acquisition of Kimberly-Clark’s Personal Protective Equipment (KCPPE) business for USD 640 million. This acquisition strengthens Ansell's position in global scientific and industrial markets, enhancing its growth strategy and generating economies of scale through combined supply chain efficiencies.

- In April, 2023, Armbrust American announced the launch of 100% U.S.-made nitrile gloves. It includes FDA-cleared, chemo-rated gloves and food-grade industrial gloves in various sizes, reinforcing Armbrust's mission to become a premier source of domestic medical products amidst global supply chain challenges.